A limited pay life insurance policy offers a unique approach to whole life coverage. This type of insurance is characterized by its set period for premium payments, after which the limited pay policy remains active without further cost, making it an good choice for those seeking permanent life insurance coverage without lifetime payments.

This article delves into the intricacies of limited pay life insurance, exploring the various limited pay policy types, their advantages and disadvantages, and how they compare to other insurance products. Our objective is to equip you with the knowledge to make the best decision for you, based on your needs and objectives.

Limited Pay Life Insurance: Securing Lifelong Protection with Finite Payments

Table of Contents

- Key Takeaways: Understanding Limited Pay Life Insurance

- Introduction to Limited Pay Life Insurance

- Best Limited Pay Life Insurance Companies

- What is Limited Pay Life Insurance?

- Limited Pay Life Insurance vs Other Types of Life Insurance Policies

- Types of Limited Pay Life Insurance Policies (Sample Rates)

- Limited Pay Life Insurance Example

- Pros and Cons of Limited Pay Life Insurance

- Riders and Additional Coverage Options

- Policy Management and Monitoring

- Alternatives to Limited Pay Life Insurance

- Frequently Asked Questions

- Conclusion and Next Steps

Key Takeaways: Understanding Limited Pay Life Insurance

- Limited Pay Life Insurance is a type of whole life insurance policy where you pay premiums only for a specified period, yet the coverage lasts for your lifetime.

- The limited pay premium payment period can vary, commonly ranging from single-pay policies to those spanning 7, 10, 15, or 20 years or to age 65. Once the payment period ends, no further premiums are due.

- A limited pay whole life policy builds cash value, which can be accessed via withdrawals or loans, providing a financial resource in addition to the death benefit.

- Limited pay is different from term life insurance, which only covers you for a specified term and doesn’t typically build cash value. It also differs from traditional whole life policies, which require lifelong premium payments.

- The limited pay policy’s cash value grows on a tax-deferred basis, and beneficiaries typically receive the death benefit tax-free.

- Limited pay is a good fit for individuals seeking permanent life insurance coverage without the commitment to lifelong premium payments.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Introduction to Limited Pay Life Insurance

The best mutual insurance companies offer options that allow you to fund a dividend paying whole life insurance policy within a specific time frame. Once the premium obligation has been met, the limited pay life policy stays in force for the rest of your life but no more premium payments are required. Understanding the different options available is key to finding the whole life product that best meets your needs.

Best Limited Pay Life Insurance Companies

Each of these are top rated mutual insurance companies that offer various limited pay whole life insurance options and have a history of strong dividend payments.

Our current picks for the Best Limited Pay Life Insurance Companies include:

2. Lafayette Life

3. Foresters

4. MassMutual

What is Limited Pay Life Insurance?

Definition

Limited Pay Life Insurance is defined as a type of whole life insurance with a set period for paying premiums, either based on a number of years or reaching a specific age. After this period, no more premiums are due, but the limited pay life policy remains in force for your entire lifetime. It builds cash value through guaranteed returns, fixed premiums, and death benefit protection.

Paid Up Additions

There are different ways to structure your limited pay life insurance policy. The more traditional method focused on maximizing the death benefit. However, a more streamlined policy can be designed that focuses on cash value growth through paid up additions.

Paid up additions allow you to overfund the limited pay life insurance policy so that more premium payment is going towards cash value instead of towards base, which funds the death benefit. Depending on your goals, it is important that you structure your policy correctly to maximize cash value growth vs the death benefit in the early years.

Limited Pay Life Insurance vs Other Types of Life Insurance Policies

Limited Pay vs. Whole Life

With a traditional whole life insurance policy, you will typically be required to pay premiums on a regular basis until age 100. Older whole life policies were paid up at age 100, with newer policy designs having the policy paid up at age 121. In both instances, the premium payment schedule is factored in to age 100.

Alternatively with a limited pay life policy, although the premium is higher, once the payment period has ended, there are no further premiums required. This can make budgeting and paying expenses in the future much easier, while at the same time, still giving you the permanent life insurance protection that you need.

