Life Insurance For Children [the Best Policies for Kids]

When you consider purchasing life insurance for your child, it’s often with the somber thought of providing a safety net should the unthinkable happen. However, focusing solely on the death benefit overlooks the broader opportunities that the right kind of life insurance can offer. By choosing a policy designed with high cash value, not only do you secure peace of mind, but you also pave the way for your child’s financial independence. Let’s delve deeper into why a well-chosen life insurance policy could be a transformative investment for your child’s future, offering substantial living benefits that extend far beyond the typical coverage.

Table of Contents

Key Takeaways:

- Whole life insurance for children builds guaranteed cash value they can use throughout life

- Properly structured policies offer tax advantages and financial flexibility

- Starting early maximizes compounding benefits and secures future insurability

- These policies can become a teaching tool for financial literacy and wealth building

The Best Whole Life Insurance Policy for Children

Have you ever heard the phrase, “It’s all in the name”? This certainly holds true for properly structured participating whole life insurance.

Here’s what that means:

Whole Life: This term doesn’t just indicate that the policy lasts for your child’s entire life; it also suggests a comprehensive, or “whole,” approach to living. Whole life insurance is designed to contribute not just to financial security, but to a well-rounded, holistic life.

The benefits of whole life insurance include:

- Guaranteed Cash Value Accumulation

- Guaranteed Level Premiums

- Guaranteed Death Benefit

- Tax Deferred Cash Value Growth

- Tax-Free Access to Money

- Income Tax Free Dividends

- Tax Free Death Benefit

Whole Life as a Financial Mentoring Tool

Using whole life insurance as a financial mentoring tool for the younger generations can prepare our kids for lifelong financial success and help preserve wealth across generations.

The Misunderstood Potential of Whole Life Insurance

Let’s start by addressing a common misconception: whole life insurance for children is merely about the death benefit. While it’s true that these policies do provide a death benefit, that’s not the primary reason we’re discussing them today. Instead, we’re focusing on their incredible living benefits—benefits that begin accruing right from the start and continue throughout your child’s life.

Did You Know?

Wealth often evaporates by the third generation because previous generations do not pass down sound financial principles. Starting a whole life policy for your child creates both a financial asset and an educational opportunity to teach lasting money management skills.

What Whole Life Insurance Really Offers

Whole life insurance isn’t just a safety net—it’s a proactive financial tool. These policies provide guaranteed cash value accumulation, level premiums, tax-deferred growth, and income tax-free dividends. This financial utility means your child’s policy is not just a promise for the future; it’s an active player in their financial present.

Building a Legacy

Here’s a startling fact: wealth often evaporates by the third generation because previous generations do not pass down sound financial principles. By starting a whole life policy for your child, you’re not just insuring their life but investing in their financial education and future independence. This strategy creates a ‘family bank’ to fund education, start businesses, or even help purchase a first home.

Real-life Examples and Benefits

Consider this: by funding a whole life policy for your child from a young age, you can utilize tax advantages while building substantial cash value they can borrow against tax-free. This is a strategy that has built legacies. For example, a 10-Pay policy started for a four-year-old with $6,000 annual premiums can grow into millions by the time they retire without ever being taxed on those gains. And that same policy has a death benefit of over $5 million by age 85.

Why Start Early

The earlier you start, the more powerful the effect. A whole life insurance policy begun in childhood secures insurability and benefits from decades of compounding interest and dividends. This is how generational wealth is built and maintained—not through momentary gains but long-term, strategic planning.

Financial Strategy Spotlight

Entrepreneurs can employ their children (age 12 in some states, 14 in most) and pay them up to $12,200 in income tax-free earnings. This income can then be placed into a whole life insurance policy, creating a tax-advantaged wealth-building vehicle.

The child earns income tax-free, you get the business write-off, and later the child can access the cash value income tax-free via policy loans. A truly multi-generational tax strategy!

Choosing the Right Policy

Not all policies are created equal. Correct policy design is critical to maximize lifetime cash value gains. And it’s crucial to choose a whole life policy from a reputable mutual insurance company that offers participating policies. These policies allow dividends to be reinvested in paid-up additions, increasing both the cash value and the death benefit over time.

The Educational Component

As a parent, your role doesn’t end at purchasing the policy. Educating your child on how to manage and grow this asset is crucial. This financial mentorship helps them understand and leverage their policy to fund their dreams without falling into debt traps and depleting their “personal bank.” Instead, providing financial wisdom and coaching ensures your child has the tools necessary to thrive.

Top Life Insurance Providers for Children

Note: These are the top companies for children right now but not necessarily our recommendations.

- Mutual of Omaha

Policy Type: Whole Life Insurance

Coverage: $5,000 to $50,000

Key Features:- Affordable premiums.

- Guaranteed insurability with no medical exam required for future increases in coverage.

- Lifetime protection starting as early as 14 days old.

- State Farm

Policy Type: Term Rider and Whole Life Insurance

Coverage: Up to age 25 (term rider) or lifetime (whole life).

Key Features:- Flexible term rider that can be converted to permanent insurance.

- Coverage adaptable to changing needs, including up to five times the amount on the child’s 18th birthday.

- American Family

Policy Type: DreamSecure Children’s Whole Life

Coverage: $25,000, $50,000, or $75,000

Key Features:- Flexible payment options (10 or 20 years).

- Guaranteed purchase options for increasing coverage at life milestones like marriage or parenthood.

- Nationwide

Policy Type: Whole Life and Term Riders

Coverage: No limit on whole life; term riders convertible at adulthood.

Key Features:- High customer satisfaction and financial stability.

- Flexible standalone policies or riders for families.

- Penn Mutual

Policy Type: Whole Life and Term Riders

Coverage: No maximum coverage limit.

Key Features:- Policies earn annual dividends for cash value growth.

- Low customer complaint rate relative to market share.

- Foresters Financial

Policy Type: BrightFuture Whole Life

Coverage: Customizable amounts.

Key Features:- Focus on customizable coverage with additional benefits like scholarships and community grants.

- Gerber Life Insurance

Policy Type: Grow-Up Plan (Whole Life)

Coverage: Doubles automatically at age 18 without additional cost.

Key Features:- Affordable premiums with guaranteed insurability.

- Cash value accumulation over time.

Whole Life Insurance Rates for Children

Example 1

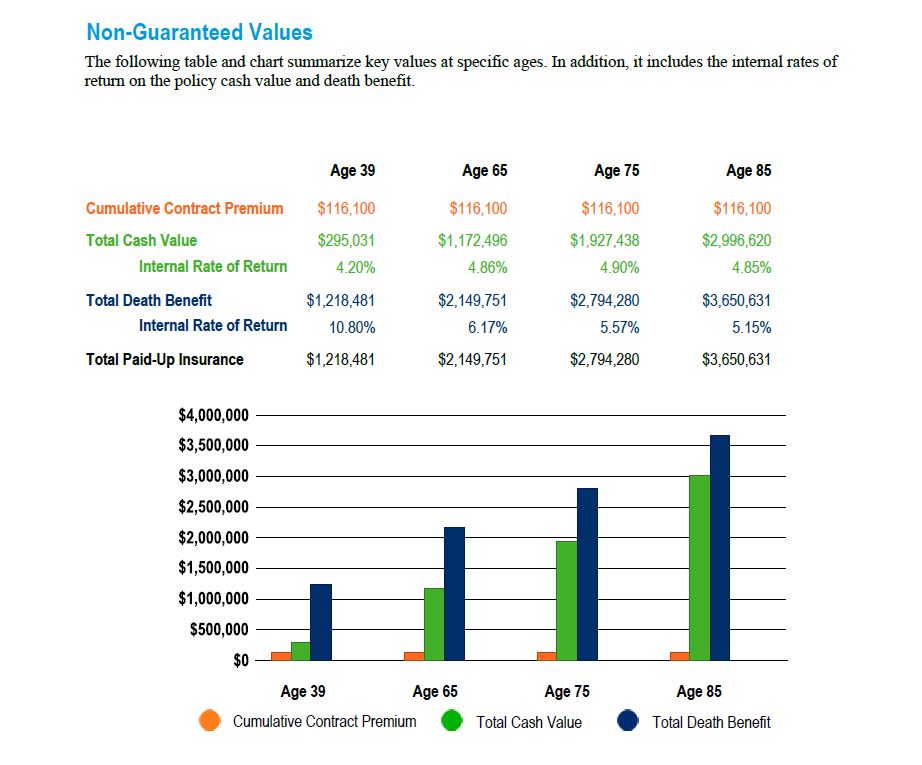

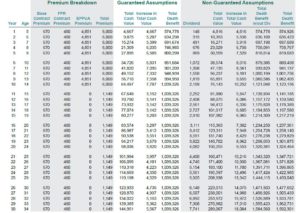

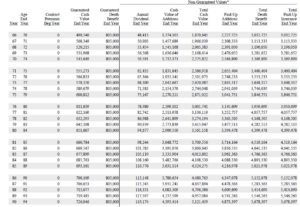

Our first illustration of a whole life insurance policy for a child will feature a 10-Pay Life Insurance Policy. In this instance, the parent or grandparent of the child will contribute $11,610 annually into the policy. The policy is based on a 12 year old male child. Let’s take a look at how this policy illustrates over the child’s lifetime.

As you can see above, the total premiums contributed to the child’s life insurance policy was $116,100. At age 65, the total cash value will be over $1.1 million. And the death benefit at age 85 will be greater than $3.6 million.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Example 2

In this whole life insurance for children example illustration provided from an A+ rated carrier, we will be looking at how much $6,000 total premiums would generate over the first 30 years on a 10 pay whole life policy that the owner can continue to make base premium payments on after the initial 10 years.

We chose $6,000 annual premiums for a reason as a parent might be able to hire a child age 12 (age 14 in most states) and pay him or her an income without incurring a tax liability.

Under current tax law a parent can pay a child up to $12,200 income tax free earnings (lowest tax bracket). Please consult with your tax advisor for your specific situation.

So, for those of you who are entrepreneurs, you can employ your child age 12 in some states and age 14 in most. Your child earns $12,200 income tax free. You get the write off (win-win). You can then place that income into a whole life insurance policy for your child. Down the road, your child can access the cash value income tax free via a life insurance loan. So, your child may never be taxed on that money.

After 10 years, the dividend paid to the children’s life insurance policy should be more than enough to cover any premium due.

Example 3

Example 3

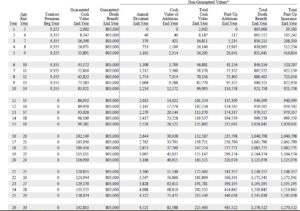

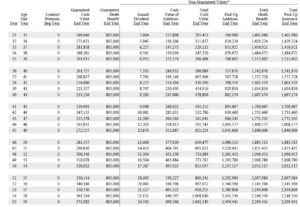

And here is a whole life illustration for a child. This is a properly designed 10 pay whole life policy for a 4 yo boy with a guaranteed insurability rider with an A+ rated carrier focused on cash value growth.

The starting face amount is $800,000 on an annual premium of $9,355 a year for 10 years, at which point no more premiums are due.

The policy ends at age 121, at which point the non-guaranteed totals equal over $21,000,000 for the cash value and death benefit.

Ages 5-30

Whole Life Insurance for Kids

We work with many of the best companies in the marketplace. However, when we at I&E talk about the best whole life insurance for kids, we are talking about a policy that is designed to act as a lifelong “banking policy.”

When using whole life as a banking policy AND utilizing the infinite banking concept, the policy becomes a wealth building storehouse.

Thanks to compound interest, the cash value in the policy continues to grow and grow, regardless if you choose to borrow against the cash value. And even when a life insurance loan is taken out against the policy’s cash value, the cash account continues to earn interest and dividends on the entire principle balance. This continuous growth allows for a true compound interest environment, which avoids taxation on two fronts.

One, the cash value growth is not taxed while it remains inside the policy.

Two, you can access the cash value tax free by taking out life insurance loans.

The Power of Starting Young

The younger your child is when they get a whole life policy, the more efficient it becomes over time. Due to compound interest, a policy started in childhood can create substantially more wealth than one started in adulthood – sometimes millions more over a lifetime.

Guaranteed Cash Value Accumulation

A properly structured child life insurance policy will accumulate cash value.

The life insurance is an asset that will become more and more efficient as time goes on. Therefore, the younger your child is when they get the policy, the more amazing the policy will be long term.

This is one of the main reasons the wealthy buy life insurance policies for their children, because it offers a lifelong supply of tax free money, with a growing tax free death benefit for legacy creation.

There is simply NO other vehicle that can guarantee a continuous compounding return, in a safe, risk free environment, backed by the financial strength of the mutual insurance company.

Guaranteed Level Premiums

Your child life insurance premiums are level, i.e. fixed. And the premium will not change regardless of health or lifestyle.

The premium can also be designed as limited pay life insurance, so that the insurance premium payments last for a number of years, at which time the policy is paid-up. Once the policy is paid-up, no more insurance premium payments are due.

Guaranteed Death Benefit

The death benefit face amount is guaranteed when the insured dies. With a properly structured policy, the death benefit face amount will increase as your child ages, providing your child with the ability to create a future legacy for your children’s children’s children. The policy is designed to increase the death benefit over time, so that your child life insurance policy will actually become more and more valuable as time passes.

Low Fees

One of the major knocks against whole life insurance is the fees. Granted, this objection is usually brought to light by financial professionals who are pushing their own fee based products (can you say conflict of interest?)

However, put a properly designed whole life policy head to head with any other financial vehicles out there are you will begin to see that this objection may by many financial pundits does not hold water.

It is sad that many stockbrokers and pundits in the financial community criticize whole life insurance for young people based upon various suggestions such as “high fees” OR the time needed to realize value. They instead recommend that a young person place money in a number of the market based (tax preferred) investments touted by the financial community.

First, startup costs are a necessary part of purchasing any asset such as real estate or funding the startup of a business.

Second, tax deferred is arguably NOT tax preferred because your growing asset will pay taxes on the harvest later rather than the seed now.

Third, however misguided these objections are for everyone, they are particularly flawed when it comes to kids, whose policy will have ample time to establish itself AND WILL GROW exponentially over 20+ years, making this the most powerful wealth building asset you can create for their future.

Tax Advantaged Compounding Policy Growth

The policy’s cash value grows every year tax deferred based on IRC 7702. Due to the beauty of compound interest, the principle and interest of the cash account in the policy grows at an internal rate of return which factors in a guaranteed return plus dividends.

And on properly structured life insurance policies for children, the policy’s cash value continues to earn interest and dividends, even if you or your child borrows money from the policy. That way, the compounding effect is never reduced and the cash value continues to grow and grow exponentially year in and year out!

Dividend Payments

We strongly recommend using mutual companies when designing the right whole life insurance policies for children. These mutual insurance companies offer participating life insurance. That means the policyholders get a return of premium in the form of dividends. These dividends can be used to purchase more paid up life insurance.

Paid Up Additions

With the use of paid up additions, the death benefit and cash value in the policy are supercharged for maximum growth. Paid up additions allow you to overfund the policy so you can maximize the tax incentives associated with cash value life insurance.

Guaranteed Future Insurability Rider

Once you have obtained life insurance for your children the policy will allow your child to increase coverage periodically, with no proof of insurability. This is done via the guaranteed insurability rider. This optional rider provides additional guaranteed coverage if your child opts for more life insurance at specific ages and after certain life events, such as marriage and having a child of their own.

Future Uses of Your Child’s Policy

Starting a whole life insurance policy for your child early allows the cash value to increase over time, creating a substantial “personal bank” they can use once they leave home. They can borrow against the cash value for:

- Education/Student Loans

- Vehicles

- Starting a Business

- Paying for a Wedding

- Avoiding Credit Cards

- Retirement

- Down Payment on a House

- Investments

With proper financial education, this becomes one of the most valuable gifts you can give your child.

Benefits of Whole Life Insurance for Children

Starting a whole life insurance policy for your child early allows the cash value to increase over time, creating a substantial “personal bank” they can use once they leave home. As a responsible parent, it’s important to engage in your child’s financial education, teaching them how to effectively manage their policy like a personal bank. This kind of education will provide immense lifelong benefits, enhancing their overall well-being by fostering a deep understanding of money management and financial principles.

Your child can borrow against the cash value in the policy for purchases such as:

- Education/Student Loans

- Vehicles

- Starting a Business

- Paying for a Wedding

- Avoiding Credit Cards

- Retirement

- Down Payment on a House

- Investments

- Etc.

With a properly funded whole life insurance policy and the proper education about money and finances, buying life insurance for children is one of the best gifts a parent can buy for their kids.

Alternatives to Dividend Paying Whole Life Insurance for Children

Most grandparents choose the Gerber Grow Up Plan for their grandchildren simply because that is how they are marketed. And the majority of parents buy life insurance on their kids as a term life child rider. The reasoning is, if my insured child dies at least I can pay for the funeral.

Child Term Rider vs Gerber Grow-Up Plan

A child term rider is an optional add on to a parent’s policy that offers many benefits, including:

- Available for children ages 15 days to 18-25 years old

- Child rider is attached to a parents life insurance policy

- The policy owner pays one flat fee to insure the children, no matter how many kids he or she has

- A few basic health questions

- No exam needed for the children

- May be convertible to permanent life insurance up to a multiple of the existing face amount

Quick Tip:

If you are going to add a child rider, consider choosing a mutual company AND the company you are choosing will be able to convert your child’s life insurance to the appropriate permanent life insurance for maximum cash value growth.

Gerber Grow-Up Plan

Another popular form of children’s life insurance is a policy from Gerber called the Gerber Grow-Up Plan. This is a whole life policy that builds some cash value.

Gerber Grow-Up Plan Features:

- Ages 14 days to 14 years old

- Choose from $5,000 to $50,000 of coverage

- Fixed insurance premiums

- Coverage doubles automatically at age 18

- Cash value accumulation

- Note: Policy loans are a whopping 8%!

Is the Gerber Grow-Up Plan a good investment?

Is the Gerber Grow-Up Plan is a good option for your kids? The policy acts as a forced savings plan. Your child can use the cash value down the road by either withdrawing the cash or taking out a life insurance loan.

The bottom line is the Gerber Plan is alright but certainly not the best.

We Do NOT Advocate Gerber Insurance or Child Term Rider as Viable Options

So now you know where we stand, we do not advocate anyone considering life insurance for children to choose either the Gerber Grow Up Plan or Child Term Rider.

Drawbacks to the Gerber Plan

The Gerber Grow Up Plan lacks many of the benefits that can be found in a properly designed cash value policy, where the focus is on maximizing cash value growth over the lifetime of the child.

In addition, Gerber’s 8% loan charge when you borrow against the cash value is too high compared to other more competitive insurance providers which currently charge closer to 5%, which turns out to be a wash loan when factoring in the guaranteed rate and dividend.

A child term rider also comes up short when it comes to life insurance for kids because the rider is designed for death benefit only, with no cash value accumulation.

Conclusion

In conclusion, purchasing whole life insurance for your child isn’t just about securing a financial safety net in case of tragedy; it’s a proactive investment in their future financial independence. By selecting a high cash value policy, you’re not only ensuring lifelong coverage but also equipping your child with a powerful financial tool. This tool can fund education, start businesses, and even help purchase a first home. Moreover, it offers a profound educational opportunity, allowing you to mentor your child in managing and appreciating the value of money. This holistic approach not only prepares them for financial success but also instills a legacy of wise financial stewardship for generations to come.

Explore Whole Life Insurance for Your Child’s Future

Give your child a head start with a whole life insurance policy that builds cash value and financial security. Our independent advisory team can guide you through selecting a policy tailored to your family’s goals, ensuring lifelong benefits and wealth-building opportunities.

