Mastering the Velocity of Money With Properly Designed High Cash Value Whole Life Insurance

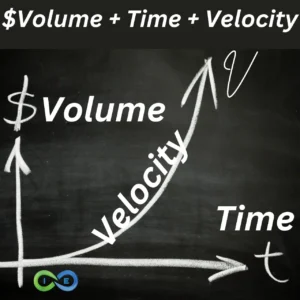

Discover how properly designed high cash value whole life insurance can revolutionize your financial strategy by mastering the velocity of money. This approach challenges traditional saving methods, enabling nearly all your income to work continuously for you. Let’s explore how volume, velocity, and time combine to transform your financial future.

Table of Contents

-

- Traditional Approach vs. Overfunded Whole Life Strategy

- Understanding Volume in Finance

- The Concept of Money Velocity

- Time: The Critical Third Dimension

- How Overfunded Whole Life Insurance Works

- Maximizing Volume and Velocity

- The Asset Multiplier Blueprint

- Scenario: Sarah’s Strategy

- A Revolutionary Money Approach

- Addressing Common Misconceptions

- Steps to Implement This Strategy

- Potential Drawbacks

- Conclusion and Next Steps

Traditional Approach vs. Overfunded Whole Life Strategy

⚠️ Traditional Approach: Income → Taxes → Bills → Lifestyle → Save what’s left (often 10% or less)

The conventional financial model follows this pattern:

- Earn income

- Pay taxes

- Cover bills and living expenses

- Save or invest what’s left (often 10% or less)

This approach is like filling a pool with a garden hose while most of your water flows elsewhere, leaving your savings underutilized.

♾️ Overfunded Whole Life Approach: Income → Fund Policy → Use Policy to pay Taxes, Bills, Lifestyle

The overfunded whole life insurance strategy flips this model:

- Earn income

- Fund a specially designed life insurance policy

- Use policy loans to pay taxes, bills, and living expenses

This subtle shift maximizes the productivity of your money, ensuring it works for you from day one.

Understanding Volume in Finance

Volume refers to the amount of money in your financial system. Traditional savings rely on the 10-15% of income left after expenses, limiting your wealth-building potential.

With an overfunded whole life insurance strategy, you channel potentially your entire income into a policy. Even when borrowing for expenses, the full amount grows within the policy, accelerating wealth accumulation. This larger volume also provides flexibility for investments, business ventures, or major purchases while maintaining the policy’s growth and protection benefits.

The Concept of Money Velocity

A body in motion, stays in motion

For our purposes, velocity is how fast money moves through your financial system. Unlike traditional banking, where money sits idle, an overfunded whole life policy keeps your money in motion, enabling it to:

- Grow through guaranteed interest and potential dividends

- Be accessible for investments or emergencies

- Fund your lifestyle

- Build a legacy for your heirs

All simultaneously, without halting its growth.

Practical Strategies to Maximize Velocity:

- Convert monthly bills to annual payments for cost savings

- Pay bills on the last day of the month to maximize policy interest

- Use rewards credit cards (1-3% cashback) for bills, paying them off monthly with policy loans

- Redirect freed-up cash flow into the policy via paid-up additions for tax-advantaged growth

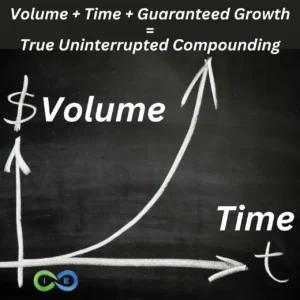

Time: The Critical Third Dimension

Time is an active participant in wealth creation, amplifying the effects of volume and velocity. The longer your money moves (velocity) and the more of it works for you (volume), the greater your wealth potential.

In a properly structured whole life policy, time ensures consistent, predictable growth through guaranteed cash value increases and potential dividends. This stable trajectory becomes more powerful over years, making time a critical ally in your financial strategy.

How Overfunded Whole Life Insurance Works

A properly designed overfunded whole life insurance policy prioritizes cash value growth alongside a death benefit. Key features include:

- High cash value accumulation from the start

- Guaranteed cash value growth

- Potential dividend payments

- Ability to borrow against cash value

- Tax-deferred growth

- Tax-free access via loans

The “overfunded” aspect involves paying more than the base premium, directing extra funds into cash value through paid-up additions, supercharging growth.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Maximizing Volume and Velocity

The power of overfunded whole life insurance lies in maximizing both volume and velocity:

- Volume: Channeling most of your income into the policy works with a larger sum than traditional savings.

- Velocity: Policy loans ensure money grows in the policy while funding lifestyle and investments.

This creates a powerful compounding effect, unmatched by most financial tools.

