Do you regularly “pay yourself first?”

If so, where does the money go?

According to best selling financial author Robert Kiyosaki, one of the best ways to get – and stay – on track financially is to pay yourself first. Kiyosaki is quoting the book, The Richest Man in Babylon, where George Samuel Clason proposes that the rich pay themselves first, so if you want to be rich you should adopt the practices of the rich. This means setting aside money on a regular basis before you pay your bills and other obligations.

But paying yourself first is only one part of a good, solid overall wealth-building plan – and where you put the money you save can make a significant difference in how long it takes to increase the value of your savings and how you can actually use those funds to your benefit.

Which is Better – Traditional Savings or High Cash Value Whole Life Insurance?

We often hear that putting “money in the bank” will keep it safe and liquid. Yet, what if there was a way to take those very same dollars that you’re putting in a bank savings account and not only boost their growth, but also leverage them to use for other needs like healthcare, making high-ticket purchases (without having to qualify for a loan), supplementing your retirement income tax-free, and leaving a legacy for those you love?

This is what a high cash value whole life insurance policy can do.

There are several factors that can make this financial vehicle ideal for creating and maintaining financial security – both now and in the future. When comparing high cash value life insurance with traditional bank savings accounts, the key areas to consider are:

- Earnings rate

- Withdrawals and earnings

- Loans

- Loan repayment

- Added benefits upon death

- Living Benefits

- Costs

Earnings Rate

One of the biggest differences between a traditional bank savings account and a high cash value whole life insurance policy is the growth potential. For instance, the guaranteed interest rate on a whole life policy is typically higher than that of a savings account.

This is because many high cash value whole life insurance policies pay dividends, which can boost the overall growth – often by an additional 2% to 4% over and above the guaranteed interest rate that is paid.

And up until recently, most bank savings accounts offered abysmal interest rates. This is particularly true with big banks, such as Wells Fargo, Bank of America, and Chase, where the rate of return on savings accounts offer annual percentage yields well under 1%. (As of December 2023, Wells Fargo Platinum Savings Account offers a mere .25% for accounts with a balance under $100,000.)

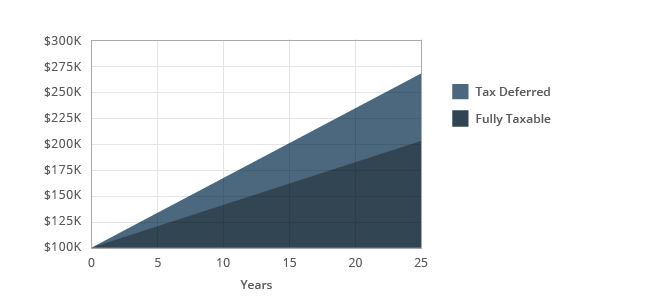

Plus, because the money in a cash value life insurance policy grows tax deferred, the earnings are not reduced each year by gains taxes. Therefore, uninterrupted compound growth continues to accrue on the premium contributions, as well as on previous earnings, and on the funds that would have otherwise been paid out in taxes.

This is not the case, however, with a bank savings account, where the gains are fully taxable every year – and for those who are in higher income tax brackets, the negative impact of taxes can be even worse.

The above chart shows the difference in the growth of an account funded with $100,000 growing over 25 years at 4% in a tax deferred versus a fully taxable account. In 25 years, the tax deferred account would grow to $266,583 versus $208,691 in a taxable account with a 25% tax rate, a difference of $57,892.

Withdrawals and Earnings

Withdrawals can also differ between a cash value life policy and a savings account. For instance, with the latter, the “pool” of money you have to draw from is reduced by gains taxes each year. Over time, these taxes can really chip away at the overall long-term value of the account.

On the other hand, the tax advantaged nature of a whole life insurance policy’s cash value can provide you with a much larger sum of money to access. Further, these funds can be accessed tax free through a policy loan versus only by way of a taxable withdrawal.

Loans

While you can withdraw money from a bank savings account, there is no loan feature available. So, when you access money from this type of account, the value will be reduced. This, in turn, results in a lower “base” from which to generate interest and future growth going forward.

But taking a loan from the cash value of a whole life insurance policy allows you to obtain funds tax free. As an added bonus, accessing money through a policy loan will not affect the growth in the account. That is because you will continue to generate interest and dividends on the entire amount of the cash value.

For example, if your policy’s cash value is $100,000 and you take a $50,000 loan, growth keeps building upon the $100,000. This is because you are actually borrowing from the insurance company and simply using your policy’s cash value as collateral.

In addition, unlike a traditional loan from a bank or other lender, there is no approval necessary for taking a whole life insurance policy loan. Nor will taking this type of loan impact your credit score.

Loan Repayment

When you borrow from a high cash value whole life policy, you have control over how and when – or even IF – you repay the loan. While interest will accrue on the borrowed funds, if you opt not to repay the loan (or to fully repay it), when the insured passes away, the remaining balance will simply be deducted from the death benefit. (And the remainder of the death benefit funds will then be paid to the policy’s beneficiaries).

Alternatively, when you borrow money from a bank, the bank will determine:

- The payment schedule and due date

- The duration for repayment

- The monthly payment amount

In addition, if you miss a payment or do not make your payments on or before the due date, you could incur late fees. You also risk having a negative impact on your credit score if this occurs.

Added Benefits Upon Death

With life insurance, you can literally “buy dollars with pennies.” The premium payment can leverage a much larger amount of funds via the death benefit – which is received income tax free to the beneficiary(ies). This is true, even if only one premium payment has been made before the insured dies.

However, if you pass away with money in a bank savings account, these funds may be paid to one or more named individuals via a POD (Payable on Death) designation. In this instance, the recipient will only receive the amount of money that is in the account – and the funds may also be taxable to them.

Living Benefits

Although many people are aware of life insurance death benefits, there are also ways to use high cash value life insurance while the insured is still alive. For instance, many of these policies include living benefits, meaning that cash can be accessed in certain situations.

Some of the most common types of living benefits include the:

- Chronic Illness Rider – If you require long-term care services or are diagnosed with a chronic illness, you may qualify to tap into the policies death benefit.

- Accelerated Death Benefit – Likewise, if you are diagnosed with a terminal illness, such as cancer, you may access money from the death benefit to pay for healthcare and/or any other need or want.

In addition, in most states, whole life insurance is protected from creditors, as well as from lawsuits and bankruptcy. This can provide an added layer of protection – one that is not typically available with a traditional bank savings account.

Costs

Although there are no out-of-pocket costs per se for having a bank savings account, you could lose out on a significant amount of growth and flexibility by having money in this type of account versus in a high cash value life insurance policy.

Although there is a premium payment required to keep a whole life insurance policy in force, the long list of added benefits – including the tax-related advantages – can make it well worth the “price.”

Comparison of Traditional Bank Savings Account vs. High Cash Value Whole Life Insurance

| Traditional Bank Savings Account | High Cash Value Whole Life Insurance Policy | |

|---|---|---|

| Earnings Rate | The national average yield for savings accounts is 0.58 percent APY as of Dec. 18, 2023 (*Bankrate, December 13, 2023). But actual earnings are less after tax and not guaranteed. | Guaranteed (average) 3% interest. Plus an additional 2%-4% dividends. Tax-free, so net earnings of 5%-7%, which may increase as interest rates increase. |

| Withdrawals and Earnings | Amount available for withdrawals is lower because gains in the account are taxable. | Full amount of cash value is available for withdrawals. |

| Loans | Does not offer loans. Loan would have to be obtained through a bank or other lender. | Loans are available via the cash value, with no approval needed. Plus, the amount borrowed still continues to generate interest and dividends. |

| Loan Repayment | Amount and due date of repayments is determined by the bank or lender. If payments are late or missed, it negatively impacts your credit score. | No required loan payments. Policyholder determines when and how much is paid - or even IF payments are made. |

| Added Benefits Upon Death | Paid on Death (POD) to a beneficiary. | Death benefit is paid to beneficiary income tax free. |

| Living Benefits | None | ~Chronic Illness Rider - With a chronic illness diagnosis or need for long-term care, funds may be accessed from the death benefit. ~Accelerated Death Benefit - Death benefit funds may also be accessed in the event of a terminal illness diagnosis. ~Protection from 3rd party creditors - In most states, whole life insurance is protected from creditors, lawsuits, and bankruptcy. |

| Costs | Potential savings and checking fees. | Premium is required for death benefit. However, premium payments are leveraged for a larger death benefit payout - which is received income tax free by the beneficiary(ies). |

| Creditor Protection | Minimal. | Creditor protection based on individual state laws. |

Is a High Cash Value Whole Life Insurance Policy Right for You?

While high cash value life insurance offers many enticing alternatives as compared to a traditional bank savings account, it is important to determine whether or not this financial tool is truly right for you.

When doing so, walking through your specific financial goals, time frame, and tax situation with a high cash value whole life insurance professional can help you to narrow down the best alternative.

At Insurance and Estates, we specialize in helping people grow and protect wealth, while also accessing the funds that they need for other of life’s necessities. So, if you would like to learn more about a better and more flexible alternative to traditional savings using a high cash value whole life insurance policy, contact Insurance and Estates today at (877) 787-7558 and let’s set up a time to talk.

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

1 comment

Antonino la puma

Desidero essere contattato per informazioni. Grazie