Complete Guide to Indexed Universal Life Insurance

The following article we will help shed some light on which companies offer the best IULs, what are the many benefits indexed universal life provides, as well as list some of the potential pitfalls you should be aware of.

Table of Contents

- Key Takeaways

- Best Indexed Universal Life Insurance Companies

- About Indexed Universal Life Insurance

- Different Types of Life Insurance

- Floor, Participation, and Cap Rates

- Indexed Universal Life Insurance Mechanics

- Evaluating IUL as an Investment

- Advantages/Disadvantages of IULs

- Tax Benefits of Indexed Universal Life Insurance

- Challenges with Market Volatility

- IUL for Long-term Care and Chronic Illness

- Concerns with IUL Marketing

- Indexed Universal Life Insurance Rates

- Managing and Monitoring IUL Policies

- Conclusion and Next Steps

Key Takeaways

- IULs offer a combination of death benefit protection and cash value growth linked to market indices, typically with caps and participation rates limiting the growth and providing downside protection.

- Caps and Participation rates are crucial in IULs as they define the minimum and maximum returns and the extent of participation in index growth.

- IUL policyholders can generally choose to allocate the funds between a fixed account and one or more index-linked subaccounts.

- The top 10 IUL insurance companies are determined by policy performance and company strength.

- IULs offer tax-free death benefit proceeds and tax-deferred growth of cash value.

- IULs may also provide long-term care and chronic illness coverage.

- Be aware of potentially misleading performance models and lack of transparency in rate changes.

- IULs are a popular and beneficial option for those seeking a mix of life insurance and investment-like compound interest growth with downside protection.

Top 10 Indexed Universal Life Insurance Companies

So which IUL insurance companies are currently outperforming their competitors? We put together the following list with the caveat that IULs are a very popular segment of the life insurance industry and companies are constantly vying for supremacy, so things can change in the blink of an eye. Having said that, the following companies make our list for the best indexed universal life insurance policies based on

- policy performance,

- company strength, and

- structure of underlying fees.

Companies are listed in alphabetical order.

| Company | Comdex Ranking |

|---|---|

| AIG | 81 |

| John Hancock | 93 |

| Lincoln National | 90 |

| Mutual of Omaha | 93 |

| National Life Group | 80 |

| Nationwide | 89 |

| North American Company | 88 |

| Pacific Life | 90 |

| Penn Mutual | 92 |

| Prudential | 94 |

| Securian | 92 |

| Symetra | 80 |

| Transamerica | 90 |

Our current Top 3 IUL Companies

We have also narrowed down our top 10 list to the three IUL companies we currently favor the most, which are Mutual of Omaha, Lincoln Financial Group, and John Hancock. These 3 IUL insurance companies currently have the best cash value accumulation concept in the market.

Mutual of Omaha

- Benefits: Mutual of Omaha has streamlined the company’s IUL chassis to maximize cash value growth. There are also very low policy charges inside this product. With an IUL insurance policy, you want to make sure that in those years where the market has negative returns and you hit your 0% floor, you are not losing money due to excessive policy costs. Another benefit of Mutual of Omaha is its accelerated underwriting, which gives applicants the opportunity to forego a medical exam (i.e. no exam life insurance). One last benefit of Mutual of Omaha is they treat existing clients and new clients the same, providing the same cap and participation rates.

- Potential drawback: tighter life insurance underwriting.

Lincoln Financial

- Benefits: Lincoln Financial’s IUL company is Lincoln National. Lincoln National offers 2 different IUL designs, providing index options outside the S&P 500 to go after larger, potentially uncapped returns. No exam accelerated underwriting is available for qualifying applicants.

John Hancock

Benefits: John Hancock is a great IUL company if you are in the market for estate planning and wealth transfer. The company’s Second-to-Die Indexed Universal Life policy provides a great vehicle to pass on a legacy to the next generation in the most tax efficient manner. Survivorship universal life pays out the death benefit upon the passing of both spouses.

About Indexed Universal Life Insurance

Indexed Universal Life Insurance

An indexed universal life insurance policy, aka IUL insurance, or simply “IUL”, is similar to traditional universal life (UL) in that it offers a death benefit and a cash value account that increases over time.

