Comparing IRC 7702 vs 401k and 529 plans

A 7702 account is a cash value life insurance policy that offers significant tax advantages over traditional 401(k) plans for retirement and wealth building. Named after IRS Code 7702, these accounts provide tax-free access to funds, no contribution limits, and no required minimum distributions – making them an attractive alternative to conventional retirement planning. This comprehensive guide compares 7702 accounts vs 401k plans, covering the top pros and cons of each to help you determine which strategy best fits your financial goals.

💡 TL;DR: 7702 vs 401k Quick Comparison (2025)

- Contribution Limits: 7702: No federal limits vs 401k: $23,000 ($30,500 age 50+)

- Tax Access: 7702: Tax-free loans vs 401k: 100% taxable withdrawals

- Early Access: 7702: No penalties vs 401k: 10% penalty before 59½

- Required Withdrawals: 7702: None vs 401k: RMDs at age 73-75

- Market Protection: 7702: Principal guaranteed vs 401k: Full market risk

- Death Benefit: 7702: Tax-free to heirs vs 401k: Account value only

Table of Contents

- Introduction

- What is an IRC Section 7702 Plan and How Does It Work?

- IRA Conversion Strategies with Indexed Universal Life Insurance

- How 7702 Plans Differ from Traditional Retirement Accounts

- Traditional 401(k) Pros and Cons

- Case Study: Sarah’s Retirement Planning Decision

- Benefits of 7702 Plans – Both Before and After Retirement

- Are You a Good Candidate for a 7702 Plan?

- How to Find the Best 7702 Plan

What is an IRC Section 7702 Plan and How Does It Work?

Named for a section of the Internal Revenue Code (IRC), the 7702 plan is a specific type of cash value life insurance policy that can be leveraged for various tax advantages – including supplementing your retirement income with tax-free funds.

In many ways, 7702 plans work the same as other permanent life insurance policies. For instance, they are life insurance contracts between a policyholder and the offering insurance company – and, provided that the plans meet certain regulations listed in the tax code, a portion of the premiums paid into a 7702 plan go towards building up cash savings while another portion goes towards the cost of the insurance coverage (i.e., the death benefit).

But, while most people consider purchasing life insurance for the death benefit proceeds it can provide for debt payoff and income replacement, the reality is that these flexible financial tools can be used for so much more – even when the insured is still alive.

Different types of cash value life insurance:

- Whole life insurance

- Universal life insurance

- Indexed universal life insurance

- Variable universal life insurance

Each of these life insurance types use different parameters for how the return in their cash value components are determined. But all allow for the funds in the plan to grow on a tax deferred basis. This means that there is no tax on the gain unless or until the money is withdrawn.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

How 7702 Plans Differ from Traditional Retirement Accounts

If your employer offers a traditional 401(k) plan, you have the opportunity to build up a nice nest egg, as well as take advantage of tax-related benefits like pre-tax contributions and tax deferred growth.

For instance, the money that you contribute – up to the annual maximum amount – is not considered taxable income in the year(s) that you contribute. Therefore, with a reduced income base, you can either pay less in income taxes or receive a larger income tax refund during these years.

In addition, because the funds in the traditional 401(k) plan grow tax deferred, you won’t have to pay taxes on the growth until you withdraw the gains. This, in turn, could allow your account value to grow exponentially because you are generating a return on your:

- Contributions

- Previous gains, and

- Funds that would have otherwise been paid in taxes

Traditional 401(k) plans may allow you to do some other things, too, such as:

- Choosing from a variety of different investments (like mutual funds, bonds, and money market accounts)

- Borrow money from the account (although interest will be charged on the borrowed funds)

- Take penalty-free withdrawals for certain types of emergencies

Depending on the company that offers the traditional 401(k) plan, you may also receive “matching” contributions from your employer. The amount of the match is typically determined as a percentage of what you contribute in a given year.

Because many 401(k) plan participants invest at least some of their funds in equities (such as stocks and mutual funds), there is a risk of loss. This could include the erasing of previous gains, as well as losing some (or all) of your contributions.

Average vs Actual Returns

Many investment advisors tout “average” returns when trying to entice investors to move money into various financial vehicles. But even if a particular investment generates a good average return, you could still come up short.

Take, for instance, contributing $1,000 into an account, generating a 0% (a seemingly “break even”) average return over a 10-year period, but still losing a portion of what you contributed. In fact, any time there is a negative return that is factored into the overall mix, the average return will not equal the actual return on your money.

| Year | Annual Return | Account Value (Starting with $1,000) |

Notes |

|---|---|---|---|

| Start | – | $1,000.00 | Initial investment |

| Year 1 | -30% | $700.00 | Major market downturn |

| Year 2 | +30% | $910.00 | Strong recovery year |

| Year 3 | -20% | $728.00 | Another market correction |

| Year 4 | +20% | $873.60 | Recovery continues |

| Year 5 | -10% | $786.24 | Minor correction |

| Year 6 | +10% | $864.86 | Modest growth |

| Year 7 | +15% | $994.59 | Strong growth year |

| Year 8 | +5% | $1,044.32 | Finally back above initial investment |

| Year 9 | -15% | $887.67 | Significant correction |

| Year 10 | +15% | $1,020.82 | Final value after 10 years |

| 10-Year Results: | Average Return: +2.0% per year |

Actual Return: +0.2% per year |

Despite a positive average return of 2% per year, the actual annualized return is only 0.2% |

Key Insight: This example demonstrates how sequence of returns matters. Even though the average of all annual returns is +2% (seemingly positive), the actual growth over 10 years is just 2.08% total (0.2% annualized). This significant difference occurs because negative returns early in the investment period have a greater impact than later positive returns of the same percentage.

401 (k) Drawbacks:

The following are potential hazards to consider when using a 401(k) plan.

1. Maximum annual contribution limits.

Participants in traditional 401(k) plans are only allowed to contribute up to a certain amount each year. In 2025, if you are age 49 or younger, the most you can put into an employer-sponsored 401(k) is $23,000. If you are age 50 or older, you can add an additional $7,500 in “catch up” contributions, for a total of $30,500. So, what happens if you wish to contribute more so you can obtain more tax-advantaged growth? The 7702 plan can help!

2. Required minimum distribution (RMD) rules.

Under the SECURE Act 2.0, when a traditional 401(k) plan participant turns 73 (for those born between 1951-1959) or 75 (for those born in 1960 or later), they are required to start withdrawing at least a certain amount from the account every year going forward. If they don’t, they will face a financial penalty from the IRS.

3. IRS early withdrawal penalty.

Conversely, if you withdraw funds before turning 59 ½, you could incur a 10% “early withdrawal” penalty from the IRS. This is in addition to any taxes that you owe.

4. Volatility (Sequence of Returns Risk)

Sequence of returns risk is a big concern for those nearing retirement, particularly if they’re heavily invested in market-based assets like 401(k)s. This risk refers to the devastating impact of negative market returns in the early years of retirement. While the average return over time might be positive, the order in which those returns occur can significantly affect your retirement savings.

For example, imagine two retirees with identical portfolios and withdrawal rates, but different market conditions in their first few years of retirement. Retiree A experiences negative returns in the first three years, while Retiree B sees positive returns. Even if their long-term average returns are the same, Retiree A’s portfolio may be depleted much faster due to withdrawing funds from an already diminished account. This scenario can force Retiree A to either reduce their standard of living or risk running out of money.

5. Withdrawals are usually 100% taxable.

Another significant drawback to traditional 401(k)s is that 401(k) withdrawals are usually 100% taxable. Because you are allowed to contribute money on a pre-tax basis, and the funds in the account grow tax deferred, Uncle Sam will eventually want HIS money – and he would much rather generate tax from an account that has grown substantially over time versus the much smaller contributions that go into the account.

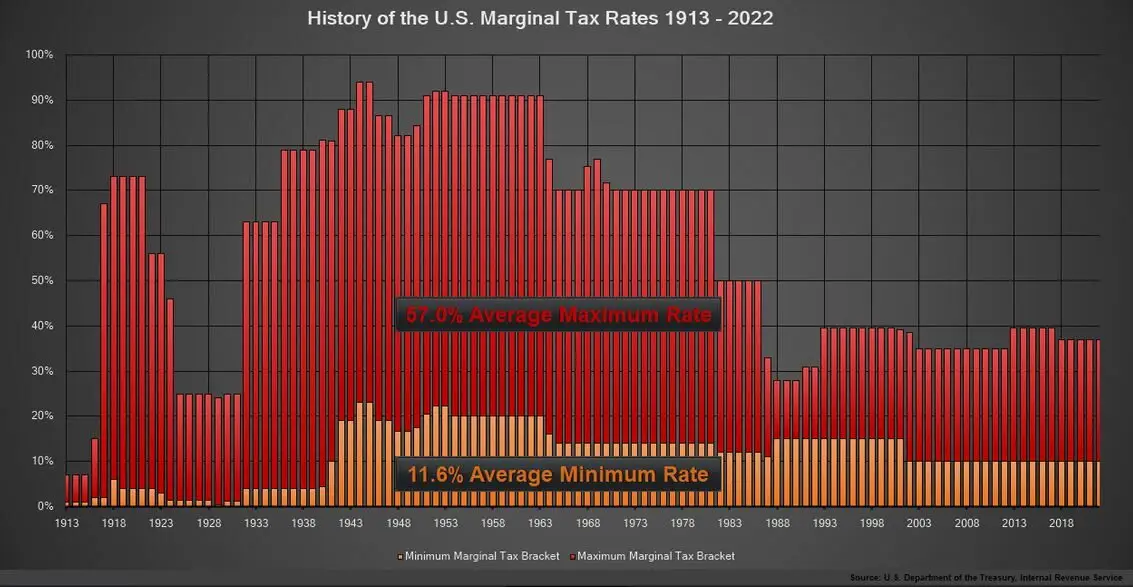

This taxation on withdrawals can actually create a double whammy, as many economists expect income tax rates in the U.S. to rise in the near future…and no one knows how high they will go. But in the past, the top federal income tax rate has been in excess of 90% several times.

So, the more income tax you owe, the less net spendable income you will have available for your retirement. And with the government over $35 trillion in debt, it is not hard to see why taxes will most likely be higher (rather than lower) in the future.

Top Federal Income Tax Rates 1913 – 2022

Source: Tax Foundation

Tax Dominoes

Like a row of dominoes, more taxable income in retirement can affect other cash flow sources, too. For instance, many retirees do not know that up to 85% of their Social Security retirement income benefits could be taxable.

How much these benefits are taxed depends in large part on how much taxable income you generate from other sources – such as a traditional 401(k) plan – as well as when you claim your Social Security benefits.

Based on your situation, you may have to pay tax on a percent of your Social Security benefits (in 2025), if you meet one of the following criteria:

- You file your federal income tax return as an individual taxpayer, and your combined income is:

- Between $25,000 and $34,000 (if so, up to 50% of your Social Security retirement benefits could be taxable)

- More than $34,000 (if this is the case, up to 85% of your Social Security benefits may be taxable)

- You file a joint income tax return with your spouse, and you have a combined income that is:

- Between $32,000 and $44,000 (if so, then up to 50% of your benefits may be taxable)

- More than $44,000 (in this case, up to 85% of your Social Security retirement income benefits may be taxable)

- You are married and you file a separate tax return.

Note that the amount of your combined income is equal to your adjusted gross income plus any non-taxable interest earned, plus one-half of your Social Security benefits.

In addition, under the SECURE Act 2.0, the IRS requires you to start withdrawing at least a minimum amount of money from traditional 401(k)s once you turn 73 or 75 (depending on your birth year) – and if you don’t follow these required minimum distribution rules, you can be penalized.

KEY ADVANTAGE

Tax-Free Income That Won’t Trigger Social Security Taxation

Here’s a critical advantage most financial advisors won’t tell you: 401(k) withdrawals count as taxable income that can trigger taxation of your Social Security benefits. Once your combined income exceeds $34,000 (single) or $44,000 (married), up to 85% of your Social Security becomes taxable.

But 7702 policy loans don’t count as income for Social Security taxation purposes. This means you can access retirement funds without pushing yourself into higher tax brackets or triggering Social Security taxation, potentially saving thousands annually in retirement.

Traditional 401(k) Pros and Cons

| Pros of Traditional 401(k) Plans | Cons of Traditional 401(k) Plans |

|---|---|

|

|

Contrast this with a 7702 Plan

This is where the 7702 plan can provide you with some significant benefits – including the ability to access funds tax free from the policy’s cash value component. Depending on the then-current income tax rates, this feature alone could allow you to put much more money towards your living expenses in the future.

Policyholders can usually access cash from permanent life insurance plans. One way is through withdrawals. But, similar to with the traditional IRA, when the tax deferred gains are accessed via withdrawals, they will be taxable.

Another option for accessing cash from a cash value life insurance policy is through a loan. Although some people are uncomfortable with borrowing money, a life insurance loan could provide several enticing benefits.

Life Insurance Loans Are Not Taxable

For instance, life insurance loans are not taxable. Therefore, you will be able to use 100% of the funds from the loan for whatever you need or want. Plus, these loans are actually from the insurance company, and they simply use the cash in your policy as collateral (versus borrowing directly from the cash value). Because of that, 100% of your cash value funds will still be generating interest.

As an example, if you have $80,000 of cash value in a whole life insurance policy, and you borrow $40,000, you will continue to generate returns on the full $80,000.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Life Insurance Gains are Tax Deferred

Similar to traditional 401(k) plans, the funds that are in a 7702 plan grow tax deferred. So, the build-up of account value can snowball – especially over time. If the policy is structured properly, there are ways to enhance the growth of the cash value in a 7702 plan even more.

For instance, a paid up additions rider is a mechanism that is used to put additional dollars into a dividend paying whole life insurance policy in order to increase the performance of the cash value. In this case, every dollar of premium that is allocated to the paid up additions rider creates a small “paid up” insurance policy that has its own cash value that is created right away.

A whole life insurance policy that has a substantial portion of its total premium payment allocated to paid up additions will usually outperform those that do not take advantage of paid up additions.

Additional 7702 Plan Benefits

- No maximum annual contribution limits

- No required minimum distribution (RMD) rules

- Tax-free policy loans have no impact on the taxability of your Social Security retirement income benefits

- Protection from creditors and bankruptcy (in some states)

- Self-completion (i.e., if the insured dies, the death benefit proceeds are received income tax free by the beneficiary, and they can be used for their originally intended purpose and/or other needs and wants)

Because certain cash value life insurance policies protect principal in any type of market or economic environment, you generate a nice profit over time and without worry about what is happening with the stock market. With whole life insurance you have a non-correlated asset and with index universal life you have a 0-1% floor to protect against market losses.

Given the many advantages of 7702 plans, there are a few potential drawbacks to be mindful of, such as:

- No income tax deduction for contributions

- The cash value might initially build up slowly

- Surrender penalties on IUL withdrawals in the early years of the policy

- Gains that are withdrawn are taxable

- The insured must qualify for the life insurance coverage

Because not all life insurance policies are the same, it is essential to work with a professional who is well-versed on how a cash value life insurance policy could be used to supplement your retirement plan.

Pros and Cons of 7702 Plans

| Pros of 7702 Plans | Cons of 7702 Plans |

|---|---|

|

|

Case Study

📊 Sarah’s 30-Year Retirement Comparison (Realistic Numbers)

| Strategy | Annual Contribution | Total at Age 65 | Spendable Income |

|---|---|---|---|

| 401(k) Strategy 6% return, 32% tax rate |

$26,000 ($23K + $3K match) |

$2,055,513 | $1,397,749 (after taxes) |

| 7702 Strategy 5% return, tax-free access |

$24,000 (annual premium) |

$1,594,532 | $1,594,532 (100% tax-free) |

| 7702 Advantage: | $196,784 MORE spendable | ||

Key Advantages of 7702 Plan

- $196,784 more spendable income despite lower contributions

- Access to funds without penalties at any age

- Tax-free income that won’t trigger Social Security taxation

- No required minimum distributions

- Death benefit for family protection

- Principal protection from market downturns

Bottom Line: While the 401(k) accumulates more total wealth due to employer matching, the 7702 plan provides Sarah nearly $200,000 more in spendable retirement funds while offering greater flexibility and protection against market volatility and tax increases.

Benefits of 7702 Plans – Both Before and After Retirement

In addition to accessing tax-free retirement income, there are other areas where the 7702 plan can also be beneficial, such as college funding. The cost of a college education can be daunting, so it is important to start as early as possible when saving for this expense.

529 Plans

Many families opt to use a 529 plan when saving money for a child, grandchild, or other loved ones’ future college costs. These are state-run plans where you can invest in a selection of mutual funds.

The earnings in the account grow tax deferred, and provided that the withdrawals are used for education-related expenses, they are tax free. Depending on the state, you could also receive a tax deduction or credit for contributions to a 529 plan.

529 Plan Disadvantages

Although 529’s are popular college savings plans, though, they have a couple of drawbacks. First, because the money is often invested in equities like mutual funds, there is the chance that prior gains and contributions could be lost if the market or investment turns south.

In addition, if the donor / contributor to a 529 plan suddenly passes away, there is no guarantee that enough funds will be available for the beneficiary when he or she is ready to go to college.

That’s why a strategy for college savings (or to supplement savings for college) is to purchase a cash value life insurance policy. These policies offer a cash value component that grows tax deferred. Money may also be accessed tax free through a policy loan.

Cash Value Life Insurance vs. 529 Plans for College Saving & Funding [VIDEO]

Cash Value Can Be Used for Anything

But unlike the 529 plan, there is no requirement that the life insurance cash value be used for college-related costs. In fact, the money that is either borrowed or withdrawn from a cash value life insurance policy can be used for anything. Therefore, if the potential student decides not to attend college in the future, there are no “penalties” when accessing the life insurance cash value.

Further, the cash value of whole life and indexed universal life insurance policies won’t be reduced – even in the event of a stock market correction. So, because the principal – and the previous gains – are all locked in, there is no concern about the account losing value in the future.

Unlike a 529 plan, life insurance won’t impact any financial aid that the student may be applying for. This is because the cash surrender value is not considered as an eligible asset when determining the expected family contribution for need-based financial aid when submitting the federal government’s form, Free Application for Federal Student Aid, or FAFSA.

A cash Value life insurance policy is also considered to be a self-completing plan. This means that if the insured passes away – even if they have only made one premium payment into the policy – the beneficiary will receive the tax free death benefit. Therefore, the insured individual can make sure that even if the unexpected is to occur, the beneficiary will still have the money that they need for their future education costs.

7702 vs. 529 College Savings Plan

| Feature | 7702 Plan (Life Insurance) | 529 College Savings Plan |

|---|---|---|

| Primary Purpose | Life insurance with tax-advantaged cash accumulation | Education-specific savings vehicle |

| Contribution Limits | No federal limits (subject to insurance qualification) | High limits (varies by state, typically $300,000+) |

| Tax Treatment of Contributions | After-tax (no tax deduction) | After-tax, but state tax deductions may be available |

| Tax Treatment of Growth | Tax-deferred growth | Tax-deferred growth |

| Tax Treatment of Withdrawals | Tax-free loans against cash value; withdrawals up to basis are tax-free | Tax-free when used for qualified education expenses; taxable plus 10% penalty for non-qualified uses |

| Flexibility of Use | Highly flexible – can be used for anything (college, retirement, emergencies) | Limited – primarily for education expenses |

| Investment Options | Whole Life: Guaranteed returns + dividends IUL: Market-linked returns with downside protection |

Various mutual funds, age-based portfolios, etc. |

| Risk Profile | Low risk – typically offers principal protection | Variable risk – depends on investment choices, potential for market losses |

| Financial Aid Impact | Minimal impact – not counted in FAFSA calculations | Considered an asset for FAFSA (though with parental favorable treatment) |

| Death Benefit | Yes – provides income tax-free death benefit to beneficiaries | None – only the account value is available |

| Self-Completion | Yes – if insured dies, beneficiary receives full death benefit | No – only accumulated savings available if contributor dies |

| Cost Structure | Insurance costs, fees, and surrender charges (especially in early years) | Administrative fees and investment expense ratios |

| Changing Beneficiary | Flexible – can change policy ownership or beneficiary | Flexible – can change beneficiary to another family member |

| Ideal For | Those wanting flexibility, low risk, and potential additional benefits beyond education funding | Those specifically saving for education expenses with a clear timeline |

| Note: This comparison is for informational purposes only. Individual policy features may vary by insurer and specific 529 plans differ by state. | ||

Are You a Good Candidate for a 7702 Plan?

A 7702 plan may be a good option if you:

- Are seeking more tax free income in retirement

- Have “maxed out” the annual contributions to your 401(k) and/or other qualified retirement plan(s) and want additional tax advantaged growth

- Would like principal protection in any type of stock market environment

- Want to use certain benefits while living

- Do not want to make up for losses before generating gains again

- Want the assurance of the death benefit so that finances are still covered – even in the event of the unexpected

- Do not want additional income that could cause your Social Security benefits to be taxable

- Don’t want to be forced to withdraw money at age 73 or 75 (nor be penalized if you don’t do so)

How to Find the Best 7702 Plan

Although 7702 plans can be a nice compliment to your other retirement savings, these vehicles should not be used to completely replace them. Rather, it is recommended that you look at your overall financial picture – including short- and long-term objectives, potential tax situation, and other retirement income generators – and from there design a plan that works for you.

At Insurance and Estates, we focus on assisting consumers with protecting what they have worked for, while at the same time helping them to reduce – or even eliminate – taxable income and withdrawals in retirement.

Ready to Maximize Your Retirement and Education Planning?

After helping thousands of clients navigate their financial futures, we’ve seen firsthand how properly structured 7702 plans can transform both retirement and college funding strategies. But every family’s situation is unique, and personalized guidance is essential.

Take the next step toward financial security with a one-on-one strategy session with our IRC 7702 specialists. We’ll help you determine if a cash value life insurance plan aligns with your retirement and education funding goals, and how to optimize it for your specific situation.

No pressure, no sales tactics – just straightforward advice to help you make informed decisions about your financial future.

2 comments

Monique R Peek

7702 form..need more information

Steven Gibbs

Hello Monique, I’m not sure what you mean by 7702 form, but it sounds like you may need to connect with a tax advisor.

Best, Steve Gibbs for I&E