Dave Ramsey, a popular financial advisor, has been critical of the Infinite Banking Concept (IBC) and whole life insurance. This article presents Ramsey’s claims and provides detailed responses to each. If you have any questions or comments, please leave it below the article and we will reply to you quickly.

How Whole Life Complements Dave Ramsey’s Financial Principles

Many financial professionals are familiar with Dave Ramsey’s core principles of building wealth – avoiding debt, maintaining emergency funds, and focusing on long-term financial stability. While Dave himself has been critical of whole life insurance, it’s interesting to note how the features of high cash value whole life insurance align with many of his fundamental teachings. The following comparison illustrates how whole life’s guaranteed growth, tax advantages, and self-banking capabilities parallel the key principles Dave advocates for building sustainable wealth:

For a more comprehensive comparison of Dave Ramsey’s financial advice and whole life insurance strategies, check out our in-depth article: Dave Ramsey’s Financial Advice Vs A Whole Life Insurance Strategy: A Comparison of Two Approaches.

Webinar: Dave Ramsey Doesn’t Understand Whole Life

General Concept and Design

1. Claim: IBC and whole life insurance are “scams.”

Response: This characterization that infinite banking is a scam is highly misleading. Whole life insurance is a legitimate financial product regulated by state insurance commissioners. The Infinite Banking Concept is a strategy for using these products, not a product itself. While not suitable for everyone, these tools offer unique benefits such as guaranteed cash value growth, tax-advantaged growth, and the ability to access cash value through policy loans.

2. Claim: Whole life insurance is “old school done poorly.”

Response: Modern high cash value whole life policies, those designed for IBC, are significantly different from traditional whole life policies. They are structured to maximize cash value growth and provide flexibility that older designs lacked. This claim demonstrates a lack of understanding of current policy designs and the IBC strategy.

You can check out our top dividend paying whole life insurance companies for further insight into the companies and policies. These policies are specially designed and are nothing like their “old school” counterparts.

3. Claim: Infinite Banking policies are just traditional whole life policies.

Response: IBC policies are specifically designed to maximize cash value growth and minimize the initial death benefit, which is different from traditional whole life policies.

Key differences include:

a) Higher proportion of premiums directed to cash value growth

b) Use of paid-up additions to accelerate cash value accumulation

c) Often incorporates a blend of whole life and term insurance to optimize the design

d) Emphasis on policy loan utilization as part of the banking strategy

e) Results in lower commissions to agents (by 70%-90%) compared to traditional whole life policies

Cash Value and Dividends

4. Claim: Cash value in whole life policies “dies with you.”

Response: This claim is inaccurate. In a whole life policy, the cash value is not separate from the death benefit; it’s a representation of the present value of the future death benefit. When the insured passes away, the full death benefit is paid out, which includes the cash value. The policyholder doesn’t “lose” the cash value – it’s part of the total death benefit paid to beneficiaries.

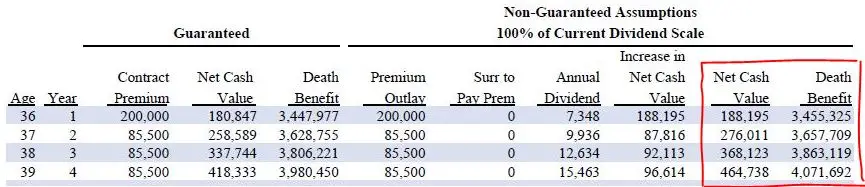

For example, look at this policy we created for an entrepreneur who wanted to place a large lump sum into her policy. Her death benefit in year 4 is almost 10X her cash value.

5. Claim: Dividends are just a return of overcharged premiums.

Response: While life insurance dividends in mutual insurance companies are partially a return of premium, they are primarily based on the company’s overall performance and investment returns. Mutual insurance companies invest policyholder premiums in various assets, primarily bonds, and share the profits with policyholders through dividends. These dividends are tax-free and can significantly enhance the policy’s value over time.

6. Claim: Cash values in policies are “just sitting there.”

Response: Cash values in a whole life policy are not stagnant. They grow through guaranteed interest and potential dividends. Dividends are not guaranteed, but the companies we work with have all paid dividends every year for over 100 years.

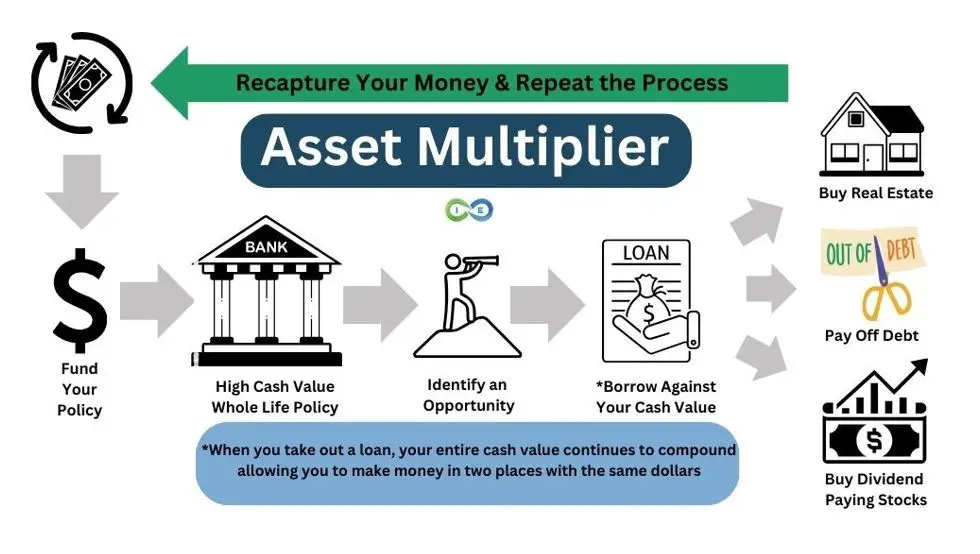

Moreover, in an IBC strategy, these cash values are actively used as a financing tool, providing liquidity for various financial needs and investments.

Policy Loans and Flexibility

7. Claim: Borrowing against policies means “borrowing your own money.”

Response: When taking a policy loan, you’re not borrowing your own money but borrowing from the insurance company using your cash value as collateral. The key advantage is that your cash value continues to grow as if you hadn’t borrowed the money, creating a unique opportunity for leverage without interrupting the compound growth within the policy.

8. Claim: Whole life insurance is not flexible enough for changing financial needs.

Response: This claim doesn’t fully consider the various features and options available with many high cash value whole life policies. Benefits such as:

Policy Loans: The ability to borrow against cash value provides significant financial flexibility.

Paid-Up Additions: The option to purchase paid-up additions allows for increasing the policy’s value over time.

Dividend Options: Policyholders often have multiple options for how to use dividends, providing flexibility.

A properly structured high cash value whole life policy offers built-in premium flexibility. You have control over how much you pay into your policy. You can choose to pay the maximum premium to maximize cash value growth. Alternatively, you can reduce your payments to the minimum required premium. You also have the option to pay any amount between the minimum and maximum. This flexibility allows you to adjust your premium payments based on your financial situation or goals.

Death Benefit

9. Claim: Only the face value of the policy is paid out at death.

Response: This is incorrect for IBC-designed high cash value whole life insurance policies. The death benefit increases over time due to paid-up additions and the structure of the policy. In many cases, the death benefit paid out is significantly higher than the initial face value.

And a growing death benefit provides psychological benefits as well, such as the peace of mind knowing your loved ones are financially taken care of if you die.

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Cost and Value Comparison

10. Claim: Whole life insurance is too expensive compared to term insurance.

Response: While whole life premiums are higher initially than term insurance premiums, this comparison overlooks the cash value accumulation, permanence of coverage, and additional benefits of whole life policies. Term insurance is cheaper initially but becomes prohibitively expensive to renew in later years and builds no cash value.

Further, an IBC policy typically includes term life insurance, so you are getting whole life and term life combined in the early years, which increases the death benefit and the amount of money you can put into the policy.

11. Claim: You should “buy term and invest the difference” instead of buying whole life insurance.

Response: While this strategy can work for some, buy term and invest the difference, a/k/a BTID, oversimplifies the decision and ignores several important factors:

- It assumes people will actually invest the difference, which many fail to do consistently.

- Investing “the difference” typically involves market risk, while whole life provides guaranteed cash value growth.

- Investment gains are typically taxable, while the cash value growth in a whole life policy is tax-deferred and can be accessed tax free through loans.

- If someone needs lifelong insurance coverage, “buy term and invest the difference” may not meet their needs as term insurance becomes prohibitively expensive in later years.

Investment Comparisons

12. Claim: Whole life insurance is a poor investment compared to mutual funds.

Response: Comparing whole life insurance directly to mutual funds is not an apples-to-apples comparison. Whole life insurance provides state creditor protection, death benefit protection, guaranteed growth, leverage, and tax advantages that mutual funds don’t offer. While mutual funds may provide higher potential returns, they also come with market risk and lack the multifaceted benefits of a whole life policy.

13. Claim: Investing the same money in mutual funds would yield much higher returns (citing 11% annual returns).

Response: This claim is problematic for several reasons:

a) It assumes consistent, high market returns that are not guaranteed. Historical stock market returns have averaged around 10% before inflation, but with significant volatility. Further, average returns and actual stock market returns are not the same.

b) It doesn’t account for market downturns, which can severely impact returns, especially if money is needed during a downturn, called sequence of returns risk.

c) It ignores the multiple benefits of whole life insurance beyond just returns, such as the death benefit, tax advantages, and ability to access cash value tax free.

d) It doesn’t consider the guaranteed growth aspect of whole life insurance, which provides stability and predictability.

e) This comparison doesn’t account for the fees and taxes associated with mutual funds, which can significantly reduce actual returns.

f) This comparison doesn’t account for using your cash value as collateral and purchasing other cash flowing assets.

14. Claim: The returns on whole life insurance are too low to be worthwhile.

Response: This claim focuses solely on rate of return of traditional whole life vs high cash value whole life which offers 5%+ returns. Further it ignores the multifaceted benefits of whole life insurance:

- Guaranteed Growth: Unlike market-based investments, whole life insurance provides a guaranteed rate of return on the cash value.

