About AAA Life Insurance

In 1969, the American Automobile Association (better known as “AAA”) established AAA Life Insurance Company to provide optional coverage to AAA members. Today, AAA no longer owns Livonia, Michigan-based AAA Life (though the insurer is owned by companies in AAA’s network), and membership in AAA is not a requirement to purchase coverage through AAA Life. However, 10% member discounts are sometimes available.

AAA Life currently has around 1.3 million active policies covering insureds throughout the country. The company offers a noteworthy assortment of policy options, with two varieties of term, whole life, and universal life available. New applicants for some policies can work directly with AAA Life through its website, while application for more complex policies must proceed through local agents.

AAA Life issues policies in every state except New York. The company is affiliated with Auto Club Life Insurance Co., Automobile Club of Southern California Life Insurance Co., and Pacific Beacon Life Reassurance, Inc.

AAA Life Insurance Financial Ratings

A.M. Best: A

Fitch: NR

Moody’s: NR

S&P Global: NR

Comdex Ranking: NR

Although AAA Life is not rated by Fitch, Moody’s, or S&P Global, the company’s A score from A.M. Best suggests that its financial position is solid and has remained relatively stable.

Business Wire notes that AAA Life’s assets are primarily held in secure bonds, with only light exposure to riskier securities. With over $420 million in annual revenue, AAA Life has very little risk of failing to satisfy policy obligations in the foreseeable future.

AAA Life is not currently accredited by the Better Business Bureau. Nonetheless, the BBB grades AAA at A+ for its resolution of customer complaints.

Online customer reviews suggest room for improvement, but the National Association of Insurance Commissioners reports that AAA Life draws relatively fewer consumer complaints than most life insurers its size.

On its website, AAA Life boasts that its claims handling scored highest among eight major life insurance carriers in a 2015 survey of policy beneficiaries conducted by the Life Insurance Marketing and Research Association (LIMRA).

Products Offered by AAA Life Insurance:

- Term Life

- Whole Life

- Final Expense Insurance

- Universal Life

- Annuities

- Accident Insurance

Life Insurance Policies Offered by AAA Life Insurance

AAA allows you to choose between both term life or whole life insurance.

Traditional Term Life:

AAA Life’s Traditional Term Life insurance policy provides new insureds from ages 18 to 75 with level term coverage for initial terms of 10, 15, 20, 25, or 30 years. Longer initial terms are reserved for younger applicants.

Upon conclusion of the initial term, policies can be renewed annually through age 95, subject to increased premiums upon each yearly renewal.

Coverage amounts start at $100,000 and go as high as $5 million.

Traditional Term policies are fully underwritten, which means most applicants will need to undergo a medical examination.

A Return of Premium rider is available for an additional cost.

ExpressTerm Life:

ExpressTerm is a simplified-issue no exam term life policy providing coverage from $25,000 to $500,000.

In most cases, only an online application with medical screening questions is necessary, though a medical exam may be required for applicants who are not clearly eligible.

Life insurance premiums are fixed during a policy’s initial term, which can be 10, 15, 20, or 30 years.

After the initial term, coverage can be renewed annually through age 95, subject to higher premiums at each renewal. New applicants can be from age 18 to 75, with longer term periods limited to younger applicants.

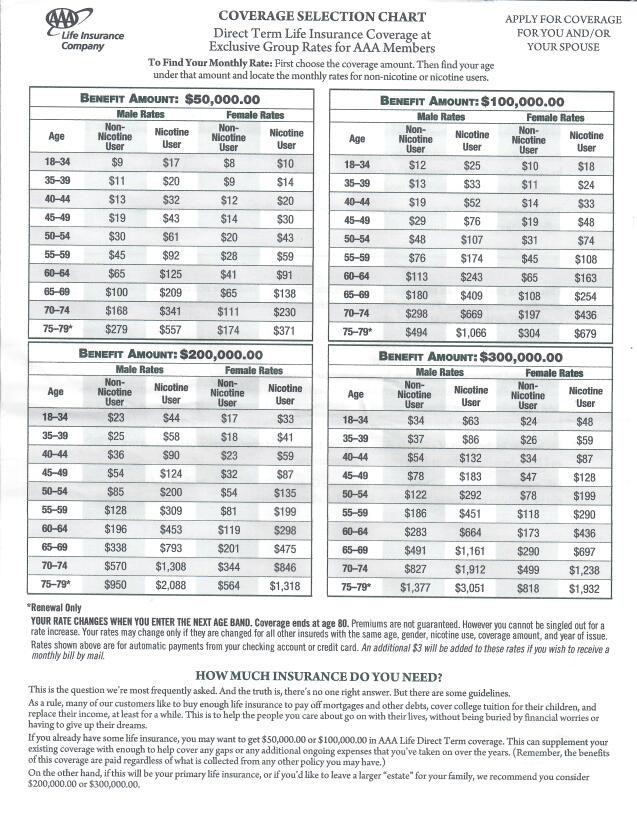

Direct Term Life Insurance

AAA member may qualify for exclusive group term life insurance. The term policy requires no medical exam or tests, you must only answer three questions.

Face amounts available include: $50,000, $100,000, $200,000 and $300,000.

The policy has set premiums based on your age. Your premiums increase as you enter a new age band. Age bands include 18-34, 35-39, 40-44, 45-49, 50-54, 55-59, 60-64, 65-69, 70-74, 75-79, with coverage ending at age 80.

The three health questions include:

- Have you used nicotine in the last 12 months?

- Have you received treatment or been diagnosed with heart trouble, cancer, stroke, lung disease, liver disease, kidney disease, AIDS, lupus, ALS, schizophrenia or dementia?

- In the last 12 months have you had diagnostic testing or been recommended by a doctor to have testing for an undiagnosed condition?

To be approved for group term from AAA you must answer “NO” to all three questions.

Whole Life:

AAA Life’s standard cash value whole life insurance offering provides permanent coverage starting at $5,000 and going up to $75,000.

When applying for coverage over $30,000, most applicants will need to undergo a medical exam. New insureds can be anywhere between age 18 and age 85.

New policies below $25,000 may include a two-year graded-benefit waiting period.

When applicable, death benefits for non-accidental death during the first two years after issuance are measured as 135% of premiums paid to date.

As whole life insurance, policies have fixed premiums, guaranteed-for-life death benefits, and accumulate interest-earning cash value.

Policy premiums are scheduled to be fully paid-up by the time an insured reaches his or her 100th birthday.

Guaranteed Issue Whole Life:

Guaranteed Issue Whole Life is a guaranteed-acceptance policy, which means no medical screening is required and all applicants within the ages of 45 and 85 will be approved for coverage.

Coverage amounts are limited to a $25,000 maximum (doubled if death results from a qualifying “travel accident”).

Guaranteed issue policies include a two-year waiting period. If the insured dies during the first two years after issuance, the policy’s death benefit is measured as 135% of premiums paid to date. If the insured’s cause of death is an “accident,” full death benefits pay out regardless of the waiting period.

As whole life insurance, policies have fixed premiums, guaranteed-for-life death benefits, and accumulate interest-earning cash value.

Policy premiums are scheduled to be fully paid-up by the time an insured reaches his or her 100th birthday.

After a policy has been in place for two years, the policyholder receives a lifetime AAA membership.

LifeTime Universal Life:

LifeTime is a universal life policy designed for policyholders who want stable premiums and are more concerned with leaving a legacy than with accumulating cash value during life.

Universal life insurance policies provide coverage from between $100,000 and $5 million, with flexible premiums guaranteed not to increase above a monthly minimum stated in the policy. New insureds can be between 18 and 85 years old, and most new insureds will need to undergo a medical exam.

Accumulator Universal Life:

Accumulator has the same basic universal life structure and coverage levels as LifeTime, but is designed for policyholders who want more flexibility to vary premiums and death benefits and who place more of an emphasis on cash-value growth.

New insureds can be as young as 15 days or as old as 80 years. Policies are fully underwritten, and most new insureds will need to undergo a medical exam.

Guaranteed Increase and Yearly Renewable Term riders are available for an extra cost. The former grants the policyholder the contractual right to purchase additional coverage at specified intervals with no additional underwriting. The latter allows policyholders to purchase supplemental term coverage each year.

Available Life Insurance Riders.

Child Term: If purchased, the Child Term rider adds supplemental term insurance covering the insured’s children in amounts up to $20,000.

Disability Waiver of Premium: If the insured becomes totally disabled, premium obligations are waived during the period of disability.

Return of Premium: If the policy reaches the end of the initial term period, the total premiums paid are refunded to the policyholder. The rider is only available with Traditional Term and is not offered with ten-year term policies.

Terminal Illness: If an insured is diagnosed as having less than one year to live, up to 50% of a policy’s death benefit (subject to a $250,000 cap) can be accelerated.

Conversion Option: Allows term policyholders to convert to permanent life insurance with no additional underwriting if the option is exercised during the initial term period and before the insured reaches age 65.

Accidental Death: If the insured’s death results from a qualifying “accident,” a supplemental death benefit of up to $150,000 is added to the death benefit.

Travel Accident: If the insured’s death occurs during a qualifying “travel accident,” the rider provides a supplemental death benefit to the policy’s beneficiary.