The Banking Secret They Don’t Want You to Know

What if I told you that America’s largest banks are quietly stockpiling over $130 billion of an asset that most financial advisors never mention? The same asset Walt Disney used to build Disneyland when no bank would lend him money. The same asset generations of wealthy families have used to create lasting fortunes.

As an estate planning attorney, I’ve watched how the ultra-wealthy actually build and protect their wealth. Their strategy looks nothing like the conventional wisdom of maxing out 401(k)s and hoping for the best in the market. Instead, they focus on something far more powerful – what I call The Ultimate Asset™.

Think about this: Every time you put money in a traditional bank account or investment, you face an impossible choice. Either your money stays liquid and earns almost nothing, or you lock it away and pray the market cooperates when you need it.

But what if you didn’t have to choose?

What if you could:

- Guarantee your money grows every year, regardless of market conditions

- Access your capital whenever you want, without penalties

- Watch your entire account continue growing even while you’re using the money

- Build wealth completely tax-free

Sounds too good to be true? That’s exactly what I thought – until I discovered why banks and wealthy families have quietly used this strategy for over 200 years.

The Truth About How Banks Build Wealth

Here’s what fascinates me: Banks don’t follow their own advice. They don’t day trade. They don’t anxiously watch the market. Instead, they focus on something far more powerful – volume-based wealth accumulation.

The Power of Volume Over Returns

Think about how banks actually make money. When you deposit $100,000, they don’t just sit on it hoping for better returns. They leverage it to create nearly $1 million in loans. They understand that volume matters more than rate of return. They focus on how many times their money can work simultaneously.

This is where The Ultimate Asset™ changes everything.

The Ultimate Asset™: A New Paradigm in Wealth Building

Using a properly designed high cash value dividend paying whole life policy, in conjunction with an abundant mindset focused on asset acquisition, you can create a perpetual wealth-building machine that lets your money work in multiple places at once – just like banks do. Imagine having a financial foundation that offers:

Guaranteed Growth, Forever

Here’s what makes this truly remarkable – once your money starts growing, it never stops. Unlike market-based investments where you can lose years of progress in a market downturn, The Ultimate Asset™ locks in your gains every year. Your cash value only moves in one direction – up. This guaranteed, uninterrupted compound growth creates a snowball effect that accelerates over time, building momentum year after year. It’s like having a financial engine that never turns off.

Complete Control and Access

Unlike traditional retirement accounts that lock away your money or charge penalties for early withdrawal, you maintain full access to your capital. Need money for an investment opportunity? It’s available within days, no questions asked.

The Ultimate Banker’s Secret

Here’s what makes this truly powerful – your money never stops working. When you use your capital for investments or opportunities, your entire account continues growing as if you never touched it. This is how banks multiply their money, and now you can do the same.

Real World Example: How The Ultimate Asset™ Changes Everything

Let me share a story about one of my recent clients – we’ll call him Ethan. Like many successful business owners, he was looking for a smarter way to build wealth for his family while keeping control of his capital.

At just 30 years old, running his own business, and with two young kids at home, Ethan understood something most people miss: True wealth isn’t just about making money – it’s about how you structure it.

How We Structured His Ultimate Asset™

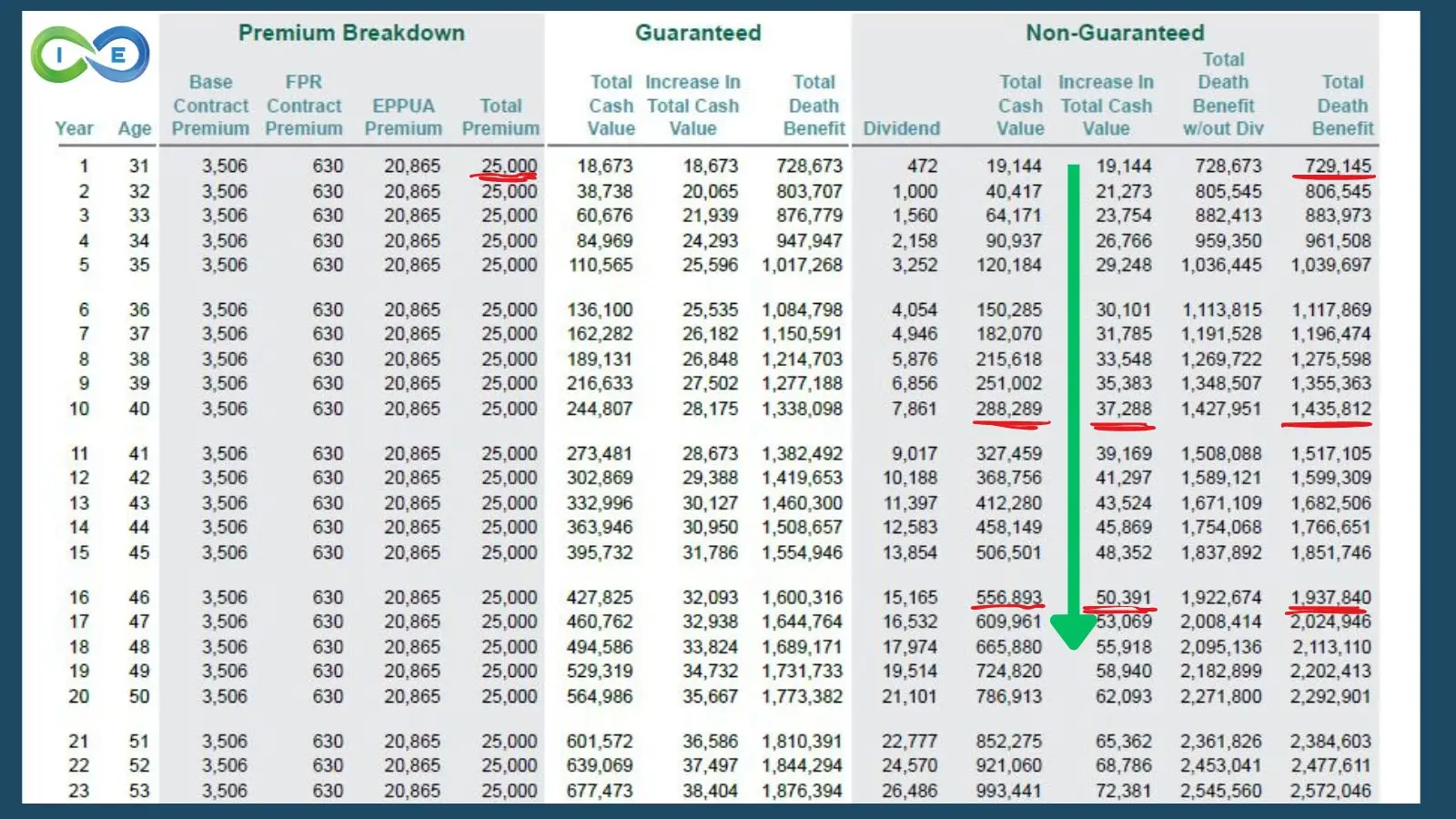

We designed Ethan’s policy with a $25,000 annual premium, maximizing early cash value while maintaining the tax benefits. Here’s what happened:

From day one, his family had over $729,000 in protection. But that was just the beginning. By year 16, that protection grew to nearly $2 million – completely tax-free.

But here’s where it gets fascinating:

By year 10, something remarkable happened. His $25,000 premium was generating $37,288 in cash value growth – that’s $12,288 more than what he put in. Think about that: His money wasn’t just growing, it was multiplying.

And by year 16? His $25,000 premium was creating $50,391 in cash value growth – a cash-on-cash return of over 100%. Show me another asset that does that while maintaining complete liquidity and tax advantages.

The Power of Strategic Design

What makes this truly powerful is how Ethan can use his growing capital. Unlike traditional investments that lock away your money or force you to sell to access capital, Ethan’s policy gives him three unique advantages:

- Tax-free borrowing against his cash value

- Continuous compound growth on his entire balance

- A growing death benefit that keeps pace with inflation

This isn’t just about protection – it’s about creating a financial foundation that works in multiple ways simultaneously. When the market dips or a real estate opportunity appears, Ethan has capital ready to deploy without disrupting his policy’s growth.

Beyond Basic Benefits

The Ultra-wealthy understand that true financial power comes from stacking multiple benefits:

- Tax-free growth and access

- Asset protection from creditors*

- Guaranteed increases every year

- Additional dividend payments from companies with 100+ year payment histories

- Complete privacy (no reporting to credit bureaus)

- A tax-efficient way to transfer wealth to the next generation

The Power of Uninterrupted Compound Growth Most people face a frustrating choice: either their money grows OR they can use it. The Ultimate Asset™ eliminates this false dichotomy. Your entire account value continues compounding even while you’re using the money for other opportunities.

*See if your state offers life insurance creditor protection.

Understanding Economic Value Added (EVA)

Let me share something that changed my perspective entirely about how money works. Every dollar you have is either costing you interest or earning you interest. There’s no middle ground.

The Hidden Cost of Cash

Think about it: When you spend $50,000 in cash on a down payment, you’re not just parting with the money – you’re giving up all the compound growth and tax advantages that money could have earned. Banks understand this. That’s why they never actually spend their capital.

The Banking Reality

Here’s what fascinates me about how banks think about EVA:

- They focus on keeping their capital working in multiple places

- They understand that efficiency and volume matters more than rate of return

- They create systems where their money has multiple jobs

Your Money Should Never Stop Working

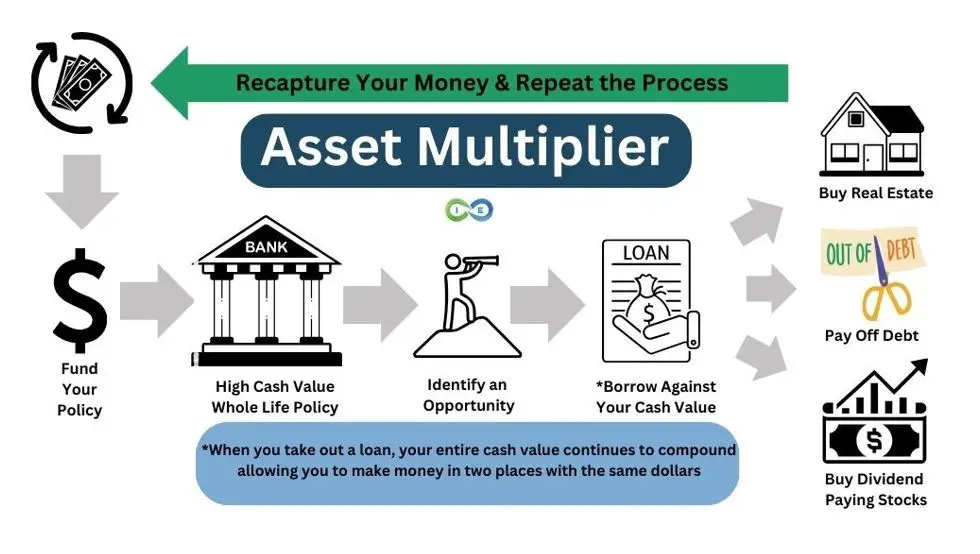

With The Ultimate Asset™, you can finally put EVA to work for you instead of against you. When you borrow against your policy:

- Your entire cash value keeps growing tax-free

- You maintain access to future capital

- Your money works two jobs simultaneously

This isn’t just about returns – it’s about never letting your money take a day off. Just like banks, you can keep your capital working for you continuously, creating wealth in multiple places at once.

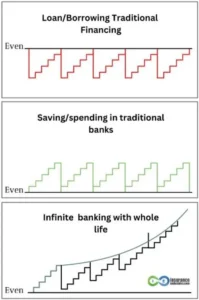

The Cash Method: Back to Zero

When you use cash, the story is simple. You save $50,000 for a down payment on a rental property. Once you spend it, that money stops working for you. Sure, you have the property, but the $50,000 you saved is gone – back to zero.

The Loan Method: Pay to Get Even

If you take out a traditional loan, you’re actually moving backwards. You borrow $50,000 from a bank, and spend years making payments with interest just to get back to even. All while the bank makes money on your effort.

The Ultimate Asset™ Method: Growth in Two Places

But what if you could keep your money growing while using it at the same time? This is where The Ultimate Asset™ changes everything.

Here’s how it works:

- Your $50,000 sits in your high cash value whole life policy, growing tax-free with guaranteed returns

- You borrow against this cash value to buy your rental property

- Your entire $50,000 continues earning compound interest and dividends, exactly as if you never touched it

- The rental property generates income to pay back your policy loan

- You end up with both the property AND your growing cash value

Think about that: Instead of going back to zero or paying to get even, you’re building wealth in two places simultaneously. This is exactly how banks multiply their money – and now you can do the same with the Asset Multiplier Blueprint.

Asset Multiplier Blueprint Using The Ultimate Asset™

Here is a visual showing the Asset Multiplier Blueprint that shows how to use the Ultimate Asset to buy more assets. Then wash, rinse, and repeat.

Designing The Ultimate Asset™

The Power of Proper Structure

Most people misunderstand what makes The Ultimate Asset™ so powerful. It’s not just about owning it – it’s about how you structure it. The ultra-wealthy use specific design elements that transform this from a simple financial tool into a sophisticated wealth-building machine. Think of it like building a high-performance engine. Every component matters. The wealthy focus on:

Maximum Early Cash Value

Instead of waiting decades for benefits, proper structure provides significant accessible capital within the first few years. This isn’t about patience – it’s about strategic design. We want to prioritize cash value accumulation and minimize the death benefit. This is done by adding certain riders to the policy, mainly a paid up additions rider and a term rider.

Optimal Premium Structure

By using advanced funding techniques, you can maximize growth while maintaining flexibility. No more being locked into rigid payment schedules or sacrificing performance. Instead, you will have a minimum and maximum premium amount you can pay into your policy, that will vary greatly, providing maximum premium flexibility.

Tax-Free Leverage

The wealthy understand that accessibility without tax consequences creates true financial freedom. Your money grows tax-free, and you can access it tax-free. Take out a policy loan and use it to buy other assets, while your entire cash value balance still earns interest and dividends as if you never touched it.

Common Misconceptions: What Most People Get Wrong

You can see our comprehensive list of commonly asked question and objections. Here are a few of the most common:

“Whole Life Insurance Is Too Expensive”

But what does “too expensive” really mean? Unlike term insurance that becomes prohibitively expensive as you age, The Ultimate Asset™ locks in your costs forever. More importantly, it’s not about cost – it’s about what you get in return. When properly structured, your premium builds a foundation of guaranteed growth and tax-free access that no other asset can match.

“The Returns Are Too Low”

Banks don’t stockpile $130 billion of low-return assets. In a properly structured policy, you typically see returns around 5% – tax-free. But here’s what most people miss: it’s not just about the return rate. It’s about:

- Guaranteed growth regardless of market conditions

- Tax-free accumulation and access

- The ability to use your money while it continues growing

- Additional dividend payments from century-old companies

“You’re Locked Into High Premiums”

This is perhaps the biggest myth. With proper structure, you maintain complete flexibility. You can adjust your premiums between a minimum and maximum range, while your money continues growing. For example, we recently designed a policy for a 30 year old where the minimum monthly payment was as low as $500, with a maximum as high as $5,000. That is a ton of flexibility.

“It Takes Too Long to Access Your Money”

Another misconception that comes from looking at traditional policies. In a properly structured Ultimate Asset™, you can access your capital within the first month. By year 3-4, many policies have cash value equal to premiums paid. Compare this to retirement accounts that lock away your money for decades. And by year 10, you could be getting an internal return that is much higher than your premium payment.

From our example above, we did a policy recently that had $25,000 annual premiums but in year 10 the cash value grows $37,000. And by year 16, the premium due is $25,000 but the cash value growth is over $50,000, providing a cash on cash return of over 100%.

“Only Insurance Agents Promote This”

Look at who actually owns these policies:

- Major banks holding over $130 billion

- Fortune 500 companies

- Wealthy families who’ve used this strategy for generations

- Sophisticated investors seeking tax-free growth

And we at I&E design these policies so that they accumulate the most cash value with the lowest commissions. This isn’t about getting your agent rich, but providing you with the best policy based on your goals.

Your Strategic Implementation Guide

Foundation First

Start with as little as $500 monthly. Remember – this isn’t about getting rich quick. It’s about building an unshakeable financial foundation that banks and wealthy families have relied on for generations.

Phase 1: Strategic Growth Phase

Your policy begins working immediately providing you with:

- Guaranteed tax-free growth

- Immediate access to capital

- Asset protection benefits

- Dividend potential from day one

Phase 2: Volume Building

As your policy grows, the volume of money you can use grows as well.

- Cash value equals premium (typically years 3-4)

- Dividend payments begin

- Multiple use of money strategies available

- Strategic leverage opportunities emerge

Phase 3: Activate Velocity

This is where everything accelerates. Use your growing capital for acquiring more assets, such as:

- Real estate acquisitions

- Business expansion

- Market opportunities

- Legacy building

Taking Control of Your Financial Future

Let me share something that changed my perspective entirely. As an estate planning attorney, I watched client after client struggle with the same problem. They were successful, smart, and doing everything “right” according to conventional wisdom. Yet they felt trapped – their money either locked away in retirement accounts or exposed to market volatility.

Then I discovered what my wealthiest clients were doing differently.

Your Path to Financial Independence

The first step is a private Strategy Session. This isn’t a high-pressure sales pitch. Instead, we’ll have a thoughtful conversation about:

- Where you are now financially

- What you want your money to do for you

- How to structure your Ultimate Asset™ for maximum benefit

- Specific strategies that match your goals

What You’ll Discover

During our time together, you’ll learn exactly how to:

- Design your policy for maximum early cash value

- Create tax-free income streams

- Protect your assets from market volatility

- Build a legacy for generations

And our gift to you. Grab a free copy of The Ultimate Asset™ – our comprehensive eBook that reveals exactly why high cash value whole life is the Ultimate Asset.

The Ultimate Asset™

How Whole Life Insurance Provides Predictable, Guaranteed Growth.

The Choice Is Yours

Right now, you have a decision to make. You can continue following conventional financial wisdom – locking away your money, hoping markets cooperate, and paying unnecessary taxes.

Or you can take control.

The same strategy that banks use to build billions… that wealthy families use to create lasting legacies… that sophisticated investors use to protect and grow their wealth – it’s available to you today.

The only question is: Will you be one of the few who takes advantage of this opportunity?

Schedule your Strategy Session now. Let’s explore how The Ultimate Asset™ can transform your financial future.