- Tax Advantages: The cash value grows tax-deferred, and death benefits are generally tax-free.

- Risk Profile: Whole life offers a low-risk component to a financial portfolio, which can be valuable for balanced financial planning.

- Additional Benefits: The death benefit, ability to borrow against cash value, and potential dividends provide value beyond just the rate of return.

- Infinite Banking: Use the cash value as an Asset Multiplier and purchase other assets, while simultaneously earning interest and dividends on your entire cash value.

Real Estate and Business Applications

15. Claim: Using whole life insurance for real estate investing is not effective.

Response: Many IBC practitioners successfully use policy loans for real estate investments. The benefits include:

a) Access to capital without credit checks or traditional loan applications

b) Flexible repayment terms

c) The ability to earn returns on both the real estate investment and the continuing growth of the policy’s cash value

d) Tax advantages, as policy loans are not considered taxable income

e) Potential to enhance overall returns by leveraging the policy’s guaranteed growth alongside real estate appreciation

16. Claim: Major corporations and banks don’t see value in whole life insurance.

Response: This is incorrect. Many large corporations and banks use whole life insurance as part of their financial strategies:

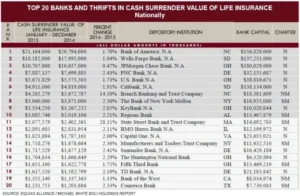

a) Banks use Bank Owned Life Insurance (BOLI) as a tax-advantaged asset on their balance sheets

b) Corporations often use whole life insurance for key person protection and as a way to fund executive benefits

c) Companies like Walmart, General Electric, and Bank of America have billions of dollars in cash value life insurance

d) These entities recognize the stable returns, tax advantages, and flexibility that whole life insurance provides

17. Claim: Banks do not use whole life insurance.

Banks use this as a tax-advantaged way to fund employee benefits and as a stable asset on their balance sheets. According to the Federal Deposit Insurance Corporation (FDIC), as of 2020, U.S. banks held over $180 billion in BOLI assets.

A question you need to ask yourself is, if it is good enough for the banks, why not you?

Financial Advisors and Insurance Agents

18. Claim: Financial advisors recommending whole life are not acting in clients’ best interests.

Response: This claim oversimplifies the situation and misses key points about IBC-designed policies and the financial advisory landscape:

b) Long-Term Perspective: Ethical financial advisors recommending IBC often do so because they believe in its long-term benefits for clients, including tax advantages, guaranteed growth, and financial flexibility.

c) Conflict of Interest in Traditional Advisory: Ironically, many financial advisors avoid recommending whole life insurance because it could reduce the assets under their management. They often prefer to have clients’ money invested in products that generate ongoing management fees.

d) Holistic Financial Planning: IBC can be part of a comprehensive financial strategy that includes investments, protection, and flexible access to capital. Advisors recommending it may be taking a more holistic view of their clients’ financial needs.

e) Education and Specialization: Advisors recommending IBC have often undergone specialized training and have a deeper understanding of how these policies can be used strategically, beyond just as an insurance product.

f) Client-Specific Suitability: The appropriateness of IBC depends on individual client circumstances. Ethical advisors recommend it only when it aligns with a client’s specific financial situation and goals.

In reality, the question of whether an advisor is acting in a client’s best interest depends on their understanding of the products, their analysis of the client’s specific situation, and their overall approach to financial planning. It’s not accurate to broadly claim that recommending whole life, especially IBC-designed policies, is against clients’ interests.

19. Claim: Insurance agents only recommend whole life because they make big commissions.

Response: This claim unfairly generalizes the motivations of insurance professionals and overlooks several important points:

Reduced Commissions: High cash value whole life policies designed for IBC typically have 70-90% lower commissions than traditional whole life policies. This significant reduction in commissions aligns the product more closely with the client’s interests.

Fiduciary Duty: Many insurance professionals have a fiduciary duty to recommend products in their clients’ best interests.

Long-Term Relationships: Successful insurance agents rely on long-term client relationships and referrals, which are built on trust and providing value.

Product Suitability: Infinite Banking and Whole life insurance is not suitable for everyone, and ethical agents recommend it only when appropriate for the client’s needs and goals.

Conclusion

While Dave Ramsey’s advice has helped many people with debt reduction and budgeting, his critiques of whole life insurance and the Infinite Banking Concept often overlook the nuanced benefits these strategies can provide when properly implemented. As with any financial strategy, it’s crucial to thoroughly understand the concept, consider your individual financial situation and goals, and consult with knowledgeable professionals before implementation. The Infinite Banking Concept and whole life insurance, when properly understood and applied, can be powerful tools in a comprehensive financial plan.

Next Steps

Don’t let Dave Ramsey think for you. Rather, educate yourself and make your own decisions on whether high cash value whole life insurance and infinite banking are legit. Please check out our resources page for many free eBooks and webinars to help you on your journey. You can also reach out to one of our Pro Client Guides for a free strategy session. Start today and take back control of your financial life.

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept