Table of Contents

- Introduction to Infinite Banking with IUL

- How Infinite Banking Works

- IUL vs. Whole Life: Comprehensive Comparison

- Designing Your IUL Policy for Infinite Banking

- Case Study: Optimizing an IUL Policy

- Policy Loan Mechanics & Tax Implications

- Long-Term Performance Analysis

- Regulatory Considerations & Compliance

- Pros and Cons of Using IUL with Infinite Banking

- Implementation Timeline & Roadmap

- Is Infinite Banking with IUL Right for You?

- Taking the Next Steps

Introduction to Infinite Banking with IUL

In the quest for financial independence, the infinite banking concept has emerged as a counter-culture strategy, allowing individuals like you to use life insurance policies as personal banking systems. The Indexed Universal Life (IUL) policy is a powerful tool if correctly harnessed, which is accomplished through proper design and implementation.

The Indexed Universal Life policy stands out for its flexibility and cash value growth potential, making it an ideal candidate for infinite banking. Unlike traditional insurance policies, IUL allows your cash value to track the performance of particular indexes, balancing risk management and growth potential. This unique feature protects your cash value with a floor, ensuring you don’t lose money even in a declining market while also providing the opportunity for potentially larger gains than whole life insurance, limited by cap and participation rates.

How Infinite Banking Works

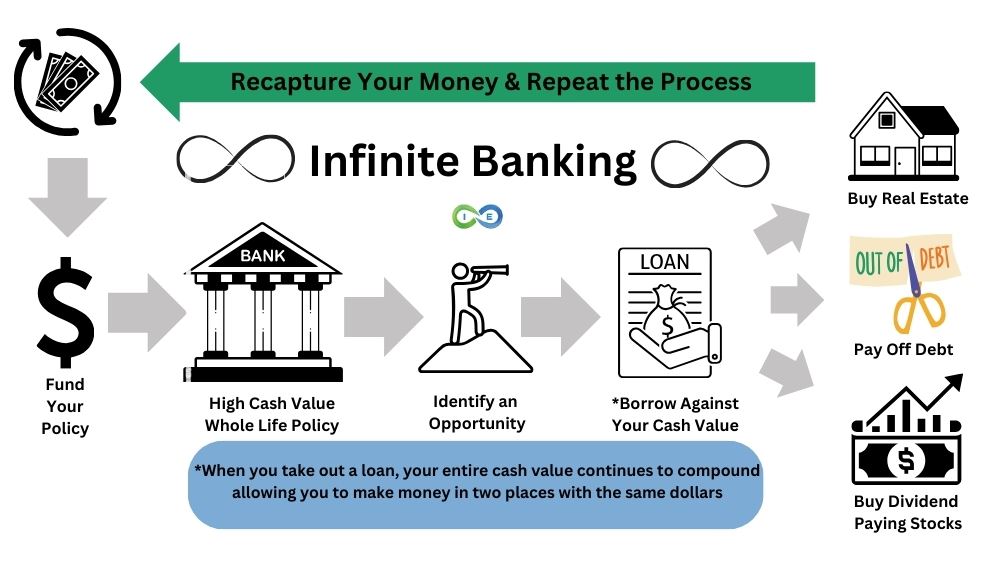

Infinite banking is using cash value life insurance policy as your own banking system. You fund your policy and borrow against the cash value to purchase investments or pay off debt. You then use the returns from your investment to pay back your loan, and repeat the process. Here is an infographic that provides a snapshot of infinite banking.

The Infinite Banking Process: Step by Step

- Fund Your Policy: Contribute premiums to your specially designed IUL policy

- Accumulate Cash Value: Your policy builds cash value that grows tax-deferred

- Borrow Against Your Policy: Take a policy loan using your cash value as collateral

- Use the Borrowed Funds: Invest in assets, pay off high-interest debt, or fund major purchases

- Repay the Loan (Optional): Pay back the loan with interest to restore your borrowing capacity

- Repeat the Process: Continue the cycle to build wealth over time

IUL vs. Whole Life: Comprehensive Comparison

When implementing infinite banking, your choice between Indexed Universal Life and Whole Life insurance is vital. Both have distinct advantages and limitations that affect their suitability for infinite banking strategies.

| Feature | Indexed Universal Life (IUL) | Whole Life |

|---|---|---|

| Cash Value Growth | Linked to market indexes (often capped at 8-11%); 0% floor protection | Guaranteed growth plus non-guaranteed dividends (typically 4-6% historically) |

| Early Cash Value Access | Variable; depends heavily on policy design; often less in early years due to higher surrender charges | Better early cash value access with properly designed policy using paid-up additions |

| Guarantees | Minimum guaranteed 0% floor (no losses); death benefit can be flexible | Guaranteed cash value growth, guaranteed level premium, guaranteed death benefit |

| Premium Flexibility | More flexible premium payments (can increase, decrease, or skip, within limits) | Fixed premium schedule; flexible premiums when used with paid-up additions |

| Policy Expenses | Generally higher administrative fees and cost of insurance; these can increase over time | Fixed expenses built into premium; typically lower overall costs long-term |

| Policy Loan Interest Rates | Variable loan rates available; typically credit the index returns to loaned amounts | Fixed direct/variable loan rates; some companies offer favorable loan spreads |

| Surrender Period | Typically 10-15 years; higher surrender charges in early years | No surrender charges on properly designed policies |

| Best For | Those seeking growth potential tied to market performance with downside protection; those wanting premium flexibility | Those prioritizing guarantees, predictability, and established dividend history; traditional infinite banking purists |

IUL vs Whole Life Recommendations

- Be Cautious with IUL Illustrations: Illustrations showing returns greater than 6% should be viewed with caution.

- Whole Life as a Safe Asset: Offers consistent returns and peace of mind, unaffected by stock market volatility.

- Overfunding IUL Policies: Overfunding can mitigate risks of poor subaccount performance in IUL policies.

- Infinite Banking Concept: Whole life is often preferred for Infinite Banking due to its guaranteed growth and greater access to early cash value, though IUL may be more attractive to those who have the discipline to effectively manage the policy and are seeking potentially higher returns.

- Time Horizon Considerations: If you need immediate access to cash value, whole life may be preferable; if you have a longer time horizon, IUL might offer better growth potential.

- Risk Tolerance: Your comfort with market-linked returns versus guaranteed growth should heavily influence your decision.

For more, see our article on the differences between whole life vs indexed universal life.

Designing Your IUL Policy for Infinite Banking

Key Design Principles

The design of your Indexed Universal Life policy is paramount. A well-structured IUL policy maximizes your cash value early on, making funds available for loans and investments, aligning perfectly with the infinite banking concept. We can’t emphasize enough the importance of working with professionals who understand the nuances of IUL policy design tailored for infinite banking. It’s not just about having an Indexed Universal Life policy; it’s about having the right IUL policy.

IUL Policy Design Checklist for Infinite Banking

- Minimize the Death Benefit: Calculate the minimum death benefit required by IRS guidelines for your premium amount and age

- Maximize Premium-to-Death Benefit Ratio: Aim for a 70/30 split where 70% of premiums go to cash value and only 30% to insurance costs

- Select Appropriate Riders: Add an overloan protection rider to prevent policy lapse if loans exceed cash value

- Choose Suitable Index Options: Select indexes that align with your growth expectations and risk tolerance

- Understand Cap Rates: Compare cap rates between policies (higher caps allow more growth potential)

- Evaluate Participation Rates: Check what percentage of index gains your policy will credit

- Review Surrender Charge Schedule: Look for policies with lower surrender charges, especially in early years

- Consider Premium Flexibility: Ensure the policy allows for additional premium payments if desired

- Analyze Loan Options: Compare fixed vs. variable loan rates and understand how loans affect cash value

- Verify No-Lapse Guarantee: Ensure the policy includes provisions to prevent lapse even during market downturns

What Not to Do: Common Mistakes

Let us illustrate the pitfalls of a poorly designed Indexed Universal Life policy through a case study. An IUL policy with a disproportionately high death benefit relative to the premium can severely restrict the policy’s cash value growth, especially in the early years. Such a IUL policy design is counterproductive for infinite banking, where the goal is to have substantial cash value accessible as soon as possible.

Common IUL Design Mistakes to Avoid:

- Excessive Death Benefit: Creates high insurance costs that drain cash value growth

- Ignoring Surrender Charges: Failing to account for high surrender charges that limit early access to cash value

- Unrealistic Return Assumptions: Basing decisions on illustrated returns of 7-8% when 5-6% may be more realistic long-term

- Overlooking Policy Expenses: Not accounting for administrative fees and increasing cost of insurance as you age

- Insufficient Funding: Underfunding the policy, which slows cash value accumulation

- Ignoring MEC Limits: Overfunding beyond MEC limits, potentially triggering tax consequences

- Choosing the Wrong Index Strategy: Selecting complex index strategies without understanding their limitations

- Working with Inexperienced Agents: Using agents unfamiliar with designing IUL specifically for infinite banking

The Optimal IUL Design Approach

The key to a successful infinite banking strategy is to minimize the death benefit and maximize the cash value component of your Indexed Universal Life policy. This approach ensures more of your premium contributes to the cash value rather than the insurance cost, making funds available for borrowing and investment sooner.

Steps to Optimize Your IUL for Infinite Banking:

- Calculate Minimum Death Benefit: Work with an experienced agent to determine the minimum death benefit required by IRS guidelines for your planned premium amount

- Structure Premium Allocation: Design the policy to maximize the portion of premium that goes to cash value rather than insurance costs

- Select Appropriate Riders: Add only necessary riders that enhance the infinite banking strategy (e.g., overloan protection)

- Choose Conservative Index Strategies: Select index options with a history of steady performance rather than more volatile options

- Plan Funding Strategy: Determine optimal funding levels to maximize cash value while avoiding MEC status

- Establish Loan Strategy: Create a plan for when and how you’ll utilize policy loans to maximize the banking strategy

- Set Up Monitoring System: Establish a process to regularly review policy performance and make adjustments as needed

Case Study: Optimizing an IUL Policy

Background

John, a 36-year-old professional, sought to implement the infinite banking concept using an Indexed Universal Life (IUL) policy. His primary goal was to build a substantial cash value within the policy that he could borrow against for investment opportunities, such as real estate and funding his children’s education, while also ensuring a financial safety net for his family.

Initial Policy Structure

Initially, John’s IUL policy was structured with a $750,000 death benefit based on a $25,000 annual premium. This traditional structuring aimed to provide a significant death benefit while also allowing for cash value accumulation. However, the high death benefit resulted in higher cost of insurance charges, which significantly slowed the growth of the policy’s cash value.

In the first year, the policy’s surrender value was practically zero, meaning John had no accessible cash value to borrow against. By the end of the second year, the cash value had grown, but only a small fraction was available for loans due to the policy’s structure and surrender charges.

The Problem

This initial Indexed Universal Life policy structure was not conducive to John’s infinite banking objectives. The high death benefit, while providing a substantial safety net, hindered the policy’s ability to quickly accumulate accessible cash value. This slow growth meant delayed opportunities for John to leverage his policy for loans and investments, undermining the essence of infinite banking.

Adjusting the Death Benefit

To align the policy with John’s infinite banking goals, a strategic adjustment to the death benefit was necessary. The key was to lower the death benefit to the minimum required to keep the policy in force and compliant with IRS regulations, thereby reducing the cost of insurance charges and allowing more of the premium to contribute to the cash value.

The death benefit was adjusted from $750,000 to $494,000, the minimum necessary based on John’s age, health, and premium size. This reduction significantly decreased the Indexed Universal Life policy’s internal costs, freeing up more of John’s annual premium to go directly into the cash value component of the policy.

Results

Year 1 Impact: By the end of the first year after adjusting the death benefit, John’s Indexed Universal Life policy showed a marked improvement in accessible cash value. The surrender value, previously zero, was now nearly $116,000, providing John with immediate liquidity for investment opportunities.

Year 2 and Beyond: In the second year, the policy’s cash value continued to grow at an accelerated pace, with a substantial portion available for loans. This rapid accumulation aligned with the infinite banking concept, allowing John to start leveraging his Indexed Universal Life policy for personal loans while the cash value continued to earn compounded returns.

Long-term Benefits: With the adjusted policy structure, John could more effectively use his IUL policy as a personal bank. The lower death benefit and optimized cash value growth enabled him to take several loans for investment purposes over the years, all while maintaining a financial safety net for his family.

Conclusion

John’s case study vividly demonstrates the critical importance of aligning Indexed Universal Life policy structure with infinite banking objectives. By strategically adjusting the death benefit, John transformed his IUL policy into a powerful tool for financial growth and security. This adjustment allowed him to maximize the Indexed Universal Life policy’s performance, turning it into an effective vehicle for tax-free loans and investments, in true infinite banking fashion.

Case Study Results Summary

| Original Design ($750,000 Death Benefit) |

Optimized Design ($494,000 Death Benefit) |

Improvement | |

|---|---|---|---|

| Year 1 Cash Value | $19,900 | $22,000 | +$2,100 |

| Year 1 Surrender Value | $0 | $15,940 | +$15,940 |

| Year 2 Cash Value | $41,559 | $46,000 | +$4,441 |

| Year 2 Surrender Value | $18,028 | $40,000 | +$21,972 |

| Accessible Cash Value (Year 1) | 0% | 64% | +64% |

Policy Loan Mechanics & Tax Implications

Understanding how policy loans work is crucial for effectively implementing the infinite banking concept with an IUL policy. These loans allow you to access your cash value while keeping your money working for you within the policy.

How IUL Policy Loans Work

Loan Basics: When you take a policy loan, you’re not withdrawing money from your policy. Instead, the insurance company is lending you money and using your cash value as collateral. This means your full cash value continues to grow as if you hadn’t taken the loan.

Types of Policy Loans:

- Fixed Loans: Interest rate remains constant for the duration of the loan (typically 4-8%)

- Variable/Indexed Loans: Interest rate may fluctuate based on market conditions; often has a “wash” loan feature where the rate charged equals the rate credited

- Participating Loans: Allow your collateralized cash value to continue participating in index returns

Interest Considerations: Policy loan interest is typically charged annually and can be paid out-of-pocket or added to the loan balance. If added to the loan balance, it compounds, potentially increasing your debt significantly over time.

Tax Implications:

- Policy loans are generally not taxable events as long as the policy remains in force

- If the policy lapses or is surrendered with an outstanding loan, the loan amount may become taxable as ordinary income

- Modified Endowment Contracts (MECs) have different rules – loans from MECs are taxable to the extent of gain in the policy

Loan Repayment: You’re not required to repay policy loans during your lifetime. Any unpaid loans and interest will reduce the death benefit paid to beneficiaries. However, for infinite banking purposes, strategic loan repayment is recommended to restore borrowing capacity.

Overloan Protection: Consider policies with overloan protection riders to prevent policy lapse if loan balances approach or exceed cash value.

Critical Tax Considerations

Avoiding MEC Status: The IRS imposes limits on how much you can fund a life insurance policy before it becomes a Modified Endowment Contract (MEC). MECs lose many of the tax advantages that make infinite banking effective.

7-Pay Test: To avoid MEC status, premiums paid during the first seven years cannot exceed the amount needed to have the policy paid up in seven years. Work with an experienced professional to calculate these limits for your specific situation.

Policy Lapse Risks: If your policy lapses with an outstanding loan, you may face a “phantom income” tax liability – being taxed on gains you never actually received.

Strategies to Mitigate Tax Risks:

- Monitor the loan-to-value ratio and avoid excessive borrowing

- Consider strategic loan repayments to reduce outstanding loan balances

- Ensure the policy has sufficient cash value growth to support the loans

- Work with a tax professional familiar with life insurance strategies

Long-Term Performance Analysis

Understanding how an IUL policy might perform over decades is essential for evaluating its suitability for infinite banking. The following analysis examines potential outcomes under different scenarios.

Long-Term Performance Projections

Assumptions: 40-year-old male, non-smoker, $25,000 annual premium, minimum death benefit, optimal policy design for infinite banking

| Time Period | Conservative (4% Average Return) |

Moderate (6% Average Return) |

Optimistic (8% Average Return) |

|---|---|---|---|

| Year 5 | $105,000 | $115,000 | $125,000 |

| Year 10 | $230,000 | $260,000 | $295,000 |

| Year 20 | $500,000 | $620,000 | $775,000 |

| Year 30 | $775,000 | $1,050,000 | $1,450,000 |

Note: Values represent approximate cash values. Actual results will vary based on policy design, fees, and actual index performance. This is not a guarantee of future performance.

Impact of Rising Insurance Costs

A critical factor often overlooked in IUL policies is the impact of rising insurance costs as the insured ages. This can significantly affect long-term performance, especially for infinite banking strategies:

- COI Increases: Cost of insurance (COI) charges typically increase annually as the insured ages, potentially reducing cash value growth in later years

- Index Cap Considerations: Some policies may reduce index caps over time, limiting upside potential

- Policy Fee Inflation: Administrative fees may increase, further eroding returns

Mitigating Strategies:

- Front-load premiums to build substantial cash value before COI charges become significant

- Consider policies with guaranteed COI schedules or COI caps

- Plan for potential policy adjustments in later years, such as reducing the death benefit if appropriate

- Implement a disciplined policy loan strategy that accounts for increasing costs

Performance During Market Volatility

The 0% floor protection in IUL policies becomes particularly valuable during market downturns. Consider how IUL might perform compared to direct market investments:

| Market Condition | Direct Market Investment | IUL Performance | Advantage |

|---|---|---|---|

| Bull Market (Index: +15%) |

+15% | +9-11% (Capped) | Direct Investment |

| Moderate Growth (Index: +8%) |

+8% | +8% | Equal |

| Flat Market (Index: +1%) |

+1% | +1% | Equal |

| Bear Market (Index: -20%) |

-20% | 0% (Floor) | IUL |

Note: This simplified analysis doesn’t account for dividends in direct investments or policy fees in IUL.

Regulatory Considerations & Compliance

Understanding the regulatory framework around IUL policies is crucial for maintaining the tax advantages that make infinite banking effective. The IRS has specific guidelines that determine whether your policy qualifies as life insurance for tax purposes or becomes a Modified Endowment Contract (MEC) with less favorable tax treatment.

Modified Endowment Contract (MEC) Rules

What is a MEC? A Modified Endowment Contract is a life insurance policy that has been funded with premiums exceeding federal tax law limits. Once a policy becomes a MEC, it loses many of the tax advantages that make infinite banking effective.

Key MEC Rules:

- 7-Pay Test: To avoid MEC status, the cumulative premiums paid during the first seven years cannot exceed the amount needed to have the policy paid up in seven years

- Material Changes: Certain policy adjustments (like death benefit reductions) can restart the 7-year testing period

- Tax Consequences of MEC Status:

- Policy loans and withdrawals are taxed on a “last-in-first-out” (LIFO) basis

- Policy gains accessed through loans or withdrawals before age 59½ may incur a 10% penalty tax

- Death benefits remain income-tax-free

Compliance Strategies:

- Work with an agent experienced in infinite banking to calculate your specific MEC limits

- Consider a “paid-up additions” strategy that maximizes cash value while staying below MEC thresholds

- Create a funding schedule that optimizes cash value growth without triggering MEC status

- Review your policy annually to ensure continued compliance

Additional IRS Guidelines

TAMRA and DEFRA Compliance: Beyond MEC rules, IUL policies must meet additional requirements to maintain their favorable tax status:

- Cash Value Accumulation Test (CVAT): The policy’s cash value must not exceed the net single premium required to fund future benefits

- Guideline Premium and Corridor Test (GPT): Premiums cannot exceed the greater of the guideline single premium or the sum of the guideline level premiums, and the death benefit must exceed a specified percentage of the cash value (the “corridor”)

- Diversification Requirements: For variable policies, underlying investments must meet diversification requirements

Most insurance companies design their policies to automatically comply with these tests, but it’s important to understand these guidelines when implementing an infinite banking strategy with an IUL policy.

Pros and Cons of Using IUL with Infinite Banking

Pros of Using IUL with Infinite Banking:

Cash Value Growth:

IUL policies are designed to accumulate cash value over time, which is essential for the infinite banking concept. The cash value in Indexed Universal Life policies can grow by being tied to an index like the S&P 500, offering the potential for substantial returns up to a capped rate.

Downside Protection:

One of the key advantages of IUL policies is their built-in protection against market downturns. With a typical floor of 0% returns, your cash value is safeguarded from market losses, providing a stable foundation for your infinite banking strategy.

Tax-Free Loans:

Indexed Universal Life policies allow you to loan yourself money using the available cash value as collateral, which can be accessed tax-free as long as the policy is active. This feature is crucial for infinite banking, where the goal is to borrow and use funds while minimizing tax implications.

Compounded Returns on Loaned Amounts:

Even after you loan yourself money from the IUL policy, you continue to earn compounded returns on the total cash value amount, not just the remaining balance. This can significantly enhance your ability to grow wealth over time.

Flexible Repayment:

The infinite banking concept with IUL policies offers flexibility in loan repayment. You’re not obligated to repay the loan during your lifetime, and any outstanding amount can be settled from the death benefit, ensuring minimal pressure on your finances.

Use of Funds:

There are no restrictions on how you can use the loaned funds, allowing you to invest in opportunities like real estate, supplement retirement income, or cover educational expenses, providing significant financial flexibility.

Premium Flexibility:

Unlike whole life policies, IULs offer greater premium flexibility, allowing you to adjust your payments based on your financial situation, which can be advantageous during times of financial uncertainty.

Cons of Using IUL with Infinite Banking:

Policy Design Complexity:

Properly structuring an IUL policy for infinite banking requires careful consideration and expertise. A poorly designed Indexed Universal Life policy can lead to suboptimal cash value growth and limited access to funds, undermining the infinite banking strategy.

Cost of Insurance Charges:

IUL policies come with inherent costs, including insurance charges and administrative fees. If not carefully managed, these costs can erode the policy’s cash value, affecting your ability to borrow against the policy.

Interest on Loans:

While the loan from your IUL policy’s cash value is tax-free, it is not interest-free. The charged interest, albeit typically low, can impact the overall efficiency of your infinite banking strategy if not properly accounted for.

Market Participation Limits:

Despite the protection against market losses, the capped rate in IUL policies means you also miss out on higher returns during exceptionally bullish market periods, potentially limiting the growth of your cash value.

Long-term Commitment:

Infinite banking using IUL policies requires a long-term perspective and commitment. It may take several years for the cash value to grow significantly enough to support the infinite banking concept effectively.

Dependence on Policy Performance:

The success of infinite banking with IUL is heavily reliant on the performance of the underlying index and the policy’s terms. Changes in market conditions or policy terms could affect the strategy’s viability.

Potential for Policy Lapse:

If not managed properly, excessive loans combined with poor policy performance could lead to a policy lapse, potentially triggering tax consequences on any outstanding loans.

Less Early Cash Value than Whole Life:

Generally, IUL policies may provide less accessible cash value in the early years compared to specially designed whole life policies, which could limit your initial banking capacity.

Implementation Timeline & Roadmap

Successful implementation of the infinite banking concept using an IUL policy requires careful planning and a strategic approach. The following roadmap provides a framework for effectively establishing and utilizing your banking system over time.

Implementation Roadmap

Phase 1: Foundation (Year 0-1)

- Education & Planning (Month 0-2): Learn the infinite banking concept thoroughly, clarify your financial goals, and determine how much premium you can commit

- Policy Design (Month 2-3): Work with an experienced agent to design an IUL policy optimized for infinite banking

- Policy Acquisition (Month 3-4): Complete medical underwriting, submit application, and make initial premium payment

- Policy Delivery (Month 4-5): Review policy documents, ensure the design matches your specifications

- Funding Strategy (Month 5-12): Implement your premium payment plan and begin building cash value

Phase 2: Initial Growth (Years 1-3)

- Cash Value Accumulation: Continue funding your policy to build accessible cash value

- Policy Performance Monitoring: Track index crediting and cash value growth

- Education Deepening: Further develop your understanding of policy loans and infinite banking strategies

- Opportunity Identification: Begin identifying potential investments or debt reduction opportunities

- First Small Loan (Optional): Consider taking a small policy loan to experience the process

Phase 3: Active Banking (Years 3-10)

- Strategic Policy Loans: Begin using policy loans for investments or major purchases

- Loan Management: Implement a disciplined approach to loan repayment

- Banking System Expansion: Consider adding additional policies to expand your banking capacity

- Strategy Refinement: Adjust your approach based on policy performance and financial needs

- Annual Review: Conduct annual policy reviews to ensure optimal performance

Phase 4: Maturity & Legacy (Years 10+)

- Banking System Optimization: Maximize the efficiency of your banking system

- Legacy Planning: Develop strategies for transferring your banking system to heirs

- Policy Adjustments: Consider reducing death benefits if appropriate to lower costs

- Retirement Integration: Coordinate your banking strategy with retirement income planning

- Continued Education: Stay informed about changes in tax laws and policy features

Success Metrics: Key Benchmarks

| Time Period | Cash Value Benchmark | Banking Activity Milestone |

|---|---|---|

| Year 1 | 50-70% of premiums paid accessible as cash value | Policy established, funding plan implemented |

| Year 3 | 90-100% of premiums paid accessible as cash value | First major policy loan taken and investment made |

| Year 5 | 110-130% of premiums paid accessible as cash value | Multiple policy loans taken and repaid |

| Year 10 | 140-160% of premiums paid accessible as cash value | Banking system fully established with regular cycling of capital |

| Year 20 | 180-250% of premiums paid accessible as cash value | Banking system providing significant financial leverage |

Note: Actual results will vary based on policy design, funding, loan activity, and index performance.

Is Infinite Banking with IUL Right for You?

While the potential of Indexed Universal Life for infinite banking is undeniable, it’s not a one-size-fits-all solution. Your financial goals, risk tolerance, and time horizon are crucial factors in determining whether an Indexed Universal Life policy fits your infinite banking strategy.

Self-Assessment: Is IUL Infinite Banking Right for You?

Consider these factors when evaluating whether to implement infinite banking using an IUL policy:

Financial Situation

- Cash Flow Stability: Do you have consistent income to fund premiums for at least 5-7 years?

- Emergency Fund: Do you have 3-6 months of expenses saved separate from your banking policy?

- Debt Situation: Have you addressed high-interest consumer debt?

Personal Factors

- Time Horizon: Can you commit to a long-term strategy (10+ years)?

- Financial Discipline: Are you disciplined enough to manage policy loans responsibly?

- Risk Tolerance: Are you comfortable with some variability in returns, albeit with downside protection?

Goals Alignment

- Investment Objectives: Do you seek opportunities to invest in businesses, real estate, or other assets?

- Tax Efficiency: Is tax-advantaged growth and access to funds important to you?

- Legacy Planning: Do you want to build a legacy for your heirs?

Infinite Banking Alternatives

- Whole Life Policy: May offer more predictable returns and better early cash value

- Self-Banking: Creating your own banking system using conventional accounts

- Traditional Investments: Directly investing in markets without the insurance wrapper

Ideal Candidates for IUL Infinite Banking

In our experience, these profiles tend to be particularly well-suited for implementing infinite banking with IUL:

- The Business Owner/Entrepreneur: Benefits from access to capital for business opportunities, tax advantages, and asset protection

- The Real Estate Investor: Uses policy loans to fund down payments, renovations, or entire property purchases

- The High-Income Professional: Seeks tax-efficient wealth accumulation and financial flexibility

- The Family Steward: Wants to create a multi-generational wealth transfer system

- The Market-Wary Saver: Desires growth potential but is uncomfortable with market risk

Consulting with an IUL expert who is also an infinite banking advocate can provide clarity, helping you make an informed decision tailored to your unique financial landscape.

Taking the Next Step

If infinite banking with IUL resonates with you, the next step is to investigate how it aligns with your financial goals. Scheduling a one-on-one consultation with our IUL expert can provide personalized insights and guidance, ensuring your IUL policy is a stepping stone to financial freedom.

Your Action Plan:

- Schedule a Consultation: Meet with our IUL and infinite banking specialists to discuss your specific situation and goals

- Get a Customized Policy Design: Receive a tailored IUL policy design optimized for infinite banking

- Review Your Options: Compare your IUL infinite banking strategy with alternatives

- Implementation Support: Get expert guidance throughout the policy application and funding process

- Ongoing Education: Access resources to maximize the effectiveness of your banking system

Ready to take control of your financial future with infinite banking using an IUL policy?