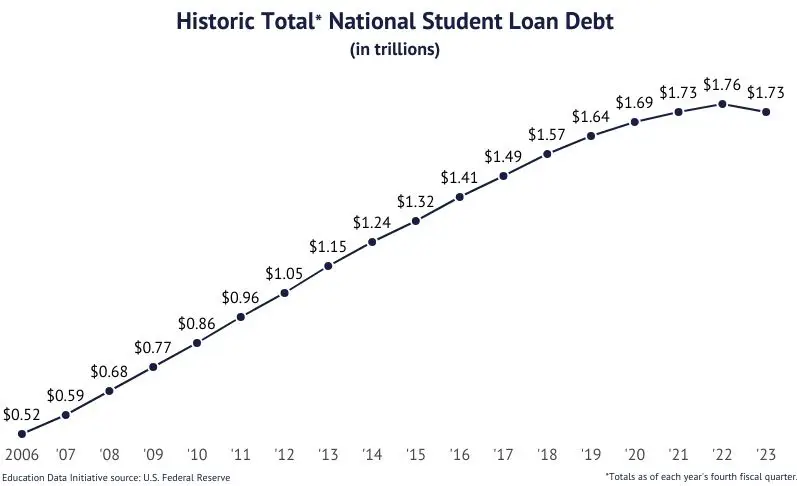

The Student Loan Crisis: What Every American Needs to Know

In an era where higher education is increasingly viewed as essential for career success, the student loan system has become one of America’s most pressing financial challenges. This comprehensive guide examines the realities of student debt, its historical context, and what every American needs to understand before taking on educational debt.

Historical Interest Rate Context: A Tale of Lost Flexibility

Understanding today’s student loan crisis requires looking at how interest rates and loan options have evolved. From 1992 to 2006, student loans featured variable interest rates that fluctuated with market conditions. These loans could be consolidated to lock in lower interest rates. And if you had already consolidated but had another loan, you could reconsolidate all your loans into one. From 2002-2005 this was extremely beneficial for borrowers due to the low interest rate environment we were in.

Historical Rates of Federal Stafford loans to undergraduate students

The student loan variable rate system allowed borrowers to benefit from market rate decreases. However, changes in 2005 and later in 2010 eliminated many refinancing options, effectively locking borrowers into fixed rates regardless of market conditions. This shift fundamentally altered how Americans must approach educational financing.

The Government’s Hidden Tax Machine

The industry underwent two seismic shifts that stripped borrower protections. In 2005, the Bush administration made private student loans non-dischargeable in bankruptcy, putting student debt in a category previously reserved for criminal fines and unpaid child support. Then in 2010, the Obama administration eliminated private lenders as middlemen in federal loans, centralizing control but removing competitive market forces that had previously helped keep rates in check.

The Reality of Student Loan Debt: A Modern Mortgage

Today’s student loan debt is effectively a mortgage on your future. The impact extends far beyond monthly payments:

Life Milestones Delayed

- Home Purchase: Starting life with substantial education debt makes qualifying for a mortgage nearly impossible

- Marriage: Partners increasingly delay marriage due to debt burden

- Family Planning: The financial strain of student loans often forces couples to postpone having children

- Career Choices: Debt can force graduates to prioritize salary over passion or public service

The average graduate now enters the workforce with $27,000 in student loan debt, but many owe significantly more, particularly those with advanced degrees.

Types of Federal Student Loans and Current Rates (2024-25)

The federal student loan system offers several types of loans, each with distinct features, risks, and rates that borrowers must understand:

Undergraduate Stafford Loans (6.53%)

Subsidized loans offer a significant advantage: the government pays the interest while you’re in school and during deferment periods. These need-based loans have lower borrowing limits but offer better protections. Unsubsidized loans, available regardless of financial need, start accruing interest immediately—meaning that $10,000 borrowed freshman year could grow to $12,000 or more by graduation through accumulated interest at current rates.

Graduate and Professional Loans (8.08% – 9.08%)

Graduate students face significantly higher rates, with unsubsidized loans at 8.08% and Graduate PLUS loans at 9.08%. These loans often lead to the highest debt burdens—it’s not uncommon for law, medical, or other professional school students to accumulate $150,000+ in federal loan debt alone. With these higher interest rates and income-driven repayment plans that can extend 20-25 years, graduate borrowers often find their balances growing despite making regular payments.

Parent PLUS Loans (9.08%): A Family Trap Parent

PLUS loans represent one of the riskiest federal loan products, carrying the highest rate at 9.08%. Unlike Stafford loans, PLUS loans allow parents to borrow up to the full cost of attendance minus other aid, often leading to six-figure debt. These loans offer fewer repayment options than student loans, cannot be transferred to the student, and can follow parents into retirement. Even more concerning, PLUS loans require only a minimal credit check, making it easy for parents to borrow far more than they can realistically repay at these high rates.

Private Loan Alternatives (4% – 17%)

Private student loans offer rates ranging from about 4% to 17%, based primarily on creditworthiness. While some borrowers with excellent credit might find lower rates than federal loans, private loans lack the crucial protections and flexible repayment options of federal loans. Additionally, many private loans have variable rates that could increase significantly over time.

Looking Ahead: Rate Trends According to financial analysts, federal student loan rates are likely to increase further in the 2024-25 academic year due to rising Treasury yields. This could push undergraduate rates above 7% and graduate/parent PLUS rates over 10%, making the cost of borrowing even more burdensome for future students. Source.

Hidden Complexities of the System

Amortization: The Hidden Trap

Most student loans use amortized payment schedules, meaning:

- Early payments go primarily toward interest rather than principal

- Making minimum payments can result in negative amortization

- The total amount paid can be multiple times the original borrowed amount

Consolidation Restrictions

- Historically required 2 loans to qualify for consolidation

- 2005 changes severely restricted reconsolidation options

- Current system offers limited flexibility for refinancing

Inside the Lending Machine

The student loan industry’s transformation is perhaps best illustrated by Sallie Mae’s evolution from a quasi-public institution to an aggressive private lender. Originally created to serve the public interest, Sallie Mae became notorious for aggressive collection practices, including harassing phone calls to workplaces, contacting distant relatives, and applying fees that could balloon a $40,000 loan to over $100,000.

Reconsolidate At Lower Rates

The consolidation process once offered borrowers significant protections. The little-known ‘two-step process’ required borrowers to have at least two separate loans to qualify for consolidation—a detail that prevented many from accessing better rates. Those who qualified could first consolidate with the Department of Education, then refinance with a private lender to secure lower rates. During the early 2000s, borrowers could lock in rates as low as 3% through this process, providing substantial savings over the life of their loans.

Can’t Take Advantage of Low Interest Rates

The loss of this reconsolidation option has proven particularly costly in recent years. During the historic low interest rate environment of 2020-2021, when mortgage rates hit record lows below 3%, student loan borrowers were unable to take advantage of these market conditions. Had the old system still been in place, millions of borrowers could have locked in significantly lower rates than the current fixed rates that new loans originate at—a missed opportunity that will cost borrowers billions in additional interest over the life of their loans. This system, while complex, gave borrowers options that no longer exist in today’s centralized framework.

The College Promise vs. Reality

Universities often market degrees with optimistic employment projections, but the reality can be starkly different:

Employment Expectations

Many colleges present average salary data. The average salary date can be misleading. When colleges advertise that their graduates earn an ‘average salary’ of $60,000, they’re using the mean—simply adding all salaries and dividing by the number of graduates. This can be dramatically skewed by a few high earners. For example, if nine graduates make $35,000 and one lands a $305,000 investment banking job, the ‘average’ salary would be $62,000—yet 90% of graduates earn far less. The median (the middle number when all salaries are arranged in order) might be $35,000, and the mode (the most frequently occurring salary) could be even lower. This is why examining the median salary and salary ranges for your specific degree program provides a more realistic picture of likely earnings.

ROI Considerations

Before taking loans, students must critically evaluate:

- Actual starting salaries in their field

- Employment rates for their chosen major

- Total cost of education vs. potential earnings

- Alternative education paths

A System Without Safeguards

Unlike any other financial product, student loans lack basic consumer protections. There’s no requirement for clear disclosure of total costs, no standard bankruptcy protections, and no statute of limitations on collection. The accreditation system that supposedly ensures college quality is run by organizations deeply tied to the schools themselves—a clear conflict of interest that helps explain why tuition continues to rise while graduation rates stagnate.

Consider this stark contrast: A bank wouldn’t approve a $100,000 mortgage without verifying income and assets, yet 18-year-olds can borrow similar amounts for education based purely on future earnings potential, with no meaningful assessment of their ability to repay. And while mortgage borrowers can refinance when rates drop or declare bankruptcy in worst-case scenarios, student loan borrowers remain locked into their original terms regardless of market conditions or personal circumstances.

Essential Reforms Needed

Financial Literacy

The current student loan system demands fundamental reform to protect future generations. First and foremost, mandatory financial education must become a cornerstone of the borrowing process. Before signing loan documents, students need a clear understanding of how amortization works—the way their payments will be divided between interest and principal over time. This education should include real-world payment scenarios showing exactly how much of their future monthly income will go toward loans, along with a thorough analysis of the long-term impact on their financial lives. Students must also receive accurate, region-specific data about career earnings expectations in their chosen field.

Bankruptcy Protections

Beyond education, the system itself requires structural changes. Congress should restore bankruptcy protections for student loan borrowers, bringing these loans in line with other forms of consumer debt. The system needs to reintroduce flexible refinancing options, allowing borrowers to take advantage of lower interest rates when available—a standard feature in virtually every other type of lending. Additionally, meaningful oversight of college cost increases must be implemented to curb the runaway inflation in tuition and fees. Finally, loan servicers need stricter accountability measures to ensure they’re acting in borrowers’ best interests rather than maximizing profits through penalties and fees.

Mandatory Financial Education

- Comprehensive explanation of amortization

- Real-world payment scenarios

- Long-term impact analysis

- Career earnings expectations

System Reforms

- Enhanced bankruptcy protections

- More flexible refinancing options

- Better oversight of college cost increases

- Improved loan servicer accountability

Practical Advice for Prospective Students

Before taking on student loans, consider these crucial points:

When Loans Make Sense

- Clear path to employment

- Salary projections support repayment

- Degree required for career advancement

- ROI analysis shows positive outcome

Warning Signs

Smart Alternatives to Traditional Student Loans

Before committing to massive student loan debt, consider several proven alternatives that could dramatically reduce your education costs. Community college transfer programs offer one of the most powerful strategies – by completing your first two years at a community college before transferring to a four-year university, you could save tens of thousands of dollars while still graduating with the same degree. Many states have guaranteed transfer agreements between community colleges and state universities, ensuring your credits will transfer smoothly.

Work-study programs provide another valuable path, offering part-time jobs that help offset education costs while gaining relevant work experience. These positions, often available on campus, typically accommodate class schedules and can provide networking opportunities within your field of study. Some work-study positions even relate directly to your major, providing both income and career-relevant experience.

Many employers now offer tuition assistance programs, recognizing the value of an educated workforce. Major companies like Starbucks, Amazon, and Walmart provide significant education benefits to even part-time employees. These programs often cover several thousand dollars per year in tuition costs, and some companies partner directly with universities to offer complete degree programs at little to no cost to employees.

Trade schools and vocational programs deserve serious consideration, especially given the high demand and strong salaries in many skilled trades. While traditional college degrees often lead to significant debt, many trade programs can be completed in two years or less, cost significantly less, and lead directly to well-paying careers. Fields like electrical work, plumbing, HVAC, and advanced manufacturing often offer apprenticeships where you can earn while you learn, graduating with zero debt and immediate job prospects.

These alternatives aren’t mutually exclusive – many successful students combine several approaches, such as starting at community college while working part-time for an employer that offers tuition assistance. The key is to think creatively about financing your education before defaulting to student loans that could burden you for decades.

Conclusion

The student loan crisis represents a significant challenge for American society. While higher education remains valuable, the current financing system often creates more problems than it solves. Understanding these complexities is crucial for making informed decisions about education financing.

Before taking on student loan debt, carefully consider all options and implications. Remember that this debt will likely impact life choices for decades to come. Most importantly, ensure that any educational investment has a clear path to positive return through future earnings potential.