Protect Your Legacy: Smart Trust Planning for Every Family

Did you know that 66% of Americans have no estate plan, leaving their families vulnerable to costly probate, family conflicts, and unnecessary taxation?

Estate planning isn't just for the wealthy—it's essential protection for everyone who wants to safeguard what they've worked so hard to build. A properly structured trust gives you control over your assets during your lifetime and ensures your wishes are carried out exactly as you intend when you're no longer here.

Start Planning Your Trust

A Living Trust is not something only for the Rockefellers and Kennedys.

Planning your estate is about protecting your nest egg (whether large or modest) and your family from needless confusion and heartache. This is why the vast majority of all estates benefit from a trust.

Did you know that 66% of Americans don't have an estate plan?

Here's what that means for families:

✔️Probate can consume 3-8% of your estate’s total value in court costs, attorney fees, and administrative expenses

✔️The average probate process takes 9-24 months to complete, during which your assets remain frozen

✔️Without proper planning, up to 40% of your estate could be lost to taxes depending on your state and estate size

✔️58% of family wealth transfers fail due to lack of trust and communication among family members

✔️Only 18% of people with children under 18 have designated legal guardians in writing

✔️Over 50% of family conflicts during estate settlement could be prevented with clear, legally-binding instructions

✔️70% of wealth transfers fail by the second generation, and 90% fail by the third generation without proper planning

Don't leave your family's future to chance. Our workshop will show you how to avoid becoming part of these statistics.

A properly structured trust allows you to:

- Avoid Probate Entirely – Save your family from a costly court process that typically takes 9-24 months and can consume 3-8% of your estate’s value

- Maintain Complete Privacy – Unlike wills which become public record, trusts keep your family’s financial matters and inheritance plans completely private

- Create Protection During Incapacity – Ensure someone you trust can immediately manage your affairs if you become ill or injured, without court intervention

- Protect Inheritances for Children – Establish safeguards so inheritances are managed responsibly for minor children or young adults

- Prevent Family Disputes – Clearly outline your wishes and reduce the likelihood of disagreements among family members

- Shield Assets from Creditors – Properly structured trusts can provide protection against lawsuits and creditor claims

- Reduce or Eliminate Estate Taxes – Strategic trust planning can significantly minimize tax burdens for larger estates

- Protect Government Benefits – Special needs trusts can preserve eligibility for government assistance while providing supplemental support

- Simplify Property Ownership Across Multiple States – Avoid ancillary probate for property owned in different states

- Create a Legacy That Lasts Generations – Establish values and guidelines that extend your influence long after you’re gone

What Clients Are Saying

Not Ready to Start?

Join Our Next Free Estate Planning WorkshopJoin Our Next Free Estate Planning Workshop

Frequently Asked Questions

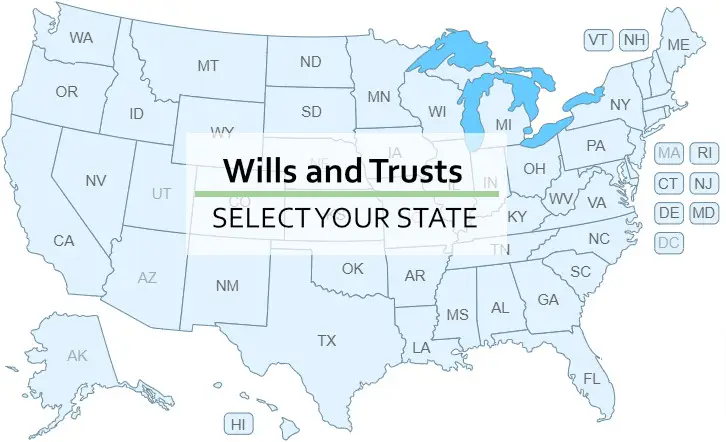

How do you ensure documents comply with each state’s requirements?

At I&E, we partner with a premier legal technology company that maintains a dedicated legal department staffed by attorneys who continuously monitor state law changes. They invest heavily in staying current with all 50 states’ requirements through bar association resources and legal publications. Unlike traditional law firms that often draft documents once and rarely update them, our platform ensures your documents remain compliant with the latest state laws. This allows us to provide the legal security you need while our team focuses on what attorneys typically don’t handle—the crucial financial aspects of your estate plan.

How often are your templates updated for state law changes?

Our documents are continuously updated whenever state laws change. Unlike traditional law firms where clients must initiate and pay for document updates, our technology platform automatically incorporates legal changes. This means your estate plan remains current without additional legal fees. We believe estate planning should provide ongoing protection, not just a one-time solution that becomes outdated with legislative changes.

Do you have special features for certain states with unique requirements?

Our estate planning platform addresses all state-specific requirements automatically. While estate laws share common foundations nationwide, there are important differences between states regarding marital property, inheritance taxes, and executor powers. Our system automatically adjusts your documents based on your state of residence, ensuring complete compliance with your specific state laws. This gives you the confidence that your documents will work exactly as intended, regardless of where you live.

How do your documents handle differences between community property and common law states?

Our system automatically accounts for critical differences like community property provisions in states like California, Texas, and Arizona versus common law states. When you enter your state of residence during our process, the system adjusts all provisions accordingly. This means spouses in community property states receive the appropriate joint property protections, while those in common law states get the specific provisions they need. This automatic customization happens behind the scenes, giving you perfectly tailored documents without requiring you to understand complex legal distinctions.

What’s included in the $1,995 fee?

Our comprehensive trust package includes everything you need for complete estate protection:

- Complete Revocable Living Trust – Customized to your specific family situation and state requirements

- Pour-Over Will – Ensures any assets not in your trust at the time of your passing are directed into it

- Durable Power of Attorney – Allows your chosen representative to manage financial affairs if you’re incapacitated

- Healthcare Power of Attorney – Designates someone to make medical decisions if you’re unable to communicate

- Living Will/Advanced Healthcare Directive – Documents your wishes regarding end-of-life care

- HIPAA Authorization – Gives designated individuals access to your medical information

- Property Deed Preparation – Documents to transfer your real estate into your trust

- Personalized Guidance – One-on-one support with our trust specialists throughout the process

- Asset Inventory System – Tools to organize and document all your assets

- Funding Instructions – Clear guidance on transferring assets into your trust

- Digital Document Storage – Secure electronic copies of all your documents

- 30-Day Satisfaction Guarantee – Full refund if you’re not completely satisfied

How do you ensure documents comply with each state’s requirements?

At I&E, we partner with a premier legal technology company that maintains a dedicated legal department staffed by attorneys who continuously monitor state law changes. They invest heavily in staying current with all 50 states’ requirements through bar association resources and legal publications. Unlike traditional law firms that often draft documents once and rarely update them, our platform ensures your documents remain compliant with the latest state laws. This allows us to provide the legal security you need while our team focuses on what attorneys typically don’t handle—the crucial financial aspects of your estate plan.

How often are your templates updated for state law changes?

Our documents are continuously updated whenever state laws change. Unlike traditional law firms where clients must initiate and pay for document updates, our technology platform automatically incorporates legal changes. This means your estate plan remains current without additional legal fees. We believe estate planning should provide ongoing protection, not just a one-time solution that becomes outdated with legislative changes.

Do you have special features for certain states with unique requirements?

Our estate planning platform addresses all state-specific requirements automatically. While estate laws share common foundations nationwide, there are important differences between states regarding marital property, inheritance taxes, and executor powers. Our system automatically adjusts your documents based on your state of residence, ensuring complete compliance with your specific state laws. This gives you the confidence that your documents will work exactly as intended, regardless of where you live.

How do your documents handle differences between community property and common law states?

Our system automatically accounts for critical differences like community property provisions in states like California, Texas, and Arizona versus common law states. When you enter your state of residence during our process, the system adjusts all provisions accordingly. This means spouses in community property states receive the appropriate joint property protections, while those in common law states get the specific provisions they need. This automatic customization happens behind the scenes, giving you perfectly tailored documents without requiring you to understand complex legal distinctions.

What’s included in the $1,995 fee?

Our comprehensive trust package includes everything you need for complete estate protection:

- Complete Revocable Living Trust – Customized to your specific family situation and state requirements

- Pour-Over Will – Ensures any assets not in your trust at the time of your passing are directed into it

- Durable Power of Attorney – Allows your chosen representative to manage financial affairs if you’re incapacitated

- Healthcare Power of Attorney – Designates someone to make medical decisions if you’re unable to communicate

- Living Will/Advanced Healthcare Directive – Documents your wishes regarding end-of-life care

- HIPAA Authorization – Gives designated individuals access to your medical information

- Property Deed Preparation – Documents to transfer your real estate into your trust

- Personalized Guidance – One-on-one support with our trust specialists throughout the process

- Asset Inventory System – Tools to organize and document all your assets

- Funding Instructions – Clear guidance on transferring assets into your trust

- Digital Document Storage – Secure electronic copies of all your documents

- 30-Day Satisfaction Guarantee – Full refund if you’re not completely satisfied

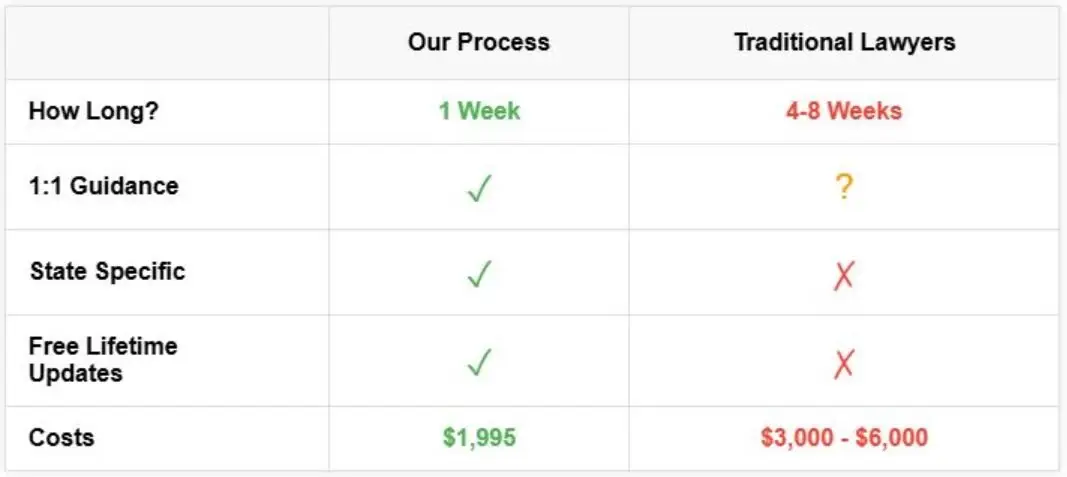

If you’re interested in a Trust, our online trust program helps people create a trust to protect their nest egg, family and legacy, for less than you’d pay a lawyer, and with more long term benefits.

One of our experts will walk you through this program and guide you in creating the trust in a fraction of the time that it would take a traditional lawyer to do the same thing.

Consider this comparison:

Not Ready to Start?

Join Our Next Free Estate Planning WorkshopJoin Our Next Free Estate Planning Workshop

The Family-First Approach: Estate Planning That Truly Protects What Matters

Most estate planning focuses on documents, not people. We believe your family deserves better.

Our personalized 1:1 process begins by understanding your unique family dynamics and goals. We’ll explore your family tree together, uncovering important relationships and considerations that typical estate attorneys often overlook or rush through.

“Most lawyers draft documents without truly understanding your family’s unique needs—we do the exact opposite.”

What Makes Our Approach Different:

-

Personalized Coaching: You’ll receive step-by-step guidance throughout the entire process, not just a one-way conversation where an attorney talks at you while the billing clock runs.

-

Family-Centered Design: Your trust will reflect your specific family relationships, values, and long-term objectives—not just a template with your name inserted.

-

Transparent Value: At $1,995, your complete trust package costs significantly less than traditional attorney fees while providing more personalized attention.

-

Risk-Free Guarantee: If you’re not completely satisfied with your trust within 30 days, we’ll refund your preparation fee—no questions asked.

Ready to protect your family with a plan that truly works? Register today and a dedicated Pro Client Guide will personally contact you to begin your journey toward peace of mind.

Learn More About Our Trust Planning Program

"*" indicates required fields

I’ll look forward to meeting you and introducing you to this amazing program!

Steve Gibbs, JD, AEP®,

CEO and Co-Founder

Steve Gibbs, JD, AEP®,

CEO and Co-Founder

Learn More About Steve