The Ramsey Paradox: How Anti-Debt Advice Could Be Keeping You Poor in an Asset-Based Economy

🔗 Part of Our Dave Ramsey Analysis Series: This paradigm analysis builds on our comprehensive review of Dave Ramsey’s financial advice. For mathematical proof, expert responses, and business model analysis, explore our complete research series.

🎯 Bottom Line Up Front

Dave Ramsey’s debt elimination advice helps escape consumer debt but may prevent wealth building in today’s asset-based economy. While 60-80% of Americans live paycheck-to-paycheck despite his influence, the problem isn’t his anti-consumer debt message—it’s his one-size-fits-all approach that ignores how modern financial systems actually build wealth through strategic leverage and sophisticated banking principles.

📊 Quick Facts

- Dave Ramsey’s reach: 13 million weekly listeners across 600 stations

- Americans living paycheck-to-paycheck: 60-80% (despite widespread financial advice)

- Credit card companies marketing budget: More than all professional sports combined

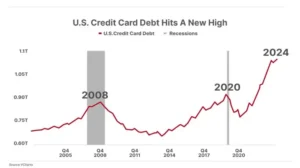

- Average credit card debt: $7,236 per person at 23% interest

- Bank-owned life insurance (BOLI): $180+ billion held by financial institutions

📋 Table of Contents

- 1. Introduction: The Ramsey Paradox

- 2. Understanding Today’s Financial System

- 3. The Three Pillars of Wealth Creation

- 4. Time: The Ultimate Multiplier

- 5. The Power of Uninterrupted Compound Growth

- 6. Critical Analysis of Ramsey’s Approach

- 7. The Asset Multiplier Alternative

- 8. Strategic Self Banking: Three Layers

- 9. Implementation Framework

- 10. Building Your Legacy

- 11. Complete Analysis Series

- 12. Conclusion: The Path to Financial Transformation

Introduction: The Ramsey Paradox

Watching Dave Ramsey’s recent interview with Tucker Carlson struck a chord. Here was America’s most trusted voice in personal finance, someone who has helped millions escape crushing consumer debt, including me. His message of financial discipline and debt freedom resonates deeply – after all, his radio show reaches 13 million weekly listeners across 600 stations. And there’s no denying his impact: countless Americans have broken free from the paycheck-to-paycheck cycle by following his advice.

Yet something wasn’t sitting right. Despite Ramsey’s massive influence and the undeniable value of his core message, 60-80% of Americans still live paycheck to paycheck – and surprisingly, this includes many high-income earners. As I dug deeper into this paradox, I realized something profound: the problem isn’t with Ramsey’s message about consumer debt. It’s that his approach, while perfect for escaping debt, may actually be keeping people from building real wealth in today’s asset-based economy.

Think about it: While Ramsey focuses on individual behavior and discipline – crucial starting points – he misses how the modern financial system actually builds wealth. His one-size-fits-all approach to avoiding all debt ignores crucial systemic realities about how money works in today’s economy. It’s like having a great map to escape a maze, but no guidance on where to go once you’re out.

To truly build wealth today, we need to look beyond simple debt avoidance. We need to understand how the financial system actually operates, and why well-intentioned advice about avoiding all debt might be keeping you from building real wealth in an asset-based economy. The path forward isn’t about rejecting Ramsey’s foundation – it’s about building upon it with sophisticated strategies that can create lasting wealth.

🎯 The Core Problem

Dave Ramsey’s strength: Excellent for escaping consumer debt and building discipline. Dave Ramsey’s limitation: May prevent wealth building in an asset-based economy by treating all debt equally and missing strategic leverage opportunities that institutions use.

Understanding Today’s Financial System

The scale and sophistication of modern financial institutions dwarf anything most consumers imagine. Consider this startling fact revealed in the recent Tucker Carlson interview. In Dave Ramsey’s own words: credit card companies spend more on marketing annually than all professional sports combined. This isn’t just impressive – it’s strategic. The financial system isn’t just large; it’s deliberately designed to shape consumer behavior in specific ways.

The Credit Industry’s Architecture of Exploitation

The credit industry’s power extends far beyond mere marketing budgets. The scale of this manipulation is staggering, as we explored in our mathematical analysis showing how 12% return promises delivered only 6.91% reality. Their operations reveal a sophisticated system of consumer manipulation:

- Marketing campaigns larger than any other product line, including automotive

- Targeted marketing to college students before they understand financial implications

- Collection departments that match accent types (Northern collectors for Southern customers and vice versa) to create intentional friction

- Interest rates up to 33% – rates that would be illegal if charged by private lenders

- Payday lending operations charging up to 800% annual interest, primarily targeting lower-income communities

What’s particularly telling is who doesn’t criticize this system. As Ramsey himself points out, even progressive politicians who routinely attack capitalism rarely mention credit card companies. The silence speaks volumes about the industry’s influence and integration into our financial infrastructure.

The Digital Money Transformation

The shift from cash to digital payments isn’t just about convenience – it’s about psychology. Research shows that people spend 12-18% more when using plastic instead of cash. Why? Because digital payments remove the psychological “pain” of spending:

- Cash activates pain centers in the brain; digital payments don’t

- Digital payments feel less “real” than handling physical money

- Auto-payments and subscriptions make spending passive

- Price increases (like gas prices) become less noticeable without cash transactions

This transformation serves financial institutions’ interests by increasing consumer spending while reducing awareness of that spending.

The Production-Consumption Dynamic: A System Designed for Debt

Today’s financial reality presents a troubling paradox: even high-income earners often find themselves trapped in a cycle of consumption and debt. The average American carries $7,236 in credit card debt with average interest rates at 23%. More startlingly, 78% of credit card users don’t pay their balance monthly, despite many claiming they will.

This isn’t merely a failure of individual discipline – it’s the predictable outcome of a carefully designed system:

Normalization of Debt

- Credit cards marketed as necessities (“Don’t leave home without it”)

- Debt portrayed as a normal part of middle-class life

- Complex financial products sold to financially illiterate consumers

- Credit scores that reward debt rather than wealth building

The Consumption Trap

Banks and credit card companies don’t just wait for you to spend – they actively engineer your spending habits. They flood your mailbox with pre-approved credit offers, promising easy money and instant gratification. Their sophisticated marketing campaigns create needs you never knew you had, while reward programs turn your spending into a game you can’t win.

Watch how they shift your focus from total cost to “affordable” monthly payments. That $40,000 car becomes “just $499 a month,” masking the thousands you’ll pay in interest. Even their credit scoring system plays this game – try avoiding debt completely, and your credit score actually drops. They’ve created a system where you must play their game to maintain “good credit.”

Most insidiously, they’ve transformed spending into a seemingly virtuous activity. “Cash back rewards” make you feel smart for spending, while “building your credit” becomes a financial goal rather than a warning sign. The system doesn’t want producers – it wants consumers, and it’s designed to keep you playing that role.

🔑 Key Takeaway: Financial System Design

The system’s goal: Keep you as a consumer, not a producer. Credit companies spend more than all professional sports combined to engineer spending behaviors, while 78% of users don’t pay balances monthly despite intentions. The solution: Understand how the system works and position yourself as a producer who uses financial tools strategically.

The Three Pillars of Wealth Creation: A Different Perspective

While Ramsey focuses on debt elimination and saving, the wealthy focus on three fundamental pillars of wealth creation: Volume, Velocity, and Value Creation. Understanding these pillars reveals why his advice, while well-intentioned, may be fundamentally limiting.

Volume: Beyond the 10% Rule

Traditional financial advice, including Ramsey’s, suggests saving 10-15% of your income. But this approach has a fundamental flaw: it leaves 85-90% of your money working for someone else. Instead, consider how you can flip the script and implement volume into your savings plan. Consider this:

- Banks utilize nearly 100% of their capital

- Major corporations maximize every dollar

- Wealthy individuals create multiple layers of return

- Financial institutions never leave money idle

The key isn’t just saving money – it’s putting more of your money to work simultaneously.

Velocity: The Hidden Power of Money Movement

While Ramsey advocates parking money in savings accounts or paying off mortgages early, this advice overlooks a crucial aspect of wealth building: the velocity at which money moves and works. Consider how banks operate versus how most individuals handle money:

Banks’ Approach:

- Leverage deposits multiple times

- Keep money in constant motion

- Create multiple layers of returns

- Generate income from the same dollar repeatedly

Traditional Consumer Approach (Ramsey’s Model):

- Money sits idle in checking accounts

- Emergency funds earn minimal interest

- Home equity trapped in properties

- Retirement funds locked away until 59½

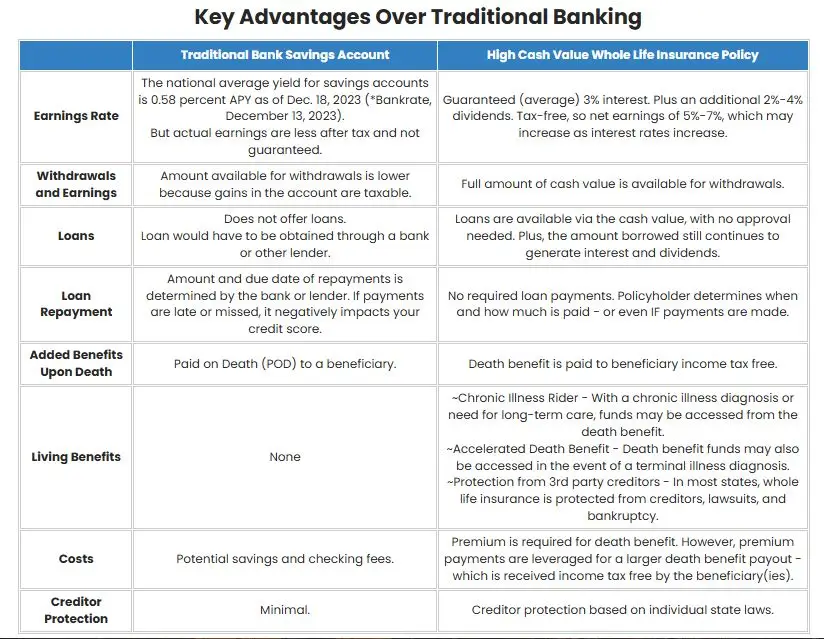

The difference isn’t just philosophical—it’s mathematical. When money moves efficiently through a system, it creates multiple opportunities for growth and return. This is why banks use sophisticated tools like Bank Owned Life Insurance (BOLI), holding over $180 billion in such assets. They understand that stagnant money is inefficient money.

Value Creation: Producer vs. Consumer Mindset

The most fundamental divide between Ramsey’s approach and true wealth building lies in the mindset it creates between producers vs consumers. Let’s contrast these perspectives:

Consumer Mindset:

- Focus on saving and cutting expenses

- Views money as something to accumulate

- Emphasizes debt avoidance over wealth creation

- Passive approach to money management

- Short-term thinking about financial decisions

Producer Mindset:

- Focus on creating value in the marketplace

- Views money as a tool for further creation

- Emphasizes strategic leverage and opportunity

- Active engagement with financial systems

- Long-term perspective on wealth building

The producer mindset recognizes that in an asset-based economy, the path to wealth isn’t just about saving—it’s about creating and capturing value through strategic positioning and leverage.

🔑 Key Takeaway: Three Pillars Strategy

Traditional approach: Save 10-15%, park money in accounts, consumer mindset. Wealth building approach: Maximize volume (more money working), increase velocity (constant motion), create value (producer mindset). Banks use 100% of capital while individuals use 10-15%.

Time: The Ultimate Multiplier

While Ramsey correctly emphasizes the importance of time in wealth building, his approach often fails to maximize its potential. Time doesn’t just affect how long you save—it amplifies the effectiveness of all three wealth-building pillars.

Traditional Time Perspective (Ramsey’s View):

- Wait 30 years for mutual funds to grow

- Hope for 12% market returns (historically inaccurate)

- Accept market volatility and sequence risk

- Lock money away until retirement

- Focus on delayed gratification

Strategic Time Leverage:

- Multiple layers of growth occurring simultaneously

- Guaranteed base growth plus potential dividends

- Continuous compound growth even while utilizing capital

- Tax-advantaged accumulation

- Legacy building across generations

The Power of Uninterrupted Compound Growth

Consider two compound interest growth scenarios:

Traditional Approach:

- Invest in market

- Forced to sell during downturns or “wait it out”

- Reset compound growth clock

- Pay taxes on gains

- Start over after each withdrawal

Strategic Self Banking

Traditional banking makes you choose: keep your money growing or use it. Strategic self banking eliminates this false choice. First, you pay yourself first and this allows more of your money to grow steadily through guaranteed cash values and dividends, while you simultaneously tap into that capital for investments and opportunities. No more idle dollars, no more growth interruptions, no more missed opportunities.

Think of it as having your cake and eating it too. Your policy value increases year after year with true uninterrupted compound interest, yet you maintain complete access to your capital through tax-free policy loans. Use these loans to acquire rental properties, fund business expansion, or seize market opportunities – all while your original capital continues its upward march.

Most powerful of all? This isn’t just about your wealth – it’s about generations of wealth. When structured properly, your entire self banking system transfers tax-free to your heirs, creating a lasting legacy of financial power that grows stronger with each generation.

This isn’t your grandfather’s savings account. It’s a sophisticated wealth-building engine that puts every dollar to work, all the time, in multiple ways. Welcome to strategic family banking that builds empires, not just accounts.

🔑 Key Takeaway: Compound Growth Strategy

Traditional approach: Choose between growth or access, reset compound clock with withdrawals. Strategic self banking: Uninterrupted compound growth while maintaining access, no growth interruptions, multi-generational wealth transfer. Your money works in multiple places simultaneously.

Critical Analysis of Ramsey’s Approach

Now that we understand these fundamental principles, we can see why Ramsey’s advice, though well-intentioned, may actually limit wealth building potential. Let’s examine the specific limitations:

The Debt-Free Paradox: When Good Advice Becomes a Limitation

While Ramsey’s warnings about consumer debt are valid, his blanket condemnation of all debt creates a significant barrier to wealth building. Here’s why:

The Home Equity Trap

- Ramsey advocates paying off mortgages early

- Reality: This locks wealth into an illiquid asset

- Home appreciation occurs regardless of equity

- No return on extra equity payments

- Reduced financial flexibility

The Emergency Fund Inefficiency Ramsey’s Approach:

- 3-6 months expenses in savings

- Money earning less than 1%

- Value eroded by inflation

- No additional benefits

- Opportunity cost of idle money

The Retirement Account Restrictions

- Heavy reliance on 401(k)s and IRAs

- Money locked away until 59½

- Required Minimum Distributions

- Limited investment options

- Tax implications on withdrawals

Investment Strategy Flaws

Ramsey’s investment advice reveals concerning oversimplifications:

The 12% Return Myth

- Promotes unrealistic 12% market returns

- Actual mutual fund investors average much less (Dalbar studies)

- Ignores impact of fees and taxes

- Overlooks sequence of returns risk

- Dangerous for retirement planning

For detailed mathematical proof of this shortfall, see our analysis of Dave’s 12% mythology vs 5% guaranteed returns with real S&P 500 data from 2000-2024.

The “Buy Term and Invest the Difference” Problem

- Oversimplified comparison

- Ignores multiple benefits of whole life insurance

- Misses infinite banking concept opportunities

- Fails to consider tax implications

- Overlooks legacy planning aspects

Licensed practitioners explain why this oversimplified comparison misses critical benefits in our expert response to Dave’s whole life insurance claims.

Business Model Conflicts and Industry Relationships

Understanding Ramsey’s advice requires examining his business model:

Revenue Stream Analysis

- Referral fees from endorsed providers

- Commissioned financial advisors

- Zander Insurance relationship

- Financial Peace University fees

Our consumer investigation revealed concerning conflicts including $10-15M annual SmartVestor Pro fees and a $150M lawsuit for undisclosed endorsements.

🔑 Key Takeaway: Ramsey’s Limitations

Debt approach: Blanket condemnation of all debt limits wealth building. Investment flaws: Unrealistic 12% returns, oversimplified comparisons. Business conflicts: $10-15M in referral fees may influence recommendations. His strength (debt elimination) becomes a weakness for advanced wealth building.

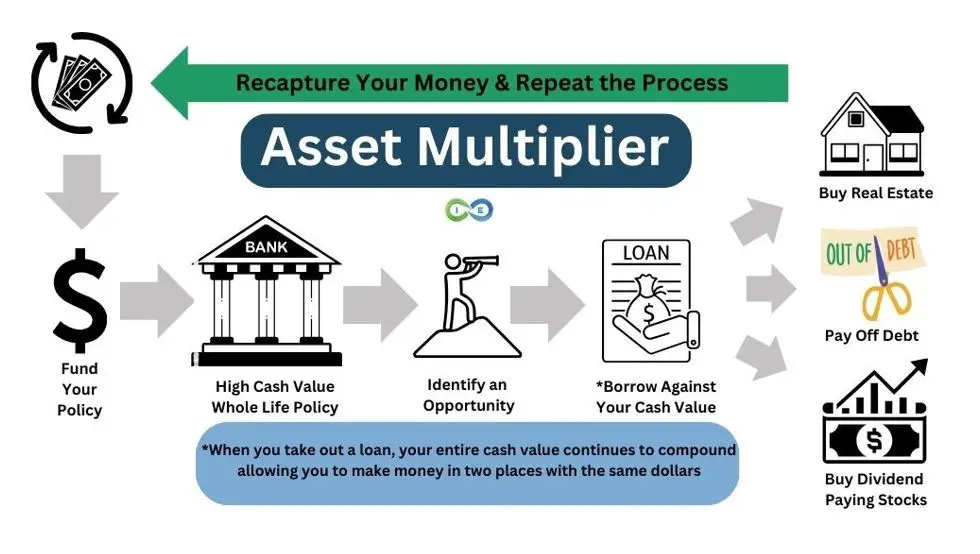

The Asset Multiplier Alternative: A Strategic Approach to Wealth Building

The life insurance policies Dave Ramsey criticizes are like Model T Fords – outdated and inefficient. Modern banking policies are more like Tesla’s – completely redesigned for today’s financial world. These specialized policies strip away the expensive insurance components and maximize immediate cash value growth.

Here’s what makes them different: Through careful engineering, infinite banking life insurance policies minimize insurance costs while maximizing early cash value through paid-up additions. By blending in term insurance strategically, they slash traditional commission structures by 70-90%. The result? A streamlined financial vehicle built for banking, not just insurance.

Whole Life Institutional Validation

Banks aren’t just storing your money – they’re putting it to work in ways they never tell their customers about. Right now, America’s largest banks hold over $180 billion in specialized bank owned life insurance policies. They’re not protecting against death – they’re building wealth through a strategy so powerful that federal regulators limit how much they can own.

For mathematical proof of why institutional usage contradicts Dave’s claims, see our analysis of whole life insurance returns with personal experience and real data.

Major corporations follow the same playbook. Companies like Walmart, Bank of America, and countless others use corporate-owned life insurance (COLI) to grow their wealth tax-efficiently while maintaining access to capital. They’ve discovered what mutual insurance companies have proven for over a century through consistent dividend payments: properly structured life insurance builds wealth reliably and efficiently.

Think about it: If the world’s smartest financial institutions trust this strategy with billions of dollars, shouldn’t you at least understand how it works? They’re not gambling – they’re banking, and they’re using a system you can access too.

🔑 Key Takeaway: Institutional Validation

Banks hold: $180+ billion in life insurance policies for wealth building. Corporations use: COLI for tax-efficient growth and capital access. The contradiction: If it’s “terrible” as Dave claims, why do the world’s smartest financial institutions use it extensively? Follow the money, not the marketing.

Strategic Self Banking: Building Wealth Through Three Layers

Your journey to financial transformation begins with a specially designed high-cash-value life insurance policy. Think of this policy as your personal banking foundation – but unlike traditional banking, every dollar serves multiple purposes simultaneously through three distinct but interconnected layers.

This three-layer approach directly contradicts Dave’s recommendations, as detailed in our comprehensive strategy comparison.

Layer One: Your Foundation Grows Automatically

Your policy’s cash value grows steadily through guaranteed increases and potential dividends. While banks pay minimal interest, your money grows tax-deferred and protected from creditors. As your cash value increases, your death benefit grows too, creating an expanding financial foundation for your family.

Layer Two: Access Capital Without Stopping Growth

Here’s where traditional banking falls short – when you withdraw money, you lose all future growth. Your policy, however, continues growing even while you access capital through policy loans. You won’t face credit checks or qualification requirements, and you control the repayment terms. Best of all, when structured properly, this access remains tax-free.

Layer Three: Your Money Multiplies

Now your strategy accelerates. Deploy your accessible capital into cash-flowing investments while your policy value continues growing. Your money works in multiple places simultaneously – earning returns from your investments while your policy compounds uninterrupted. Tax advantages stack up across both your policy and investments, creating a multiplier effect on your wealth.

Real-World Applications

Transform Real Estate Investing

Fund property down payments and renovations through policy loans while maintaining flexibility in your acquisition strategy. Create a tax-efficient structure that includes built-in emergency reserves for your properties. When tenants pay rent, use that income to repay policy loans or fund new investments while your original capital keeps growing.

Fuel Business Growth

Finance inventory purchases and equipment upgrades without traditional bank approval. Manage seasonal cash flow fluctuations smoothly and seize time-sensitive opportunities quickly. Implement employee benefit programs and protect key personnel while building a corporate banking system that puts every dollar to work.

Revolutionize Personal Finance

Optimize bill payments and major purchases by maintaining control of your money’s growth. Fund college expenses and create tax-efficient retirement income streams while eliminating the need for traditional emergency funds. Eventually, expand into a family banking system that can benefit multiple generations.

The Power of Integration

This three-layer approach transforms how your money works. Rather than following the conventional model where dollars serve single purposes, your capital now functions in multiple ways simultaneously:

- Your policy grows continuously

- You maintain access to capital

- Your investments generate returns

- Tax advantages multiply

- Protection increases

- Wealth transfers efficiently

The result? A dynamic financial system that builds wealth systematically while maintaining liquidity and control. Each layer reinforces the others, creating an upward spiral of financial efficiency that traditional banking simply cannot match.

By understanding and implementing these three layers strategically, you’ve built more than just a banking alternative – you’ve created a wealth multiplication system that can serve your family for generations.

🔑 Key Takeaway: Three-Layer Strategy

Layer 1: Foundation grows automatically with guarantees and dividends. Layer 2: Access capital without stopping growth through policy loans. Layer 3: Money multiplies in multiple places simultaneously. Result: Dynamic wealth system vs. Dave’s static savings approach.

Implementation Framework: Making It Work

Moving Beyond Fear-Based Finance

Most Americans view money through a lens of fear – fear of debt, fear of risk, fear of making mistakes. This fear-based thinking keeps them trapped in old patterns while the wealthy play by different rules. The first step toward real wealth isn’t learning new strategies – it’s rewiring how you think about money itself.

Start by understanding how the financial system actually works. Not all debt destroys wealth – strategic debt builds it. Banks don’t fear debt; they use it to multiply money. Major institutions don’t avoid leverage; they harness it. Once you recognize these patterns, you begin seeing opportunities where others see only risk.

Education and Mindset Shift

This mental transformation requires new knowledge. Learn how infinite banking turns traditional finance on its head, putting you in the banker’s seat. Master how premium structures and policy design create financial efficiency. Understand how tax advantages multiply your gains while strategic cash flow management keeps your money working constantly.

But here’s the key: This isn’t about becoming reckless with money. It’s about moving from fearful avoidance to confident strategy. It’s about seeing money as a tool for creating value rather than something to hoard. When you make this shift, you stop playing defense with your finances and start playing offense.

| Dave’s Core Principles | How High Cash Value Whole Life Implements Them |

|---|---|

| Emergency Fund | ✓ Access liquid cash value without penalties, credit checks, or waiting periods |

| Avoid Debt | ✓ Borrow from yourself instead of banks – eliminate external debt dependency |

| Wealth Building | ✓ Guaranteed growth plus dividends with zero market risk or volatility |

| Save Money | ✓ Forced savings mechanism with guaranteed compound growth |

| Be Self-Reliant | ✓ Become your own banker – control your financing without external approval |

| Leave a Legacy | ✓ Guaranteed death benefit passes tax-free to beneficiaries |

| Avoid Market Risk | ✓ Not tied to market performance – contractually guaranteed returns |

| Tax Efficiency | ✓ Tax-deferred growth, tax-free loans, tax-free death benefit |

| Pay Cash | ✓ Policy loans let you “pay cash” while your money keeps growing |

| Long-term Thinking | ✓ Built for multi-generational wealth accumulation and transfer |

| Avoid Get Rich Quick | ✓ Steady, predictable growth without speculation or gambling |

| Personal Responsibility | ✓ You control your money, financing decisions, and financial destiny |

The irony: Dave teaches these principles, then recommends strategies that work against them. Meanwhile, the tool he opposes delivers on every single one. As our real policy illustrations demonstrate, properly structured whole life delivers on every principle Dave teaches while providing additional benefits he ignores.

🔑 Key Takeaway: Implementation Framework

Mindset shift: Move from fear-based to strategic thinking about money and debt. Education focus: Learn how banking principles work and why institutions use them. The irony: Whole life insurance delivers on all of Dave’s principles better than his own recommendations.

Building Your Legacy: Advanced Strategic Banking

Strategic self banking with high cash value whole life insurance reaches its full potential when woven into the fabric of your family and business. Think of it as building a financial ecosystem where each part strengthens the others – family wealth supporting business growth, business success funding family opportunities, and both working together to create lasting impact.

The Family Dynasty

Start by teaching your children how money really works. Instead of just giving them an allowance, help them manage their own junior policies. Let them experience how banking principles work firsthand – watching their money grow, making loan decisions, and understanding the power of uninterrupted compound growth.

As they grow, gradually introduce them to more sophisticated concepts. Show them how family investments work, let them sit in on decision-making discussions, and give them increasing responsibility within the system. You’re not just passing on money – you’re transmitting financial wisdom and values that will serve generations.

The Business Integration

Your business becomes dramatically more efficient when integrated with strategic self banking. Instead of relying solely on traditional financing, you can deploy capital quickly when opportunities arise. Need to fund a new equipment purchase? Your banking system provides ready capital. Want to expand operations? Your system scales with you.

Real Estate Investing

Your family banking system becomes the engine driving your real estate operations. When a promising property comes on the market, you don’t scramble for financing – you access capital immediately through policy loans. While traditional investors wait for bank approval, your family moves quickly, securing better deals with more flexible terms.

🔑 Key Takeaway: Legacy Building

Family system: Teach children banking principles, create multi-generational wealth transfer. Business integration: Quick capital deployment, no traditional financing delays. Real estate advantage: Move faster than competitors, secure better deals with ready capital access.

📈 Strategy Performance Comparison

| Financial Element | Dave Ramsey’s Approach | Strategic Self Banking |

| Emergency Fund Growth | 0.5-3% (savings account) | 4-7% guaranteed + dividends |

| Investment Returns | Promises 12%, reality 6.91% | Guaranteed 4-7% + opportunity access |

| Capital Access | Locked until retirement | Immediate access without growth interruption |

| Tax Efficiency | 15-37% on withdrawals | 100% tax-free access via loans |

| Legacy Transfer | Taxable inheritance | Tax-free death benefit |

📚 Complete Dave Ramsey Analysis Series

Our comprehensive investigation examines Dave Ramsey’s financial advice from multiple angles:

Core Analysis & Mathematical Proof

Expert Insurance Analysis

Conclusion: The Path to Financial Transformation

Beyond the Ramsey Paradigm

While Dave Ramsey’s advice has undoubtedly helped millions escape consumer debt, today’s economy demands a more sophisticated approach to wealth building. The paradox lies not in his core message about financial discipline, but in how his oversimplified solutions can inadvertently keep people from building real wealth in an asset-based economy.

This isn’t about abandoning financial discipline – it’s about evolving beyond a one-size-fits-all approach. In an economy where assets consistently appreciate while saved dollars lose purchasing power, being debt-free isn’t enough. The real challenge is learning to use strategic leverage and banking principles to acquire assets that generate wealth over time.

The ultimate irony is that by following Ramsey’s advice to avoid all debt and keep things simple, many Americans may be missing the very opportunities that could lead to true financial freedom. The path to lasting wealth isn’t through fear of debt or oversimplified solutions—it’s through understanding how money really works and positioning yourself to take advantage of proven wealth-building strategies.

Taking Control of Your Financial Future

The question isn’t whether Dave Ramsey’s advice about avoiding consumer debt is valid—it is. The question is whether his one-size-fits-all approach is enough to build lasting wealth in today’s sophisticated financial system. As we’ve demonstrated, it likely isn’t.

Remember: The wealthy don’t just save money—they create systems that multiply it. Banks don’t just hold money—they leverage it. And you don’t have to choose between financial security and wealth building—you can have both through proper strategy and structure.

Don’t let fear of debt keep you from building real wealth. Don’t let oversimplified solutions prevent you from accessing sophisticated strategies. And most importantly, don’t let another day go by without taking control of your financial future.

📋 The Ramsey Paradox Summary

What Dave gets right: Consumer debt elimination, financial discipline, basic budgeting principles.

What Dave misses: How modern wealth is actually built through strategic leverage, banking principles, and asset multiplication.

The solution: Build on Dave’s foundation with sophisticated strategies that create lasting wealth while maintaining financial discipline.

Transform Your Financial Future Beyond the Ramsey Paradigm

Ready to move beyond debt elimination into wealth multiplication? Our experts can help you understand how strategic self banking and the Asset Multiplier Blueprint can build lasting wealth while maintaining the financial discipline Dave Ramsey teaches.

- ✓ Learn how banks and institutions really build wealth using strategies Dave criticizes

- ✓ Discover why $180+ billion in bank-owned life insurance contradicts Dave’s claims

- ✓ See real policy illustrations showing 4-7% guaranteed returns vs. market volatility

- ✓ Understand how to implement the three pillars of wealth creation in your strategy

Schedule your complimentary 30-minute wealth strategy consultation and learn how to build real wealth in today’s asset-based economy.

No obligation. No sales pressure. Just expert guidance to help you move beyond one-size-fits-all advice to strategies that actually build lasting wealth.