Thank you for stopping by. The following video is a webinar offered by us here at I&E on how to triple your real estate returns with infinite banking. For your convenience, we have also provided the full transcript below.

After watching the video and/or reading the transcript, we invite you to schedule a call with Barry.

Thank you again and we hope you enjoy!

See also Real Estate Wealth Building Strategies

Transcript follows.

Alright everyone. We’re going to dive in. Hope everyone’s well, wherever you are. So welcome to the live webinar, How to Triple Your Real Estate Returns Without Taking More Risk. I’m Barry Brooksby, founder of Focus Wealth Group, and tonight we’re going to learn more about real estate, and I’m super excited to be here with all of you. By you being here, it shows that you have a desire to learn. You’re investing in yourself tonight, so good job. A lot of people don’t invest in what I call their number one asset, which is themselves. So great job for being here, you’re investing in yourselves.

I hope that you have a pen and paper and are ready to take notes, because most people don’t know what I’m going to share with you. You’ll learn things that are just unknown to most people. Now, if you’re already a real estate investor, some of what I teach you tonight, you might already know, but I promise you’ll still get some nuggets out of the webinar. And for those of you that want to get into real estate, this will be eye opening and very informative.

My Background

I want to give you a little bit of some of my background. This will kind of help us become better friends, if you will. I’ve been 14 years in the real estate industry, 18 years in the financial services industry, and I have clients in over 45 states right now. I’m the founder of Focus Wealth Group. I’ve owned and been involved with multimillion dollar companies. And on the real estate side, I’ve owned single family residential property, that’s what the SFR is there for. I’ve owned land, I’ve done flips, I’ve owned rental properties, all sorts of different real estate deals. One of the companies I owned in Las Vegas was a trusteed real estate investment company, where we would lend money to borrowers, and then investors would take a trusteed investment on real estate and earn a great return. I am an Infinite Banking practitioner and in partnership with Insurance and Estates, because of my expertise as an infinite banking practitioner.

I’ve also shared with some of you about my family, I’m married, husband and father of five awesome kids. Love to play guitar, I love to mountain bike. Before we go any further, just some quick housekeeping. Make sure that you turn off anything that’s distracting you. We’re going to be focused here. Shut down Facebook, turn off your cell phone, go to airplane mode if you need to, just put away anything that might be distracting you.

All right, great. Let’s dive in. We all have to start somewhere, right? It’s important to see that when we’re watching or looking at successful people, what we usually see is just the top of the iceberg. If you’ve seen that picture before where there’s a massive iceberg, but 80% of it is in water, we only see the tip. Well, that’s kind of how success is. We see these successful people traveling everywhere, making great money or doing good in their particular business, we don’t see the decade or two or three of all the struggle and all the difficulty they had to go through to get there.

We have to start somewhere.

When we go through this, I want this to be empowering. I don’t want anyone to walk away from the webinar saying, “Oh my gosh, I can’t do this.” No, we don’t want to fail. Failure’s not an option. Failure is simply an opportunity to learn. So I look at life and say, “Hey, I can learn from the experience, or I can grow from the experience, or I can be successful from the experience.” This is going to be empowering. That’s the way I want you to perceive what we’re going to talk about. Failure, in my opinion, isn’t real, it’s growth, it’s opportunity, it’s learning. And I want this to be empowering for everyone.

And I had to start somewhere too. For me, I got into real estate kind of by osmosis. I grew up as a kid watching my mom and dad, right here in St. George, Utah, buy lots for single family homes. And I watched this as a kid, I remember being 9, and 10, and 11 years old and helping my dad put shingles on a new home they were building as a spec house. I remember doing some of the landscaping. But I grew up around that. I remember my parents would buy lots and then they would flip the lots and make a little bit of money on them. So as I grew up going through that, I always had this desire within me to be a real estate investor. It felt so good. It just seemed really cool to be a real estate investor. But I can also tell you, it’s not all roses. I’ve gone through tremendous struggle in real estate. The crash of ’08, I lost a ton of money in real estate. So I want to share with you tonight, the things to do right and the things to avoid.

With that in mind, let’s dive in: How to Triple Your Real Estate Returns Without Taking More Risk. Rich Dad, Poor Dad, by Robert Kiyosaki. I really like this book and I’ve recommended it probably over a thousand times, probably more than that. This book, although it’s real estate based, which is good, it teaches financial principles. And to me that’s even more empowering than the real estate itself. Robert talks about, it’s not about the money you make, it’s about the money you keep. That’s one of the principles that he teaches. He also teaches about paying yourself first, that when you make money, you should pay yourself first.

Invest in Assets

And another principle he teaches is assets versus liabilities. And so I have a quote here by him, “Invest in assets.” And when we invest in assets, from his perspective, we want to invest in assets that generate cashflow. So a lot of people believe that the home they’re living in today is an asset. And it could be considered an asset, it’s tangible, but the home you live in today is not producing cashflow. It’s taking cashflow. You’ve either paid cash for your house or you’re making a mortgage payment, and so it’s like a liability from that perspective.

So when we think about cashflow, truly, we want to think about assets that produce cashflow, which could be a business, could be real estate, could be a royalty deal, it could be intellectual property. There’s a number of things out there that we could talk about that produce cashflow, but in this case, real estate producing cashflow.

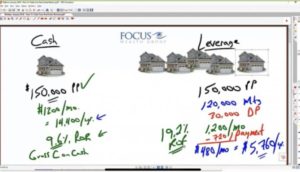

What we’re going to do here is we’re going to make a comparison, and get this idea between a cash investment and another type of investment that I’ll get to in a minute. So this house on the left, we’re going to say that the person that buys this house is going to pay cash for the house. So this is an example, a real deal that we’re going to walk through and learn from. So this property, the purchase price on this house is $150,000. PP for purchase price. And this person has saved all this money, $150,000’s taken several years to build up. They’re going to go out and buy this property cash only. And the property is going to rent for $1,200 a month, which would equal $14,400 a year.

Well, $14,400 per year is the cashflow that’s being generated from $150,000 investment. Now, the first thing that I want to teach is this term called cash on cash. It’s a cash on cash rate of return. When we look at a cash on cash rate of return, we look at the amount of money that we’re earning in rents, and then we divide that by the cash that we’ve put into the property.

So in this case, if I take the $14,400 and divide it by the $150,000 that was put into the property to buy it, it’s a 9.6% rate of return. So I want you to remember that. We’ll write it down here, 9.6% rate of return. This is cash on cash. You notice I’m not taking out any expenses right now. I want to keep this really simple for our purposes tonight, but yeah, they might be some maintenance costs, some property tax insurance. This 9.6% rate of return would be a gross cash on cash rate of return.

Financial Leverage

What I’ve learned from real estate, and Robert’s book, and other real estate gurus out there, is that using our own cash really isn’t the best thing to do. We want to talk about leverage. I did a webinar two months ago, where we talked about the four pillars of wealth. You can go back and watch that webinar. One of the pillars of wealth is leverage. How do we create more wealth? We use leverage. We use other people’s money.

What if, in this case, instead of coming in with a full $150,000 of out-of-pocket cash, the investor now decides, “You know what? Same purchase price, but instead, I’m going to ask a bank to give me a mortgage for $120,000, which is 80% of value,” so there’s the mortgage, “And I’m only going to come out of pocket with 20% down, which would be $30,000.” This is our down payment. Now we’re leveraging. Well, the issue we run into here is that when we have a mortgage, there’s now a payment associated with the mortgage. So let’s look at that.

The rent isn’t going to change, it’s the same $1,200 a month or $14,400 a year. But let’s look at what this mortgage does. So I’m going to grab a loan analysis calculator, in the left hand corner it says loan analysis, and I’m going to type in the $120,000 mortgage. So this is an amortization schedule, essentially. We can analyze what the amount of the payment will be. And I’m going to use a loan rate of 6%, because we’re looking at this like an investment property, and we’re going to amortize this over 360 months, which is 30 years. So if we look at the amortization schedule over that timeframe, we see a payment of $720 here, $719.46, we’ll round to $720 to keep the math simple.

Now, when you’re purchasing real estate as an investment property, different banks or different credit unions, different lenders have different rules. Some might say, “Yeah, we’ll amortize over 360 months to lower your payment, but it’s really a 10 year loan or a 20 year loan.” If we did the math on this, let’s say they give you a 20 year loan, but it’s amortized over 30 years, that means in 20 years, at 240 months, they would want you to come in and pay off this $64,000 loan balance as a balloon payment. Again, different banks have different rules. Tonight I’m just keeping it really simple, 360 months of amortization for $720.

So what that means is we have to take the $720 out of the monthly rental. So $720 in a payment now is going to leave us $480 a month, which equals, let’s do the math on this, just so you can all see what I’m doing. $1,200 minus $720, which is the mortgage payment going back to the bank, but remember, now you have a tenant paying essentially your mortgage for you. And this mortgage payment of $720 a month is reducing both the principal balance of the loan and paying the interest. Every time that $720 a month is paid, what’s happening is the balance of the loan is going down. And because the balance of the loan is going down, so also is the amount of interest that you’re being charged every month. Which is great, because again, your tenant is paying for that.

So another great thing about real estate, getting back to that calculator, $720, there’s our $480, we times that by 12 months, which now gives us $5,760 of annual income, so we’ll say a year. Obviously this $5,760 for the same house is less cash flow to you than the $14,400, but here’s where it gets fun: remember, on the cash deal, you came out of pocket with $150,000, and that gave us a 9.6% cash on cash rate of return. However, with the leverage deal, you only came out of pocket $30,000.

So now if we do the math with our cash on cash rate of return, we take our $5,760 per year, and we divide it by the $30,000, again, that’s what we came out of pocket with, and that gives us a 19.2% cash on cash rate of return. So let me write this out. 19.2% ROR, versus a 9.6% rate of return. You’ve used other people’s money. You’ve leveraged. You’ve increased your rate of return. Although the net rent is lower at $5,760, you’ve increased your rate of return.

Now, we’re not done. As awesome as that is, doesn’t this person that had the $150,000 of cash still have money leftover? He’s still sitting on $120,000, so what that means is he could go out and purchase more houses, four more, exactly. So let’s take a look at that.

Let’s put another house over here, another house over here, another house over here, one more over here. For the same $150,000 that the cash investor was putting into one home, that exact same dollar amount with a $30,000 down payment can now purchase five rental properties. The rate of return will stay exactly the same, 19.2%, but check this out. We now take the $5,760, that’s annual income after we make the mortgage payment, per house. So we’re going to times it by five. So with the same $150,000, not only did we increase the rate of return to 19.2%, but the cash coming in: $28,800. It’s double the amount of income and the same amount of money out of pocket.

Leverage is extremely powerful.

Some people fear leverage. I get that. Because they look at it like debt, right? There’s going to be a lot of debt on five properties. We have to be cautious, right? We want to make sure that we’re safe as we get into these properties and we’re not leveraging too much. That’s the issue that I had back in 2008. Had the market continued to go the way it had been, everything would’ve been fine, but because of the crash in ’08 I was heavily leveraged, and learned the lesson, but I’m glad I learned it because now it’s given me the opportunity to leverage the experience. I can now leverage money, and I can also leverage the experience and share with you the pain that I’ve gone through, so you don’t have to go through the same thing.

So when we’re thinking about leverage, we want to consider a few things.

Number one, smart debt is when you are cash flowing on your property. If I was showing this property to you and the rent was $1,200, and the mortgage was $1,500, and I’m coming out of pocket $300 every month to pay it, that’s probably not a smart investment. We’re going to get to rules to live by here at the end, but we want to think about this from a smart investor perspective. What it comes down to, as Robert Kiyosaki said, is cashflow. We want to make sure that we cashflow on the properties.

All right, I’m going to come back to this truth concepts calculator. Now what I’ve done here, I’ve preloaded the information that we just went through. So I’ve preloaded the price of the property, and to be fair I’m using the same value as the price. So we see up here in the left hand corner, the property values at $150,000, and the price of the property is also $150,000.

Now, normally I wouldn’t buy a property for the value of the property. I would want to get a deal on it. That’s just me. But in this case, I’m trying to be fair to keep the analysis really legit. So we have $150,000. We took out the loan with the bank for $120,000, there’s our 6%, 360 months. I use $720 as a payment. And here’s our 19.2% rate of return. Now remember, what I said earlier on the whiteboard here was these are gross rate of returns. Now this one is kind of gross because I’m taking out the mortgage payment, but I’m not taking out taxes, insurance, maintenance. I’m not taking any of that out, but we’re going to now. Because again, I want to be real about this.

And when you get into real estate, you want to know your numbers.

You want to know what’s the gross cash on cash rate of return, and what’s the net cash on cash rate of return. And that’s what we’re going to discover here. We’re going to go ahead and say the property taxes on this are $100 a month. These are monthly expenses. We’ll say the insurance on this property is $50 a month, and we’ll go for maintenance at another $50 a month. So look what that did to the rate of return. We’ve dropped now to about 11% on the rate of return.

And by the way, I’m not showing any appreciation on this property either, which probably isn’t accurate. If you’re a true real estate investor, the gurus are wanting appreciation as well as income, but I’m trying to be conservative. If I put in 3% here, you can see the rate of return is awesome, brings up that cash on cash rate of return, but I’m going to go back to zero for the property appreciation. So an 11% net cash on cash rate of return, that’s where we’re sitting right now. And because of those expenses, you see the monthly income either in this column here, or this column here, is now $281. So it reduced our $480 that we had over here down to $280.

The concept that I want to share here, number one to clarify, we now have adjusted this to show a net cash on cash rate of return, but we want to take it one step further. If you’re going to spend $150,000 on real estate, either to go buy it with cash or to do what I showed with leverage and buy five properties, where is that money sitting? If you know that you have to have that money liquid to be able to use for real estate, where is it sitting? Maybe I should ask, where’s it not sitting?

It’s probably not sitting in the stock market, right? Because it’s going to be volatile. It’s probably not sitting in your 401k or IRA. It’s probably not sitting in mutual funds. It’s probably not sitting in a CD, because most CDs have a timeframe where the money’s locked up for two, three, four, five, 10 years. This money is probably sitting in your bank account.

And if it’s sitting in your bank account, it’s probably earning a 0% return, but it’s liquid.

And I say zero kind of facetiously, I know maybe it’s earning 0.02%, but the point is it’s very close to zero these days. That’s okay because we want the money liquid. We want it available.

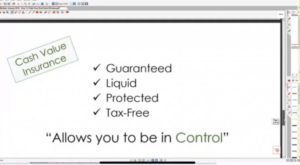

But as many of you know, there’s a better place to put this cash that still is liquid, that still is guaranteed, that’s still protected like a savings account. And one other benefit that we don’t get from savings, it’s also tax-free, and that is a cash value insurance policy.

So with a cash value insurance policy we can be storing that same $150,000 over here, earning 4% to 5% completely tax free. Much better than zero, because a 4% to 5% tax free return, depending on your tax bracket, is really like earning 10% to 12% in the stock market.

Well, let me show you what we do with this, and next month we’re going to dive more into this, how to coordinate tax free money with real estate to explode your returns and your income even greater. But let’s run with this a little bit further, because as I look at the calculator and I say, “Hmm, I’ve got this cash value insurance policy, what can I do with the money?” Rather than coming out of pocket for $30,000, what if you took a loan from your cash value policy?

I’m going to do two things here.

The first thing I’m going to do is make a little adjustment. Let’s make the adjustment as if there were, say $4,000 of closing costs that we came out of pocket with too. Some lenders will let you roll those into the loan, other times the seller might take care of those, every deal is a little different, but let’s say you come out of pocket with the $4,000. So now your total down payment over here is $34,000, which brings your net cash on cash rate of return down to 7.71%. How do we increase the rate of return? We take a policy loan from our cash value policy. Instead of the full $34,000 coming out of your own pocket, we’ll use our Infinite Banking plan, our cash value policy as collateral, and use $30,000 over here as a second mortgage to increase our return.

Watch what happens. When I put the $30,000 in here as a policy loan on this real estate deal, watch this 7.71% jump to 26%. That’s a net cash on cash rate of return of 26%. Why? Because you only came out of pocket, truly with your own money, $4,000. That was it. And remember, I’ll get into this next month more, when you take a loan from your cash value insurance policy, your full cash value is still earning interest in dividends. So although you have that money in the real estate deal, you’re still making the 4% to 5% tax free in the cash value insurance policy. Very powerful. Now this is one example of many. We’re going to go through another example next month, but here’s what I want you to comprehend. It’s the power of leverage. We’re not leveraging here in just one way. We’re leveraging in multiple ways to increase our returns and to make more money.

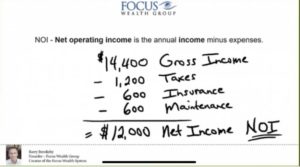

So let’s shift. We talked about cashflow and how important this cashflow is. We talked about net income. So I want to just give you a couple of definitions, and you may want to write these down.

Net Operating Income (NOI)

NOI stands for net operating income. That is the annual income minus the expenses. So what you saw me do is we took the $14,400 of gross income minus the taxes were $100 a month, minus the insurance at $50 a month and the maintenance at $50 a month. On that example, it was $12,000 net income, or NOI.

Capitalization Rate

The cap rate or the capitalization rate, it’s the ratio of net operating income to property value. So here’s my example. If the value of a property is a million dollars and it’s generating net income of $80,000, that would be an 8% cap rate. So you can do the math, 80 divided by the million for the 8% cap rate. And this is an important formula to think about. Most real estate investors are looking at NOI, net operating income, they’re looking at the cap rate, and they’re looking at a cash on cash rate of return, which is the next thing here.

Cash on Cash Return

Cash on cash is calculated by dividing the cash flow by the amount of out-of-pocket cash invested. We’ve ran that scenario before. This is what we did, the $5,760 net income divided by the $30,000 down payment gave us the 19.2% cash on cash rate of return. It’s easy to see the higher the cash on cash return, the better the investment. The higher the cap rate, the better the investment. But guess what? You still have to make sure that you cashflow, because I could manipulate the numbers to show a higher cash on cash rate of return in that last deal and actually show negative cashflow. So you still have to stay focused on cashflow.

In a lot of real estate deals, there’s not one rule of thumb to follow. There could be several.

You’re looking at location. You’re looking at, do I want to get into single family? Do I want to get into fourplexes? Do I want to get into apartment buildings? Do I want commercial buildings? Do I want warehouse space? Do I want to get into land? Do I want to build a spec home? There’s so much to do in real estate, all these analyses can take place.

Mark Ford

Now I want to introduce you to Mark Ford. He is the co-founder of the Palm Beach Research Group, he’s been very successful with his company, but he’s also a real estate investor. I want you to write down these rules to consider.

Triple 8

And I call these the Triple 8, kind of an easy way to remember it. These rules can help guide you as you’re considering buying real estate, investing in real estate, or just starting off. These again are not set in stone, but they are rules to consider.

And I introduce you to Mark Ford, because Mark has what’s called an eight times rule. And what he says is he tries to not buy property more than eight times annual income. Meaning this, so here’s a quick example.

Let’s say that the gross rents on a property are $2,000 a month, times 12 would be $24,000 a year. He would take that $24,000 gross income, times it by eight, and say that he would never pay more than $192,000 for that particular property. So that’s Mark Ford’s eight times rule.

The other rule to consider is an 8% cap rate. Because I will have people asking me, “Well, Barry, what cap rate should I be looking for?” And I’ll say, “Well, if you can get 8% or more, that’s fantastic.” But I was just talking to a real estate investor a few days ago that’s getting a 5% cap rate. Again, there’s not a right or wrong answer here, you have to look at your own comfort level and determine, is it good or bad?

And then the 8% cash on cash rate of return, here’s where that comes into play. If you’re in a mutual fund or another investment, a stock, a CD, whatever it might be, this is a great determining factor, because you’ve put cash into those investments. If you can earn 8% on your money, that’s pretty good. But remember, your number one asset is you, your number one investment is your business or your career, your job, that’s where you should be focused. So if you’re going to invest outside of yourself or outside of your business, an 8% cash on cash rate of return is a good rule to live by. Anything higher than that, obviously much better.

Memorize these, they’re quick and simple to remember, and use them moving forward. You might find deals that are lower, but provide greater equity. You might find that you’re in what’s called a syndication, where you’re investing with other investors. You’re taking less risk, but you’re getting a higher rate of return. Real estate is one of those animals that has many facets and many opportunities.

I hope that this has been beneficial for you to see how to leverage, how to increase your returns, how to make more money in real estate. The Infinite Banking concept is what you get, these are your benefits: guaranteed money, liquid cash, protected in most states from creditors, lawsuits, bankruptcy, and tax-free use of your money. The best thing you can do when it comes to real estate is educate yourself. And the more you know, the less risk you take. The more you know, the more success you’ll have.

If you’ve liked what you’ve seen here, and you want to learn more and find out what’s possible for you, click the button below to schedule a call. The button will take you to a short questionnaire, and then to my calendar. We’ll meet, we’ll talk about your goals, what you want to accomplish, and find out what’s possible for you with Infinite Banking. Thanks for being with me, learning how to triple your real estate returns and not take as much risk. Great job attending the webinar, and I hope to talk with you soon.