And with a universal life insurance policy, the funds in the IUL cash value account grows over time and can be accessed in the form of partial withdrawals or policy loans. The cash value can also be used to purchase more death benefit.

Where IUL differs from UL is that these indexed universal life insurance policies have a greater growth potential since policyholders can invest some or all of their available cash account in a subaccount option based on the performance of an indexed account that tracks the performance of the S&P 500 or the NASDAQ 100.

The ability to invest in equity-linked subaccounts with your IUL cash account offers you the chance to experience faster growth during periods when the market performs well, subject to policy features such as cap and participation rates.

These features limit how much such an indexed account can grow relative to the performance of the linked index.

Top IUL Companies: Expert Analysis

Join us as IUL specialist Jason Herring breaks down his picks for the top three indexed universal life insurance companies. With so many options available, Jason shares which providers have consistently outperformed the market based on Insurance and Estates’ rigorous annual reviews, helping you select a company that aligns with your financial goals.

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Other Types of Life Insurance

There are different types of life insurance policies available, ranging from term life insurance, which is pure death insurance, providing no cash value but purely death benefit protection. On the other side of the coin is permanent life insurance which provides permanent death benefit protection and cash value growth in the policy.

Term Life Insurance

A term life policy is the easiest to understand versus other life insurance policies. Term allows the owner to purchase life insurance coverage for a set period of time, usually 10,20 or 30 years. If the insured dies during the term, the designated beneficiary will receive the death benefit. Once the policy ends it can normally be renewed annually, although the premiums will increase substantially year over year.

Term life insurance does not provide cash value growth. Once the policy term ends, the coverage no longer exists.

Whole Life Insurance

With a whole life insurance policy, you get guaranteed growth, a guaranteed death benefit, and guaranteed minimum interest rate on cash value growth. Some whole life policies also offer dividends, which can be used to further grow the death benefit and cash value. For more, see IUL vs Whole Life.

Universal Life Insurance

Somewhere between term life and whole life is Universal Life Insurance. Universal life is cash value life insurance which provides similar benefits of both term policies and whole life policies, depending on the type of universal life policy you choose.

Universal life insurance provides death benefit coverage with flexible premiums and some cash value growth.

Guaranteed Universal Life Insurance

And IUL should be differentiated from Guaranteed Universal Life, where the focus of GUL insurance is on the death benefit, although the policy may provide for a guaranteed fixed rate of return. In contrast, most IUL policies are primarily focused on high cash value accumulation and growth.

Variable Universal Life Insurance

Variable Universal Life (VUL) is similar to IUL insurance but has some distinct differences. When comparing VUL vs IUL, it is important to understand that variable universal life is different to an IUL in that, VUL insurance actually participates in the market returns via subaccounts that act like mutual funds that the owner of the VUL can invest in, similar to a stock market index fund.

Since it invests directly into the market, a variable universal life policy has potential unlimited cash value upside (and downside), placing it into a higher risk vs reward category than IUL insurance. For more, see IUL vs VUL.

Floor, Participation and Cap Rates

An attractive feature of Indexed Universal Life policies is a floor rate, which represents the minimum an index-linked subaccount can earn (or the maximum it can lose) in any one period.

Floor Rate

The floor rate sets a limit on how much a subaccount can lose, or the minimum interest rate it can gain, in any one year.

This floor rate is typically set at no less than 0%, which means that even if the index being tracked by your subaccount loses money in any one year, your account will not suffer a performance loss, (although some fees or administrative expenses may result in a small loss).

In some cases, the floor rate is positive so that whatever the market does, your subaccount will earn a minimum interest rate of at least 1 or 2% interest or whatever rate the floor is set at for that year.

And at times you may be cautious of putting your cash value towards a market index, so a fixed interest rate account is also available.

While floor rates limit the risk of investing some portion of your cash account in an index-linked subaccount within an IUL, the potential to experience gains along with market linked indexes is the main draw of these types of indexed universal life insurance policies for many.

However, when selecting an IUL policy, it’s important to pay attention to its cap rate and participation rate, as these will determine how much upside you can earn when the market rises.

Cap Rate

The cap rate is the maximum percentage growth a subaccount can experience in any one crediting period. The cap rate varies from one company to the next but is often in the range of 7-11%, but can be even higher at times.