Limited Pay vs Term Life

Limited pay whole life differs from term life in that once a term policy ends, the coverage stops and you will need to renew the term policy, get a new policy, or choose to no longer have life insurance protection. With certain term insurance policies you can convert your term life insurance to permanent life insurance coverage before the term life policy ends, albeit at a much higher premium. In contrast, when the payment period ends with a limited pay life policy, the limited pay policy coverage will continue for the rest of your lifetime.

Limited Pay vs Universal Life Insurance

Universal life is another form of permanent life insurance that offers both a death benefit and cash value that grows on a tax deferred basis. However, while universal life can provide more flexibility regarding the timing and the amount of the premium, whole life insurance tends to have more guarantees – such as the amount of the premium and the rate of return on the cash component. In addition, a universal life insurance policy will require premium payments for as long as you want to keep the policy, whereas a limited pay policy has a set period of time that you need to make payments.

Limited Pay vs Variable Life Insurance

Because limited pay life is whole life insurance, it offers a guaranteed death benefit, as well as a fixed return on the cash value component of the policy. With limited pay whole life you will never have a negative growth year.

This is not the case with variable life insurance. In a variable life insurance policy, the amount of the cash value can fluctuate up and down, based on the performance of the underlying investments (such as mutual funds) that are being tracked. In addition, variable life insurance can lose value if the market has a down year.

Types of Limited Pay Life Insurance Policies

Mutual insurance companies offer a variety of dividend paying limited pay whole life insurance policies, including

Mutual insurance companies offer a variety of dividend paying limited pay whole life insurance policies, including

- Single Premium,

- 7-Pay,

- 10-Pay,

- 15-Pay,

- 20-Pay,

- 30-Pay,

- Life Paid up at age 65.

Let’s take a closer look at a few of these options below as well as look at some sample rates.

Single Premium Whole Life

Single premium life insurance, a/k/a survivorship life insurance, offers permanent life insurance coverage that is paid up in a onetime lump sum payment. This is the shortest limited pay policy available.

The pros of single premium is that you get leverage on your dollars and many of the benefits inherent in life insurance, such as a tax free death benefit.

The con to single premium is the policy is considered a modified endowment contract and you lose some of the tax advantages of cash value life insurance.

7 Pay Whole Life

A 7 Pay limited pay whole life policy offers permanent death benefit coverage on a policy that is paid up in 7 years.

The reason the number 7 is significant is because of the 7 pay test found in the internal revenue code determines whether a policy will be considered cash value life insurance or a modified endowment contract.

In other words, 7 Pay Whole Life is the shortest time frame you can choose to overfund your policy without it changing the nature of the policy.

10 Pay Whole Life Insurance

10 Pay Life provides permanent life insurance coverage that is paid up in 10 years. This is a very popular option, particularly for those who practice infinite banking with their policy.

You can choose a 10 Pay Whole Life Policy with a term rider to increase your death benefit coverage while you wait for the death benefit of the whole life policy to grow.

The following sample 10-Pay Quotes are from an A+ rated carrier for a preferred plus male. Annual Rates are for informational purposes only and must be qualified for.

| Age | $100,000 | $250,000 | $500,000 | $1,000,000 |

|---|---|---|---|---|

| 40 | $3,628 | $8,717 | $17,225 | $34,170 |

| 45 | $4,297 | $10,310 | $20,360 | $40,370 |

| 50 | $5,082 | $12,167 | $24,010 | $47,590 |

| 55 | $5,979 | $14,272 | $28,140 | $55,740 |

| 60 | $6,973 | $16,565 | $32,610 | $64,530 |

| 65 | $8,075 | $19,077 | $37,490 | $74,100 |

20 Pay Whole Life Policy

Another popular choice, 20 Pay Life provides permanent life insurance coverage which is fully paid up in 20 years. The following sample 20-Pay quotes are from an A+ rated carrier for a preferred plus male. Annual Rates are for informational purposes only and must be qualified for.

| Age | $100,000 | $250,000 | $500,000 | $1,000,000 |

|---|---|---|---|---|

| 40 | $2,277 | $5,342 | $10,470 | $20,660 |

| 45 | $2,698 | $6,312 | $12,365 | $24,390 |

| 50 | $3,200 | $7,462 | $14,600 | $28,770 |

| 55 | $3,797 | $8,817 | $17,235 | $33,930 |

| 60 | $4,580 | $10,582 | $20,645 | $40,600 |

| 65 | $5,536 | $12,730 | $24,795 | $48,710 |

30 Pay Whole Life

30 Pay Life provides permanent life insurance coverage that lasts your entire life with premiums due for 30 years. The pro with this policy is you stretch out the premiums for 30 years, resulting in more affordable coverage in comparison to the other limited pay life policies.

Life Paid Up at 65

A limited pay policy to age 65 offers permanent life insurance coverage which becomes a paid up policy at age 65. The number 65 is significant because it has been the common age of retirement since 1935.

The pro of life paid up at 65 is that upon entering retirement you no longer have to pay premiums, freeing up your cash for other pursuits or expenses. In addition, your life insurance retirement plan is now fully funded, which can be used to help supplement your income in retirement.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Limited Pay Life Insurance Example

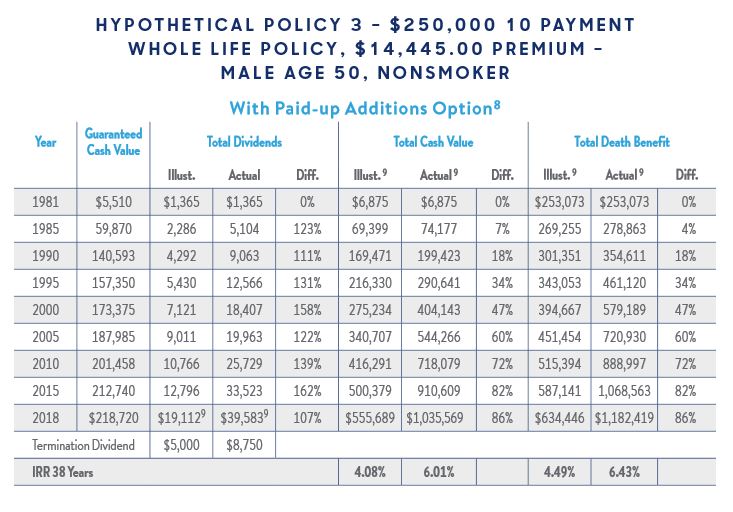

The following chart shows a hypothetical whole life insurance cash value chart based on a 10 Payment Whole Life Policy with a paid-up additions option that was taken out in 1980 by a 50 year old male.

Note that in the above example, the chart shows that the 38 year cash value growth was 6.01% and the total internal rate of return (IRR) including the death benefit was 6.43% over the same time frame. And this is a tax-free death benefit so the actual rate of return a taxed account would need to get to compare would be more like 8.5% assuming a tax rate of 25%.

Limited Pay Life Insurance Pros

The following are benefits of limited pay life insurance.

No more premiums:

You pay into the limited payment life insurance for the required time and in return, you get a paid up policy with no more premiums due and all the benefits of cash value life insurance therein.

Long-term care:

You can get a limited pay long term care life insurance policy. Many limited pay policies provide long-term care insurance rider and will pay a death benefit, long term care insurance benefit or chronic illness benefit, and cash surrender return of premium.

High Cash Value:

Limited pay whole life is a great way to supercharge your policy, giving you high cash value growth in the early years. For those looking to use life insurance as a personal bank, having your cash value grow quickly is a huge benefit.

Increased IRR:

Limited pay policies may also create a better internal rate of return (IRR), providing superior long-term growth in comparison to ordinary whole life that you pay premiums on until you die. One of the primary reasons is your policy is paid up and many of the fees associated with it are no longer taken, providing a higher return dollar for dollar.

Great for kids as well:

Limited pay whole life insurance for children is a great way to provide for your kids into the future. You can pay into the policy for 10 or 20 years and your child will be able to reap the benefits for of whole life insurance for their entire life.

Limited Pay Life Insurance Cons

It is important to also consider the following drawbacks to limited pay life policies.

Price:

Limited pay life insurance requires payments for 7, 10, 15, 20 or to age 65. Ordinary whole life requires premium payments to age 100. Due to the rapid nature of paying on the policy for a limited time you will pay a higher premium than a ordinary whole life insurance policy that has its premium payment schedule stretched out to age 100.

However, you can always adjust the initial death benefit amount to lower your premiums. You can also design your policy so that the majority of your premium payment is going towards paid up additions. Over time, thanks to your guaranteed return plus potential dividends used to purchase additional paid up insurance, your policy cash value and death benefit will continue to grow, even after your have finished your limited pay period.

That way, even though it is more expensive than the cheaper whole life insurance to age 100, you will be paying into your policy for a shorter period of time, say for 10 years or to age 65. And this will free up your cash for other uses, particularly as your are older and may not be making a regular income, rather than pay into your whole life to age 121 policy for another 30 or 40 years.

Modified Endowment Contract:

It is possible to MEC your policy with limited pay whole life. In particular, single premium whole life insurance does not meet the IRC requirements of cash value life insurance, so it is considered a modified endowment contract.

With limited pay policies, particularly those that are funded using paid up additions, it is important to keep an eye on the MEC level where your policy changes from life insurance to a modified endowment contract.

The good news is the insurance carrier and your insurance agent can help you in determining how much you can safely contribute to your policy without your policy becoming a MEC. And if you go over the MEC limit, the insurance provider will alert you. Just make sure to open your mail!

| Advantages of Limited Pay Life Insurance | Disadvantages of Limited Pay Life Insurance |

|---|---|

| Predictable and guaranteed costs | Possible policy lapse |

| Shorter premium payment term | Potential for Modified Endowment Contract |

| Faster cash value growth | Higher premiums in early years |

| Tax deferred growth of cash value | Lost opportunity cost |

| Lifetime coverage | |

| Possible dividends | |

| Retirement income supplement | |

| Living benefits |

Riders and Additional Coverage Options

Common riders include Paid Up Additions, Accelerated Death Benefit, Waiver of Premium, and Family Insurance.

Paid Up Additions Rider

Adding a paid up additions rider or paid-up additional insurance rider allows you to apply your dividend payment to your policy to increase the death benefit and cash value. This allows your cash value growth to compounded year in and year out. Not all carriers offer dividends, so it is important you go with a company that offers a dividend paying limited pay whole life insurance policy.

Accelerated death benefit rider

Accelerated death benefits, also referred to as living benefits, allow you to access a portion of the death benefit in certain qualifying situations.

Waiver of Premium

A waiver of premium rider is a special add-on to life insurance that pays all your insurance premium owed to the carrier if you suffer a total disability. Essentially, your premium is waived, as the life insurance company pays your tab.

Family insurance rider

A family insurance rider allows you to add extra coverage to the policy that pays a benefit if the insured’s spouse and/or child(ren) dies.

Policy Management and Monitoring

Once you have purchased a limited pay life insurance policy, you should not just “set it and forget it.” It is important to monitor and review your coverage at least once per year to ensure that it is still in line with your coverage and cash value needs.

You should review the policy more often if you have experienced any major life changes, such as:

- Marriage or divorce

- Loss of your spouse

- Retirement

- Purchase and/or sale of a home

- Purchase and/or sale of a business

- Birth or adoption of a child or grandchild

Alternatives to Limited Pay Life Insurance

Because there are many different types of life insurance available in the marketplace, there are alternatives to using limited pay life insurance, depending on how you plan to use the coverage and/or the cash value.

Some limited pay life alternatives could include:

- Term life insurance

- Traditional whole life insurance

- Universal life insurance

- Indexed universal life insurance

- Variable life insurance

- Variable universal life insurance

- Final expense life insurance

Frequently Asked Questions

Even with a good understanding of how limited pay life insurance works, you may still have additional questions. These could include the following:

Can you change your premium payment?

Typically, the premium payment period is fixed in a limited pay life insurance policy. Therefore, it is not possible to change your premium on a traditional policy. However, a high cash value whole life policy that has a mixture of base and paid up additions provides a lot of flexibility. Depending on how your policy is designed will determine how flexible your premium payments will be and why it is important to have a limited pay life insurance professional design your policy.

Are you allowed to borrow against a limited pay life insurance policy?

You may borrow against your cash value in a limited pay life insurance policy. The funds can be used for supplementing retirement income, making purchases, buying assets, or any other need or want. It is important to keep in mind that any unpaid loan balance at the time of the insured’s death will be repaid using the death benefit. The remaining funds will then be paid to the policy’s beneficiary(ies).

Conclusion and Next Steps

In wrapping up, we think Limited Pay Life Insurance is worth considering because it offers flexibility, tax advantages, and financial protection, and it is a way to have lifetime whole life insurance coverage without having to make premium payments for the rest of your lifetime. It’s great for people who want to plan ahead and make sure they’re protected, but don’t want the financial obligation down the road.

Just remember, it’s a big decision, so talking to someone who really knows about limited pay life insurance can help you figure out if it’s the right choice for you. For more information or to determine if Limited Pay Life Insurance fits your specific needs and goals, contact Insurance and Estates at (877) 787-7558.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

13 comments

Patrick

Are any of these Dividend Paying Whole of Life policies available in the UK?

Henry Riano

whole life for 10 years please sends me the information

male born in 1952.

thanks

Insurance&Estates

Hello Henry, if you would like information go ahead and request a call from Barry Brooksby at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Bez danie

Which one is better? Limited Permium pay up to age 23 for kids and up to age 68 for adults or premium pay up to age 121.

Age kids 7 and 10, adults 33 and 43

Thank you

Insurance&Estates

Hello, the best thing to do is get some real numbers by connecting with our limited pay expert Barry Brooksby. You can connect with him directly at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Samantha

Hey , can someone contact me to go over the different companies and decide the best fit for whole life insurance for me .

Thanks 😊

Insurance&Estates

Hello Samantha, I suggest you check in with Barry Brooksby to get started. You can connect with him at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Agatha Stratourides

Please send me lowest quotes for Lafayette 10-yr. limited pay whole life insurance with PUAs for 30-yr. old woman standard and preferred rates to my email only.

Insurance&Estates

Hello Agatha, we’ve passed your request to one of our Pro Client guides. If you haven’t yet connected, reach out to barry@insuranceandestates.com.

Best, I&E

Lydia Spicer

Send me lowest quotes for Lafayette whole life insurance for 58 yr old male and 54 yr old woman to my email only. Do not call me.

Insurance&Estates

Hi Lydia,

Thank you for stopping by. We hope you are finding the site informative.

We will send you an email from @insuranceandestates.com. Please keep an eye out for it.

Sincerely,

I&E

George

I am going to purchase life insurance. I am going with a term policy, but I am contemplating if I should go with a whole life policy, I could convert into a whole life before the term expires, but in the long run, would it be cheaper to get whole life right away?

I&E

Make sure the company you are contracting with for term life offers whole life conversions. Certain whole life companies are going to have far superior options than others so you might want to take that into consideration when choosing your term life company.

It will be cheaper to get whole life right away rather than waiting 10 years or more down the road primarily due to the premium payment difference going up significantly once you reach 40. Term is cheap while you are young but gets more and more pricey as you age. If you lock into a whole life policy now you pay a lower premium. Plus, you can choose a limited pay policy and not have to make premium payments later.

One question you need to ask is, “am I going to live 20-30 more years or am I going to outlive my term policy?” Whole life is the optimists life insurance policy because you know you are going to live well into your 90s so having a policy that builds cash value and lasts your whole life is the far better choice. Unless of course, you die young.