Table of Contents

- 1. Introduction to FIRE+IBC

- 2. Limitations of Traditional FIRE

- 3. How FIRE+IBC Works

- 4. HCVWL as a Bond Alternative

- 5. Real-World Impact

- 6. Addressing Objections

- 7. Taking Action

- 8. Conclusion

- 9. Ready to Explore FIRE+IBC?

- 10. FAQ

Key Points

The FIRE+IBC strategy combines infinite banking with FIRE principles, using high cash value whole life FIRE to address the 4% rule’s vulnerabilities, mitigate sequence of returns risk FIRE, and create tax-efficient FIRE strategies for a robust, stress-free financial future.

Revolutionizing Financial Independence with FIRE and Infinite Banking

1. Introduction to FIRE+IBC

The FIRE (Financial Independence, Retire Early) movement has revolutionized how many people approach wealth building. But as a trailblazer who’s spent years analyzing both traditional FIRE approaches and the Infinite Banking Concept (IBC), I’ve discovered something remarkable: when strategically combined, these frameworks create a financial strategy far greater than the sum of their parts. By integrating infinite banking and become your own banker principles, the FIRE+IBC strategy enhances financial sovereignty.

After years of studying FIRE’s limitations, I’ve developed the FIRE+IBC Integration Strategy, a comprehensive approach that maintains FIRE’s core principles while addressing its vulnerabilities through strategic use of high cash value whole life insurance (HCVWL). This aligns with financial independence with infinite banking, offering a path to true wealth control.

2. Limitations of Traditional FIRE

The conventional FIRE approach relies heavily on the 4% rule, the idea that withdrawing 4% of your portfolio annually provides a safe, inflation-adjusted income stream. On paper, it sounds solid. In practice? The math reveals concerning vulnerabilities:

- The Trinity Study’s 4% rule was designed for 30-year retirements, but FIRE practitioners often need 50+ years of withdrawals

- Research shows a concerning 43% failure rate for 50-year retirements using strict 4% withdrawals

- Sequence of returns risk FIRE increases failure probability by 37% in early retirement years

- 68% of FIRE aspirants underestimate tax drag during the decumulation phase

Add to this the psychological reality that 89% of early retirees monitor portfolios weekly and 61% report stress from market volatility, and we see a strategy that works mathematically but may not fully account for real-world conditions. This is where 4% rule alternatives like FIRE and infinite banking offer a more resilient path.

3. How FIRE+IBC Works

Maintain FIRE’s High Savings Rate

The FIRE movement gets this absolutely right – saving 50-70% of your income accelerates financial independence. The FIRE+IBC strategy preserves this discipline but redirects a portion of savings to align with bank on yourself principles.

Maximize Tax-Advantaged Vehicles

The path to financial independence demands optimizing every dollar for maximum tax efficiency, a cornerstone of tax-efficient FIRE strategies:

Phase 1: Roth IRA First

- Maximize Roth IRA contributions annually ($7,000 in 2025)

- Invest Roth funds in low-cost index funds for long-term growth

- Create tax-free growth and withdrawals in retirement

- Benefit from no required minimum distributions (RMDs)

- Access contributions after five years without penalties

Phase 2: High Cash Value Whole Life Insurance

- Direct additional savings to properly structured HCVWL

- Design policy for maximum early cash value with paid-up additions

- Create a tax-advantaged vehicle complementing your Roth

- Build a banking system for FIRE strategy with whole life insurance

Phase 3: Opportunity Assets

- Use policy loans to acquire cash-flowing assets

- Target real estate, business investments, or non-correlated assets

- Create multiple income streams beyond your portfolio

- Repay policy loans to accelerate banking system growth

This approach maximizes tax efficiency throughout accumulation and distribution, unlike traditional FIRE’s reliance on taxable accounts.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

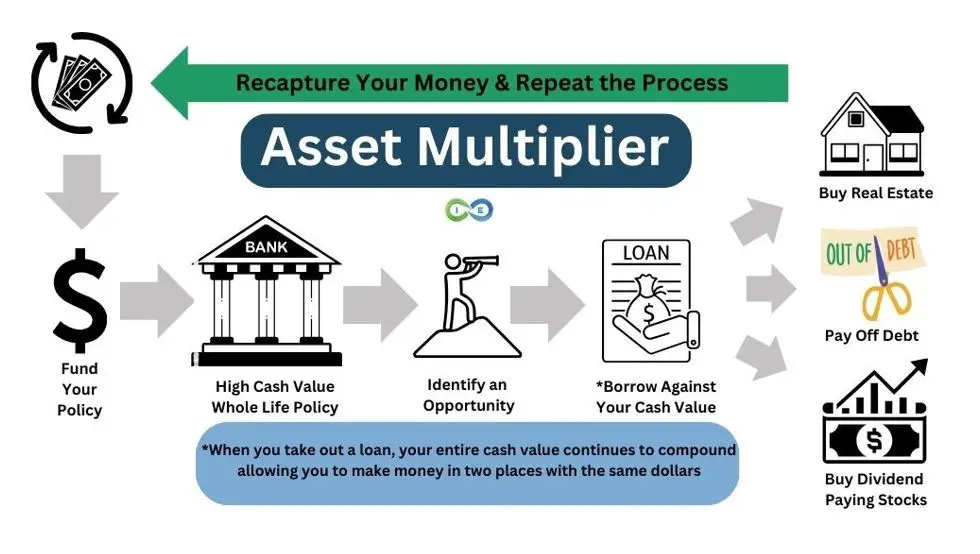

Implement the Asset Multiplier Effect

Using policy loans from the HCVWL banking bucket to fund investments creates a powerful asset multiplier effect:

- Cash value grows at 5-7% (even on borrowed amounts)

- Borrowed funds generate 8-12% from opportunity investments

- Loan repayments accelerate policy growth

- Compounding growth occurs in multiple assets simultaneously

This is a hallmark of retire early with infinite banking, leveraging money in two places at once.

Create a Sequence-of-Returns Shield

Traditional FIRE’s vulnerability to sequence of returns risk FIRE is mitigated by withdrawing living expenses from HCVWL policy loans during market downturns, preserving portfolio recovery potential and enhancing FIRE vs infinite banking resilience.

Maximize Tax Efficiency

The strategy optimizes taxes via:

- Tax-free policy loans instead of taxable withdrawals

- Strategic Roth conversion ladders during low-income years

- Asset location optimization across buckets

- Tax-free death benefit as a safety net

This supports tax-efficient FIRE strategies, reducing tax drag.

4. HCVWL as a Bond Alternative

HCVWL replaces bonds in traditional portfolios with significant advantages for high cash value whole life FIRE:

Unlike bonds, which lose value when interest rates rise, HCVWL cash value is guaranteed not to decrease. While bonds yield 3-4% with taxable interest, HCVWL delivers 4-6% tax-deferred returns through guaranteed growth plus dividends. HCVWL offers non-correlation to equities, unlike bonds during crises, and is accessible without penalties, unlike retirement account bonds.

With policy loans, your principal continues growing, eliminating the risk of outliving your money—a key advantage over traditional withdrawal strategies and a core feature of bank on yourself.

5. Real-World Impact

The psychological benefits of FIRE+IBC are significant:

- Guaranteed cash value growth despite market performance

- Multiple income streams beyond portfolio withdrawals

- Capital access without liquidation

- Built-in legacy planning

The strategy adapts to various FIRE approaches:

Fat FIRE: Allocate more to growth, using policy loans for luxury investments.

Coast FIRE: Bridge income gaps with policy loans, preserving growth bucket compounding.

Barista FIRE: Use part-time income to accelerate policy funding, supporting retire early with infinite banking.

6. Addressing Objections

Many FIRE practitioners dismiss whole life insurance. I’ve heard the objections and once shared them. Here’s why they don’t hold up:

“Whole life insurance is too expensive”

Compared to term insurance, which sees premiums skyrocket and rarely pays out, HCVWL minimizes insurance costs, with 75-85% of first-year premiums going to cash value—a wealth transfer, not an expense.

“The returns are too low compared to the market”

HCVWL isn’t a market replacement but a complementary tool, offering 5%+ tax-free returns with no market risk, as seen in a policy where $8,275 cash value grows to $120,000 in 10 years.

“You’re locked in with inflexible premiums”

With paid-up additions, premiums are flexible, and dividends can eventually cover costs.

“It takes too long to build cash value”

In banking-designed policies, cash value is accessible in year one, equaling premiums by year 3-4.

“Surrender charges hit if you change your mind”

No surrender charges apply; you receive 100% cash value if canceled.

“Self-banking is marketing hype”

Policy loans maintain uninterrupted compounding, allowing money to work in two places, a core become your own banker principle.

“I’ll self-insure as wealth grows”

Self-insuring strains portfolios, while HCVWL’s growing death benefit supports legacy planning without compromising retirement income.

7. Taking Action

To implement financial independence with infinite banking:

- Assess your FIRE strategy for vulnerabilities (taxes, sequence risk)

- Research mutual insurance companies with 153+ years of dividends

- Consult an advisor skilled in FIRE and IBC, like I&E’s team

- Start a policy designed for early cash value

- Develop opportunity strategies for policy loans

Begin modestly and scale as you see the asset multiplier effect.

8. Conclusion

Traditional FIRE works but has vulnerabilities. By integrating FIRE and infinite banking with high cash value whole life FIRE, you address the 4% rule’s limits, mitigate sequence of returns risk FIRE, and create tax-efficient FIRE strategies. This isn’t about abandoning FIRE but enhancing it with bank on yourself principles for a robust, flexible path to financial sovereignty.

9. Ready to Explore FIRE+IBC?

If you’re ready to explore how this integrated approach could work with your specific numbers and situation, our team of Pro Client Guides is here to help. These aren’t average insurance agents – they’re specialists who understand both FIRE principles and the Infinite Banking Concept, with thousands of successful implementations.

Your Next Steps:

- Schedule a Free Strategy Session with one of our Pro Client Guides who will analyze your current financial situation and show how FIRE+IBC could work for you

- Download Our Free Self-Banking Blueprint to explore the concepts in greater depth

- Join Our Community of financial contrarians who are building wealth outside the conventional system

Our Pro Client Guides will walk you through our proven process:

- Education Phase: Understanding the concepts and how they apply to your situation

- Application Phase: Implementing your customized strategy

- Maintenance Phase: Ongoing support as your needs evolve

10. Frequently Asked Questions

What is the FIRE+IBC strategy?

It combines FIRE principles with infinite banking, using high cash value whole life FIRE to enhance tax efficiency and legacy planning.

How does FIRE+IBC address sequence of returns risk?

Policy loans cover expenses during market downturns, reducing sequence of returns risk FIRE by preserving portfolio recovery.

Is HCVWL a good 4% rule alternative?

Yes, HCVWL provides stable, tax-free funds, serving as 4% rule alternatives for FIRE strategy with whole life insurance.

Can FIRE+IBC support early retirement?

Absolutely, it leverages policy loans and cash value for retire early with infinite banking, ensuring flexibility and income.

How does FIRE+IBC compare to traditional FIRE?

FIRE vs infinite banking shows IBC adds tax efficiency, asset protection, and stability, enhancing traditional FIRE’s vulnerabilities.