If your indexed universal life insurance company designates a cap rate of 11% and the market rises 20%, the most you can receive for that crediting period would be 11%.

A cap rate usually is locked for one year and can be changed at the insurer’s discretion after the lock has expired.

Participation Rate

The participation rate determines what percentage of the growth realized by the index the subaccount tracks will be credited to your account, subject to the cap rate.

For instance, if the participation rate set by the life insurance company is 85%, and the index returns 20% for the year, the amount your account would be entitled to receive, subject to the cap rate, would be 17% (85% of 20%).

Further, if the cap rate was 12%, you would receive 12% rather than 14%. If the index returned 10%, you would receive 8.5% (85% of 10%).

As with a cap rate, a participation rate is typically locked for a year, and can be changed by the insurer after the year has elapsed.

A Note on Cap and Participation Rates

We try and choose companies that have a history of keeping cap and participation rates equal between old and new policies. Some companies engage in the practice of reducing the caps and participation rates on existing Indexed Universal Life (IUL) policies, while simultaneously offering higher rates on new policies to attract fresh clients. This approach is used as a strategy to make new offerings more appealing to potential customers but it also frustrates existing policyholders.

Indexed Universal Life Insurance Mechanics

So, what is actually going on inside of these IUL policies?

Index Period

Allocation to these subaccounts are generally credited with an amount of interest based on the growth of the relevant index over a certain period of time, often called the index period, using two methods used to determine the crediting rate:

Annual point-to-point

This involves a computation of the growth (if any) in the subaccount after taking into account the floor, cap, and participation rates after which this amount is credited to the account.

For instance, if your subaccount was linked to the performance of the S&P 500, and it rose 14% for the year, and the account had a 100% participation rate and a 10% cap rate, your crediting rate would be 10% at the end of the year.

In most indexed universal life insurance policies, the new cash value of this subaccount then becomes the baseline for the next year when calculating the amount that will be credited to your account.

Monthly average

A monthly average of the performance of the underlying index the subaccount is attached to is calculated and credited to the account at the end of each month, after taking into account the floor, cap, and participation rates.

To be able to provide the higher credited rates of return that can be generated by equity index-linked subaccounts, life insurance companies purchase options on these indices rather than invest in them directly.

The usage of cap and participation rates means that they don’t have to directly match the return of these indices, they simply need to generate enough money to pay the relevant amount of interest representing whatever fraction of the indices’ return the policy owes at the end of the year.

The life insurance company will typically invest the funds not used to buy options in bonds to generate sufficient income to meet the policy floor guaranteed return.

Dividend Interest

It should be noted that index-linked subaccounts do not pay dividend interest associated with the indices they track. For an index like the S&P 500, this is typically a not insignificant portion of the index’s total yearly return.

A yearly dividend amount of around 2.5% or even more is common for the S&P 500, which represents a sizable portion of the 9% or 10% yearly total return the index has generated over long periods of time.

Volatility Dangers

Due to the mechanics used to generate earnings to pay interest to index-linked subaccounts, the profit an insurer makes on IUL policies is subject to the premiums charged for buying options on the indices being tracked.

In periods where volatility increases, insurance companies often must pay more to buy options on indices. This extra expense can cause them to adjust the cap and participation rates to reduce the amount of interest they pay on index-linked subaccounts to maintain their profit margins.

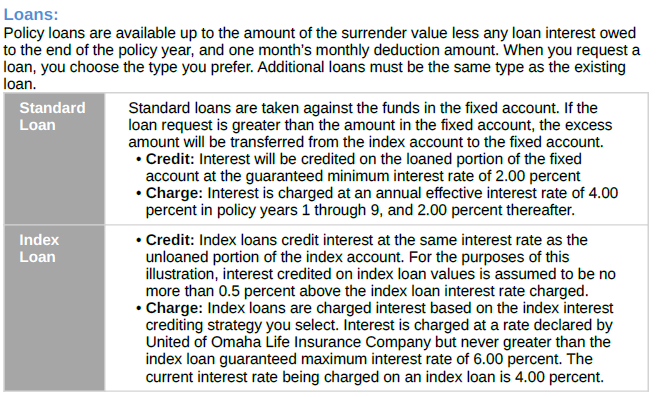

IUL Loans

When taking out an indexed universal life insurance loan, there are two options you can choose from: Standard Loan and Index Loan

If the IUL loan is a standard loan, the loaned portion is set to the side and the company credits a guaranteed rate. If it is an index loan, the loaned value stays in the index account and can still go after the higher cap return. All carriers credit the same way, but use different rates and loan charges.

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Evaluating IUL as an Investment

We use the word “investment” cautiously as it relates to life insurance because apart from variable life insurance, ordinary life insurance is not an investment, but rather a savings vehicle or perhaps even a wealth accumulation account.

IUL can be an attractive investment vehicle, given its opportunity for market-linked gains and tax advantaged growth. Plus, unlike Individual Retirement Accounts (IRAs) and employer-sponsored retirement plans (such as 401ks), there is no annual maximum contribution limit imposed on indexed universal life insurance. So, IUL can provide an avenue for continuing to add to tax advantaged retirement savings – even if annual contributions to these other plans have been “maxed out.”

As an added bonus, when accessed via a policy loan, the funds from the IUL policy’s cash value can be received tax free. So, similar to a Roth IRA, 100% of the money that is accessed can be put to use. Given that, IUL can be an important component of a diversified investment strategy.

The ability of an IUL to offer close to stock market-like returns in an insurance policy cash value account, combined with downside protection that typically prevents your account from suffering a loss even if the market declines, has made IUL policies very popular in recent years as an alternative to Wall Street.

Properly Illustrated

It is important to be aware that many indexed universal life insurance illustrations may not live up to the hype. If your illustration is showing returns in excess of 6% you may want a second opinion. Inaccurate illustrations can greatly effect your policy’s long term performance. The most common side effect of this being a policy that will eventually lapse due to being underfunded

Restrictions

While IUL policies can boost the performance of your cash account over that of traditional UL, the restrictions on how much you can benefit from market movements in the form of cap and participation rates should be studied carefully when considering a purchase of IUL, given their potential to limit the growth of these equity indexed accounts.

These restrictions, combined with the lack of any dividend payments from the indices being tracked, means that from a pure growth potential perspective, a direct investment in an index ETF or mutual fund is likely to outperform an IUL index linked subaccount.

However, the downside protection of a floor rate combined with the insurance features of an IUL policy make such policies attractive to investors who are not just looking to maximize their potential rate of return, but also preserve capital in the case of a market downturn.

Advantages and Disadvantages of Indexed Universal Life Insurance

As with other insurance and investment vehicles, there are both pros and cons to indexed universal life. The primary advantages of indexed universal life insurance include:

- Market-linked growth of the cash value, giving the potential for more (and quicker) gains

- Tax deferred growth

- Access to cash tax free (via policy loans)

- No annual contribution limits

- No required minimum distributions at any age (unlike traditional tax advantaged IRA and retirement accounts)

- Penalty-free access to funds for healthcare and/or long-term care needs

- Protection from creditors and bankruptcy (in most states)

- Ongoing death benefit protection (provided that the premium is paid)

- Income tax free death benefit goes to beneficiary(ies)

- Death benefit can be reduced to lower costs

Although IUL offers numerous advantages, there are also several factors to consider before moving forward with the purchase of a policy. These can include the following:

- Ability to qualify for the coverage (based on the insured’s health)

- Possibility of a higher premium if the cost of insurance rises when the insured gets older

- Limited upside returns (due to caps and/or participation rates)

- Taxes on gains that are withdrawn

- Surrender charges on withdrawals (during the earlier years of the policy)

It is important to note that because not everyone has the same financial goals, timeline, and risk tolerance, what is considered to be an advantage or a drawback may differ from one person to another. With that in mind, it is critical to determine whether or not IUL is a suitable tool for the specific objectives of each individual investor.

| IUL Pros | IUL Cons |

|---|---|

| Potential for higher cash value growth | Qualification for coverage |

| Tax deferred growth | Possibility of higher premium cost in the future |

| Access to cash tax free | Limited upside return |

| No annual contribution limits | Taxes and/or surrender charges on withdrawals |

| No required minimum distributions | Living benefits riders may require additional amount of premium |

| Penalty-free access to funds for healthcare / long-term care needs | |

| Protection from creditors and bankruptcy (in most states) | |

| Coverage does not "expire" | |

| Death benefit proceeds received income tax free by the beneficiary |

Tax Benefits of Indexed Universal Life Insurance

As with all life insurance, the death benefit proceeds paid to your life insurance beneficiary are income tax free.

In addition, life insurance loans are income tax free and you can use the money as tax-free income for any use you want.

And many IUL companies offer wash loans after 10 years or so, which means your net cost for taking the loan is zero, allowing you supplemental tax-free retirement income, which is what LIRP is primarily about.

Another advantage of an IUL is the tax-deferred growth of your cash value. The ability to compound your capital on a fax-favored basis enables your funds to grow more rapidly than would be the case if taxes had to be paid every year.

Market Volatility

During a period when the stock market is rising steadily, IUL policies are likely to offer better returns than straight UL. However, during periods of high market volatility and flat or declining markets, the reverse is likely to be the case.

Even if the market is moving upwards, if volatility is elevated the higher costs the insurance company must pay as a result can result in reduced cap and participation rates, reducing the amount of interest credited to your index-linked subaccounts.

The good news is an IUL policies also includes a fixed account so you can choose to allocate your funds into the fixed account and earn a return based on the interest rate set by the company.

Company History

Given the importance of cap and participation rates to the performance of an IUL, analyzing IUL carriers to see not only their current floor, cap, and participation rates, but also how they have adjusted those rates in the past in response to market conditions is recommended.

Because of the expenses involved in purchasing options to mimic the return of an index, within the confines of the cap and participation rates, IULs can feature higher expense ratios than traditional UL policies. As a result, be sure to inquire about the expenses an insurer charges as well as the cap and participation rates it offers.

IUL for Long-term Care and Chronic Illness

Many people are looking away from traditional long-term care insurance companies and towards companies that offer hybrid long-term care life insurance policies.

These Asset Based LTC policies offer accelerated death benefits that can provide additional protection for terminal illness and chronic illness.

Additionally, IUL policies offer long-term care riders or chronic illness riders that provide benefits for qualifying chronic illnesses. Some offer chronic illness riders at no extra charge, while other companies offer LTC riders for an additional cost.

IUL Marketing

The negative buzz surrounding indexed universal life has to do with how the product is marketed. At the end of the day, indexed universal life is not an investment, it is life insurance and should be seen as such.

Policy Performance Models

While IULs have proven attractive to investors looking to take advantage of stock market-linked returns in a life insurance format, the marketing of these policies by insurers has in some cases been deemed deceptive by industry observers.

This occurs most often when sales material only shows how a policy would perform given positive, steady equity market performance year after year. In reality, the market is often volatile from one year to the next.

For example, instead of returning 12% two years in a row, the market might advance 24% one year and 0% the next.

What would this mean for an IUL with $100,000 cash value on a 12% cap rate, 0% floor rate, and a 75% participation rate? In the first case, you would earn 9% each year for an 18% total return over two years.

In the second scenario, you would earn the cap rate of 12% in year one, while in the second year you would earn the floor rate of 0%, for a total two-year return of 12% vs a potential return of 24% if you were directly invested in the stock market via an ETF or Mutual Funds.

Fine Print

Another complaint about IUL marketing relates to the lack of disclosure, other than in the fine print, of the insurance company’s ability to change cap and participation rates.

As mentioned earlier, these rates are typically only guaranteed for one year, so a hypothetical illustration of returns showing performance over 10, 20 or more years can be misleading if it turned out that during that period the insurance company changed the cap or participation rate.

Also, showing high projected performance numbers can mask the effect of high policy fees on the performance of an IUL in periods where market returns are not robust.

Because of this, if you are considering purchasing an IUL it is important to look into the product’s projected performance during periods which feature mediocre or poor market performance as well as during periods of good performance.

Indexed Universal Life Insurance Rates

Getting accurate indexed universal life insurance quotes require a few things.

- You need to speak to an experienced life insurance agent and explain what it is you are focused on, death benefit or cash value, or somewhere in between?

- You will also need to decide if you need additional riders, such as term insurance, chronic illness, or waiver of premium riders.

- Another variable that determines your indexed universal life insurance premium payments is the death benefit option you choose. Some companies offer up to three different options, such as return of premium, level and increasing death benefits.

Managing and Monitoring IUL Policies

Once you have an IUL insurance policy in place, it is essential not to just “set it and forget it.” As with other financial vehicles in your portfolio, market conditions can impact the growth of the cash in the policy.

In addition, as your current and future financial needs change over time, it may be necessary to adjust the amount of the death benefit or the index tracking strategy, or even to reevaluate whether or not the policy is still an integral part of your overall strategy.

Therefore, it is best to review your policy – and your complete financial plan – with a professional who specializes in indexed universal life insurance. That way, you can better ensure that you have the best plan in place for your specific needs. This can be with your original agent, where you go over the current policy and make sure it is working out as the original illustration showed.

Conclusion & Next Steps

As the most popular permanent life insurance in the market right now, Indexed Universal Life is a great option for many who want to participate in stock market returns, without actually being invested in the market and subject to risk of loss.

IULs have a lot to offer and should definitely be considered as part of a well rounded financial protection and wealth building strategy.

To find out if an IUL policy is the best choice for you, give us a call today for a complimentary strategy session as we go over your specific needs, goals and objectives to help you determine what is best for your unique circumstances.

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

31 comments

Gilberto Ramos

Hi,

I will like an opinion on the IUL from Ohio National and F&G Pathsetter,

Steven Gibbs

Hello Gilberto,

Thanks for reaching out. If you haven’t already connected with Jason Herring, I recommend that you do so as he is a great help with IUL questions. You can request a call at jason@insuranceandestates.com.

Best, Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Ronnie Keith

Want to know information on the iul life policy

SJG

Hello Ronnie, thanks for commenting. Your request has been forwarded to our IUL expert Jason Herring. If you haven’t connected with him already, you can request a call at jason@insuranceandestates.com.

Best, Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Marilynn Hopman

Hello Adam,

I am still learning about selling IULs and learn new concepts and information about IULs on a daily basis. How would you rate the National Life Group Summit IUL on a scale of A being the best and F being the worst? Summit has enhancers and is recommended for people who can contribute $400 – $500/month.

SJG

Hello Marilyn, the way to go about getting product information is to connect with our IUL expert Jason Herring. Go ahead and request a call or his calendar link at jason@insuranceandestates.com.

Best, Steve Gibbs for I&E

Kerry Cowden

Good Afternoon, this was well written!! Great Job, Please keep me updated!!

Kerry C

Shammy Peterson

It sure was interesting when you said that what becomes the baseline for the next year when calculating the indexed universal life insurance policy is the new cash value of this subaccount. My sister will surely consider this tip because she mentioned last Friday that she wanted to purchase a life insurance policy that will meet her budget and her needs. She wanted to make sure that she will find a policy that can provide her peace of mind when it comes to securing her future, so your tips are helpful.

Insurance&Estates

Hello Shammy and thanks for connecting. Actually for peace of mind, my personal suggestion is that she may want to consider a properly designed high cash value mutual whole life policy. This is one of our key focus areas and actually offers more certainty than the IUL due to fixed costs and guaranteed returns with the whole life route. If your sister wants to explore further, she can reach out to Barry Brooksby at barry@insuranceandestates.com.

Best, Steve Gibbs, for I&E

Henry

I noticed that the Mutual of Omaha Life Insurance was not listed in your rankings, but you did favor it in your comments. Omaha Life is a reputable company and I was wondering if you could further explain how beneficial you think Omaha is, especially for Living benefits and financial growth. If you could attach a comdex rating as well that would be great!

Additionally, I’m glad you included National Life group on your list because recently, someone has been trying to sell it to our family. I am just not sure about their business model, and reading their reviews has me worried. Your thoughts about this company would also be appreciated.

Thank you so much for your time, this article was very in-depth and overall very helpful toward my understanding of IULs. Still learning! Cheers

Wassim

I am a Canadian citizen searching for over 1 year to get my hands on an IUL but nothing in Canada similar to what you have in USA. Is there a way to get one, always ready to hear a solution.

Thank you and stay safe!

HI Wassim

We have this product in Canada the company used to be Transamerica now called IVARI in Canada and they this product. Let me know if you need help.

Insurance&Estates

Hello, your question has been forwarded to our IUL expert Jason Herring and you can also reach out to him directly jason@insuranceandestates.com.

Best, Steve Gibbs, Esq.

Mark E Frazier

I would like to talk to someone that’s an expert on iul

Insurance&Estates

Hello Mark, I recommend that you reach out to Jason Herring who handles most of our IULs. His direct e-mail is jason@insuranceandestates.com.

Best, Steve Gibbs, Esq.

dilip naim

what are the top 5 companies to invest in iul

Insurance&Estates

We’ve referred your request to our IUL expert Jason Herring and you can also reach out to him at jason@insuranceandestates.com.

Best, I&E Pro Team

Leon F

How would you rate Midland National as a IUL issuer and why are they not listed in your top choice of insurers for this product?

Insurance&Estates

Hello Leon, I’m not directly familiar with Midland; however, you can connect with our IUL expert Jason Herring at jason@insuranceandestates.com.

Best, Steve Gibbs, for I&E

sedney

someone recommended nationalwide IUL as the best, but it is not on your list, can you comment on this product?

Insurance&Estates

Hello Sedney, Nationwide is a reputable company and our list criteria is based upon many factors. Most likely someone recommended it to you because they are appointed to sell there. I encourage you to research many top companies before deciding. Our agents are independent and work with many companies. For IULs I recommend you connect with Jason Herring at jason@insuranceandestates.com.

Best, Steve Gibbs for I&E

Sedney

thank you, I will do more research.

Victor Cuevas

I’m surprised you don’t have Allianz in that list. Better than the ones you have listed and higher comdex rating than any company you have listed as top IUL companies. Better in cost than most there as well as crediting options.

Insurance&Estates

Hi Victor, thanks for your comment. Folks are often surprised when a preferred company isn’t on our list; however, there are numerous great companies available. Thanks for bringing these strengths to our attention.

Our IUL products expert, Jason Herring, offered the following comments which are from his professional experience and are strictly his opinion: Allianz is tricky when it comes to IUL. They are well thought of in the IUL space. I would place them second behind Pac Life in the POTENTIAL for cash value growth. The problem with Allianz, like Pac Life, is the product is expensive and several things have to happen to hit the bonus and credits they illustrate.

Plus, Allianz looks great when showing projections of 6% or better. But, I like to Stress Test IULs and see what happens if we only average a 4-5% return. Often Allianz and Pac Life products crash and burn due to the high cost in the contract and a lower return. For this reason, I like to stay more conservative with my IUL options. Pru, Mutual of Omaha, Securian, Symetra all have IUL options that are more reasonable. Bottomline, I believe with IUL, we need to use options that lower the risk of having to apologize to the client down the road. Hope that helps.

Zachary Meissner

This is great feedback. I like the Allianz IUL but have been running it against the Mutual of Omaha lately. The stress tested analysis and commentary on cost structure is spot-on.

Adam Ishee

I sell IUL’s, and I’m wondering is what you are calling a LIRP is in fact an IUL. I’ve read a lot of your articles and have been very impressed by your concepts. I feel like I’m still learning new information and concepts about IUL’s everyday, and your articles have been insightful. Thank you in advance!

Insurance&Estates

Adam,

Thank you for the positive feedback. To answer your question, a LIRP is an IUL, although it could also be a whole life policy. But a LIRP is also the implementation of the policy and how you utilize it to maximize the benefits of the product in retirement.

All the best,

I&E

MaryJo Webster

Interested to learn about IUL vs. Strategic Whole Life policy — and to possibly sell the products.

Clarence oliphant

I like more information IUL insurance.

Steven Gibbs

Hello Clarence,

If you haven’t already connected, I recommend that you connect with our IUL expert Jason Herring by emailing him at jason@insuranceandestates.com. Jason works regularly with a number of top IUL carriers as well.

Best, Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Insurance&Estates

MaryJo,

Thank you for stopping by. Please be on the lookout for an email from Jason@insuranceandestates.com.

Sincerely,

I&E