- ✓ Receive a personalized analysis of whole life insurance options for your child

- ✓ Learn how to maximize cash value growth and tax advantages

- ✓ Understand how to use the policy as a financial mentoring tool

- ✓ Get clarity on securing future insurability and building generational wealth

Schedule your complimentary 30-minute consultation today and discover how whole life insurance can empower your child’s financial future.

No obligation. No sales pressure. Just expert guidance to help you choose the best whole life insurance policy for your child’s long-term success.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Frequently Asked Questions About Whole Life Insurance for Children

1. Why should I consider whole life insurance for my child?

Whole life insurance for children goes beyond a death benefit, building guaranteed cash value that grows tax-deferred over time. It’s a financial tool your child can use for education, starting a business, or buying a home, while securing lifelong insurability.

2. How does whole life insurance help my child financially?

The policy accumulates cash value that can be borrowed against tax-free for major expenses like college or a house down payment. It also earns dividends and grows through compound interest, creating a “personal bank” for your child’s future.

3. What are the tax advantages of whole life insurance for kids?

Cash value grows tax-deferred, and policy loans provide tax-free access to funds. Dividends are income tax-free, and the death benefit is also tax-free, making it a powerful wealth-building vehicle.

4. Why start a whole life policy when my child is young?

Starting early maximizes compound interest, leading to significant cash value growth over decades. It also locks in insurability, ensuring your child can always have coverage regardless of future health changes.

5. Can whole life insurance teach my child financial responsibility?

Yes, managing the policy’s cash value offers a hands-on way to teach money management. You can mentor your child on using it wisely for loans or investments, fostering financial literacy.

6. How does whole life insurance differ from term life or Gerber plans for kids?

Unlike term life, which offers only a death benefit, whole life builds cash value for living benefits. Compared to Gerber’s Grow-Up Plan, a properly designed whole life policy offers better cash value growth and lower loan rates (e.g., ~5% vs. 8%).

7. What is a “properly designed” whole life policy for a child?

A properly designed policy, typically from a mutual insurance company, maximizes cash value growth through paid-up additions and dividends. It includes riders like guaranteed insurability to enhance flexibility and value over time.

8. Can my child use the policy’s cash value in the future?

Yes, they can borrow against the cash value for things like education, vehicles, weddings, or retirement. With proper education, they can use it as a financial tool without depleting the policy’s growth.

9. Is whole life insurance for kids expensive?

Premiums are affordable when started young, and options like 10-pay policies limit payment years. The long-term benefits—tax-free growth, dividends, and cash access—often outweigh initial costs.

10. How do I choose the right whole life insurance policy for my child?

Work with an advisor to select a policy from a reputable mutual insurer focused on cash value growth. Ensure it’s tailored to your goals, with features like paid-up additions and a guaranteed insurability rider.

7 comments

May

Is there a cap amount on the face value for our children? One example you used was an 800K on year 1 for the 9K premium. You can do it that high? Thought I was told it can only be so much in comparison to why my policies are, but maybe I misunderstood. thoughts?

Insurance&Estates

Hello May, your question have been forwarded to our product expert Jason Herring and you can also reach out directly to him at jason@insuranceandestates.com.

Best, I&E

lucy

how to choose the right life insurance for 5/11 children ?

Angela

Very interesting article. I’m interested in whole life protection for my grandsons, ages 2, 3, and 4. The article provides much food for thought but I was hoping to see a list of top insurance companies that you would recommend.

Derek

Great article! Once you have a policy set up for your kid, you own the policy and therefore you control the policy, correct? In other words, you can use the banking features just like a policy taken out on yourself, and then you can choose to sign over the policy when your kid is a certain age – if you choose – or you can control it until you die, if that was what you decided to do, right? In other words, even though your kid is the insured, you have complete control as the owner until you relinquish control through paperwork filed with the insurance company giving ownership to someone else (e.g., your kid). Thanks!

Tal S.

Great article…So what are the best high cash value whole life policies for children? Mine are 5, 7, and 14.

Insurance&Estates

Hi Tal,

Thank you for the question. Please be on the lookout for our reply to the contact info you provided.

All the best,

I&E