Most insurance companies keep your cash value when you die, paying only the death benefit to your beneficiaries—but this isn’t the full story. With expert policy design focused on growing both cash value and death benefit simultaneously, your beneficiaries can receive significantly more than the original face amount. Our specialized approach ensures your life insurance becomes a powerful wealth transfer vehicle, not just a death benefit check.

Table of Contents

- Term vs. Whole Life Insurance: Understanding the Difference

- Cash Value vs. Death Benefit: What’s the Difference?

- How Does the Whole Life Policy’s Cash Value Work?

- What Happens to the Whole Life Policy’s Cash Value When I Die?

- How to Maximize Both Cash Value and Death Benefit

- How Can I Use a Whole Life Policy’s Cash Value While I am Still Living?

- Choosing the Best Use for Cash Value

Term vs. Whole Life Insurance: Understanding the Difference

Superficially, the difference between term life insurance versus permanent insurance, such as whole life, is that a permanent policy remains effective for your entire life (hence, ‘whole life’), whereas a term policy expires after a fixed period of years (the “term”).

At the conclusion of a term policy’s coverage period – typically 10, 15, 20, or 30 years – the policy ends. You do have the option to convert term life insurance, but this can be expensive since you are converting your term insurance policy when you are older. And with a term policy, after the initial term the premiums increase as you age.

Also, if you die the day after the end of the term (and you have not chosen to convert the policy or renew), your beneficiaries don’t receive a death benefit. That’s an important distinction, especially if you need or want a life insurance pay-out regardless of how long you live.

But it’s not the only distinction. Where term coverage is valueless after the term ends, whole life comes with a cash value component, allowing the policy to serve as both a means of protecting your loved ones in the event of tragedy and as a wealth-building vehicle.

The trade-off is that whole life premiums for a working-age purchaser are notably higher than term life premiums, although this can be mitigated through proper policy design.

Whole life insurance premiums are fixed. You pay the same monthly premium at 63 that you paid at 36. Term coverage is cheap for young, healthy purchasers, but coverage becomes much more costly – or even unavailable – as you approach retirement age.

Cash Value vs Death Benefit

A brief mention here on the difference between the cash value and the death benefit. The cash value, AKA cash surrender value, is the amount of money you receive from the insurance company if you surrender your life insurance.

The death benefit is the amount the insurance company will pay your beneficiary if you die, (minus any outstanding loans).

Industry Insight: Many policyholders and even some financial advisors misunderstand that cash value typically does not automatically transfer to beneficiaries. According to recent reports, this misunderstanding is one of the most common complaints about whole life insurance policies. However, with proper policy design and riders, you can ensure your beneficiaries receive maximum value.

The whole life policy’s cash surrender value grows over time thanks to a guaranteed rate of return and optional dividends that can be used to purchase additional paid up life insurance. As the cash value grows, so does the death benefit. As the policy nears maturity, typically at age 120 or 121 for new issued policies, the cash value will equal the death benefit.

How Does the Whole Life Policy’s Cash Value Work?

In retirement planning, the cash value offered by a whole life policy is just as important as its permanence. With each premium payment, the policy’s cash value steadily builds until, if the policy stays in place long enough, the cash value eventually equals (or even surpasses in some cases) the original death benefit.

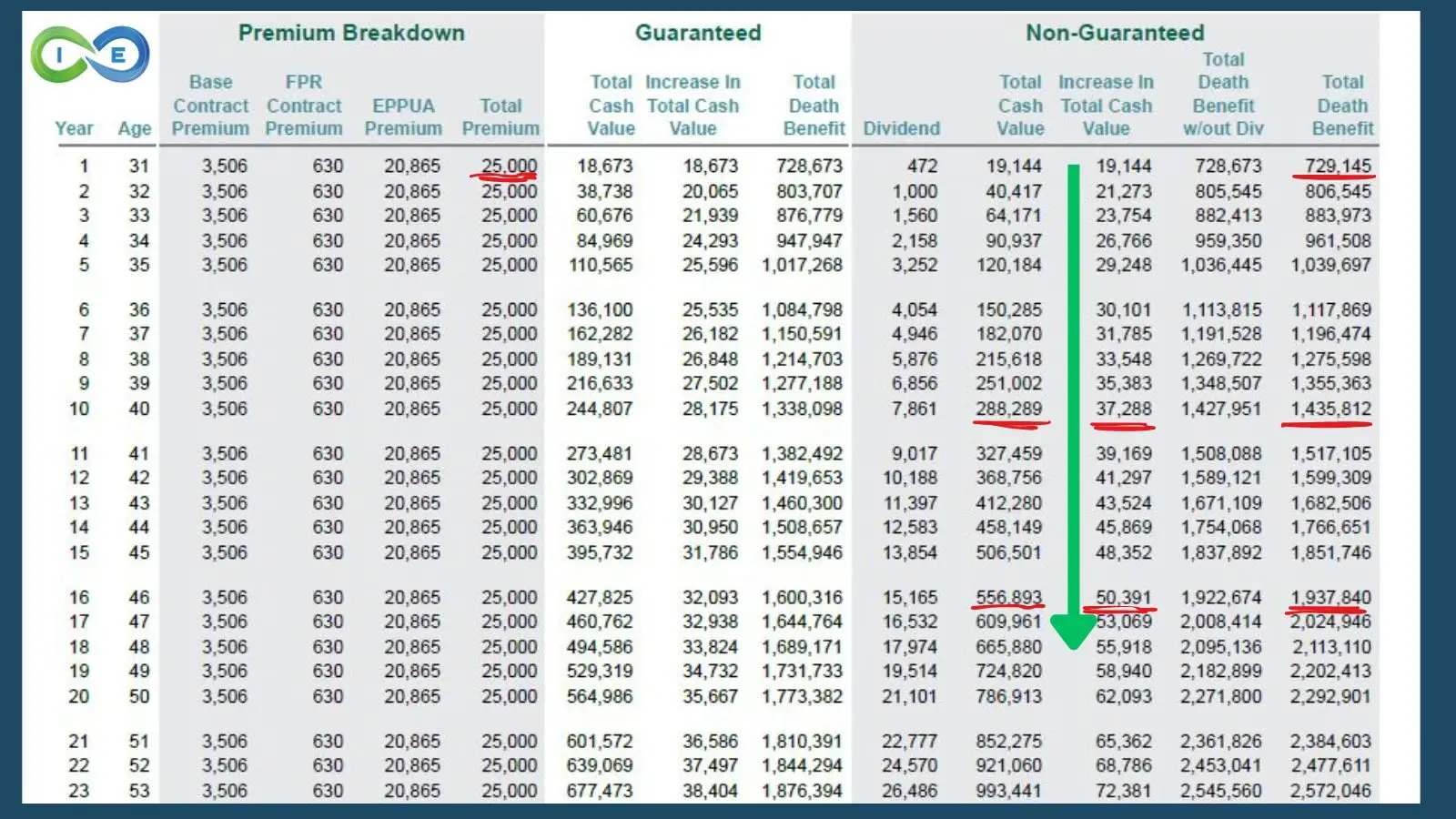

With dividend paying whole life insurance, your death benefit actually INCREASES as the years go by, making your policy more valuable as time passes.

Once the whole life policy has been in place for a few years, the cash value becomes a significant financial resource, even while the policyholder is still living. Because of these duel features – death benefit and cash value – whole life can be viewed as both an insurance and a glorified savings product, earning typically a much higher interest rate multiple than typical savings accounts.

The way it works is that part of each premium payment is applied toward the underwriting costs involved in providing the death benefit, and part is placed in a sort of savings account tied to the policy. The cash value in the account builds up slowly at first but picks up steam the longer the policy remains in place, earning interest at a return rate guaranteed by the insurance company, plus a dividend if the policy is participating whole life insurance.

Assuming all premium payments are made, after a little while the cash value exceeds the total premiums paid, with gains tax-deferred until withdrawn. Additionally, you can always borrow against the cash value at rates that typically amount to a wash (with positive arbitrage being available at times).

What Happens to the Whole Life Policy’s Cash Value When I Die?

Importantly, although a whole life policy’s cash value and death benefit are separate benefits, they are also linked. So, if you tap the cash value for a withdrawal or a loan, you potentially decrease the death benefit your beneficiaries will receive.

And, conversely, if you apply cash value and policy dividends toward additional paid up additions, you can increase the eventual pay-out – sometimes dramatically. When you die, the cash value and death benefit essentially merge, and the insurance company pays the death benefit to the policy’s beneficiaries – not the cash value.

With standard whole life insurance policies, the insurance company keeps the cash value when the insured passes away, only paying out the death benefit. This is a key point that many policyholders don’t understand until it’s too late.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Real Estate Example

Cash value life insurance is an asset similar to real estate. You can think of your policy like a mortgage for a home purchase. With each mortgage payment, you build up equity in the home until, after all the mortgage payments are made, you own the home outright. When you fully pay off the mortgage, you don’t have the home equity and the home as two separate assets. The equity is tied to the home. The cash value of a whole life policy can be viewed as interest-earning equity in the death benefit.

How to Maximize Both Cash Value and Death Benefit

At Insurance & Estates, we design policies differently than most insurance advisors. We focus on strategies that grow both the cash value and death benefit simultaneously, ensuring your beneficiaries receive much more than the original face amount when you pass away.

Here are key strategies we implement to maximize policy value:

- Paid-Up Additions (PUAs): These riders allow you to contribute additional money to your policy, purchasing small chunks of paid-up insurance that immediately add to both your cash value and death benefit.

- Strategic Dividend Use: By directing dividends to purchase additional paid-up insurance rather than taking them as cash, you compound your policy’s growth over time.

- Policy Blending: We can design policies that blend base coverage with term riders and paid-up additions in precise ratios to maximize both immediate cash value and long-term death benefit.

- Policy Stacking: In some cases, using multiple smaller policies rather than one large policy can provide more flexibility and efficiency.

Expert Insight: A properly designed whole life policy can deliver 3-5 times the original death benefit after 30+ years through strategic use of paid-up additions and dividend reinvestment. This means a $500,000 policy could potentially provide a $1.5-2.5 million legacy for your beneficiaries.

It’s worth noting that certain riders and types of permanent life insurance other than traditional whole life are available that provide for payment of death benefits and accrued cash value. As you might suspect, though, premiums will be higher for a policy that pays out both.

How Can I Use a Whole Life Policy’s Cash Value While I am Still Living?

As with equity in real estate, there are multiple ways to put a whole life policy’s cash value to beneficial use. The best use depends on your individual situation and goals, so it’s important to plan ahead when selecting a policy to ensure that both the death benefit and cash value provide what you need. With that said, there are several general strategies for taking advantage of a whole life policy’s cash value.

Using Cash Value to Cover Premiums

After a policy has been in place long enough, it reaches a point where it is “paid up.” Paid up life insurance means that enough cash value has accrued that you can elect to use cash value to cover the premium payments, which is particularly helpful for retirees on a fixed budget.

Most policies are timed to reach paid-up status when you reach your life expectancy. But policies can also be tailored to mature after a defined number of years – either before or after life expectancy. Through the use of limited pay whole life insurance, you can tailor the policy to be paid up upon a certain period of time, such as 7, 10, 15 or 20 years.

All things being equal, the less time until a policy is paid-up, the greater the monthly premium payments will be, and vice versa. Notably, if you continue making premium payments after a policy is paid-up, both the cash value and the death benefit will increase substantially beyond the original face value of the policy.

Surrendering a Whole Life Policy

A policy’s cash value is sometimes referred to as its “cash surrender value” because it’s more or less the amount that the insurance company would pay you if you decided to cancel the policy and cash out.

When you surrender a life insurance policy, you receive a check from the insurance company for the cash surrender value, and you relieve the insurance company of its obligation to pay the death benefit to your beneficiary.

Any policy growth you receive (i.e., the surrender value minus the total premiums you have paid) will be taxable income, and there may be surrender fees – particularly for younger policies.

Obviously, this isn’t a good option if you still need life insurance (unless you intend to use the surrender value to procure another policy). But it can make good sense if you’ve reached an age when your former dependents no longer rely on you financially, life insurance is not part of your estate plan, and you could use the money to help fund your retirement.

However, we suggest a better way to utilize your cash value and retain your policy.

Partial Withdrawals and Policy Loans

A compromise between cashing out and reinvesting cash value for higher coverage is to make a partial withdrawal or borrow against the policy. If you make a partial withdrawal, or fail to repay a loan, the death benefit will be reduced by the withdrawn amount or loan balance. As long as you repay a loan, though, it won’t affect the death benefit.

Recent Trend: Strategic Policy Loans

Financial advisors are increasingly recommending using policy loans strategically during market downturns. By borrowing from your policy to invest when markets are low, then repaying the loan when markets recover, you can potentially create significant wealth while keeping your life insurance intact.

This approach allows you to:

- Access capital without selling investments at a loss

- Continue earning dividends on your full cash value

- Create tax-advantaged investment opportunities

- Maintain your death benefit protection

Policy loans come with interest, but the rate is usually low. So, when you need ready cash, borrowing against a whole life policy is a great option, particularly when used to purchase other income producing assets, such as real estate.

Partial withdrawals are a popular strategy to supplement retirement income without completely forgoing death benefits.

Say, for example, you have a paid-up policy with a $200,000 face value. The kids are grown-up and self-sufficient, but you still want enough life insurance to pay for funeral and estate costs and taxes, with a little cash left over. You could earmark half of the policy’s cash value as an emergency fund or for special occasions – or as a reserve to avoid withdrawing from other investments when markets are down.

The policy’s pay-out will be reduced by whatever you withdraw, but there should be a sufficient death benefit left over to accomplish your estate-planning goals.

The precise effect that a withdrawal has on a policy’s death benefit varies according to the language of the specific policy and the amount of cash value that has accrued. Generally, a policy that has been in place longer and built up more cash value and growth will be less likely to charge withdrawal fees and will have a lesser reduction to the death benefit.

Choosing the Best Use for Cash Value

Versatility is one of the biggest selling points of whole life insurance, as illustrated by the many beneficial uses of cash value. For most long-term policyholders, the best approach involves putting cash value to work one way or another – whether through a loan, complete or partial withdrawal, or funding additional premiums and/or a greater death benefit.

Ultimately, though, a policy’s cash value should be used strategically according to your priorities and objectives.

Get a Custom Whole Life Strategy That Maximizes Both Cash Value AND Death Benefit

Unlike most advisors who sell standard policies where the insurance company keeps your cash value at death, our expert team designs policies specifically to grow both cash value and death benefit simultaneously.

- ✓ Receive a personalized policy design that ensures your beneficiaries get significantly more than the original face amount

- ✓ Learn how to use paid-up additions and dividends to maximize both living benefits and legacy

- ✓ Understand exactly how your cash value and death benefit will grow over time

- ✓ Get clarity on the optimal policy structure for your specific financial goals

Don’t settle for a standard policy where the insurance company keeps your cash value. Schedule your complimentary Whole Life Strategy Session today and discover how to maximize both cash value and death benefit.

No obligation. No sales pressure. Just expert guidance to help you design a policy that truly benefits your family for generations.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept