A Guaranteed Universal Life (GUL) insurance policy offers a perfect blend of affordability, reliability, and simplicity, providing lifelong coverage without the investment complexities of other life insurance products. With fixed premiums and a no-lapse guarantee, GUL ensures financial stability and peace of mind for you and your loved ones. In this comprehensive guide, we explore the top GUL policies and companies for 2025, backed by the latest market data, to help you choose the right solution for your long-term insurance needs.

Table of Contents

- Key Takeaways

- Market Overview: GUL Trends

- Introduction to Guaranteed Universal Life Insurance

- How Does a GUL Policy Work?

- Pros and Cons of GUL

- Comparison with Other Life Insurance Policies

- Cost Considerations

- Sample Rates

- Choosing the Right GUL Policy

- Top GUL Insurance Companies

- GUL Riders

- Who Should Consider GUL?

- Policy Application and Underwriting Process

- Conclusion

Key Takeaways

- Guaranteed universal life insurance provides stable, long-term death benefit protection with fixed premiums and minimal cash value, making it a cost-effective option for those seeking permanent coverage without complexity.

- GUL offers flexibility in coverage duration (e.g., to age 90–121) with a no-lapse guarantee and, in some cases, a return of premium option.

- Key advantages include affordability, guaranteed premiums, and simplicity, while drawbacks are limited flexibility and minimal cash value accumulation.

- GUL differs from term life by offering lifelong coverage, from whole life and universal life by avoiding cash value focus, and from variable universal life by eliminating investment risks.

- Premiums depend on age, health, lifestyle, and insurer, with policies tailored via no-lapse guarantees and riders like return of premium.

- GUL suits those seeking reliable death benefit coverage without high premiums or investment components, with options for simplified underwriting.

Market Overview: GUL Trends

Guaranteed Universal Life (GUL) is a niche but growing segment of the U.S. life insurance market, valued for its affordability and simplicity. According to LIMRA (limra.com), GUL accounted for ~1% of individual life insurance sales in 2024, compared to 86% for term and whole life combined. However, GUL is projected to grow at the highest rate among universal life products through 2033, driven by digital platforms and demand for predictable coverage (nerdwallet.com).

| Product Type | Market Share (2024) | Growth Trend | Key Features |

|---|---|---|---|

| Guaranteed Universal Life (GUL) | ~1% | Highest projected | Guaranteed death benefit, low cash value |

| Indexed Universal Life (IUL) | 23–24% | 3–7% YoY | Market-linked returns, flexible premiums |

| Variable Universal Life (VUL) | 14–15% | 12–16% YoY | Investment options, higher risk/reward |

| Term/Whole Life | 86% (combined) | Modest | Simplicity, core coverage |

Industry Highlights

- Growth Outlook: GUL is gaining traction for its “Goldilocks” appeal—balancing cost and lifelong coverage.

- Digital Adoption: Insurers are using digital tools to streamline GUL sales and underwriting.

- Industry Moves: In 2024, Prudential reinsured $11 billion of its GUL block, signaling active risk management.

- Consumer Appeal: GUL attracts cost-conscious buyers and estate planners seeking guaranteed coverage.

Introduction to Guaranteed Universal Life Insurance

Guaranteed Universal Life (GUL) insurance offers long-term death benefit protection with fixed premiums, ensuring stability and predictability. Unlike other universal life policies, GUL typically has minimal or no cash value accumulation, resulting in lower premiums compared to whole life or standard universal life for the same death benefit. This simplicity makes GUL an ideal choice for those prioritizing reliable, lifelong coverage over investment growth.

How Does a GUL Policy Work?

A GUL policy is a type of permanent cash value life insurance that allows you to choose coverage duration, typically to ages 90, 95, 100, or 121. It features fixed premiums and a guaranteed death benefit, providing budget certainty even as you age or face health challenges. Unlike whole life, GUL offers some flexibility in premium payments within set guidelines.

No-Lapse Guarantee

A standout feature of GUL is the no-lapse guarantee, ensuring the policy remains active as long as premiums are paid on time. This prevents cancellation even if the minimal cash value doesn’t cover charges, though unpaid loans or underfunding may reduce the benefit period.

Return of Premium

Some GUL policies offer a return of premium rider, allowing you to recover some or all paid premiums if you cancel within a specific period, adding value for flexibility.

Note: Timely premium payments are crucial to maintain guarantees. Setting up autopay can help ensure consistency.

Pros and Cons of Guaranteed Universal Life

GUL offers unique benefits but also has limitations depending on your goals. Here’s a breakdown:

Pros

- Affordability: Low-cost permanent coverage compared to whole life or universal life.

- Guaranteed Premiums: Fixed rates that won’t increase, even with age or health changes.

- Simplicity: Long-term protection without complex cash value or investment components, ideal for estate planning.

Cons

- Limited Flexibility: Less adjustable than other universal life policies.

- Minimal Cash Value: Little to no savings component, unlike whole life or IUL.

| Advantages of Guaranteed Universal Life Insurance | Disadvantages of Guaranteed Universal Life Insurance |

|---|---|

| Affordability | Limited flexibility |

| Guaranteed premiums | Low or no cash value accumulation |

| Long term coverage (without the complexity of cash value growth) |

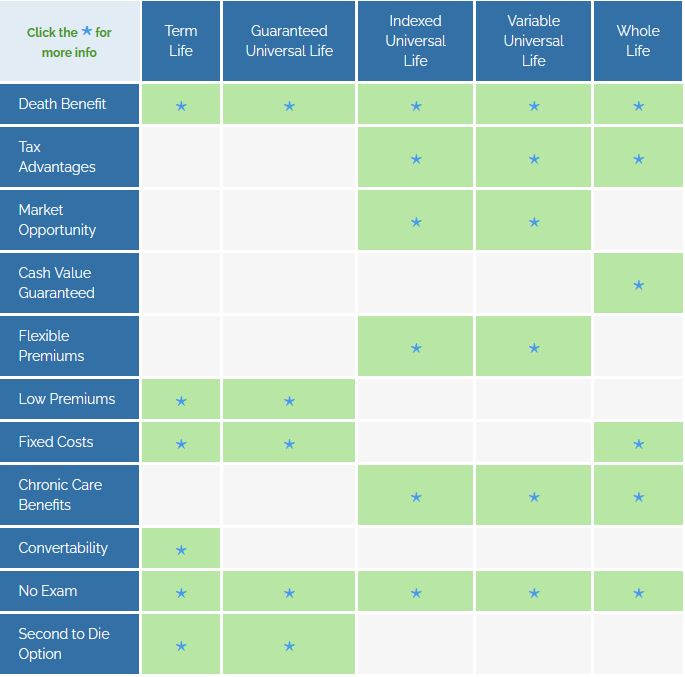

Comparison with Other Life Insurance Policies

GUL shares some features with other life insurance policies but differs significantly in focus and benefits. Here’s how it compares:

GUL vs. Term Life Insurance

Term life insurance offers affordable death benefit protection for a set period (e.g., 10–20 years) with no cash value. Premiums are low initially but increase upon renewal, and coverage may lapse if not converted. GUL, however, provides lifelong coverage with fixed premiums, ideal for permanent needs like estate planning.

GUL vs. Whole Life Insurance

Whole life insurance guarantees lifelong coverage and builds tax-deferred cash value, but premiums are higher due to this savings component. GUL prioritizes affordability, offering similar guarantees with minimal cash value.

GUL vs. Indexed Universal Life (IUL)

Indexed Universal Life (IUL) ties cash value growth to market indexes like the S&P 500, offering higher growth potential but with variable premiums. GUL avoids market risks, ensuring stable premiums and coverage.

GUL vs. Variable Universal Life (VUL)

Variable Universal Life (VUL) allows cash value investment in subaccounts, with high growth potential but also market risk. GUL is risk-free, focusing solely on guaranteed death benefits.

Cost Considerations

GUL is more affordable than whole life or other universal life policies due to its minimal cash value. Premiums depend on:

- Age and gender of the insured

- Health condition at application

- Death benefit amount

- Lifestyle/hobbies (e.g., risky activities like rock climbing)

- Occupation

- Smoking status

- Family health history

- Medications taken

- Premium payment mode (e.g., monthly, annually, or limited pay)

- Insurance company

Sample GUL Premium Rates

The following sample rates are for a GUL policy to age 121 for a male at a preferred plus rate class from A-rated companies and higher. Rates are for informational purposes only and must be qualified.

| Age | $100,000 | $250,000 | $500,000 | $1,000,000 |

|---|---|---|---|---|

| 40 | $879.23 | $1806.41 | $3612.69 | $6545.24 |

| 45 | $1072.89 | $2215.27 | $4430.26 | $7969.30 |

| 50 | $1334.15 | $2764.30 | $5528.46 | $10,183.30 |

| 55 | $1580.46 | $3635.82 | $7271.56 | $13,519.72 |

| 60 | $2017.20 | $4634.69 | $9269.24 | $17,365.04 |

| 65 | $2652.86 | $6420.10 | $12,840.14 | $23,802.49 |

For personalized GUL quotes, contact us or schedule a consultation with one of our Pro Client Guides.

Choosing the Right GUL Policy

Not all GUL policies are identical, so selecting one that aligns with your needs is crucial. Key features to consider include:

- No-Lapse Guarantees: Ensure coverage remains active as long as premiums are paid.

- Flexible Death Benefit: Ability to reduce coverage if needs change.

- Return of Premium: Option to recover premiums if the policy is canceled.

GUL shines in its ability to customize coverage to specific ages (e.g., 90, 95, 100, 121) and include riders like return of premium or accidental death benefits for added protection.

Top Guaranteed Universal Life Insurance Companies

The best GUL company depends on your goals. Below, we detail the top 10 providers for 2025, known for strong GUL offerings, financial stability, and customer service. For more on universal life providers, see our universal life insurance guide.

Pacific Life

AM Best Rating: A+ (Superior)

Key Products: Pacific Elite GUL

Highlights: Pacific Life is a leader in GUL, offering customizable coverage to ages 90–121 with competitive premiums and no-lapse guarantees. Their policies include flexible riders like return of premium and accidental death benefits.

Learn more in our Pacific Life review.

North American Company

AM Best Rating: A+ (Superior)

Key Products: Custom Guarantee GUL

Highlights: North American excels in affordable GUL policies with strong no-lapse guarantees and simplified underwriting options, ideal for cost-conscious buyers.

Learn more in our North American review.

Lincoln National

AM Best Rating: A+ (Superior)

Key Products: LifeGuarantee UL

Highlights: Lincoln National offers flexible GUL policies with robust no-lapse guarantees and riders for long-term care and chronic illness, catering to estate planning needs.

Learn more in our Lincoln National review.

Prudential

AM Best Rating: A+ (Superior)

Key Products: PruLife Universal Protector

Highlights: Prudential is a top GUL provider, with $11 billion in GUL policies reinsured in 2024, reflecting its market strength. Their policies offer customizable terms and strong customer service.

Learn more in our Prudential review.

Mutual of Omaha

AM Best Rating: A+ (Superior)

Key Products: Guaranteed Universal Life

Highlights: Mutual of Omaha provides affordable GUL policies with flexible riders, including long-term care and accidental death benefits, backed by excellent customer service.

Learn more in our Mutual of Omaha review.

John Hancock

AM Best Rating: A+ (Superior)

Key Products: Protection UL

Highlights: John Hancock offers innovative GUL policies with simplified underwriting and riders for critical illness, appealing to those seeking straightforward coverage.

Learn more in our John Hancock review.

Foresters Financial

AM Best Rating: A (Excellent)

Key Products: Advantage Plus GUL

Highlights: Foresters stands out with no-exam GUL options for ages 16–55, offering accessibility and competitive premiums for estate planning.

Learn more in our Foresters Financial review.

Penn Mutual

AM Best Rating: A+ (Superior)

Key Products: Guaranteed Choice UL

Highlights: Penn Mutual is a top GUL provider, offering customizable coverage and riders like return of premium, with a strong focus on affordability.

Learn more in our Penn Mutual review.

Transamerica

AM Best Rating: A (Excellent)

Key Products: Transamerica Financial Choice GUL

Highlights: Transamerica provides flexible GUL policies with competitive premiums and riders for long-term care, ideal for budget-conscious buyers.

Learn more in our Transamerica review.

American National

AM Best Rating: A (Excellent)

Key Products: Signature GUL

Highlights: American National offers reliable GUL policies with no-lapse guarantees and simplified underwriting, catering to estate planning needs.

Learn more in our American National review.

Ready to explore guaranteed universal life insurance?

Our expert advisors can help you find the perfect GUL policy for lifelong coverage and peace of mind. Schedule a free 30-minute consultation to discover tailored solutions—no obligation, just expert guidance.

Guaranteed Universal Life Insurance Riders

Customize your GUL policy with riders to enhance protection:

- Long-Term Care Rider: Use death benefit for long-term care expenses.

- Chronic Illness Rider: Access death benefit early for permanent chronic illness.

- Critical Illness Rider: Draw from death benefit for conditions like heart attack or cancer.

- Terminal Illness Rider: Receive part of the death benefit for terminal illness.

- Accidental Death Benefit Rider: Adds extra payout for accidental death.

- Children’s Term Insurance Rider: Covers children’s life insurance.

- Waiver of Monthly Deductions Rider: Covers deductions if disabled (after 6 months).

Who Should Consider Guaranteed Universal Life Insurance?

GUL is ideal if you:

- Seek lifelong coverage without high premiums.

- Don’t need significant cash value accumulation.

- Want simplicity without investment features.

- Desire customizable riders for added protection.

- Need guaranteed premiums despite future health changes.

Policy Application and Underwriting Process

Applying for a GUL policy involves an application and underwriting process. You’ll provide personal and health information, and a medical exam may be required to assess risk factors like heart disease or diabetes. For high-risk applicants, simplified underwriting options are available, though premiums may be higher. A life insurance specialist can guide you through the process to find the best policy.

Conclusion

A guaranteed universal life insurance policy is a strategic choice for stable, long-term death benefit protection without the complexities or costs of investment-driven policies. With fixed premiums and no-lapse guarantees, GUL aligns with your need for budget certainty and reliable coverage, making it ideal for estate planning or securing loved ones’ futures. Connect with one of our Pro Client Guides to explore the best GUL policy for you.

Find the Perfect Guaranteed Universal Life Insurance Policy

Ready to secure lifelong coverage with a GUL policy? Our independent advisory team will provide a personalized analysis to help you choose the best policy for your financial goals, with no investment complexity.

- ✓ Get a tailored comparison of top GUL policies based on your needs

- ✓ Explore no-lapse guarantees and return of premium options

- ✓ Understand rider benefits like long-term care and accidental death

- ✓ Receive expert guidance on affordable, lifelong protection

Schedule your complimentary 30-minute GUL consultation today and ensure peace of mind.

No obligation. No pressure. Just expert insights to help you find the right GUL policy for financial stability.