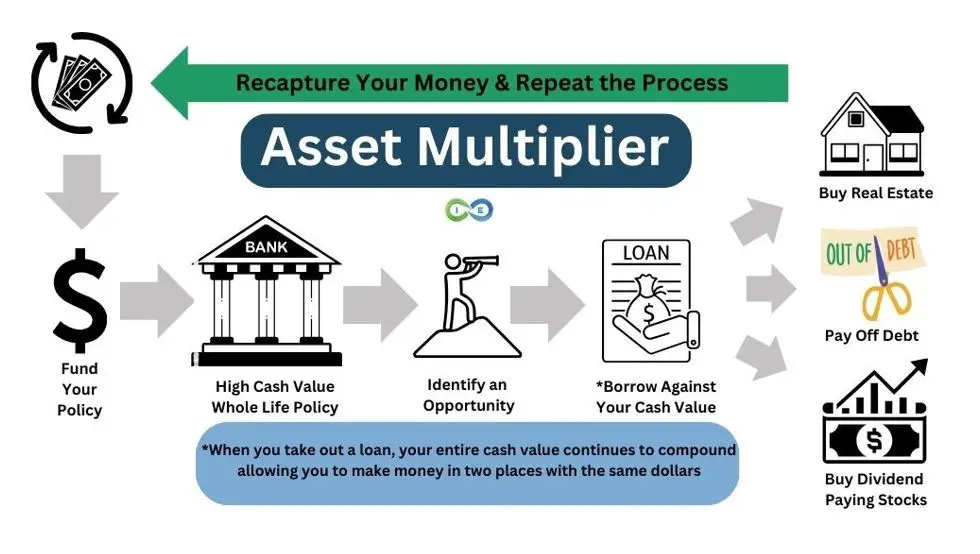

In the world of wealth building, savvy investors are always on the lookout for strategies that can maximize returns while minimizing taxes. Enter the Asset Multiplier Blueprint, a powerful approach that leverages high cash value whole life insurance to acquire other assets and build substantial wealth over time. This strategy, often used by the ultra-wealthy, transforms a specially designed whole life insurance policy into more than just death benefit protection – it becomes your foundation for building serious wealth. Think of it as your own private banking system, where your money grows tax-free and can be used to fund investments while continuing to compound in your policy.

Understanding the Asset Multiplier Blueprint

At its foundation, the Asset Multiplier Blueprint uses a specially designed dividend paying whole life insurance policy as your financial cornerstone. This policy becomes more than just life insurance; it transforms into a powerful, growing asset that can be leveraged to acquire other assets, creating a cycle of wealth building.

Key Components:

- Establish: Set up a strategically designed high cash value whole life insurance policy.

- Grow: Allow the policy’s cash value to grow tax-free over time.

- Leverage: Use the policy’s cash value as collateral to acquire other assets.

- Repeat: As your new assets generate returns, use those to acquire even more assets.

The Power of High Cash Value Whole Life Insurance

High cash value whole life insurance offers unique benefits that make it an ideal foundational asset:

- Tax-Free Growth: The cash value in your policy grows tax-free.

- Asset Protection: In many states, life insurance policies offer creditor protection.

- Borrowing Power: You can borrow against your policy without triggering taxes.

- Continuous Growth: Your policy continues to grow even while you’re using it to fund other investments.

- Predictable Returns: Whole life insurance offers guaranteed cash value growth, unlike market-based investments.

How It Works: The Asset Multiplier in Action

- You establish a high cash value whole life insurance policy, funding it with a $200,000 lump sum and $100,000 annually for 15 years.

- By year 3, your policy has accumulated $450,000 in cash value.

- You take a $450,000 loan from your policy to purchase a rental property.

- Now you have two assets working for you:

- Your policy, which continues to grow as if you never touched it

- A rental property generating income

- You can use the rental income to:

- Pay back your policy loan

- Purchase more policies

- Acquire more assets

This cycle creates a perpetual wealth machine, where your assets are constantly working to acquire more assets. This continuous cycle of growth, investment, and reinvestment maximizes the efficiency and speed at which your money works for you, embodying the principle of high money velocity.

Advantages Over Traditional Financing

Using your life insurance policy as a source of financing offers several advantages over traditional bank loans:

- Quick and Easy Approval: No credit checks or lengthy application processes.

- No Impact on Credit Score: Policy loans don’t appear on your credit report.

- Flexible Repayment Terms: You control the repayment schedule.

- No Risk of Foreclosure: Your policy, not your other assets, secured the loan.

- Continued Growth: Your policy’s entire cash value grows, even with an outstanding loan. So you make money in your policy and in the asset you bought with the money from the loan.

Tax Advantages

One of the most significant benefits of this strategy is its tax efficiency:

- Tax-Free Growth: The cash value in your policy grows tax advantaged and is able to be used 100% tax-free.

- Tax-Free Loans: Policy loans are not taxed as income.

- Tax-Free Death Benefit: The death benefit paid to your beneficiaries is generally income tax-free.

By using policy loans to fund investments, you can avoid or defer capital gains taxes that would typically be incurred when selling assets to fund new investments.

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Case Study: How a Savvy Business Owner Leveraged One Strategy to Build Wealth Beyond Traditional Assets

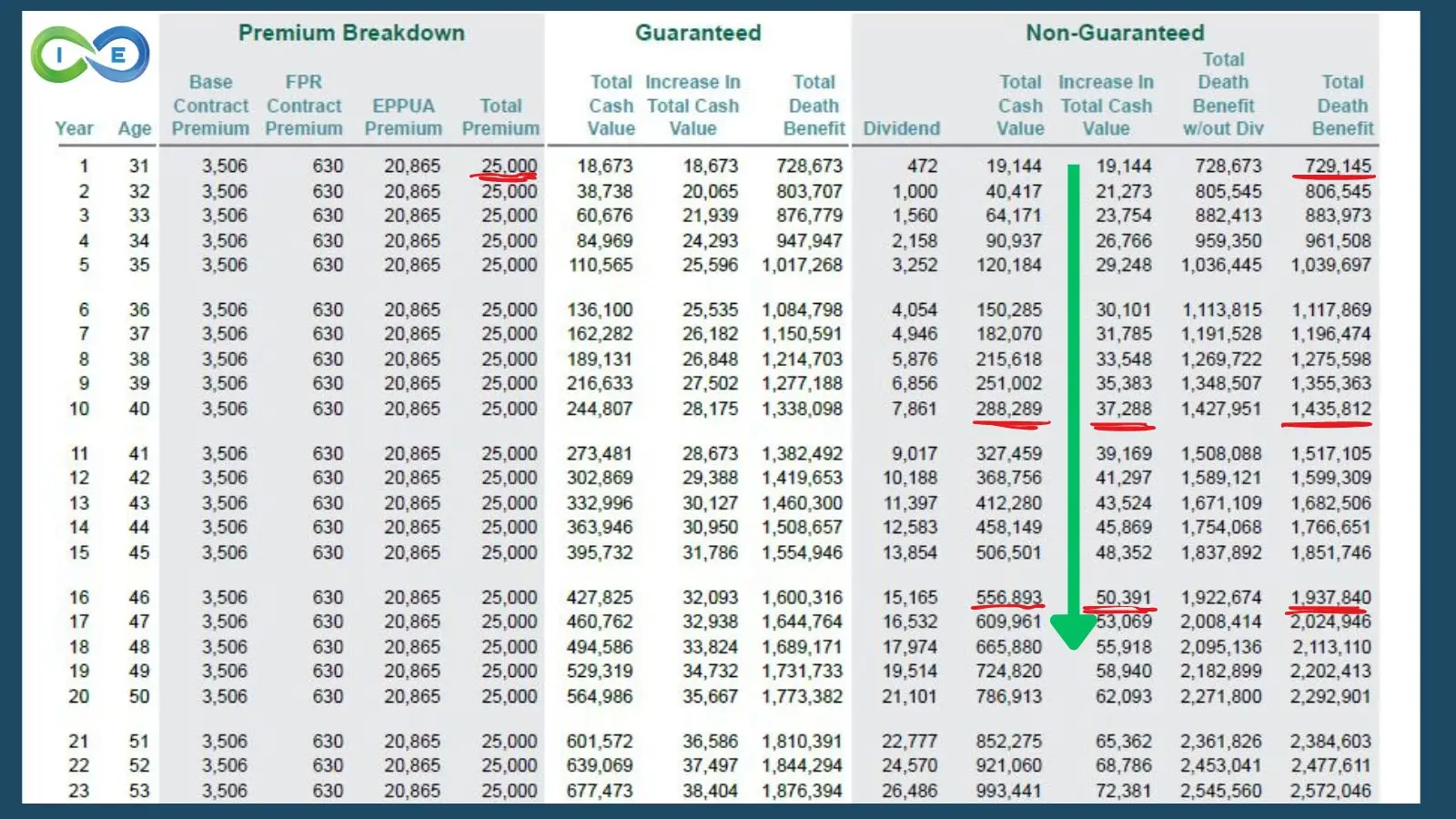

Now most reading this don’t have that much money sitting around so let’s look at another case study, this time involving $25,000 annual payment. (And really, you can do this with much less. We’d recommend a minimum premium around $500 a month.)

Meet Ethan, a 30-year-old business owner who discovered a powerful financial strategy that’s been a game-changer for both his family and his business. At the heart of Ethan’s approach is a whole life insurance policy designed with a focus on cash value growth.

Here’s the breakdown of Ethan’s plan:

- Policy Type: Whole Life Insurance with emphasis on cash value accumulation

- Annual Premium: $25,000

- Starting Age: 30 years old

- Family Status: Married with 2 young children

Let’s walk through Ethan’s financial journey together and see how high cash value life insurance can be a game-changer for you too. Imagine you’re in Ethan’s shoes – you’re 30, married with two young kids, and running your own business. You’re doing well, but you want to make sure your family’s future is secure and your wealth keeps growing. Sound familiar?

Let’s Look at Ethan’s Policy Growth:

Impressive, right? Let’s break down what this means for you:

- Family First: From day one, your family has over $729,000 in protection. By year 16, that’s nearly $2 million! Talk about peace of mind.

- Your Money, Growing: See how your cash value takes off? By year 10, you put in $25,000 and your cash value grows at $37,288, which is $12,288 more than what you’re putting in. That’s your money working for you! And look what happens in year 16. You pay your premium of $25,000 and your cash value grows at $50,391, which is more than double what you paid into your policy. So you cash on cash return in year 16 is over 100%!

- Borrow Smart, Grow Faster: Here’s a cool trick – you can borrow against your cash value without paying taxes on the gains. It is your Financial Swiss Army Knife. This policy isn’t just about protection. It’s a tool you can use to grab opportunities when they come up. Stock market or Bitcoin dip? Real estate deal? You’ve got funds ready to go.

- Snowball Effect: Notice how both your cash value and death benefit keep growing? That’s the magic of compound growth, my friend.

- Instant Net Worth Boost: That death benefit? It’s like giving your net worth an immediate upgrade, closer to what you’re really worth (because let’s face it, you’re priceless to your family).

- Inflation? No Sweat: As your death benefit grows, it helps keep pace with rising costs over time.

What Does This Mean for You?

- You’re Covered: Your family’s financial future gets more secure every year.

- Your Money Multitasks: While it’s growing, it’s also there for you to use. Need to invest in your business or grab a hot investment? Your policy’s got your back.

- You’re in Control: Unlike other investments, you decide when and how to use your money. No need to sell at a bad time just because you need cash.

- Tax Perks Galore: Borrow against your policy? No taxes. Death benefit to your family? Tax-free. Keep Uncle Sam out of your (and your families) pocket.

- Legacy Locked In: You’re not just growing wealth; you’re creating a legacy that can last generations.

Let’s Sum It Up

Look, we know everyone’s financial journey is unique. But whether you’re all about growing your business, securing your family’s future, or building long-term wealth (or hey, why not all three?), a strategy like Ethan’s could be your secret strategy.

Consider how this strategy creates balance. You want protection for your loved ones, and you also want your money to grow. You need flexibility for opportunities, and you also want stability. That’s exactly what we’re seeing in Ethan’s case.

Remember, this isn’t just about numbers on a page. It’s about creating options for yourself, security for your family, and opportunities for your future. It’s about sleeping better at night knowing you’ve got a financial tool that’s working hard for you, even when you’re not.

Other Real-World Success Stories

Many successful individuals and businesses have used this strategy to build substantial wealth:

- Walt Disney used loans from his whole life insurance policies to acquire land for Disney World.

- Ray Kroc leveraged his whole life policy to finance the expansion of McDonald’s.

These examples demonstrate the power of using life insurance as a financial tool for major business and investment opportunities.

Getting Started with the Asset Multiplier Blueprint

To implement this strategy effectively:

- Work with an Expert: Partner with a life insurance professional specializing in designing high cash value whole life policies for this purpose.

- Policy Design is Crucial: Ensure your policy is structured to maximize cash value growth while staying within IRS guidelines to avoid creating a Modified Endowment Contract (MEC).

- Choose the Right Company: Select a reputable, financially strong insurance company known for its dividend performance.

- Start Early: The earlier you start, the more time your policy accumulates cash value.

- Be Patient: This strategy requires time to build significant cash value, but the long-term benefits can be substantial.

Common Objections and Counterarguments

While the Asset Multiplier Blueprint offers numerous benefits, it’s natural for potential investors to have concerns. Let’s address some common objections:

“Whole life insurance is too expensive.”

Counterargument: While whole life insurance premiums are higher than term life insurance, viewing this as a strategic asset rather than an expense is essential. The cash value growth, tax benefits, and ability to leverage the policy for investments can outweigh the cost over time.

“I can get better returns in the stock market.”

Counterargument: While the stock market may offer higher potential returns, it also comes with higher risk and volatility. Whole life insurance provides guaranteed cash value growth and dividends, offering a stable foundation for your investment strategy. Moreover, the ability to leverage your policy for other investments allows you to potentially benefit from market returns while maintaining the stability of your insurance policy. In other words, buy stocks when an opportunity arises if that’s your thing.

“I’ll be paying interest on my own money.”

Counterargument: While you do pay interest on policy loans, remember that your entire cash value continues to grow as if you hadn’t taken out a loan. The growth and dividends can often offset or exceed the loan interest. Additionally, the tax benefits and investment opportunities facilitated by policy loans can potentially outweigh the interest costs.

“It takes too long to build significant cash value.”

Counterargument: Building wealth is a long-term process. However, in a properly structured cash value policy, your cash value grows more rapidly. While it can take time to accumulate substantial cash value, the strategy provides ongoing benefits throughout the policy’s life. Even in the early years, you’re building a stable financial foundation while still having access to your money through policy loans.

“This strategy is too complex for the average person.”

Counterargument: While the Asset Multiplier Strategy does require some financial sophistication, it’s within the reach of motivated individuals. Working with a knowledgeable professional (such as the team at I&E) can help you navigate the complexities and tailor the strategy to your specific needs and goals.

Conclusion

The Asset Multiplier Strategy, centered around high cash value whole life insurance, offers a powerful approach to building wealth while minimizing taxes. Using your policy as a foundational asset to acquire other assets, you can create a self-perpetuating cycle of wealth growth. While this strategy requires careful planning and execution, it has the potential to transform your financial future, providing you with the tools to build lasting wealth for generations to come.

Remember, as with any financial strategy, it’s essential to consult with qualified professionals to ensure this approach aligns with your individual financial goals and circumstances.

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept