Welcome to our comprehensive guide on life insurance for high net worth individuals and families. We designed this resource to provide you with in-depth knowledge and strategic insights into how whole life insurance can serve as a fundamental component of your financial and estate planning. Here’s a brief introduction to what you can expect from this guide:

Table of Contents

- Introduction to Life Insurance for High Net Worth Individuals

- Understanding Whole Life Insurance: Basics and Benefits

- Strategic Financial Planning with Whole Life Insurance

- Customizing Whole Life Policies for Enhanced Benefits

- The Role of Whole Life Insurance in Estate Planning

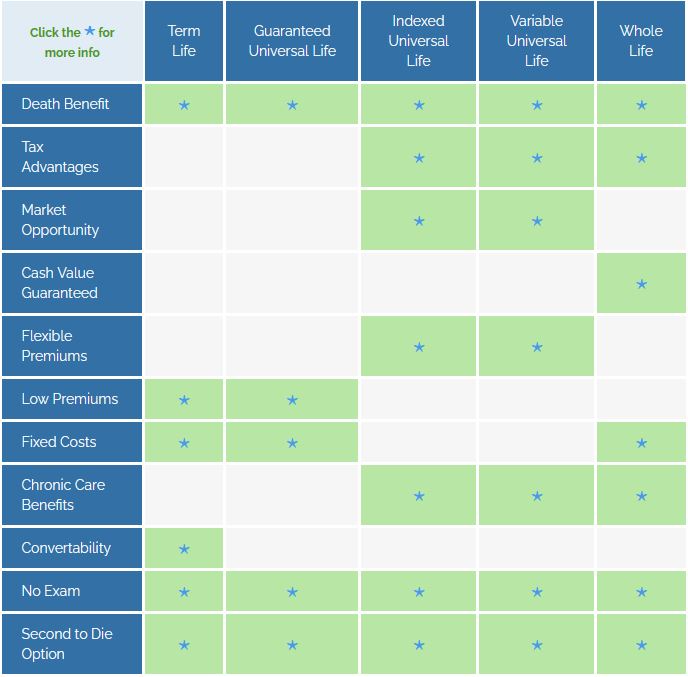

- Comparison: Whole Life vs. Other Insurance Products

- Funding Mechanisms for Whole Life Insurance

- Case Studies: Success Stories and Practical Applications

- Choosing the Right Insurance Provider and Policy

- Conclusion: Integrating Whole Life Insurance into Your Financial Portfolio

Introduction to Life Insurance for High Net Worth Individuals

High net-worth individuals have unique insurance needs that go beyond the basic coverage sought by the general population. Their financial situations are typically more complex, involving various types of assets, potentially multiple revenue streams, and a need for strategic tax planning and asset protection. Whole life insurance is critical in addressing these needs through its inherent benefits and features. Here’s an overview:

Unique Insurance Needs of High Net Worth Individuals

- Asset Protection: Protecting the extensive assets and investments of high net worth individuals is crucial. These assets often require more sophisticated management and protection strategies against legal and financial liabilities.

- Estate Planning: High net worth individuals require comprehensive estate planning to ensure a smooth transfer of wealth to future generations while minimizing estate taxes and legal complications.

- Tax Strategy: Effective tax planning strategies are essential for high net worth individuals to optimize tax liabilities and maximize the efficiency of their financial growth and wealth transfer.

Role of Whole Life Insurance in Wealth Management and Legacy Planning

- Permanent Coverage: Whole life insurance covers the insured’s entire lifetime as long as premiums are paid. This permanence is essential for lifelong financial planning and certainty in legacy considerations.

- Cash Value Accumulation: The cash value in a whole life insurance policy grows tax-deferred, which can be a significant advantage for high net worth individuals looking to grow their wealth efficiently. The cash value provides a compound interest growth environment where interest grows on the premiums paid and on the interest previously earned, all while avoiding immediate taxation.

- Liquidity and Access to Funds: Policyholders may access the cash value via loans or withdrawals, which can serve as a source of liquidity for various needs, such as funding business opportunities, covering unexpected expenses, or even as part of a strategic retirement plan.

- Estate Liquidity: Whole life insurance provides liquidity to estates upon the policyholder’s death, offering immediate funds that can be used to pay estate taxes, settle debts, and cover other related expenses without the need to liquidate other assets hastily.

- Tax Benefits: The death benefit of a whole life insurance policy is generally income tax-free to beneficiaries, which is a significant advantage in legacy planning. It ensures that heirs receive a greater portion of the intended inheritance without the burden of heavy taxes.

By integrating whole life insurance into their financial portfolios, high net worth individuals can protect their wealth and strategically plan for their estates’ future, ensuring a lasting legacy and financial security for their beneficiaries.

Understanding Whole Life Insurance: Basics and Benefits

Whole life insurance is a form of permanent life insurance that offers financial protection, a cash value accumulation feature, and tax advantages. It is an integral part of long-term financial planning, especially for those seeking stability and predictability in their insurance and investment strategies. Here’s a detailed explanation of its key components:

Permanent Coverage

- Lifetime Protection: Whole life insurance provides coverage that remains in force for the insured’s entire life as long as the premiums are paid. This lifetime coverage guarantees that beneficiaries will receive a death benefit, regardless of when the insured passes away, offering peace of mind that your future financial obligations and legacies will be secured.

Cash Value Accumulation

- Savings Component: Each premium payment towards a whole life insurance policy contributes to its cash value, which grows over time. This cash value component accumulates on a tax-deferred basis and can be a significant asset for policyholders.

- Compound Interest: The cash value benefits from compound interest, growing from the premiums paid and the interest that accumulates. This interest compounds because it is earned on the initial principal and the accrued interest from previous periods without current taxation, enhancing growth potential.

- Access to Funds: Policyholders can access the cash value through withdrawals or policy loans, which can be used for various purposes such as funding retirement, paying for education, or covering unexpected expenses. However, withdrawals and loans reduce the policy’s cash value and death benefit unless repaid.

Tax Benefits

- Tax-Deferred Growth: The growth of the cash value in a whole life insurance policy is tax-deferred, meaning taxes on interest, dividends, or capital gains are only paid once the money is withdrawn. This tax-deferred growth allows the cash value to increase faster than it would in a taxable account.

- Tax-Free Death Benefit: The death benefit paid to beneficiaries upon the insured’s death is generally free from federal income tax. This provides a significant financial advantage as it ensures that the intended benefit reaches the beneficiaries without being diminished by taxes.

- Potential Dividend Payments: Some whole life policies, particularly those issued by mutual insurance companies, may pay dividends. While not guaranteed, you can use these whole life insurance dividends to increase the death benefit or cash value, pay premiums, or even receive them as cash. Importantly, dividends are generally treated as a return of premium and thus are received tax-free under current IRS rules.

Whole life insurance’s blend of permanent protection, cash value growth, and favorable tax treatment make it an appealing choice for individuals seeking reliable and effective financial planning tools. This type of insurance ensures a financial safety net over the long term and contributes to wealth accumulation and fiscal efficiency, which is crucial for comprehensive financial strategies.

Strategic Financial Planning with Whole Life Insurance

Whole life insurance is a versatile tool that fits into the broader financial strategies of high net worth individuals by providing solutions for estate planning, tax optimization, and wealth preservation. Here’s how whole life insurance plays a pivotal role in each of these areas:

Estate Planning

- Providing Liquidity: Whole life insurance provides immediate liquidity to an estate upon the policyholder’s death. This liquidity is essential for covering estate taxes, settling debts, and funding other obligations without the need to sell off assets, such as real estate or business interests, that might be illiquid or undervalued at the time of the policyholder’s death.

- Equalizing Inheritances: For high net worth individuals with multiple heirs, especially when assets vary in type or liquidity (such as a family business versus marketable securities), whole life insurance can provide funds to balance inheritances among heirs, ensuring fairness and potentially preventing disputes.

Tax Optimization

- Tax-Deferred Growth: The cash value in whole life insurance grows tax-deferred, meaning that taxes are only paid on the growth once funds are withdrawn. This allows the cash value to compound more effectively, providing a robust growth mechanism that can be essential to wealth accumulation strategies.

- Tax-Free Death Benefit: The death benefit from a whole life insurance policy is typically paid out tax-free to beneficiaries. This feature is critically important for high net worth individuals looking to transfer wealth efficiently without a significant tax burden, reducing the amount passed on to heirs.

Wealth Preservation

- Asset Protection: In some jurisdictions, life insurance’s cash value and death benefits are protected from creditors. This legal protection can be crucial for high net worth individuals, providing a secure asset that may not be accessible to creditors in cases of lawsuits or bankruptcy.

- Guaranteed Growth and Returns: Whole life insurance offers guaranteed returns on the cash value backed by the insurer. This guarantee provides a stable growth environment, free from the volatility of the stock market or other riskier investments, which is a desirable trait for conservatively managing part of an individual’s wealth portfolio.

Integration into Comprehensive Financial Plans

- Funding Retirement: The cash value in a whole life policy can be accessed via loans or withdrawals and used as a supplementary retirement income stream, particularly useful if other retirement accounts have already been maxed out.

- Business Succession Planning: Whole life insurance can also be structured to fund buy-sell agreements or provide key-person insurance, which ensures that a business can continue to operate smoothly without financial disruption if a key stakeholder passes away.

Overall, whole life insurance is not just a tool for risk management through its death benefit; it also serves as a strategic asset for financial planning. Its ability to address diverse needs such as liquidity for estates, tax-efficient wealth transfer, and secure asset accumulation makes it a cornerstone in the financial strategies of high net worth individuals.

Irrevocable Life Insurance Trust (ILIT)

The use of irrevocable trusts, especially for qualified gifting to minimize estate tax exposure, provides a practical and strategic application of life insurance within the broader context of estate planning for high net worth individuals by offering the following benefits:

- Strategic Tax Minimization: Irrevocable trusts legally minimize estate taxes by removing assets from the taxable estate of high-net-worth individuals. When life insurance policies are owned by such trusts, the death benefits paid out upon the policyholder’s death are not included in the estate for tax purposes. This arrangement helps significantly reduce the estate tax liability.

- Qualified Gifting: Using qualified gifting involves transferring assets into an irrevocable trust, which can then purchase a life insurance policy on the grantor’s life. Since these gifts are often structured to stay within annual tax exclusion limits, they do not incur gift taxes, thereby preserving more wealth to pass on to beneficiaries. Life insurance maximizes financial leverage by using the annual gift tax exclusions to fund substantial life insurance policies that provide considerable tax-free benefits to heirs.

- Asset Protection and Control: Although irrevocable trusts limit the grantor’s control over the assets (as the assets are permanently removed from the grantor’s possession), they provide a secure way to manage and protect the wealth for future generations. The trust structure ensures that the assets (including life insurance proceeds) are used according to the specific terms set out for beneficiaries, thus supporting estate planning goals and providing long-term financial security.

- Enhancing the Role of Life Insurance: Integrating life insurance with irrevocable trust planning not only offers tax benefits but also ensures that the proceeds are managed efficiently to support the financial needs of beneficiaries, whether for personal use, business continuity, or philanthropic endeavors. This approach underscores the role of life insurance as more than just a death benefit tool; it becomes a central component in sophisticated estate and tax planning strategies.

<h3Customizing Whole Life Policies for Enhanced Benefits

Whole life insurance offers a range of customization options through various riders that enhance the policy’s utility and tailor coverage to the specific needs of high net worth individuals. These riders provide additional benefits and flexibility, allowing policyholders to address concerns such as increased protection, disability contingencies, and long-term care needs. Here’s a discussion on some key riders:

Increased Death Benefit Rider

- Purpose: The Increased Death Benefit rider allows policyholders to increase the policy’s death benefit, subject to insurability, at predetermined times or upon certain events without undergoing further medical examination.

- Benefits for High Net Worth Clients: This rider is particularly useful for high net worth individuals whose wealth and liabilities may increase significantly over time. It provides an opportunity to ensure that their life insurance coverage keeps pace with their growing financial responsibilities and estate size, thereby securing adequate legacy and liquidity for estate taxes and settlement costs.

Waiver of Premium Rider

- Purpose: The Waiver of Premium rider ensures that the premium payments on the policy are waived if the policyholder becomes disabled and unable to work, as defined by the rider’s terms.

- Benefits for High Net Worth Clients: Maintaining financial strategies during periods of disability is crucial for high-net-worth individuals. This rider helps preserve the policy’s benefits and cash value growth trajectory, even when the policyholder’s income is interrupted due to disability. It protects the policyholder’s investment in life insurance, ensuring that the coverage continues without financial strain during challenging times.

Long-Term Care Rider (Living Benefits)

- Purpose: The Long-Term Care (LTC) rider allows policyholders to access a portion of the death benefit for long-term care expenses, such as nursing home care, home health care, or other long-term medical needs.

- Benefits for High Net Worth Clients: This rider is essential for high net worth individuals considering the high costs associated with long-term care. It provides financial flexibility by allowing them to use their life insurance benefits during their lifetime, where these benefits would otherwise only be accessible to beneficiaries after the policyholder’s death. It helps preserve other assets and investments for intended purposes, such as legacy and wealth transfer, rather than being consumed by healthcare costs.

- Additionally, there are typically free riders including Chronic Illness, Critical Illness, and Terminal Illness, which allow you to tap into your death benefit while you are still alive.

Customizing Whole Life Policies with Riders

- Strategic Considerations: When selecting riders, high-net-worth individuals should consider their current financial situation, potential future changes, and overall financial planning goals. Each rider comes with an additional cost, so it’s important to balance the benefits with the overall insurance strategy.

- Flexibility and Security: Adding riders to a whole life policy enhances flexibility and provides a safety net that addresses multiple financial and estate planning aspects. It allows policyholders to adapt their coverage to meet evolving personal and family needs, reinforcing the role of whole life insurance as a cornerstone in comprehensive wealth management.

These riders enhance the utility of whole life insurance, making it not only a tool for financial protection but also a flexible solution for managing long-term financial and care needs. This is crucial for high net worth individuals looking to optimize their financial legacy and security.

The Role of Whole Life Insurance in Estate Planning

Whole life insurance plays a critical role in estate planning, particularly for high net worth individuals looking to manage asset transfers, minimize estate taxes, and ensure liquidity for estate settlements. Here are some key strategies that utilize whole life insurance effectively in these areas:

Asset Transfer

- Creating an Inheritance: Whole life insurance can create a guaranteed and tax-efficient inheritance for beneficiaries. The death benefit provides a significant sum that can be directed to heirs or charitable causes according to the policyholder’s wishes.

- Bypassing Probate: Since life insurance proceeds are paid directly to beneficiaries and are not part of the probate estate, they can bypass the probate process. This probate avoidance not only speeds up the distribution of assets but also maintains privacy regarding the amount and recipients of the assets.

Minimizing Estate Taxes

- Liquidity to Pay Estate Taxes: One of the significant challenges in estate planning is ensuring enough liquidity to cover estate taxes without having to sell off valuable assets at potentially unfavorable times. Whole life insurance provides cash at death, which can be used to pay estate taxes and related costs, preserving the estate’s value for the heirs.

- Irrevocable Life Insurance Trust (ILIT): To avoid the inclusion of the insurance proceeds in the taxable estate, a policy can be owned by an Irrevocable Life Insurance Trust (ILIT). The death benefit paid to the ILIT will not be considered part of the estate and thus not subject to estate taxes, which helps significantly reduce the overall estate tax liability.

Ensuring Liquidity for Estate Settlements

- Paying Off Debts and Final Expenses: Whole life insurance can provide the funds necessary to pay off debts, final expenses, and any medical bills that might be outstanding at the time of death. This immediate access to funds helps in settling the estate smoothly and efficiently.

- Equalizing Distributions Among Heirs: In cases where estate assets are diverse and not easily divisible (such as a family business or real estate), whole life insurance can provide the funds necessary to equalize the distributions among heirs. These funds are instrumental in preventing the forced sale of such assets to meet the terms of the will.

Additional Considerations

- Funding Buy-Sell Agreements: In business estate planning, business owners can use whole life insurance to fund buy-sell agreements upon their death. A buy-sell agreement funded with life insurance ensures that enough cash is available to buy out the deceased owner’s interest without the need to liquidate business assets.

- Enhancing Philanthropic Goals: For those inclined towards philanthropy, whole life insurance can be a tool to fund charitable giving at death, creating a lasting legacy that might not have been possible through direct charitable contributions during life.

By integrating whole life insurance into estate planning, high net worth individuals can ensure that their financial goals are met, even after their passing. This strategy protects the estate’s value from erosion due to taxes and legal complications and provides a straightforward path for transferring wealth according to the individual’s precise wishes.

Comparison: Whole Life vs. Other Insurance Products

Whole life insurance stands out as a strategic asset for high net worth individuals, providing a multifaceted tool that integrates seamlessly into broader financial, estate, and legacy planning. It’s not merely insurance—it’s a sophisticated financial instrument that offers lifetime protection, wealth accumulation, and tax advantages. Here are some final thoughts on its strategic importance and why a proactive approach to insurance planning is crucial:

Lifetime Protection and Certainty

Whole life insurance guarantees a death benefit that no other financial instrument can—a guaranteed death benefit that provides certainty and protection for your beneficiaries, regardless of when you pass away. This permanence is critical for long-term planning and provides a solid foundation for your financial legacy.

Wealth Accumulation and Financial Flexibility

The cash value component of whole life insurance grows tax-deferred, allowing high-net-worth individuals to accumulate wealth efficiently. This cash value can be accessed through loans or withdrawals, providing financial flexibility to manage or leverage other investment opportunities without triggering taxable events. This makes whole life insurance a powerful tool for managing liquidity and strategically funding lifestyle or business needs.

Tax Advantages

Whole life insurance offers significant tax benefits, including tax-deferred cash value growth and a tax-free death benefit. These features are supremely valuable for high net worth individuals looking to maximize their wealth and minimize their tax liability. By integrating whole life insurance into your overall tax planning strategy, you can ensure a more efficient transfer of wealth to future generations, potentially bypassing costly estate taxes and preserving the value of your legacy.

Estate and Legacy Planning

Whole life insurance is an essential component of estate planning. It provides the liquidity to settle estate taxes and other obligations without liquidating valuable or sentimental assets. Using whole life insurance ensures that your estate transfers according to your wishes and that your legacy is protected from unforeseen financial burdens.

Encouraging Proactive Insurance Planning

High net worth individuals should take a proactive approach to insurance planning, recognizing that whole life insurance is not just about coverage—it’s about creating opportunities for wealth preservation, tax planning, and legacy building. Early planning allows for more strategic decision-making, potentially lower premiums, and the opportunity to tailor coverage extensively to fit changing life circumstances.

Collaborative Planning Approach

Engage with financial advisors, tax professionals, and estate planners who understand the complexities of your financial situation. This team approach ensures that your whole life insurance strategy aligns with your overall financial goals, providing comprehensive benefits beyond simple insurance coverage.

In conclusion, whole life insurance for high net worth individuals isn’t just a policy—it’s a crucial piece of a complex financial puzzle. It guarantees protection while offering flexible and strategic benefits that support wealth management and legacy planning. By adopting a proactive and integrated approach to insurance planning, you can secure not just your financial future, but also that of generations to come.

Contact Us

Connect With I&E! Schedule a Conversation with one of our Pro Client Guides to Discuss Strategies for Your Family, Your Investments, or Your Business, using Your Own numbers- https://www.insuranceandestates.com/proclientguide/introduction/ or email 📧 request to: info@insuranceandestates.com