Be Your Own Bank is a financial strategy based on Nelson Nash’s Infinite Banking Concept (IBC) that puts you in control of your money outside of traditional banking systems. By using a properly structured dividend-paying whole life insurance policy designed to maximize cash value growth, you can create your own banking system, finance your purchases, and build wealth on your terms.

In this comprehensive guide, we’ll walk you through exactly how to become your own banker, explore the advantages and disadvantages of implementing this strategy, and show you why whole life insurance makes an excellent vehicle for your personal banking system.

Table of Contents:

Who This Guide is For:

This comprehensive guide to becoming your own banker is perfect for:

- Investors looking for alternatives to traditional banking and investments

- Business owners seeking more control over their capital

- Real estate investors looking for creative financing strategies

- Anyone concerned about financial privacy and asset protection

- Individuals seeking tax-advantaged wealth building strategies

What is the Infinite Banking Concept?

The Infinite Banking Concept, developed by Nelson Nash, is a financial strategy that allows individuals to replicate banking functions through a dividend-paying whole life insurance policy. Instead of borrowing from traditional banks, you borrow against your policy’s cash value while still earning interest and dividends on your full cash value amount.

Key principles of Infinite Banking include:

- Taking control of your financial future

- Creating a system of uninterrupted compound growth

- Building a legacy while having access to capital

- Achieving financial independence outside of traditional banking systems

How to Be Your Own Banker in 7 Simple Steps

Step 1: Research the Infinite Banking Concept

To be your own bank doesn’t mean literally creating a banking institution. Rather, it represents a paradigm shift in your financial thinking that puts you in control of your money instead of Wall Street or traditional banks. This first step involves understanding the principles of Infinite Banking and how they apply to your financial situation.

Resources to help you learn more:

- Our IBC Pros and Cons article

- The IBC Wiki for deeper insights

- Grab a copy of our eBook, The Self Banking Blueprint

Step 2: Choose the Right Financial Vehicle

The second step to becoming your own banker is selecting the optimal financial vehicle. Not all financial products are created equal when it comes to establishing your banking system. A properly structured dividend-paying whole life insurance policy offers unique advantages that make it ideal for Infinite Banking.

Look for policies from the best infinite banking companies that offer:

- Guaranteed cash value growth

- Non-guaranteed dividends (from mutual companies with strong dividend histories)

- Death benefit protection

- Tax advantages

Step 3: Design Your Banking Policy

Creating an effective banking policy requires expert design. This isn’t a traditional whole life policy but a high cash value whole life insurance policy specifically structured to maximize cash value accumulation through:

- Optimized base premium amounts

- Strategic paid-up additions

- Blended term insurance riders

- Proper policy design to maximize early cash value access

A well-designed banking policy allows you to access your cash value within the first 30 days and provides up to 80-90% liquidity from the start.

Step 4: Fund Your Banking System

Capitalizing your banking policy requires consistent premium payments and paid-up additions. You’re essentially overfunding your life insurance policy by contributing as much money as possible into the cash value account while maintaining its status as a life insurance policy.

Important considerations:

- Stay below Modified Endowment Contract (MEC) limits

- Understand IRS guidelines for policy funding

- Create a sustainable funding strategy

Step 5: Utilize Your Banking System

Once your banking policy is funded, you can begin using it to:

- Purchase cash-flowing assets like real estate

- Pay off high-interest debt

- Finance business opportunities

- Make major purchases

When you take a policy loan, you’re using your cash value as collateral. This allows your money to work in two places simultaneously:

- Your entire cash value continues earning interest and dividends within the policy

- The borrowed funds can be deployed to purchase assets or eliminate debt

This strategy works particularly well for entrepreneurs and real estate investors looking to create financial leverage.

Step 6: Recapitalize Your Banking System

To maintain and grow your banking system, you need to pay back your policy loans. This recapitalization process ensures your banking system remains robust and ready for future opportunities.

For example, if you purchased rental property using a policy loan, you can use the rental income to repay your policy loan. Once repaid, your full cash value is available again for the next opportunity.

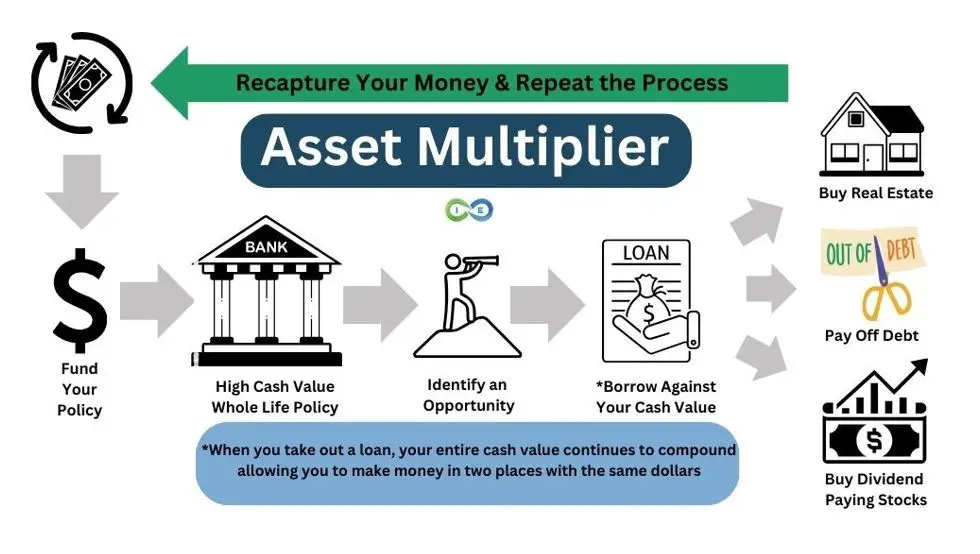

Step 7: Repeat the Process

The real magic of becoming your own banker happens when you repeat this process over and over again. Think of it as your own personal money recycling machine!

Here’s how it works:

-

- Fund your whole life policy (build your bank)

- Borrow against your cash value when opportunities arise

- Use that money to buy cash-flowing assets like real estate or dividend stocks

- Take the profits from those investments to pay back your policy loan

- Now you’re ready to do it all again – but with even MORE money in your policy!

Each time you go through this cycle, you’re building serious wealth AND enjoying some amazing benefits:

-

-

- Your money grows tax-free inside your policy

- Your cash is protected from creditors and lawsuits

- Your policy value keeps growing with GUARANTEED increases plus dividends

- You can access your cash whenever you need it – no questions asked

- And when you eventually pass away, your family gets a tax-free death benefit on top of everything else

-

This is why we call it an “Asset Multiplier” – because your dollars are literally working in two places at once. While your money is out building wealth through real estate or other investments, it’s STILL growing inside your policy at the same time!

7 Key Benefits of Being Your Own Banker with Whole Life Insurance

1. Financial Safety and Stability

When you choose to structure an Infinite Banking policy with one of the highest rated life insurance companies, you’re building on a foundation of financial stability. Many of these carriers are mutual insurance companies with over 150 years of financial strength.

Unlike banks that may engage in risky investment practices and derivatives markets, whole life insurance companies maintain conservative investment portfolios primarily consisting of high-grade bonds and secure investments.

Your banking policy serves as your financial “Safe Bucket” separate from Wall Street volatility and traditional banking system risks.

2. Uninterrupted Compound Growth

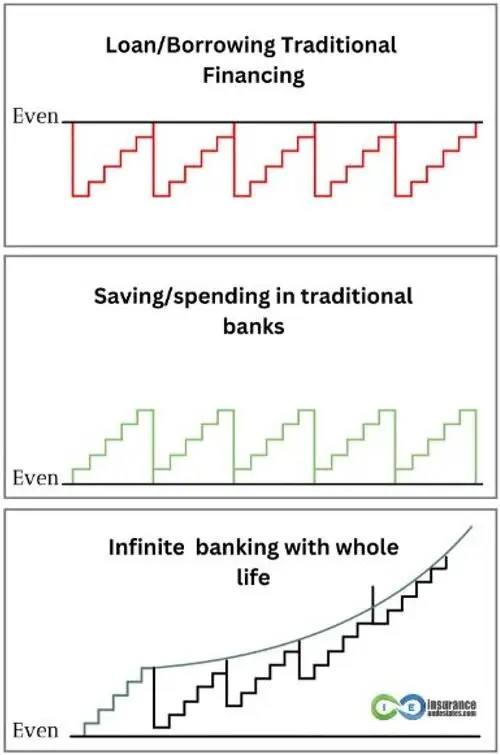

One of the most powerful benefits of using whole life insurance as your bank is uninterrupted compound growth. Even when you take policy loans, your entire cash value continues to earn interest and dividends as though you never borrowed a penny.

This uninterrupted compound interest creates significant wealth over time, especially when compared to traditional methods where withdrawing money stops its growth potential.

3. Financial Privacy

Your life insurance cash value and policy loans don’t appear on credit reports. This means:

-

-

- Large policy loans won’t affect your credit score

- Loan activity stays private

- No loan applications or credit checks required

- No questions about how you’ll use the money

-

You have a contractual right to access your policy cash value at any time, for any purpose, without justification or qualification.

4. Asset Protection

Most states provide some level of creditor protection for life insurance cash values. This means your banking system has built-in legal safeguards against judgments, lawsuits, and creditor claims.

The specific protections vary by state, but this feature makes whole life insurance an excellent asset protection tool as part of your personal banking system.

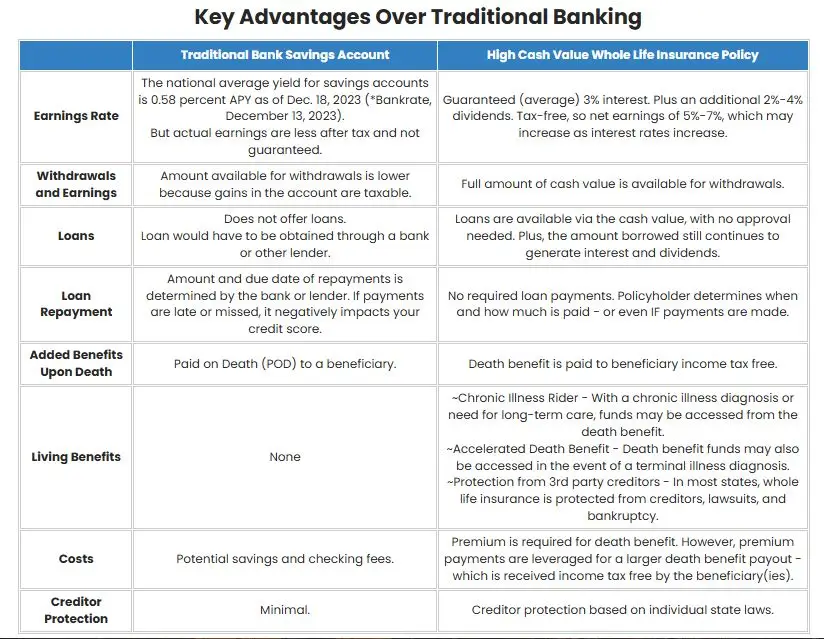

5. Superior Performance vs. Traditional Banking

When comparing traditional bank savings accounts to whole life insurance as your banking system, the differences become clear:

Bank Savings Account:

-

-

- Low interest rates (often below inflation)

- Your money funds bank loans to others

- Limited FDIC protection

- Fully taxable interest

- No death benefit

- No living benefits

-

Whole Life Banking System:

-

-

- Guaranteed growth plus potential dividends

- Your money works for you

- Insurance company financial strength

- Tax-deferred growth

- Tax-free policy loans

- Tax-free death benefit

- Living benefits and conversion options

-

6. Tax Advantages

The tax benefits of using whole life insurance as your bank are substantial:

-

-

- Cash value grows tax-deferred

- Policy loans are tax-free (not considered income)

- Death benefit passes income-tax-free to beneficiaries

- No capital gains taxes on policy growth

- No required minimum distributions

-

These tax advantages, often referred to as 7702 Plan benefits (referencing the Internal Revenue Code section), create significant long-term wealth accumulation opportunities.

7. Financial Leverage

Using your banking policy provides multiple layers of leverage:

-

-

- Policy loans to purchase cash-flowing assets

- Continued growth on your entire cash value while loans are outstanding

- Ability to arbitrage between policy loan rates and investment returns

- Recapture of interest that would otherwise go to banks

- Death benefit leverage providing multiples of your premium payments

-

This leverage is particularly effective when applied to real estate investing or business financing opportunities.

The Financial Philosophy: Pay Interest vs. Pay Cash vs. Pay Yourself

Pay Interest (Traditional Approach)

STOP MAKING BANKS RICH! When you use credit cards or traditional loans, you’re voluntarily transferring your hard-earned wealth to financial institutions. That $30,000 car? You’ll actually pay $42,000+ after interest. That’s $12,000 that could have been building YOUR wealth instead of the bank’s. Every time you finance through traditional means, you’re choosing to make someone else wealthy with YOUR money.

Pay Cash (Common Wisdom)

The “Dave Ramsey approach” sounds smart on the surface—avoid interest by paying cash. But there’s a MASSIVE hidden cost most people miss: opportunity cost. When you drain your savings account to pay cash, that money is GONE. It can no longer work for you. It can’t earn interest. It can’t grow. And now you’re back to square one, slowly rebuilding your savings until the next purchase wipes you out again. It’s a never-ending cycle of “save, spend, repeat” that keeps most Americans stuck in financial mediocrity.

Pay Yourself (Infinite Banking Approach)

THIS IS WHERE THE MAGIC HAPPENS! With infinite banking, you become both the borrower AND the lender. When you take a policy loan and then pay it back with interest, guess who gets that interest? YOU DO! Instead of enriching banks and credit card companies, you’re building your OWN wealth ecosystem. Your money never stops working for you—even while you’re using it to buy cars, invest in real estate, or fund your business. Your cash value continues growing uninterrupted while your money works in TWO places simultaneously. This is how the wealthy have operated for generations, and now YOU can too!

As Nelson Nash famously stated: “You finance everything you buy.” The question is whether you’ll finance it through others or through your own banking system.

Real-World Example: How Infinite Banking Works

Let’s look at how this works in real life. Meet John, a real estate investor who used the infinite banking concept to build wealth:

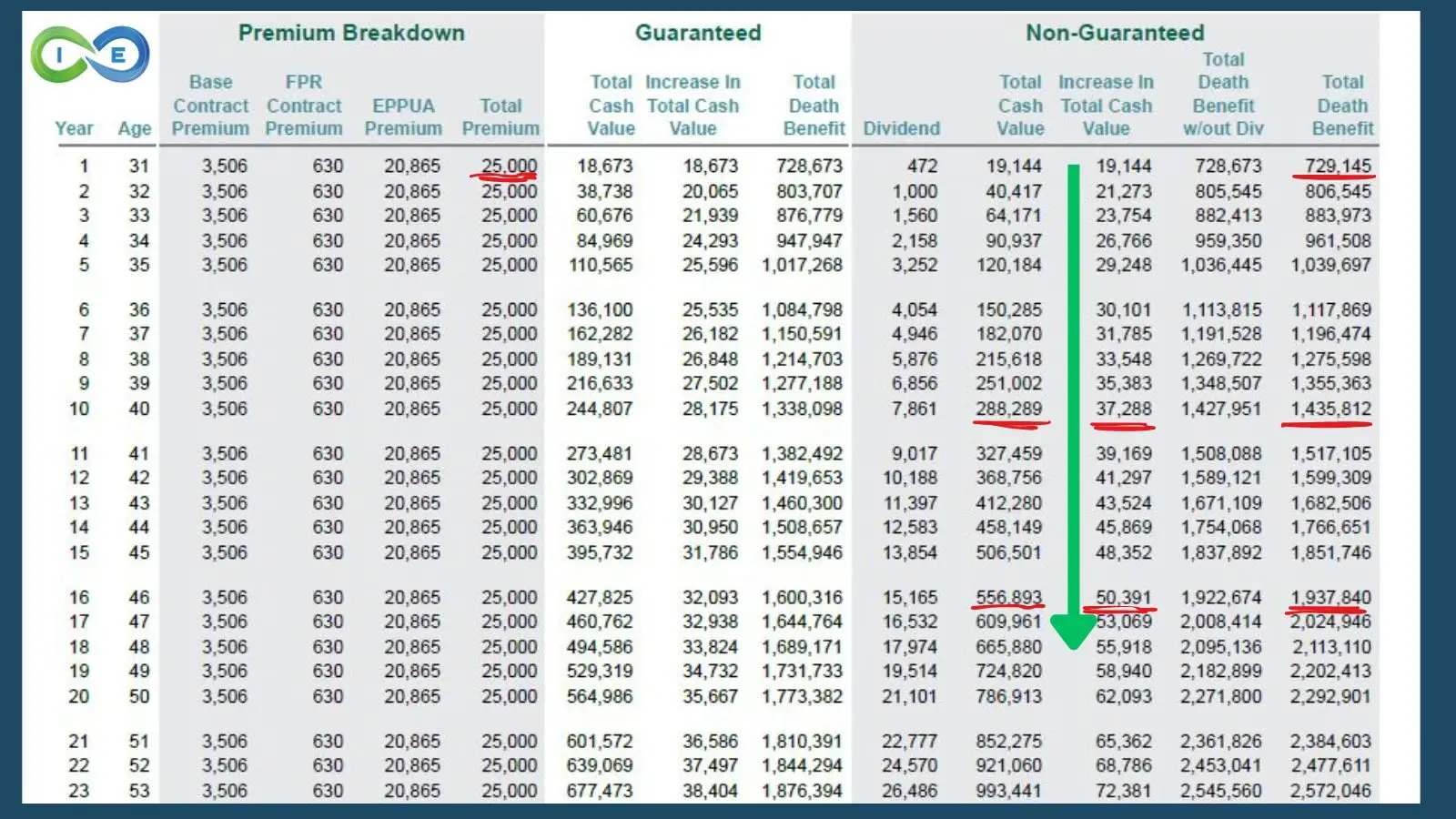

Step 1: John started by funding a high cash value whole life policy with $25,000 per year, structured for maximum cash value growth.

As you can see from this actual policy illustration above, each $25,000 annual premium is strategically allocated:

- $3,506 to the base contract premium

- $630 to the Flexible Premium Rider

- $20,865 to the Enhanced Paid-Up Additions Rider

Step 2: By year 4, John’s cash value had grown to approximately $90,937 (as shown in the “Total Cash Value” column under Non-Guaranteed values). This rapid cash accumulation happened even though he’d only paid in $100,000 total ($25,000 × 4 years).

Step 3: John borrowed $70,000 against his policy as a down payment on a $300,000 rental property. Notice that he could access nearly 80% of his cash value for the investment.

Step 4: While his $70,000 was “out” working in real estate, his ENTIRE cash value continued earning dividends and interest inside the policy. By year 10 (as highlighted in the illustration), his cash value would grow to $288,289 even if he still had his loan outstanding.

Step 5: John used the $2,000 monthly rental income to:

- Pay the mortgage on the property ($1,200)

- Repay his policy loan with interest ($800)

Result after 5 years:

- John’s policy loan was fully repaid

- His cash value had grown to approximately $150,000 (around year 6-7 in the illustration)

- His rental property had appreciated to $350,000

- Notice that by year 10, his death benefit would be over $1.4 million – providing substantial protection for his family

- John was now ready to repeat the process with an even larger loan

Look at the long-term growth potential: by year 20, John’s policy would have a cash value of nearly $787,000 and a death benefit of $2.3 million – all from $25,000 annual premiums. THIS is the power of becoming your own banker – using the same dollars in TWO places simultaneously while creating multiple streams of wealth.

Next Steps to Becoming Your Own Banker

Understanding how to be your own bank through the Infinite Banking Concept may seem complex at first, but the fundamental shift is recognizing that a dividend-paying whole life insurance policy can be used as much more than just a death benefit vehicle.

A properly structured banking policy isn’t an “investment” in the traditional sense—it’s a financial strategy that changes how you use, control, and leverage your money throughout your lifetime.

Ready to explore how Infinite Banking could work for your specific situation?

25 comments

Camille BeBroker

Great insights on how we can use whole life insurance for financial independence! I’ve always been curious about real estate as a route to financial freedom, but your article opened my eyes to the potential of being your own banker. The way you connected Nash, Ramsey, and Kiyosaki’s philosophies was enlightening.

I was particularly intrigued by the idea of having more control over financial assets and leveraging them for greater benefit. How sustainable is this approach in the long-term?

Thanks for breaking down a complex topic into digestible content. Would love to hear more about the practical first steps for beginners looking to dive into this concept. Looking forward to more of your writing!

lee

if i wanted to build my own house and was planning to pay cash for it, how can i lend the money to myself and then pay myself back and write off the interest, without having to claim the interest payments as income also????

Insurance&Estates

No, you cannot write off interest payments you make on a whole life insurance policy loan that’s used to build your personal residence. The IRS doesn’t allow deductions for interest paid on policy loans except in very specific business scenarios. If you own a construction business and use the policy loan funds for business purposes rather than personal use, you may have a potential path to deducting the interest. You would want to consult a tax expert before doing anything.

Jarrell

How much does it take to start being your own bank?

Insurance&Estates

Hi Jarrell,

There are various ways to go about setting up a policy. You can design the infinite banking policy so that the base premium is something you believe you can reasonably pay in good seasons and in bad, when money is flowing or when things are tight. You can then have the paid up addition portion of the policy be 3-4 times as high, so that if you choose to fund the policy with more money you can. This policy design provides a lot of flexibility.

I recommend that if you’re interested in Infinite Banking, connect with either Denise@insuranceandestates.com or Barry@insuranceandestates.com by emailing or scheduling on their respective calendar there.

To your success!

Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Matthew Curotto l

I have so many questions. Who can I talk to, to get answers and understanding?

Steven Gibbs

Hello Matthew, thanks for connecting. We have numerous webinars and videos on our website and 100’s of articles on our blog covering virtually every aspect of this strategy.

When you’re ready, you can also reach out to Denise Boisvert to schedule a call by emailing her at denise@insuranceandestates.com.

Best, Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

lawrence jeffords

interested in be your own banker policy

SJG

Hello Lawrence and thanks for inquiring. A great next step is to email Denise Boisvert at denise@insuranceandestates.com to request a call.

Best, Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Jared

I feel like there’s a catch.. surely I don’t just buy a policy and have access to all that money to do with as I please.. right?

SJG

Hey Jared, there isn’t really a catch except that a best practice for any cash value policy is arguably to “let it bake”. Loans are typically available early on at about 90% of cash value in most cases. However, policy loans do have interest rates to consider, notwithstanding these rates (5-7% currently) are somewhat nominal when compared to other bank rates. Point being, this is an asset with easy leverage capability. There isn’t anything mysterious about cash value life insurance (see IRS Code 7702); however, “do as I please with it” isn’t accurate either. Become a student of this asset. We get call from folks in other countries asking for it and it isn’t available there.

Best, Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Mariyah Rojas

I’m 22 years old and I want to become my own bank. I feel as thought a step by step guide would be more helpful than the step by step process provide. Although There was just a update I hope 2023 update would have better detailed information. So that more motivated young people like myself, can have the online resources that we need to achieve our goals.

SJG

Hello and thanks for your comment and insight. We’ve done some education on the 7702 updates so that would be the biggest take away for 2022-2023. Also, we are always seeking to bring things current in terms of our high cash value pages and articles.

Best, Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Osagie Agboh

I will like to explore the option of BYOB through whole like Ins.

I think it is a great idea!

SJG

Hi Osagie, thanks for connecting! It looks like one of our IBC experts connected with you.

To your success!

I&E Pro Team

Eugene

Hi

How to incorporate this into a family trust thing,or it’s just a one man thing?

Insurance&Estates

Hello, this strategy can be utilized with and compliments a family trust in a number of ways. For starters, the life insurance death benefit could be directed to the trust for dynasty planning purposes and death benefit proceeds are far more flexible and offer tax advantages vs. other kinds of accounts. A great next step would be to schedule a discussion by connecting with Barry Brooksby at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Lawrence

Hi, I want to get my daughter started with this. She is 19 years old and my other son is 14, will they be to qualify? thanks

Insurance&Estates

Hello Lawrence, a great first step is to request a call from Barry Brooksby by emailing him at barry@insuranceandestates.com.

Best, Steve

Nik Catalina

How does this work for people at or above a certain age? Are there companies that will issue whole life policies to aged individuals … or is there a cut-off age ? I imagine the premiums would be high ? Please adivise Thanks

Insurance&Estates

Hello Nik, this can work at older ages depending upon health and other factors. Your best first step is to connect with Barry Brooksby by emailing him to request a call at barry@insuranceandestates.com.

Best, Steve

carla domino

Do you have your lecture on video ,I’m hearing impaired and will need close capture.

Insurance&Estates

Hello Carla and thank you for inquiring. At this point I do not have a close caption version of the lecture and apologize for this. I will work on getting this one updated for you. In the meantime, if you haven’t already I invite you to check out our blog page and search “be your own bank” at the top of the page to get an article on this topic also.

Best, Steve Gibbs for I&E

Vincent F Malfa

Do you have software for being own banker

Insurance&Estates

Hello Vincent, thanks for reading and commenting. Yes we like Truth Concepts software for IBC design and financial comparisons, etc. You can google search them directly.

Best,

Steve Gibbs for I&E