How to Build True Financial Freedom By Shifting Your Paradigm

It’s 7:30 AM on a Monday morning. Millions of Americans are fighting traffic, rushing to spend the most energetic hours of their day with people they didn’t choose, doing work that doesn’t fulfill them. This isn’t just about making a living – it’s about life itself slipping away, one precious hour at a time.

Look closer at these morning commuters. The executive in the luxury car next to you might be making seven figures, but he’s missing his children’s bedtime five nights a week. The successful attorney might have a prestigious corner office, but she hasn’t taken a real vacation in years without being tethered to her phone. Even high earners often find themselves trapped, trading their most valuable asset – time – for money they’re too busy to enjoy.

The traditional financial narrative tells us this is just how it works: Save 10% of your income, invest in the market, and hopefully someday you’ll have enough to escape. But here’s the uncomfortable truth: this advice isn’t just incomplete – it’s actively keeping you trapped in a cycle that delays your freedom until it’s too late to fully enjoy it.

Rethinking Wealth: The Freedom Paradigm

True wealth isn’t about a number in your account. True wealth is the ability to do what you want, when you want, with whom you want. This isn’t just another feel-good phrase – it’s the foundation of a completely different approach to building wealth and creating freedom.

As Morgan Housel points out in “The Psychology of Money,” doing well with money has little to do with how smart you are and everything to do with how you behave. But there’s something even more fundamental: understanding what money is really for.

Consider this: Would you rather have $5 million but be required to work 80-hour weeks in a high-stress environment, or have $2 million with the freedom to spend your time exactly as you choose? This isn’t a theoretical question. It’s the exact choice many “successful” professionals face, often without realizing there’s an alternative.

The Three Pillars of Strategic Wealth

Our alternative to traditional wealth building rests on three fundamental pillars: Volume, Velocity, and Value Creation. Each pillar addresses both the technical and psychological aspects of wealth building, creating a framework that’s both powerful and sustainable.

Volume: The Money Multiplication Effect

Traditional advice suggests saving 10-15% of your income. Consider the absurdity of this approach: you’re letting 85-90% of your money work for someone else. Banks don’t operate this way – they use nearly every dollar to generate returns. This raises the question: what if you could build your own banking system?

By utilizing a properly structured whole life insurance policy as your financial foundation, you can channel a significantly larger portion of your income into a financial vehicle that acts as your personal bank. Like a well-designed banking system, it provides guaranteed growth, tax advantages, and complete access to your capital – all while protecting your family’s future through a substantial death benefit. Instead of leaving the majority of your money working for others, you’re now positioning yourself to think and operate like a bank, maximizing the productivity of every dollar.

Think of it like a reservoir versus a stream. Traditional saving is like trying to fill a swimming pool with a garden hose. Our approach is like building a dam – you’re accumulating volume while maintaining control over the flow.

Velocity: The Hidden Power of Money Movement

While most people’s money sits stagnant in checking accounts or locked away in retirement plans, the wealthy keep their money in constant motion. This isn’t about spending – it’s about strategic movement that creates multiple layers of returns.

Consider how banks operate. They don’t just accept deposits and make loans. They create complex systems where the same dollar generates multiple returns through various channels simultaneously. Your money can do the same thing.

When you have a properly structured whole life insurance policy designed for strategic self banking:

- Your policy continues growing through guaranteed cash value increases

- You can access your money through tax-free policy loans

- Those loans can purchase cash-flowing assets

- All while maintaining the death benefit protection for your family

This isn’t theoretical – it’s how Walt Disney financed Disneyland and how many of America’s most successful businesses grew during challenging times.

Value Creation: The Producer Mindset

The final pillar shifts you from consumer to producer. Instead of just saving or investing, you’re creating value in the marketplace. This mindset shift changes how you view money – from something to accumulate to a tool for creating more value. When you build a solid financial foundation, you gain the freedom to think bigger.

Take someone like Elon Musk – while most people focus on his net worth, what’s truly remarkable is his ability to pursue ambitious, world-changing projects. He’s not working to pay bills; he’s working to transform industries and solve global challenges.

That’s the power of the producer mindset. When you have your financial base secured, you can choose to work intensely on projects you’re passionate about, not because you have to, but because you want to create meaningful impact. Money becomes a tool for bringing your vision to life rather than just a measure of security.

The Psychology of Financial Freedom

Understanding these principles is one thing. Implementing them requires overcoming years of conditioning about how money “should” work. Let’s address the psychological transformations necessary for true financial freedom.

Breaking Free from Wall Street’s Grip

The traditional financial industry has convinced many that the only path to wealth is through market exposure and risk-taking. This creates a psychological trap where people:

- Feel guilty about seeking safety over potential returns

- Chase performance instead of building foundations

- Sacrifice peace of mind for the possibility of higher returns

But consider this paradox: the same Wall Street firms pushing “high-risk, high-reward” strategies to retail investors actually use whole life insurance for their own cash management. Major banks hold over $180 billion in Bank Owned Life Insurance (BOLI) – not for the death benefit, but for the guaranteed returns and tax advantages.

Further, when the market crashes and returns are subpar, do money managers take a loss as well, or do they still earn their fees? They’ve created a system where they win either way – collecting fees in good times and bad – while convincing you that seeking safety and predictability means you’re not serious about building wealth.

Building Wealth in an Inflationary World

While most Americans watch inflation erode their purchasing power, successful institutions take a different approach. Consider how major banks position themselves: they don’t just chase higher returns to combat inflation. Instead, they build systems of guaranteed growth and strategic capital deployment. With over $180 billion in Bank Owned Life Insurance, they’re seeking predictability and tax advantages – the same benefits our strategy provides.

This institutional approach to wealth building becomes increasingly valuable in times of economic uncertainty, such as our current environment of high inflation. While others are forced to take on more risk chasing returns, your financial foundation provides unique advantages:

- Your policy’s guaranteed growth continues regardless of economic conditions

- Your death benefit automatically keeps pace with inflation

- Your capital grows tax-free rather than being eroded by taxes and inflation

- Your ability to access money through policy loans lets you seize opportunities when others are constrained

Most importantly, this strategy shifts you from reacting to inflation to positioning for opportunity. Instead of watching your emergency fund lose value or taking unnecessary risks to combat rising prices, you’re building a financial system that provides options and security regardless of economic conditions.

The Freedom Target: Redefining “Enough”

One of the most profound insights from “The Psychology of Money” is that “the hardest financial skill is getting the goalpost to stop moving.” This is where the concept of a Freedom Target becomes crucial. Instead of chasing an ever-increasing net worth, focus on what truly matters: having enough predictable, sustainable income to live life on your terms.

Your Freedom Target isn’t just a number – it’s the point where:

- Your basic needs are met through guaranteed income

- You have the flexibility to choose how you spend your time

- Your family’s future is protected regardless of market conditions

- You can pursue opportunities without desperation

Most importantly, it’s about having the peace of mind that comes from knowing your wealth is real, sustainable, and protected from market volatility.

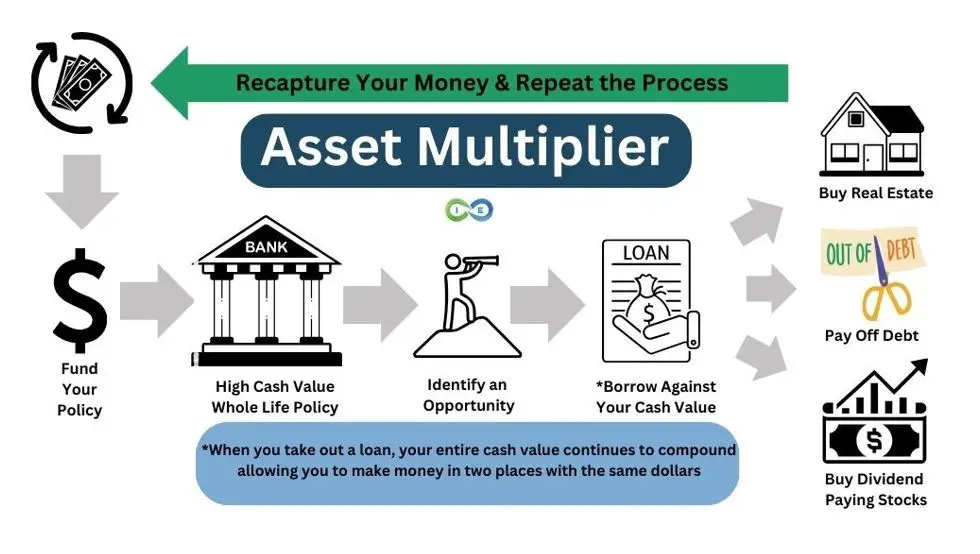

The Asset Multiplier Blueprint in Action

Let’s move from theory to practice. The foundation of the Asset Multiplier Blueprint isn’t just another financial product – it’s a sophisticated wealth-building system that transforms how your money works. At its core is a specially designed high cash value whole life insurance policy that acts as your financial command center, but its power comes from how it multiplies the productivity of every dollar.

Here’s how the Blueprint creates multiple layers of return:

Foundation Building – Your policy is strategically engineered to maximize early cash value while maintaining strong death benefit protection through:

- Specialized rider selection for enhanced cash value access

- Calculated use of paid-up additions to accelerate growth

- Precise calibration of base premium to paid-up additions ratio

- Professional design to optimize policy efficiency

Growth Multiplication – Your money grows in multiple ways simultaneously:

- Guaranteed annual cash value increases (4-6% range)

- Potential dividend payments from the insurance company

- Tax-free compound growth

- Death benefit that grows over time

Strategic Money Movement – While your policy value continues growing, you can:

- Access capital through tax-free policy loans

- Invest in cash-flowing assets or opportunities

- Generate returns from those new investments

- Build wealth in multiple places at once

The result? You’re not just getting returns in your policy – you’re creating additional returns through assets purchased with policy loans, all while maintaining the policy’s protective benefits and tax advantages. This is how one dollar can generate multiple layers of wealth simultaneously.

Think of it like a financial power plant rather than a simple savings account. A traditional account holds your money in one place. The Blueprint transforms your capital into an energy source that powers multiple wealth-generating engines at once.

The Compound Effect of Security

Here’s where Housel’s insights about compound interest meet our strategy. While he mainly discusses market returns, consider how security compounds over time:

- Your policy’s cash value grows predictably

- Your death benefit increases

- Your ability to access capital improves

- Your peace of mind compounds

- Your decision-making improves with reduced stress

This security creates what we call the “Freedom Effect” – the ability to make choices based on opportunity rather than necessity.

Beyond Numbers: The Quality of Life Compound

Just as money compounds over time, so does quality of life when you have true financial freedom. Consider these real-world impacts:

Imagine being able to:

- Take that midweek hike with friends because you control your schedule

- Be present for your children’s key moments without checking work emails

- Pursue business opportunities because you want to, not because you have to

- Sleep soundly knowing your family’s future is secure regardless of market conditions

This isn’t about retiring early or never working again – it’s about having the freedom to choose. Like Elon Musk, you might work 80-hour weeks, but you’ll do it because you’re passionate about your projects, not because you’re trapped by financial obligations.

The Implementation Framework: Making It Real

Understanding these concepts is important, but implementation is where real transformation occurs. Let’s break down how to make this transition practically and psychologically.

Starting Your Journey: The First Steps

Mindset Transformation – Traditional financial thinking has programmed most people to:

- Chase higher returns at the cost of security

- Accept giving up control of their money

- Believe that risk is necessary for reward

- Trust Wall Street with their financial future

Breaking free from this conditioning requires understanding that there’s a different path – one that prioritizes certainty, control, and true freedom over potential higher returns.

Foundation Building – The journey begins with establishing your banking foundation through a properly structured whole life policy. This isn’t about buying insurance – it’s about creating your personal banking system. Working with experienced professionals is crucial here because policy design dramatically impacts your results.

The Asset Multiplier Strategy – Once your banking system is established, you can begin implementing the Asset Multiplier Strategy:

- Your policy grows through guaranteed cash value increases and dividends

- You access capital through policy loans

- These loans fund investments or business opportunities

- Investment returns help repay loans while your policy continues growing

- Each cycle builds upon itself, creating multiple layers of wealth

The Role of Professional Guidance

This strategy isn’t complicated, but it requires proper implementation. Working with professional guides who understand both the technical and psychological aspects is crucial. They help you:

- Design your policy for optimal banking efficiency

- Understand how to utilize policy loans strategically

- Navigate the psychological shifts required

- Make decisions aligned with your Freedom Target

- Stay focused on long-term success

Managing the Psychological Transition

The shift from traditional financial thinking to strategic banking requires several key psychological adjustments. Let’s examine these crucial mindset changes.

From ROI to ROV Thinking

Most people obsess over rates of return, asking “What’s the highest return I can get?” Instead, ask yourself:

- How can I put more of my money to work?

- How can I use the same dollar multiple times?

- How can I create predictable, sustainable growth?

- How can I maintain control while building wealth?

This shift from Return on Investment to Return on Volume thinking is transformative. It’s about maximizing the efficiency and productivity of every dollar rather than chasing higher risk for higher returns.

From Fear to Strategy

Traditional investing is often driven by fear:

- Fear of missing out on market gains

- Fear of not having enough for retirement

- Fear of making the wrong investment decisions

- Fear of market crashes and economic uncertainty

Our approach transforms this fear into strategic confidence:

- Knowing your money is growing safely

- Understanding you have access to capital when needed

- Having protection from market volatility

- Building wealth with predictability and control

The Peace of Mind Premium

One of Housel’s most powerful insights is that you should never risk what you have and need for what you don’t have and don’t need. This principle perfectly aligns with a smarter approach to building wealth – one that focuses on guarantees and predictability over unnecessary risk, creating priceless peace of mind.

Consider what Housel calls being “reasonable” versus being “rational.” While it might be mathematically “rational” to seek the highest possible returns, true financial wisdom acknowledges that peace of mind has real value. Think about the successful executive who makes seven figures but lies awake at night worried about market crashes, or the business owner whose wealth is trapped in illiquid investments when opportunities arise.

Being “reasonable” means understanding that security and accessibility aren’t just psychological benefits – they’re tangible assets that create better decision-making and life quality. When you prioritize:

- Sleep-at-night security: You make decisions from a position of strength, not fear. Instead of worrying about market volatility or economic uncertainty, you know your foundation is solid and growing predictably.

- Guaranteed growth: While others chase higher returns through increasingly risky investments, your money grows steadily through guaranteed cash value increases and potential dividends. This predictability becomes increasingly valuable in uncertain times.

- Flexible access to your money: True wealth isn’t just about how much you have – it’s about having capital available when opportunities or needs arise. Having ready access to your money without penalties, applications, or market timing concerns is invaluable.

- Protection for your family: Beyond just growing wealth, knowing your family is protected regardless of future circumstances provides a peace of mind that no speculative investment can match. Your financial legacy is secure, allowing you to focus on creating impact in the present.

This peace of mind premium – choosing clarity, control, and certainty over potentially higher but uncertain returns – isn’t just about feeling better. It’s about building sustainable wealth that serves your life rather than controls it.

The Power of Guaranteed Returns

Many dismiss high cash value whole life guaranteed returns as “too low” compared to potential market returns. But this misses several crucial points:

The Value of Certainty

- Market returns are uncertain and can disappear overnight

- Guaranteed returns compound reliably over time

- Predictability enables better long-term planning

- Peace of mind has real value

The Multiplier Effect

When your money grows predictably, you can:

- Make strategic decisions without pressure

- Take advantage of opportunities when others can’t

- Maintain control while building wealth

- Sleep soundly knowing your growth is guaranteed

Legacy Building: Beyond Personal Wealth

When we talk about legacy, most people immediately think about what they’ll leave behind. But true legacy building is about much more than passing on wealth – it’s about creating impact that ripples through generations, starting today.

Imagine being able to teach your children not just about money, but about how to think strategically about wealth. Instead of just telling them to save, you’re showing them how to build financial systems that create freedom and opportunity. Your policy becomes a living case study in sound financial principles, one they can learn from and eventually replicate.

The financial foundation you’re building does more than grow tax-free – it creates a fortress of protection for your family’s future. Unlike traditional investments subject to market swings and creditor claims, your legacy remains secure, ready to transfer to the next generation without tax burden or complexity.

Living Legacy

But perhaps the most powerful aspect of this approach is what we call the “living legacy” – the ability to make meaningful impact while you’re building wealth. When you have a solid financial foundation, you gain the freedom to pursue work that matters, not just work that pays. You can dedicate time to mentoring others, supporting causes you believe in, and creating value in ways that extend far beyond dollars and cents.

Think about the compound effect of this approach. While your policy grows financially, you’re also growing your impact. You’re not waiting until retirement to make a difference or until death to transfer wealth. Instead, you’re building a legacy system that works in multiple dimensions simultaneously – financial security, knowledge transfer, value creation, and lasting impact.

This is how real multi-generational wealth is built – not just through accumulation, but through education, example, and empowerment. Your strategy becomes more than a financial tool; it becomes a blueprint for generations to follow.

Practical Application and Next Steps

Understanding these concepts is important, but taking action is crucial. Here’s how to begin:

- Define Your Freedom Target

- Calculate your basic living expenses

- Identify what true freedom means for you

- Determine the guaranteed income needed

- Account for family protection needs

- Create Your Foundation

- Work with experienced professionals

- Design your banking policy properly

- Begin building your banking system

- Learn to use your system effectively

- Develop Your Strategy

- Understand policy loan strategies

- Learn value creation opportunities

- Build your Asset Multiplier Blueprint

- Create implementation timelines

Common Obstacles and Solutions

Let’s address typical challenges people face when implementing this strategy:

“Whole Life Insurance is Expensive”

This thinking comes from viewing it as an expense rather than a banking system. Consider:

- Every dollar you put in remains yours

- Money grows tax-advantaged

- Provides multiple layers of benefits

- Creates a foundation for wealth building

“I Can Get Better Returns in the Market”

This misses the fundamental point:

- It’s not about highest returns

- It’s about guaranteed growth plus flexibility

- You can still invest in markets using policy loans

- You maintain growth even while using your money

“I’ll Be Paying Interest on My Own Money”

Understanding banking mechanics reveals:

- Your entire cash value continues growing

- Loan interest is often offset by policy growth

- Strategic use of loans can create multiple returns

- You’re creating your own banking system

The Life Impact: Beyond Numbers

The true power of this strategy reveals itself not in spreadsheets or financial statements, but in the quiet moments of daily life. Imagine waking up on a Wednesday morning and, instead of rushing to beat traffic, choosing to have breakfast with your children. Not because you called in sick, but because you’ve built a financial system that gives you control over your time.

This transformation ripples through every aspect of your life. When a friend calls about an impromptu hiking trip, you can say yes. When your child has a midday school performance, you’re there – fully present, not checking work emails or worried about getting back to the office. You travel not according to your vacation days, but according to your interests and relationships.

Relationships

The impact on relationships runs even deeper. Financial stress, one of the leading causes of relationship strain, fades as your foundation grows stronger. Conversations with your spouse shift from worry about bills to dreams about possibilities. You choose your business partners and colleagues based on shared values rather than immediate financial needs. These stronger, more authentic connections create a network of meaningful relationships built on choice rather than necessity.

Personal Growth

Perhaps most profound is how this freedom transforms personal growth. Without the pressure of needing every endeavor to produce immediate income, you can pursue learning for its own sake. That business idea you’ve been thinking about? You can explore it methodically, taking calculated risks because your foundation is secure. Your focus naturally shifts from generating income to creating impact, because your financial system gives you the security to think bigger and longer term.

This isn’t just about having more money – it’s about having more life. It’s about transforming from someone who trades time for money to someone who builds systems that create both wealth and freedom. The result isn’t just financial independence; it’s the ability to live life on your terms, creating value because you want to, not because you have to.

Time: The Ultimate Multiplier

Like a master pianist who becomes more skilled with each passing year, time orchestrates every element of this strategy into an increasingly powerful symphony of growth and opportunity. This isn’t just about money growing – it’s about an entire system gaining strength and sophistication over time.

Compounding

Consider how your financial foundation deepens with each passing year. Your policy’s cash value doesn’t just grow – it compounds in multiple ways. While your guaranteed growth builds upon itself, your death benefit steadily increases, creating an ever-larger protective umbrella for your family. Your banking capacity expands too, giving you access to larger opportunities. Meanwhile, the assets you’ve acquired using your policy continue generating their own returns, creating an expanding network of wealth-building engines working in concert.

But the real magic happens in how time amplifies your quality of life. What starts as the freedom to take an occasional midweek break evolves into complete mastery over your schedule. Your family’s sense of security deepens as they witness the stability and growth of your financial foundation. New opportunities for creating legacy emerge as your capacity for impact grows.

Perhaps most importantly, your peace of mind compounds – each year of predictable growth and protection builds upon the last, creating an unshakeable confidence in your financial future.

This compounding of both financial strength and life quality creates a virtuous cycle. The longer your strategy runs, the more powerful it becomes, and the more freedom you have to make decisions based on value rather than necessity. Like a fine wine that improves with age, your strategy doesn’t just endure time – it harnesses it to create something increasingly precious.

Making the Transition

The journey from traditional financial thinking to strategic wealth building requires:

Education and Understanding

- Learning banking principles

- Understanding policy mechanics

- Studying successful implementations

- Continuous financial education

Behavioral Adaptation

- Shifting from ROI to ROV thinking

- Developing long-term perspective

- Building banking discipline

- Creating strategic habits

Strategic Implementation

- Working with professional guides

- Following proven systems

- Regular strategy reviews

- Continuous optimization

The Path Forward: Your Journey to True Financial Freedom

Freedom

True financial freedom isn’t measured by a number in your account – it’s built through a system that generates predictable, sustainable wealth while giving you control of your time and choices. This journey begins with understanding your current relationship with money and defining what freedom really means for you. What’s your Freedom Target – that point where predictable income meets your ideal lifestyle?

Strategic

The next phase is strategic. Working with experienced guides, you’ll design your personalized banking foundation. This isn’t just about setting up a policy – it’s about creating your own financial ecosystem that grows stronger over time. Think of it like building a house: first the foundation, then the framework, and finally all the systems that make it a home.

Impact

As your system develops, you’ll begin focusing on legacy. Not just in terms of wealth transfer, but in creating lasting impact. You’ll set milestones that align with your values, identify opportunities to create value, and build a wealth ecosystem that serves multiple generations.

Each step builds upon the last, creating momentum toward your ultimate goal: the freedom to do what you want, when you want, with whom you want. Your path to financial freedom starts now.

The Ultimate Choice

You stand at a crossroads. One path leads down the traditional route – saving a small percentage of your income, hoping market returns will eventually bring freedom, and working the best years of your life away in the process.

The other path leads to strategic wealth building through the Asset Multiplier Blueprint. This path offers:

- Guaranteed growth and predictable returns

- Complete control of your money

- The freedom to choose your time

- A lasting legacy for your family

Remember what Morgan Housel teaches us: “The highest form of wealth is the ability to wake up every morning and say, ‘I can do whatever I want today.'” Our strategy doesn’t just aim for wealth – it creates true freedom.

A Final Thought

The traditional financial world wants you to believe that risk and uncertainty are the prices of wealth. We believe differently. True wealth comes from building a secure foundation, making strategic decisions, and maintaining control of your financial future.

Your time is your most valuable asset. Each day spent in the traditional system is a day you can’t get back. The choice is yours – continue following conventional wisdom that keeps most people trapped, or take control of your financial future through a proven strategy that creates true freedom.

The path to doing what you want, when you want, with whom you want starts now. The only question is: Are you ready to begin your journey to true financial freedom?