In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been diagnosed with Type 2 Diabetes or adult-onset diabetes.

Questions that will be directly addressed regarding life insurance with diabetes will include:

- Can I qualify for life insurance after I’ve been diagnosed with Type 2 Diabetes?

- Why do life insurance companies care if I’ve been diagnosed with Type 2 Diabetes?

- What information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve been diagnosed with Type 2 Diabetes?

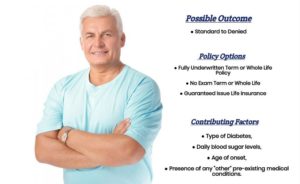

Yes, individuals can and often will be able to qualify for a traditional term or whole life insurance policy after they have been diagnosed with Type 2 Diabetes.

The only problem is, how well an individual is managing the Diabetes can vary significantly form one patient to the next which is why most life insurance companies are going to need to learn a lot more about “your diabetes” before they will be willing to make any kind of decision about your application.

Well Controlled

Life insurance companies reviewing an application for diabetic life insurance will want to see that your A1C and blood sugar levels are well controlled.

So, what does that mean?

Generally, an underwriter wants to see your blood sugar levels are steady. They will do this by looking at your A1C levels, which measures your blood glucose levels o ver a 90 day period.

If your A1C is between 5.8-6.4, the underwriter will label you a well controlled diabetic or pre-diabetic, and you may be eligible for a standard plus rate class (maybe better depending on the carrier and your age).

If your A1C is higher, say between 6.4-7.5, you may still be eligible for life insurance with diabetes, but at a lower rate class, such as standard or table B.

The Best Life Insurance Companies for Diabetics

The best life insurance company to choose when applying for life insurance with diabetes will vary based on several factors.

For example, what type of life insurance are you looking for, term or permanent? Do you have any other health complications in addition to diabetes? What age were you first diagnosed with type 2 diabetes?

The best permanent life insurance for people with diabetes include:

The best term life insurance providers for people with diabetes include:

Why do life insurance companies care if I’ve been diagnosed with Type 2 Diabetes?

Diabetes can lead to all sorts of health complications. Life insurance is about insuring you against the tragedy of death. If you have diabetes, your chances of an early demise increase. Therefore, applying for life insurance with diabetes puts the life insurance companies at risk.

Now, it’s fair to say that most life insurance companies aren’t necessarily going to be all that worried about the fact that someone has been diagnosed with adult onset diabetes per se, what’s going to worry them more is how well an individual is “dealing” with their diabetes and how well they’ll be able to manage it in the years to come.

The good news is…

That when properly managed, Type 2 Diabetes doesn’t have to lead to serious complications and can simply represent a pre-existing medical condition that one will simply have to maintain with a healthy diet, exercise, and sometimes various prescription medications.

For this reason…

Many folks who properly maintain their Diabetes won’t find the process of qualifying for a traditional life insurance policy too difficult and may even be able to qualify for a No Medical Exam Life Insurance Policy if they know were to look.

Its also why, we here at I&E wanted to take a moment and briefly describe exactly what Type 2 Diabetes is and what characteristics of this disease will most interest a life insurance company when making their determination about what whether or not you will be able to qualify for coverage.

So, without further ado, let’s dive right in!

Type 2 Diabetes Defined:

Type 2 Diabetes is chronic pre-existing medical condition that is characterized by chronic high levels of blood sugar.

It develops when the body becomes resistant to insulin or when the insulin producing cells within the pancreas aren’t able to produce enough insulin to maintain a healthy blood sugar level.

Current research postulates that the main culprit behind “Type 2 diabetes is a simple condition of having acquired more fat than the individual’s body can cope with. Excess fat has accumulated in liver and pancreas and the individual’s beta cells are susceptible to fat induced dedifferentiation.” Source

So, that would lead one to the conclusion that to put diabetes in remission you would want to lose that excess fat in the liver and pancreas. That is why calorie restrictive diets, or low carbohydrate diets have been shown to be beneficial in helping control type 2 diabetes. Source

Now, unfortunately…

As of right now, knowing why someone might become diabetic is anyone’s guess, however researchers believe that one’s genetic “makeup” may play a role in addition to other environmental factors including having a poor diet, being overweight, and not getting enough exercise.

Consider No Exam Life Insurance

That is why for someone who is not sure if they have diabetes or pre-diabetes, choosing a no medical exam life insurance policy at the outset might be the better route to take, rather than have your life insurance agent give you the bad news that your blood sugar (above 120) and A1C levels (above 6.4) are elevated and you are now considered clinically diabetic.

So what are the “signs” that you might be on the path to developing adult onset diabetes?

Early signs and symptoms of Type 2 Diabetes may include:

- Frequent urge to urinate,

- Increase thirst,

- Voracious appetite,

- Vision difficulties,

- Poor coagulation,

- Tingling, numbness and/or pain in one’s hands or feet,

- Patches of dark skin,

- Etc…

All of which…

Are certainly troubling, but what really makes a life insurance company nervous is some of the more serious complications that can arise when an individual either can’t get a “handle” on their condition or when they choose to ignore their condition entirely.

Serious Complications from Diabetes that can arise include:

- Heart and blood vessel disease,

- Increased risk of suffering from:

- Heart disease,

- High blood pressure,

- A heart attack,

- A stroke,

- Cancer

- Neuropathy,

- Kidney damage,

- Eye damage,

- Increase risk of infections due to difficult healing from cuts and or wounds,

- Hearing impairment,

- Sleep apnea,

But remember…

For most, many of these more serious complications are avoidable which is why some individuals may still be able to qualify for a Standard or standard plus rate (at best) and why most life insurance companies will be willing to insure someone who has been diagnosed with Type 2 Diabetes provided they aren’t currently suffering from any “serious” complications.

What information will the insurance companies ask me or be interested in?

Most life insurance companies will want to know about your health, unless you are applying for a simplified issue or guaranteed issue policy.

Common underwriter questions you’ll likely be asked about your diabetes and health may include:

- When were you first diagnosed with Type 2 Diabetes?

- Who diagnosed your Type 2 Diabetes? A general practitioner or a specialist?

- What symptoms (if any) led to your diagnosis?

- How are you currently treating your Type 2 Diabetes?

- Diet?

- Exercise?

- Medications?

- How often do you see your primary care physician?

- Are you currently taking any prescription medications? If so, which ones?

- Have any of your medications changed in the past 12 months?

- How often do you check your daily blood sugar?

- What would you guess your daily blood sugar levels are?

- When was the last time that you had an A1C test preformed? What was that value?

- Are you currently suffering from any diabetic symptoms now?

- What is your current height and weight?

- Have you been diagnosed with any other pre-existing medical conditions?

- In the past 12 months, have you used any tobacco or nicotine products?

- In the past 2 years, have you been admitted to a hospital for any reason?

- Are you currently working now?

- In the past 12 months, have you applied of or received any form of disability benefits?

Now at this point…

We usually like to take a moment and remind folks that nobody here at I&E has any kind of “official” medical training and we’re certainly not doctors.

All we are is a bunch of life insurance agents who just happen to be really good at helping folks with pre-existing medical conditions like adult onset diabetes, find and qualify for the life insurance coverage that they’re looking for.

Which brings us to our next topic that we want to focus on which is…

Life insurance rates with diabetes

The following are sample life insurance rates with diabetes from A- rated carriers and higher. The rates are based on a standard plus rate, 10 year term, for a male, ages shown. Actual rates may vary and must be qualified for.

| Age | $100,000 | $250,000 | $500,000 | $1,000,000 |

|---|---|---|---|---|

| 40 | $12.50 | $20.84 | $33.45 | $58.13 |

| 45 | $16.58 | $27.05 | $47.18 | $83 |

| 50 | $24.36 | $38.96 | $70.62 | $125.53 |

| 55 | $33.72 | $59.28 | $108.10 | $194.60 |

| 60 | $51.16 | $91.58 | $173.81 | $304.62 |

| 65 | $84.48 | $152.18 | $297.83 | $555.03 |

| 70 | $137.78 | $264.08 | $516.05 | $982.74 |

It is important to understand that there are a lot of factors that will come into play when trying to determine what life insurance rate class an individual might be able to qualify for.

For this reason, it’s pretty much impossible to know what kind of rate you might be able to qualify for without first speaking with you first.

That said, there are a few “assumptions” we can make about those who have been diagnosed with Type 2 Diabetes that will generally hold true when it comes time to applying for a traditional term or whole life insurance policy.

For example…

Individuals who have been diagnosed with Type 2 Diabetes later in life (i.e. after age 40), who don’t require an “injectable” form of insulin and you don’t smoke, chances are you’re likely to receive a better rate than someone who may have been diagnosed at a younger age, or than someone who may require an injectable form of insulin to maintain their blood sugar levels.

That said…

It’s important to understand that regardless of how “well” you are managing your condition, life insurance companies are always going to be a bit nervous about insuring someone with Type 2 Diabetes because you may be controlling your Diabetes well right now, but the insurance company is going to be on the “hook” for covering you for many years to come!

This is why…

In general, most life insurance companies are going to consider anyone who has been diagnosed with Type 2 Diabetes as a “higher risk” applicant.

Which means that you as the applicant are going to want to be more “selective” with which life insurance company you choose to apply with and be more “selective” with which agent you choose to work with.

You see, you are going to want to make sure that your agent is very familiar with working with diabetic life insurance applicants, and has access do dozens of different life insurance companies to choose from when it comes time to helping you find the “best” life insurance policy that you can qualify for.

Which brings us to the last topic that we wanted to take a moment and discus which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience at I&E, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance professional who will work as an advocate for you.

Such an agent…

Will not only help guide you through the application process, but also be perfectly “frank” with you about what options may or may not be possible for you.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies, because after all, it really doesn’t matter how “great” a life insurance agent you have if they don’t have access to the “best” life insurance policy for you!

Lastly…

You’ll want to make sure that you’re completely honest with your life insurance agent prior to applying for coverage. By doing so, you will be helping him or her narrow down what options might be the “best” for you, based on your health, lifestyle, needs and goals.

So, what are you waiting for? Give us a call today and see what we can do for you!