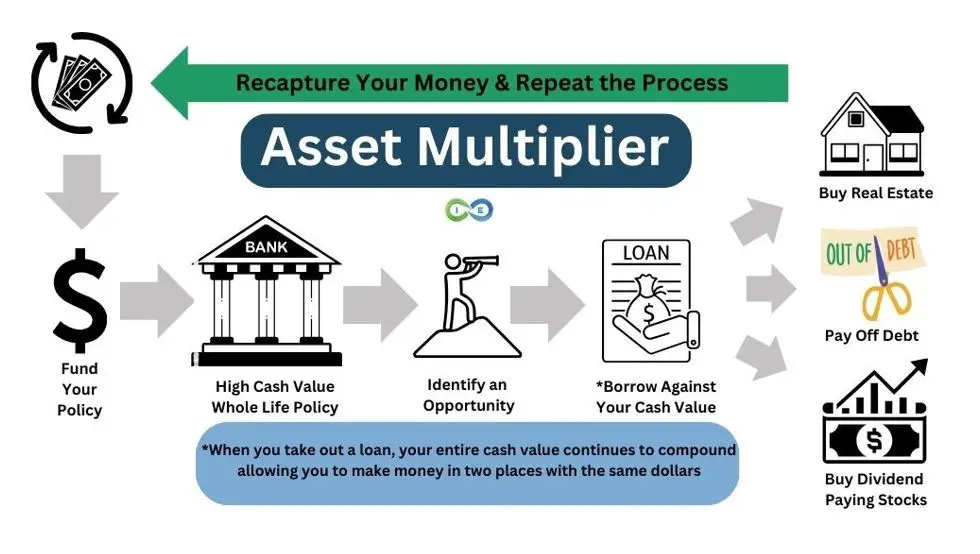

The Asset Multiplier Blueprint

The Asset Multiplier Blueprint supercharges wealth by using high cash value whole life insurance as a foundation to acquire other assets. Benefits include:

- Leveraging cash value for investments

- Tax-advantaged growth and tax-free loans

- Continued policy growth during asset acquisition

- A self-perpetuating wealth cycle

Scenario: Sarah’s Strategy

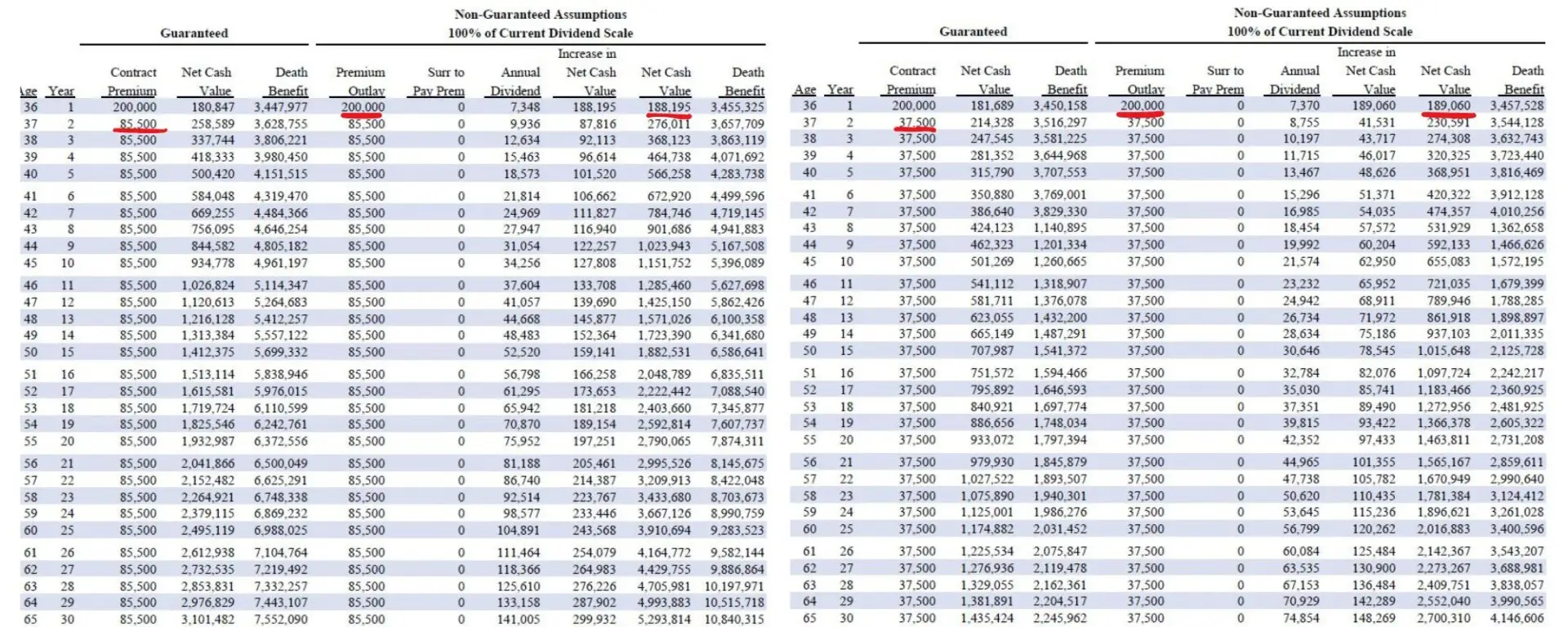

[This is a scenario for demonstration purposes only, see our disclaimer below. To see how your OWN numbers would look, please reach out to one of our Pro Client Guides.]

Meet Sarah, a 35-year-old entrepreneur earning $150,000 annually, seeking to optimize wealth while managing expenses and taxes.

Sarah’s Financial Situation:

- Annual Income: $150,000

- Living Expenses: $60,000

- Taxes (28% of income): $42,000

- Debt: None

- Current Savings: $50,000 emergency fund

We created two scenarios for Sarah, both funneling her entire income and a $50,000 lump sum into the policy. In one, she pays up to $85,500 annually from year 2; in the other, $37,500.

The Strategy:

- Sarah sets up a high cash value whole life policy to accept her $150,000 income plus $50,000 lump sum.

- She funds the policy with her full pre-tax income.

- Year one cash value: $189,000.

- She takes policy loans for expenses ($60,000) and taxes ($42,000), drawn quarterly or as needed.

- She repays $8,755 monthly on the loan.

- After a year, the loan is repaid, the policy grows on the full cash value, and she repeats the process.

Practical Implementation:

Sarah maximizes volume and velocity by:

- Converting monthly expenses to annual payments

- Using rewards credit cards

- Taking strategic policy loans

- Keeping loans below 80% of cash value

- Redirecting cash flow back to the policy

Benefits:

- Maximized Cash Value Growth: Her full cash value grows despite a $102,000 loan.

- Financial Flexibility: Additional loans for opportunities or emergencies.

- Asset Protection: Cash value may be protected from creditors (varies by state).

- Estate Planning: Tax-free death benefit for beneficiaries.

Considerations:

- Manage loans to avoid exceeding 80% of cash value.

- Be comfortable borrowing against the policy.

- Maintain discipline for long-term success.

- Work with a professional to avoid a Modified Endowment Contract (MEC).

A Revolutionary Money Approach

Shift from conventional saving to a revolutionary approach harnessing your money’s full potential. Tailor your financial ecosystem to your goals:

- Invest in stocks using policy loans for market opportunities.

- Use the policy for real estate down payments or improvements.

- Fund private lending with policy capital.

- Grow money securely outside traditional banking.

This approach doesn’t limit options—it enhances them, providing stability, tax advantages, and flexibility for financial freedom.

Addressing Common Misconceptions

“Isn’t whole life insurance expensive?”

Premiums are higher than term insurance, but it’s a wealth-building tool. Growth, tax benefits, and flexibility outweigh costs over time.

“Don’t whole life agents make huge commissions?”

Traditional policies have high commissions, but high cash value policies reduce them by 70-90% through paid-up additions. Choose an agent prioritizing your growth.

“What about loan interest?”

Policy loan interest is offset by growth on the full cash value.

“Isn’t this too good to be true?”

It’s not a quick fix. It requires discipline, proper design, and a long-term perspective but can be highly effective when implemented correctly.

Steps to Implement This Strategy

- Educate yourself on the concept.

- Consult a specialist in this strategy.

- Analyze your finances and goals.

- Design a policy maximizing cash value growth:

- Plan for optimal loan use (max 80% of cash value).

- Structure for maximum paid-up additions.

- Implement consistently:

- Convert bills to annual payments.

- Use rewards credit cards strategically.

- Redirect cash flow to the policy.

- Increase expenses run through the policy gradually.

- Review and adjust regularly.

Potential Drawbacks

Policy Loan Risks and Lapse Prevention

Policy loans are powerful but require management:

Policy Loan Management:

- Keep loans at or below 80% of cash value.

- Monitor loan interest and growth rates.

- Have a clear repayment strategy.

Lapse Prevention:

If the policy lapses, gains become taxable, and outstanding loans may be treated as taxable distributions.

Long-Term Commitment and Flexibility

This strategy is a long-term commitment requiring discipline and coaching from an experienced Infinite Banking agent.

Rethinking Opportunity Cost and Returns

The strategy isn’t just about policy returns—it creates a financial ecosystem for broader wealth-building through dual growth and asset acquisition.

Conclusion and Next Steps

Mastering the velocity of money through overfunded whole life insurance is a paradigm shift. By leveraging volume (your entire income), velocity (constant motion), and time (compounding growth), you achieve greater financial efficiency than traditional methods. This strategy empowers you to control and optimize your money continuously.

While not for everyone, it’s a compelling alternative for those embracing a new financial mindset. Research thoroughly and consult professionals before proceeding.

Next Steps

Ready to transform your financial future? Schedule a free consultation with our Pro Client Guides. Your Infinite Banking coach will help you navigate this strategy using your own numbers in a no-obligation consultation. Book today!

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept