Dave Ramsey vs. A Whole Life Insurance Strategy

Introduction: The Importance of Financial Strategy

When it comes to managing personal finances, the advice can vary significantly depending on who you ask. Among the most well-known voices in the financial world is Dave Ramsey, whose no-nonsense approach to budgeting, debt reduction, and investing has helped millions of people regain control of their financial lives. Ramsey’s strategies, centered around term life insurance, cash-based emergency funds, and paying off debt, are simple and easy to follow, especially for those looking to get out of debt and live a financially secure life.

However, there’s an alternative philosophy to consider—one that uses whole life insurance as a cornerstone of financial planning. While Dave Ramsey encourages people to avoid whole life insurance due to its higher costs, the strategic use of high cash value whole life insurance offers a flexible, powerful, and tax-efficient solution to many of the same financial concerns that Ramsey addresses. This approach, favored by many estate planners and high-net-worth individuals, can serve as both an emergency fund and a wealth-building tool, offering advantages that go beyond traditional savings and investment strategies.

In this article, we’ll compare Dave Ramsey’s financial advice with the approach centered on whole life insurance. From life insurance and emergency funds to paying off your mortgage and long-term wealth-building strategies, we’ll explore how each method works and highlight the key differences to help you determine which strategy aligns best with your financial goals.

1. Dave Ramsey’s Advice on Life Insurance: Term vs. Whole Life

One of Dave Ramsey’s most well-known recommendations is to always opt for term life insurance over whole life insurance. He firmly believes that term life is a simpler, more cost-effective way to ensure that families are protected financially in the event of an unexpected death. According to Ramsey, a term life policy gives you the coverage you need during your working years when your family relies on your income. His idea is that you should buy term insurance (typically for 10, 20, or 30 years) and invest the difference between the lower term premium and the higher cost of whole life insurance.

Ramsey’s key criticism of whole life insurance is that it is unnecessarily expensive. He points out that term insurance offers more coverage for less money, and instead of paying the higher premiums associated with whole life, individuals should invest in stocks, mutual funds, or other higher-yielding investments. By following this “buy term and invest the difference” strategy, Ramsey argues, you will achieve better returns in the long run.

High Cash Value Whole Life Insurance as an Asset: A Contrasting View

While Dave Ramsey’s advice may work well for some, it overlooks the unique benefits that properly designed high cash value whole life insurance offers as a financial tool. Whole life insurance is not just about the death benefit—it is also an asset that grows over time through guaranteed cash value accumulation and non-guaranteed dividends from mutual insurance companies, most of which have paid dividends every year for over 150 years. When structured properly, whole life insurance can serve as more than just life insurance; it becomes a liquid asset that provides both financial security and long-term growth.

Whole life insurance policies build cash value that can be accessed at any time through policy loans, allowing you to use your insurance policy as a source of liquidity while still earning guaranteed returns. In this way, whole life insurance functions as a dual-purpose tool: it offers life insurance coverage for your loved ones while also providing a tax-efficient savings vehicle that grows over time. Unlike term life insurance, which expires at the end of the term, whole life insurance lasts for your entire life and offers guaranteed protection as well as an avenue for building wealth.

Moreover, the flexibility of whole life insurance comes into play when looking at the tax advantages. The cash value in a whole life policy grows tax-deferred, meaning you don’t pay taxes on it while it’s growing. Additionally, if you borrow against the cash value, the loan is not considered taxable income and you can withdraw cash up to your basis in the policy. This makes whole life insurance a powerful tool for those looking to create a stable financial foundation with guaranteed growth and liquidity.

2. Emergency Funds: Dave’s 6-Month Fund vs. Using Whole Life Insurance

A key pillar of Dave Ramsey’s financial advice is building a robust emergency fund. Ramsey recommends setting aside 3 to 6 months’ worth of living expenses in a liquid savings account, such as a money market account or high-yield savings account. This emergency fund acts as a financial buffer in case of unexpected expenses like job loss, medical emergencies, or home repairs. The idea is to ensure that when life throws curveballs, you have quick and easy access to funds without needing to rely on credit cards or loans.

While this approach is widely regarded as sound advice, the main drawback lies in the return on the money sitting in a savings account. In today’s low-interest environment, traditional savings accounts offer very minimal growth. Even high-yield savings accounts typically earn less than 3% annually, which barely keeps pace with inflation, particularly when you factor in taxes. As a result, while Ramsey’s emergency fund offers safety and liquidity, it lacks the ability to grow significantly over time.

The Case for Whole Life Insurance as an Emergency Fund

In contrast, using whole life insurance as an alternative emergency fund offers both liquidity and growth potential. A high cash value whole life insurance policy allows you to access the cash value at any time through policy loans, making it a flexible and reliable source of emergency funds. Unlike a traditional savings account, the cash value in a whole life policy grows at a guaranteed rate, typically supplemented by dividends if the policy is from a mutual insurance company.

What makes whole life insurance particularly compelling as an emergency fund is the fact that the cash value continues to grow even when you borrow against it. When you take a loan from the policy, it is technically a loan from the insurance company, with the cash value in the policy serving as collateral. This allows you to access liquidity without interrupting the compound growth of your cash value. In essence, your money is still working for you, even when you use it.

Additionally, the tax advantages associated with whole life insurance enhance its appeal. The cash value grows tax-deferred, meaning that you won’t owe taxes on the growth unless you decide to cash out the policy entirely. All withdrawals up to your basis in the policy are tax-free. And loans taken from the policy are not considered taxable income, so you can borrow money without the tax burden that comes with selling other investments. This makes whole life insurance a more tax-efficient emergency fund compared to liquidating stocks or mutual funds.

Over time, a whole life insurance policy can provide significantly higher returns than a traditional savings account, while still offering the liquidity needed in an emergency. It’s a strategy that aligns better with long-term wealth-building goals, providing both immediate access to cash and a stable, growing asset. In comparison, Ramsey’s strategy of a cash-based emergency fund may offer short-term peace of mind but fails to maximize the potential of your financial resources.

3. Paying Off Your Mortgage: Dave Ramsey’s Perspective

For many people, owning a home outright is a financial milestone that signifies security and stability. Dave Ramsey is a strong advocate for paying off your mortgage early, suggesting that homeowners make extra payments or apply windfalls toward reducing their principal. His reasoning is simple: being debt-free, especially with a paid-off home, gives you peace of mind and financial freedom. Once the mortgage is gone, you have fewer fixed expenses, which opens up more room in your budget for saving, investing, or enjoying life.

Ramsey’s argument for paying off the mortgage also revolves around interest savings. The sooner you pay off the principal, the less interest you owe over the life of the loan. Over a 20 or 30-year mortgage, homeowners can save tens or even hundreds of thousands of dollars by paying off the loan early. Ramsey’s philosophy aligns with his broader focus on avoiding debt entirely, emphasizing the emotional and financial relief that comes with being mortgage-free.

Whole Life Insurance vs. Paying Off the Mortgage: Trapping Wealth vs. Liquidity

While there are clear benefits to being debt-free, paying off your mortgage early may not be the most efficient use of your money. One of the key arguments against Ramsey’s approach is that by paying off your home, you are effectively trapping your wealth in an illiquid asset. The equity in your home doesn’t earn any returns or grow at a guaranteed rate, and the only way to access that equity is by selling the home or taking out a loan, such as a home equity line of credit (HELOC), which comes with transaction costs and interest payments.

In contrast, using whole life insurance as a tool for building liquidity offers far more flexibility. Instead of aggressively paying down your mortgage, you could direct that extra money into a high cash value whole life policy. This strategy creates liquidity, allowing you to borrow against your policy’s cash value whenever needed—whether it’s for emergencies, investment opportunities, or other financial needs. Unlike the equity in your home, the cash value in a whole life policy is liquid and accessible without needing to sell or refinance.

Moreover, whole life insurance allows you to continue growing your asset even while accessing it. By borrowing against the cash value rather than withdrawing it, you preserve the policy’s growth while gaining access to funds. In this way, whole life insurance becomes a tool for maintaining both liquidity and growth simultaneously.

Equity Doesn’t Equal ROI

It’s important to note that the return on investment for a home does not change based on the amount of equity you have. Whether you have 20% or 100% equity, the house will appreciate at the same rate. This makes the argument for keeping your wealth in a more liquid, growing asset like whole life insurance even stronger. You still benefit from homeownership, but your wealth is not tied up in the walls of your house. Instead, it remains accessible, growing at a guaranteed rate, and available for other financial needs or opportunities that arise, and if you die, your family gets a tax-free lump sum payout.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

4. Long-Term Growth and Wealth Building

Dave Ramsey’s financial philosophy focuses heavily on long-term investing in the stock market as a primary means of building wealth. Once individuals have paid off all their debt, including their mortgage, Ramsey advises investing 15% of their income in tax-advantaged retirement accounts like 401(k)s and Roth IRAs. He recommends mutual funds with strong historical performance for steady, long-term growth. According to Ramsey, the stock market offers the best opportunity for achieving a high return on investment, with average returns historically outpacing inflation and other investment vehicles.

While Ramsey’s approach is straightforward and designed to help people avoid financial risk, it is heavily reliant on the performance of the stock market. The stock market can be volatile, and while it typically trends upward over time, periods of downturns or corrections can result in significant losses for those who aren’t prepared for that risk. Ramsey’s focus on market-based returns assumes that individuals are comfortable with the potential fluctuations in value and that they have enough time before retirement to weather market cycles.

Whole Life Insurance as a Wealth-Building Tool

In contrast, whole life insurance offers a wealth-building strategy that is more stable and predictable, providing guaranteed growth regardless of what’s happening in the stock market. A whole life policy’s cash value grows at a fixed, guaranteed rate, and in many cases, policyholders receive dividends from mutual insurance companies, which further boost the cash value. This type of growth is not subject to market volatility, making whole life insurance an appealing option for individuals who prefer a more conservative, stable approach to building wealth over time.

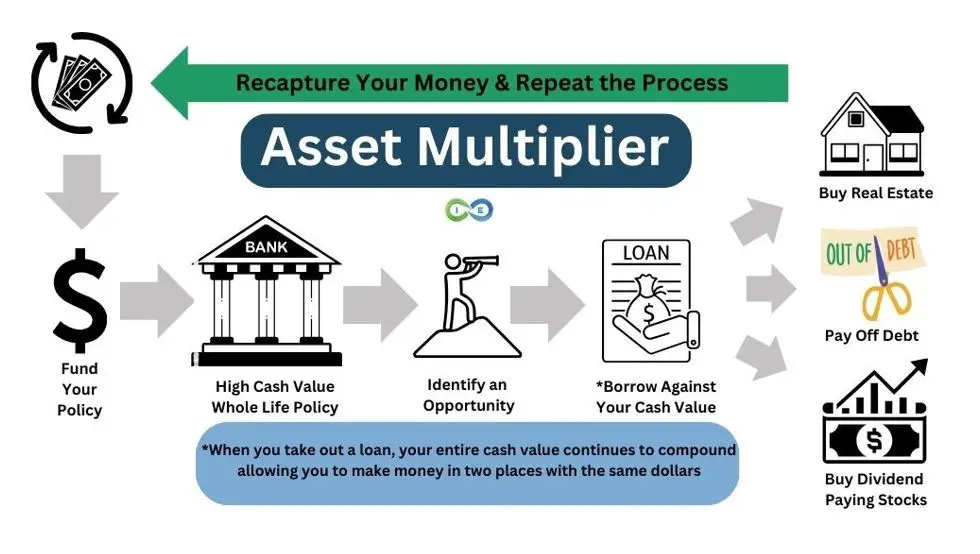

One of the most powerful aspects of whole life insurance as a wealth-building tool is its ability to function as a leveraged asset. Through policy loans, you can access the cash value without liquidating the asset, meaning the policy continues to grow even while you’re using it to fund other ventures. This strategy, which we refer to as the Asset Multiplier Blueprint, allows you to leverage your whole life insurance policy to invest in real estate, fund a business, or take advantage of other investment opportunities.

For example, consider using the cash value of your policy to purchase a rental property. You borrow against your policy’s cash value to make the purchase, and now you have two assets working for you: the whole life insurance policy, which continues to grow, and the rental property, which generates income. The rental income can be used to pay back the policy loan, creating a self-sustaining cycle of wealth-building. This concept of leveraging whole life insurance for investments provides a significant advantage over simply relying on stock market returns or traditional savings vehicles.

Additionally, whole life insurance offers protection against the risk of market downturns. Even during a bear market, the cash value in a whole life policy will continue to grow at its guaranteed rate, providing a safe harbor for your wealth. In times of uncertainty, having a stable, guaranteed-growth asset can bring peace of mind and financial security, making whole life insurance an excellent complement to more market-sensitive investments.

5. Tax Efficiency and Creditor Protection: A Key Advantage

Tax efficiency is a crucial factor in any long-term financial strategy, and Dave Ramsey often advocates for tax-advantaged retirement accounts such as 401(k)s, Roth IRAs, and HSAs (Health Savings Accounts). These vehicles provide opportunities to save on taxes either upfront (in the case of 401(k)s) or on withdrawals (Roth IRAs). Ramsey’s philosophy encourages individuals to invest in these accounts to maximize the tax benefits and build retirement savings in a structured, low-cost way.

While these accounts do offer significant tax advantages, they also come with limitations. Contribution caps restrict how much you can invest each year, and in the case of 401(k)s, you are required to start taking minimum distributions (RMDs) once you reach a certain age. Moreover, withdrawals before retirement age typically incur penalties, limiting access to your money if you need it for other purposes.

Tax and Legal Benefits of Whole Life Insurance

Whole life insurance, on the other hand, offers a unique combination of tax efficiency and creditor protection that makes it an attractive option for those looking to grow and protect their wealth in the long term. The cash value in a whole life policy grows tax-deferred, meaning you don’t have to pay taxes on the gains as long as the money remains within the policy. This allows your money to compound more efficiently over time compared to taxable investment accounts.

Additionally, policy loans from a whole life insurance policy are not considered taxable income. This is a significant advantage compared to traditional investment accounts, where selling assets to access funds often triggers capital gains taxes. With whole life insurance, you can access liquidity tax-free through policy loans, making it a highly flexible financial tool.

The death benefit of a whole life policy is also generally paid out tax-free to your beneficiaries, which ensures that your family receives the full value of your legacy without the burden of income taxes. This makes whole life insurance an excellent estate planning tool, as it can transfer wealth to the next generation without being diminished by taxes.

In addition to the tax advantages, many states offer creditor protection for whole life insurance policies, meaning the cash value and death benefit are shielded from creditors in the event of a lawsuit or bankruptcy. This level of protection is not available with most traditional investment accounts, making whole life insurance a valuable asset for individuals concerned about asset protection and financial security.

For high-net-worth individuals or those with significant liability exposure, the combination of tax efficiency and creditor protection offered by whole life insurance can be a powerful way to safeguard and grow wealth. Even for individuals at earlier stages in their financial journey, the long-term benefits of whole life insurance provide a secure, tax-efficient foundation for building and preserving wealth.

Conclusion: Which Strategy is Right for You?

Both Dave Ramsey’s financial strategies and the use of whole life insurance offer value depending on your financial goals and risk tolerance. Ramsey’s approach is excellent for those looking for a simple, structured way to get out of debt, build a cash-based emergency fund, and invest in the stock market. His advice is particularly useful for individuals who are comfortable with market risk and prefer straightforward financial products.

On the other hand, whole life insurance provides a more flexible, multi-purpose financial tool that can address both short-term needs, such as emergency funding, and long-term goals like wealth-building and legacy creation. The combination of guaranteed growth, tax advantages, and the ability to leverage the policy for other investments sets whole life insurance apart as a comprehensive financial solution. It offers stability in uncertain times, liquidity when needed, and a tax-efficient way to grow and protect your wealth.

Ultimately, the right choice depends on your personal financial situation, your long-term goals, and your comfort level with financial risk. For those seeking a stable, long-term wealth-building strategy with built-in flexibility and tax benefits, whole life insurance can provide a solid foundation that goes beyond traditional savings and investment strategies.

Take Control of Your Financial Future

If you’re ready to explore how whole life insurance can provide a flexible, long-term solution for building wealth and financial security, now is the time to take action. Whether you’re considering an alternative to traditional savings, looking to protect your assets, or seeking a more strategic approach to managing your finances, whole life insurance can offer the stability and growth you’re looking for.

Contact us today for a personalized consultation, and let us help you design a financial plan that meets your goals, maximizes your wealth, and secures your family’s future. Don’t just follow the crowd—make an informed decision that works for you!

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept