Co-Written By: Jason Herring, Pro Client Guide

14 years Life Insurance & Estate Planning expertise | Series 6, 63, 65 Licensed | Prudential Pinnacle Award Winner 2014-2015

Look, after decades of working with clients, I’ve seen just about every retirement strategy out there. And here’s what I’ve learned: most people are tired of being hostage to the stock market’s wild swings. After watching 50% of their portfolio vanish (twice in some cases), they’re looking for something different.

That’s where Life Insurance Retirement Plans come in. Having spent 70+ combined years in the trenches of life insurance planning, our team has watched LIRPs emerge as a powerful alternative for those seeking financial security without the rollercoaster ride.

But let me be clear – this isn’t for everyone. And it’s definitely not the magic bullet some advisors claim it is. What it is, though, is a distinctive form of permanent life insurance that uses cash value to provide retirement income without risking your principal.

Table of Contents

- Key Takeaways

- Introduction to Life Insurance Retirement Plans (LIRPs)

- How LIRPs Actually Work

- Understanding LIRP Policy Structures for Cash Value Growth

- Benefits of LIRPs: The Pros You Should Know

- Navigating the Challenges: The Real Cons of LIRPs

- Choosing a Company that offers the Best LIRP

- How LIRPs Stack Up Against Other Retirement Plans

- Final Thoughts: Is a LIRP Right for You?

- Frequently Asked Questions About LIRPs

Key Takeaways

📊 Quick Facts About LIRPs (2025)

- Contribution Limits: No statutory maximum (vs. $23,000 401k limit)

- Market Protection: 0% floor guaranteed in IUL, guaranteed growth in Whole Life

- Tax Treatment: Tax-free withdrawals up to basis, tax-free loans

- Early Access: No 10% IRS penalties like 401(k)/IRA

- Death Benefit: Tax-free payout to beneficiaries

- Typical Returns: 4-6.5% (IUL) / 4-5.5% (Whole Life)

Introduction to Life Insurance Retirement Plans (LIRPs)

The problem: too often people are held captive to the highs and lows of the stock market, which provides much uncertainty and fear, particularly as one nears retirement.

The solution: Provide a safe and stable alternative that you can store your savings in that provides a decent rate of return but with limited to no downside.

I had a client last month – successful doctor, about five years from retirement – who told me, “I just can’t handle another 2008. If the market crashes again right when I retire, I’m done.” This is a common fear I hear regularly in my practice.

There are 4 areas of concern that should be addressed as part of any retirement financial planning:

- 1. Longevity Risk

- 2. Sequence-of-Return Risk due to Market Volatility

- 3. Cognitive Decline

- 4. Inflation

How permanent cash value life insurance addresses each of these problems.

1. Longevity Risk: A huge fear of many nearing or in retirement is longevity risk, which is the risk of outliving your retirement savings. A properly designed permanent life insurance policy will last your entire life and provide an increasing cash value account and increasing tax free death benefit.

2. Sequence-of-Return Risk: a volatile stock market is always a concern for someone nearing retirement or at the beginning of their retirement. One bad year and it can greatly effect your retirement plan and how much you can withdraw from your account. Having an asset such as whole life insurance that is not correlated to the stock market can give you an alternative cash flowing asset to draw from in bad market years.

3. Cognitive Decline: Both Indexed Universal Life and Whole Life have riders that provide critical illness and long-term care protection. Also, asset-based long term care products are also available that mix permanent coverage and long-term care insurance into one.

4. Inflation: As mentioned above, a properly designed permanent life insurance policy will last your entire life and provide an increasing cash value account and increasing tax free death benefit. This will help you hedge against inflation.

The life insurance retirement plan, a/k/a a LIRP, is a powerful financial tool that we have seen firsthand provide many benefits and has been used by millions of Americans to protect and secure their financial future. It is a permanent life insurance policy with a cash value component, focused on capital preservation and compound growth, without the fear of loss.

The following LIRP video below provides a real-life case study. The video is focused on retirement planning and offers an excellent breakdown of the benefits of a LIRP powered by whole life insurance.

How LIRPs Actually Work

A LIRP works by taking a properly structured cash value life insurance policy, that is designed for maximizing the cash value growth, and uses it as an alternative source of income in retirement. The cash value provides the tax-free income through withdrawals and policy loans.

A Term life insurance policy is not going to work for a LIRP. Term life insurance provides death benefit protection and does not have a cash value account. And a guaranteed universal life insurance policy will not work as it typically is designed for permanent life insurance coverage but very little, if any, cash value growth.

Just last week, I had a client who thought any life insurance policy could work as a LIRP. Not true. The chassis matters tremendously.

A LIRP can be created using any number of permanent life insurance companies and policies. You can choose participating whole life, indexed universal life and variable universal life. Each type of life insurance coverage has its pros and cons associated with it.

A whole life insurance policy offers fixed premiums and fixed costs. An indexed universal life insurance policy provides 0% loss protection but potential for higher gains than whole life. And in our experience, a variable universal life insurance policy is not generally recommended for a LIRP due to its inherent volatility and associated risk.

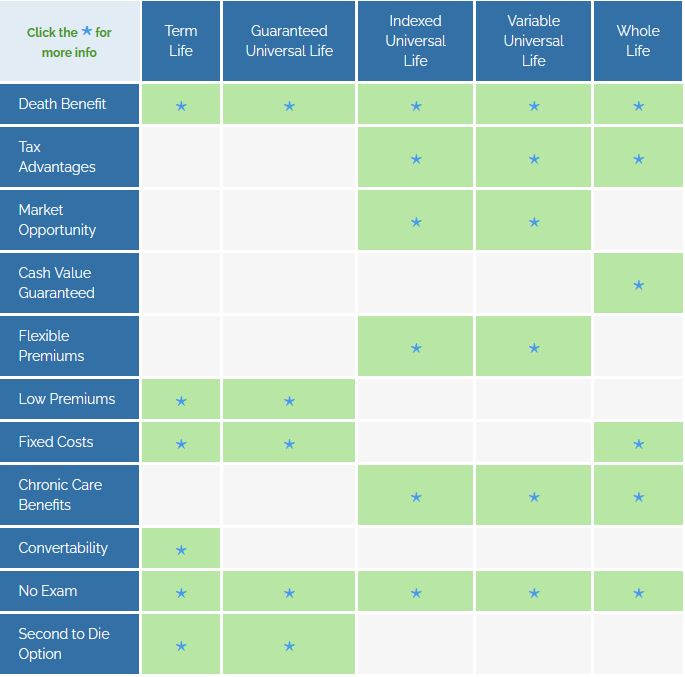

Comparing Different Life Insurance Policies

Understanding LIRP Policy Structures for Cash Value Growth

The two best permanent life insurance policies for a LIRP will be either:

The good news about either of these permanent life insurance policies is they can be properly structured so that the focus is on growing your cash value versus a large initial death benefit. The death benefit can grow over time, but the primary purpose of the LIRP is to act as a retirement plan, providing an alternative income source to other retirement accounts such as the 401k and IRA.

Let me emphasize this point: proper policy design is everything. I’ve seen too many clients come to me with existing policies that were structured for maximum commission rather than maximum cash value growth. That’s not how we do things.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Benefits of LIRPs: The Pros You Should Know

Freedom to Spend Other Assets

A permanent death benefit allows for more flexibility in spending other retirement assets. If you know that your beneficiaries will receive a tax-free death benefit upon your passing, you can freely spend down other assets.

This psychological benefit shouldn’t be underestimated. I’ve worked with clients who were so afraid of running out of money that they lived far below their means during retirement, only to leave behind a substantial estate they never enjoyed.

Increased Social Security Benefits

Using your life insurance policy’s cash value as income can delay taking Social Security, leading to higher benefits. For each month you wait to start your benefits, your monthly benefit will be higher—for the rest of your life.

We recently helped a couple postpone taking Social Security for three years by supplementing their income with LIRP distributions. The result? A 24% higher lifetime benefit that will add up to over $100,000 in additional income over their retirement years.

Protection From Losses

For many Americans that had saved with traditional investment strategies, the crash in 2008 was enough to devastate their portfolios. Many saw more than 50% of their portfolio given back to the market in massive sell-offs.

And while it’s true that these Bear markets are typically followed by Bull markets, that isn’t a solid encouragement for those that planned on retiring in 2009 or 2010, who suddenly had to get a lesson on sequence-of-returns risk.

A Guaranteed Floor

Depending on the chassis you choose for your LIRP, either whole life or indexed universal life, a LIRP provides a floor to your investment returns, also known as a guarantee. The guarantee means that you will never have a year in which you take a loss, and depending on your product choice and cash value allocation you may be able to get a guarantee that you’ll never get less than 3 or 4%.

In order to get the guarantee and the safety that comes along with it, you will give up some of the big gains that come in the incredible bull market years.

So you won’t be getting 20% when the market is booming, instead you may only get 10%. But for many that is a price they’re more than willing to pay to get a solid guarantee that they’ll never lose money, and not losing money is the key to true compound interest returns.

Guaranteed Death Benefit

In addition to guaranteed returns, you also get a guaranteed death benefit. The life insurance death benefit is paid to your beneficiaries income tax free.

And the tax free death benefit on a life insurance retirement plan can be designed to increase each year as your cash value grows, so when you do die, your beneficiary receives the maximum death benefit possible. It is also a great way to hedge against inflation, as the purchasing power of our dollar is cut in half every 25 years.

Retirement Income in Life and Replacement Income in Death

In life, your LIRP can be used as tax-free income via withdrawals up to your basis or you can borrow against your cash value. Having a steady stream of tax-free income from your policy is a great way to supplement your retirement income.

In death, a life insurance retirement plan provides income protection in the event that you can no longer provide that retirement income for those you love. In the event of your death, the LIRP provides a tax free death benefit to your beneficiaries.

Long Term Care

And if you have chosen the disability features within a LIRP, you can even provide for you spouse and family if you are permanently disabled, need long-term care or are terminally ill via long term care and chronic illness riders.

While the goal of properly designed Life Insurance Retirement Plan is to provide living benefits for you and your loved ones that last your entire lifetime, one of the key benefits is that it also provides death benefit protection if you die unexpectedly.

The peace of mind that comes from a LIRP is a great advantage, and it’s one reason why the LIRP is sometimes considered a self-completing retirement plan.

Hedge Against Rising Tax Rates

Most retirement strategies are either fully taxed, or tax-deferred. What that means is that you either pay taxes every year on the gains you receive from your investments (fully taxed), or you defer taxes on your gains and pay them when you withdraw your funds (tax-deferred).

The LIRP is not like either of these strategies, it is tax-free.

How can a LIRP be tax-free?

First and foremost the money that you invest in typical tax-deferred investments is paid for with pre-tax money. Whereas with a LIRP you pay for it with after-tax money.

So the government has already been paid to some degree. But what about the gains in your investment – when do you pay tax on those?

With a LIRP you will pay taxes on the gains if you choose to withdraw the money beyond your basis in the policy.

However, the gains don’t have to be withdrawn to be accessed. You can choose to borrow from your gains instead of withdrawing, and thereby gaining access to your money tax-free.

What about Interest?

The typical question about borrowing from a LIRP is “If it’s a loan, don’t I have to pay interest?”

The answer is yes, and no.

You do pay interest when you borrow from your LIRP, but due to the fact that you also receive interest from your LIRP, the loan typically ends up being a wash loan. These loans are often called wash loans because you earn what you pay, so it’s a wash.

But what does all this have to do with a hedge and rising tax rates? A hedge just means that something is a barrier, or a protection against, something.

In this case, having a tax-free retirement vehicle means that tax rates can rise to 50% and it won’t impact your retirement because you will be accessing your funds tax-free.

In other words, the tax situation for those with life insurance retirement plans are much more secure and predictable than those with other strategies where paying taxes is involved.

KEY ADVANTAGE

Uninterrupted Compounding: A Unique Whole Life LIRP Advantage

Here’s where LIRPs really shine compared to traditional retirement accounts, and it’s something most financial advisors won’t tell you about. When you take withdrawals from a 401(k) or IRA, that money is gone from your account. It stops working for you completely. Your account balance decreases, and all future growth on that withdrawn amount disappears.

But with a properly designed whole life LIRP, something remarkable happens. When you take a policy loan, your entire cash value continues to earn the guaranteed interest rate and dividends as if you never took the loan at all. The full amount stays intact within the policy, earning true uninterrupted compound growth.

“Your money is effectively working in two places at once – both inside your policy AND being used for whatever purpose you need.”

Think about that for a moment. Your money is effectively working in two places at once:

- Inside your policy, continuing to grow uninterrupted

- In your hands, being used for whatever purpose you need

I had a client last year who couldn’t wrap his head around this concept until I showed him his annual statement. He had taken a $50,000 policy loan for a real estate investment, yet his cash value was still earning dividends on the full pre-loan amount. “So you’re telling me my money is both in my rental property AND still growing in my policy?” Exactly.

This creates a powerful wealth-building dynamic that traditional retirement accounts simply cannot match. With a 401(k) or IRA, withdrawals permanently reduce your balance and cripple the compounding effect. With LIRPs, your money continues its compounding journey undisturbed.

For retirement income planning, this is a game-changer. While traditional retirement accounts gradually deplete as you withdraw funds (potentially running dry if you live longer than expected), a LIRP can provide income while maintaining—and even growing—your cash value base throughout retirement.

Over decades, this difference in how withdrawals are handled can result in hundreds of thousands of dollars in additional wealth and significantly more sustainable retirement income.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Penalty Free Loans and Withdrawals

With a LIRP, you can access your money without penalty for anything you need it for, including an investment opportunity that may arise. One way to access your money is a withdrawal. You can take out as much as you need up to your basis and not be taxed. Additionally, you can take out a tax-free loan by borrowing against your cash value, producing a tax free income stream.

A 401(k) may allow you to do the same thing, but the access to your money comes at a cost. With a 401(k) plan, if you access your money prior to age 59.5, you will pay a early withdrawal penalty. The penalty for early withdrawals that don’t meet the hardship criteria is 10%, and of course you are taxed on these as well.

I remember working with a business owner who needed capital for an expansion opportunity. With his LIRP, he was able to access $150,000 without triggering taxes or penalties. Try doing that with a 401(k)!

Infinite Banking

To those that have never heard of Infinite Banking or Be Your Own Bank, it’s a concept that allows you to use your LIRP to fund various financing endeavors for yourself or others.

In order to be your own banker, you need to use your saved money within the LIRP to finance various ventures, such as purchasing cash flowing assets or investing in your business. You then use the proceeds from your investment to pay back your loan, repeating the process as opportunities arise.

Long-Term Care

Life Insurance Retirement Plans also provide protection against the high cost associated with long-term care. Most LIRP policies provide for accelerated death benefits that can be used if you are diagnosed as terminally ill.

You can even add additional long-term care riders or chronic illness riders for further protection, providing access to your death benefit while you are still alive to cover costs such as nursing and in home care.

High Funding Limit

For those who are below the income requirement threshold for funding a ROTH IRA, there still is the problem of limitations on how much you can put into the Roth IRA. Currently, the maximum you can contribute to a ROTH IRA is $7,000 under age 50 and $8,000 over age 50.

However, there are very high limits on how much you can place into a LIRP, generally a multiple of your income based on your age. And there is no income threshold prohibiting you from funding a LIRP, beyond what you can qualify for. That is why cash value life insurance is referred to as the “Rich Person’s Roth.”

Navigating the Challenges: Cons of LIRPs

When it comes to the negatives of a LIRP there are two primary areas that detractors focus on. One area is price, and the other is the growth rate. We will address both of these challenges.

LIRP’s Are Too Expensive

When someone says a LIRP is too expensive, we have to ask, compared to what? And the “what” is always term life insurance. The reason this is insincere is because term life only lasts for a period of time, has no cash value, and lacks many of the benefits of a LIRP.

Most financial advisors that are critical of LIRPs like to compare term vs whole life insurance to shock the reader into a state of disbelief.

Often such comparisons will posit the cheapest term insurance to the most expensive permanent life insurance. And the person making this comparison will repeat the financial mantra “buy term and invest the rest“.

The problem is, no one actually does this. And the idea that you can simply self insure is disingenuous.

For one, no one knows when they are going to die. And with a LIRP, you get a leveraged death benefit that pays out income tax free to your beneficiary under section 7702 of the IRS.

And two, with a properly designed policy your death benefit GROWS. So that when your number finally does come up you have a much larger death benefit then when you began, creating a legacy that will most likely exceed anything you could have obtained to had you listened to the status quo advice of financial advisors who want to grow their AUM (assets under management).

LIRP’s Slow Growth vs Stock Market

Most financial entertainers bash permanent life insurance because the returns are lower than the stock market’s historic average return. However, consider that a life insurance retirement plan can be used to supplement investment accounts in down years to protect against sequence of returns risk.

Sequence of Returns Risk

When the market drops 20-40% in a year, the last thing you want to do is take money out of the account for retirement income. That is one way a LIRP provides financial protection in retirement, as it offers an alternative source of income when the market has down years.

Average vs Actual Returns

We also need to consider actual returns vs average returns. If you get a 100% return in year 1, and a negative 50% return in year 2, your account balance would be the same as when you started which is an actual return of 0%. But if you add the two years together (100-50=25) you get an average return of 25%. So you see how math can be manipulative and make people think they can get a greater return that what they actually get.

Further, consider how five consecutive years of 10% returns can be easily wiped out by one -40% return. And to make matters worse, you have now lost 6 years.

Keep in mind this is only comparing rate of return, we haven’t even talked about how much of the money you get to keep (taxes), or how easy it is to access your money.

Choosing the Company that Offers the Best LIRP

There are three things to consider when choosing a company for the ideal life insurance retirement plan.

- Choose a reputable mutual insurance company. We believe mutual companies that are beholden to the policy holders are better choices than the companies that only answer to their shareholders.

- Choose a company that has a proven track record of performance. Not all life insurance companies have great returns year after year. We recommend choosing companies that have historically outperformed their competitors, such as companies with a history of excellent life insurance dividends, or higher participation and cap rates.

- Choose a company that is top rated, flexible and allows for a variety of options. You never know what the future holds, and therefore having a life insurance retirement plan with a company that provides financial security and policy flexibility is a huge bonus.

How LIRPs Stack Up Against Other Retirement Plans

In this section we break down how a LIRP stacks up to other retirement plans such as the 401(k) and an Individual Retirement Account (IRA).

| Feature | LIRP | Traditional 401(k) | Roth IRA |

| 2025 Contribution Limits | No statutory limit (based on insurance qualification) | $23,000 ($30,500 for age 50+) | $7,000 ($8,000 for age 50+) |

| Tax Treatment of Contributions | After-tax | Pre-tax (tax deductible) | After-tax |

| Tax Treatment of Growth | Tax-deferred | Tax-deferred | Tax-free |

| Tax Treatment of Withdrawals | Tax-free (via policy loans or withdrawals up to basis) | Fully taxable as ordinary income | Tax-free (qualified withdrawals) |

| Required Minimum Distributions (RMDs) | None | Required at age 73 (increasing to 75) | None during owner’s lifetime |

| Early Withdrawal Penalties | None (potential surrender charges in early years) | 10% penalty before age 59½ (with exceptions) | 10% penalty on earnings before age 59½ (with exceptions) |

| Market Risk | Guaranteed minimum (0% floor in IUL, guaranteed growth in WL) | Full market exposure (based on investments) | Full market exposure (based on investments) |

| Death Benefit | Yes (tax-free to beneficiaries) | No (account value only) | No (account value only) |

| Income Limits for Contributions | None | None | Phase-out begins at $146,000 (single) / $230,000 (married) in 2025 |

| Fees/Costs | Insurance charges, admin fees, potential surrender charges (0.8-1.5% annually) | Fund expense ratios, admin fees (0.2-1.0% annually) | Fund expense ratios (0.2-1.0% annually) |

| Creditor Protection | Strong in most states | Strong federal protection | Varies by state |

| Long-Term Care Benefits | Available with riders | None | None |

| Typical Annual Returns | 4-6.5% (IUL); 4-5.5% (WL)* | 7-10% (historically)** | 7-10% (historically)** |

| * Returns depend on policy design, company performance, and crediting methods ** Based on historic market performance, actual returns will vary with investment choices and market conditions |

|||

401(k) & IRA

1. Maximum annual contribution limits.

Participants in traditional IRAs and 401(k) plans are only allowed to contribute up to a certain amount each year. With a LIRP, there is no statutory maximum contribution limit.

2. Required minimum distribution (RMD) rules.

When a traditional IRA and 401(k) plan participant turns 73, they are required to start withdrawing at least a certain amount from the account every year going forward. If they don’t, they will face a financial penalty from the IRS. With a LIRP, there are no RMDs.

3. IRS early withdrawal penalty.

With an IRA or 401(k) plan, if you withdraw funds before turning 59 ½, you could incur a 10% “early withdrawal” penalty from the IRS. This is in addition to any taxes that you owe. In contrast, a LIRP does not have early withdrawal penalties.

4. Withdrawals are usually 100% taxable.

Another significant drawback to traditional 401(k)s is that withdrawals are usually 100% taxable. With a LIRP, withdrawals up to your basis in the policy are tax-free and you can also take out a tax-free life insurance loan, using your death benefit as collateral.

5. No Death Benefit

Most people considering a life insurance retirement plan are not focused on the death benefit but one thing that needs to be said is that a LIRP has a death benefit and a 401(k) and IRA do not. So if you die prematurely, your family is financially protected with a LIRP, but not so much with an IRA or 401(k).

Final Thoughts: Is a LIRP Right for You?

As experienced professionals with backgrounds in Life Insurance and Estate Planning, we at Insurance and Estates firmly believe that a Life Insurance Retirement Plan (LIRP) is a vital component of a robust financial strategy.

Our deep dive into the LIRP concept has shown that, while it may not be the perfect fit for everyone, it offers unique advantages such as tax-free retirement income, flexibility, and financial security. It’s a powerful tool especially beneficial for those seeking to diversify their retirement portfolio and mitigate risks like market volatility and rising tax rates.

I’ve seen LIRPs transform retirement strategies for hundreds of clients. But I’ve also advised many prospects that a LIRP wasn’t right for their situation. That’s because I’m more interested in finding the right solution than in making a sale.

If you’re considering a LIRP, ask yourself these questions:

- Are you maxing out your other tax-advantaged accounts?

- Do you have concerns about market volatility affecting your retirement?

- Are you in a high tax bracket now or expect to be in retirement?

- Do you value flexibility in accessing your funds without penalties?

- Is legacy planning important to you?

If you answered yes to several of these, a LIRP might be worth exploring further. We encourage individuals to consider how a LIRP might align with their long-term financial goals and to reach out to us for tailored advice and insights on incorporating this strategy into their retirement planning.

Ready to Secure Your Retirement Future?

After working with hundreds of clients, we’ve seen firsthand how a properly structured LIRP can transform retirement planning. But every situation is unique, and personalized guidance is essential.

Take the next step toward financial security with a one-on-one strategy session with our LIRP experts. We’ll help you determine if a Life Insurance Retirement Plan aligns with your goals and how to optimize it for your specific situation.

No pressure, no sales tactics – just straightforward advice to help you make an informed decision.

Frequently Asked Questions About LIRPs

What is the minimum amount I should contribute to a LIRP?

While there’s no technical minimum, we typically recommend at least $500 monthly for the strategy to be effective. The sweet spot for most of our clients is between $1,000-$5,000 monthly, depending on their overall financial situation.

Can I lose money in a LIRP?

Unlike market investments, properly structured LIRPs have built-in protection against market losses. However, in the early years, surrender charges could result in receiving less than you’ve contributed if you terminate the policy. This is why we recommend viewing a LIRP as a long-term strategy.

How soon can I access cash value in my LIRP?

With optimal policy design focusing on cash accumulation, you can typically access some cash value within the first year. However, substantial cash value typically develops within 3-5 years. This varies by company, policy type, and design specifics.

Are LIRPs only for high-income earners?

While high-income earners often benefit most from the tax advantages, we’ve implemented successful LIRP strategies for clients with moderate incomes as well. The key is consistent funding and proper policy design rather than income level alone.

What happens if I can’t make premium payments?

Unlike traditional whole life policies, modern LIRPs typically offer flexibility for premium payments. If you experience financial hardship, you can often reduce or temporarily suspend premium payments, allowing the policy to sustain itself from existing cash value. However, this will affect long-term performance.

How does a LIRP compare to a Roth IRA?

Both offer tax-free growth and distributions, but LIRPs have no contribution limits or income restrictions, no early withdrawal penalties, and include a death benefit. However, Roth IRAs typically have lower fees and more investment options. We often recommend both as complementary strategies.

Can I convert my existing retirement accounts to a LIRP?

Direct rollovers from qualified retirement accounts into life insurance aren’t permitted. However, you could take distributions from existing accounts (paying applicable taxes) to fund a LIRP as part of a comprehensive strategy. This should be carefully evaluated for tax implications.

What are the best companies for LIRPs?

Based on our experience, the mutual companies with the strongest dividend histories and most flexible policy designs tend to work best for LIRPs. These include companies like Penn Mutual and Lafayette Life for whole life designs, and companies like Mutual of Omaha and John Hancock for indexed universal life designs.

How are LIRP loans different from traditional loans?

Unlike traditional loans, LIRP loans don’t require credit checks, applications, or specific repayment schedules. You’re essentially borrowing against your own money while your cash value continues to grow as if you hadn’t taken the loan. Additionally, these loans don’t appear on credit reports and can’t be denied as long as you have available cash value.

Can I use a LIRP if I already have a 401(k) or IRA?

Absolutely. In fact, most of our clients use LIRPs as a complementary strategy alongside their qualified retirement plans. This creates tax diversification, giving you options in retirement for how to take income in the most tax-efficient manner based on your circumstances at that time.

67 comments

Kristy

I have read your article and would like more information. I am 65 and my husband is 68. We currently have IRA’s and Roth’s. Do you have any additional documentation?

Thanks, Kris

Insurance&Estates

Kristy,

I recommend that you reach out to our LIRP pro Jason Herring by emailing jason@insuranceandestates.com.

Best,

Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Michael Iliescu

I am trying to find a good LIRP insurance agent in Arizona. My contact info is 480-XXX-XXXX and my cell is 480-XXX-XXXX

Insurance&Estates

Hi Michael,

I recommend that you reach out to Jason Herring by emailing jason@insuranceandestates.com to request a call if you haven’t already connected with him.

Best,

Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

John Hoxie

What determines the surrender charge? Why is it so much? Hasn’t the company already made enough off the product? Is the surrender charge also deducted if the death benefit is paid?

SJG

Hello John, thanks for your question. All UL policies have surrender changes. When you start a policy, the insurance company is counting on premium dollars to be paid. Companies take the premiums and invest them to make money. There is also a cost to the company to start a policy (applications, underwriting, medical exams, medical records, state filing fees, commissions,etc). Surrender charges are a way for a company to get back some of the cost in the early years of the policies if a client walks away from the policy. Most carriers have 10 to 15 year surrender periods, and the charge decreases each year until there is no longer a charge.

I hope this helps.

Best, Steve Gibbs for I&E

Mike

I’m retiring in a few days. Is it too late to start?

Insurance&Estates

Hello Mike, sorry for the delay as we are moving our main office:)

It isn’t too late to start. Lump sums with proper designs can aid in quickly establishing cash value growth. To get started, I suggest you connect with Barry Brooksby by emailing him to request a call at barry@insuranceandestates.com if you haven’t ready.

Best, Steve Gibbs for I&E

James

What is my best lirp for maximum retirement and little to none in death benefit?

Insurance&Estates

Hi James, the best next step to get your questions answered is to connect with Barry for individual discussion by emailing Barry Brooksby at barry@insuranceandestates.com.

Best, Steve Gibbs, for I&E

Mike Masztal

My 18 yo daughter is planning on joining the military after high school. She now works part-time and worked full time last summer. She doesn’t spend much. I convinced her to open a Roth which she did and puts in $200/mo. She had $5k in savings and close to $4K in her Fidelity Roth. For sure, we will have Euro-level taxes when she gets to middle age, if not sooner. So, would a LIRP be reasonable to supplement to her Roth given her age and if so, how much should she begin funding the LIRP on a monthly basis?

Insurance&Estates

Hello Mike, funding a LIRP can certainly be a great vehicle for your daughter to supplement her Roth. To set up, would need to determine her budget and contributions would be based upon base premium plus paid up additons with a schedule of withdrawals beginning at a certain age. To get started, go ahead and email Barry Brooksby to request a call at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Robin

Would like recommendations on a LIRP.

Insurance&Estates

Hi Robin, we have a lot some LIRP resources on our website to educate you and when you’re ready, you can connect with our expert Barry Brooksby at barry@insuranceandestates.com.

Best, Steve Gibbs, for I&E.

Mica

I’m 29/yo and am not able to use ROTH IRAs due to my income level. I’m looking for alternative tax advantaged/tax free options for early retirement income. Would you recommend using a LIRP to save/invest over a 10-20 year period before starting to pull funds out for early retirement? Thanks

Insurance&Estates

Hello, we generally do highly recommend a LIRP with a properly designed high cash value mutual whole life policy for this kind of strategy. If you haven’t yet connected with one of our experts, go ahead and reach out to Barry Brooksby at barry@insuranceandestates.com.

Best, Steve Gibbs for I&E

Mica

Can you remove my full name from this? Thanks

Insurance&Estates

Done.

I&E

SJ

Does it still make sense to consider shifting into a LIRP with a long-term care benefit from tax deferred accounts at age 72?

Insurance&Estates

Hello, that question would be best addressed in a 1 to 1 consultation with one of our experts. To schedule, go a head and e-mail Barry Brooksby directly at barry@insuranceandestates.com.

Best, I&E

Dilip

I am looking to. It a LIRPfor me and my wife we are both 40. I am also looking for a LIRP for my 8 year old if that’s a possibility, can you help?

Insurance&Estates

Hi Dilip, we’ve passed your request to one of our Pro Client guides. If you haven’t yet connected, reach out to barry@insuranceandestates.com.

Best, I&E

DJ

Hi I&E Team

First, a great article, thank you very much for the details.

A couple of questions, your advice is much appreciated.

1. I am in the midst of working with an IUL specialist and wondering if you can shed some additional light on MEC (Defined under IRC7702). i.e. when will be policy be termed MEC, with some examples would be helpful to digest the scenario.

2. Sai asked the same question (I have a significant contribution in previous employer 401K) in the comment section, so I would like to know the answer to the question: Can I rollover funds from my ex-employers 401k into LIRP? What are the tax implications of doing that? don’t know much about rule 72(t) but is this a viable option?

Regards

DJ

Insurance&Estates

Hi DJ,

Thanks for commenting and your feedback. If you’re already working with a qualified IUL advisor, he or she should be able to advise you concerning the MEC rules and tax consequences concerning any rollovers. On the other hand, our agents would prefer to work with you exclusively due to the time and effort involved and if you’d like a second opinion on your IUL option, let us know by connecting with Jason Herring at jason@insuranceandestates.com.

Best, Steve Gibbs, for I&E

Todd

Do you assist in the sale of life insurance policies?

Insurance&Estates

Hello Todd, yes we do. Please feel free to connect with Jason Herring at jason@insuranceandestates.com.

Best, Steve Gibbs for I&E

Doris F Abravanel

I would like to know if a LIRP makes sense for me. Can someone get in touch with me please.

Insurance&Estates

Hello Doris, we’ve forwarded your request to Jason Herring. If you haven’t yet connected, reach out to him at jason@insuranceandestates.com.

Best, I&E

Hemant Patel

I am 67 and working full time my wife is 61. We have one son 33 married. We have whole life policies on both our life and a survivor policy. We want to talk to you about LRIP. It looks you are the right person for us to discuss our situation. If you’re available to discuss further let us know. If possible Tel contact.

Insurance&Estates

Hello Hemant, I believe Jason has already reached out to you, but if you haven’t connected yet, go ahead and e-mail him at jason@insuranceandestates.com.

Best,

I&E Pro Team

Sai

Hi

Can I roll over funds from my ex employer’s 401k into LIRP? What are the tax implications of doing that? I heard about rule 72(t). Is this a viable option?

Thanks

Sai

Insurance&Estates

Hi Sai, I believe one of our Pro Client Guides has reached out to you. If not, please feel free to e-mail Jason Herring, jason@insuranceandestates.com.

Best,

Steve Gibbs for I&E

jim cinberg

Wish to review with one of your reps the virtue of myself, age 73 and still working, who has a DBP but wish to use LIRP to provide a tax free stream so that after the current 2026 tax levels stop to minimize the taxes that I’ll be responsible for with my salary, social security and >2 million in tax deferred with their RMDs. I’ve little need for life insurance per se as my spouse will inherit all and have little concerns as she’ll not have my salary to contend with as a tax burden.

thanks.

Jim

Insurance&Estates

Hi Jim, thanks for your insightful comment. Jason Herring most likely has reached out to you. If not, feel free to e-mail him to schedule a conversation at jason@insuranceandestates.com.

Best, Steve Gibbs, for I&E

kumar

Hi,

I am age 35 and want to know the benefit of buying LIRP as compared to buying a 30 year term and fully fund roth 401K. Don’t they have limit on LIRP contribution?

Insurance&Estates

Thanks for your interest and comment! Jason Herring, our National Sales Director, will reach out to you soon.

Best, Steve Gibbs for I&E

James

Question re LIRPs–What are the pros and cons of setting one up for a couple ages 67 and 73?

Insurance&Estates

Hello James, thank you for inquiring. I’ve asked Jason Herring, our top product expert and National Sales Director, to follow up with you.

Best, Steve Gibbs for I&E.

Robert Black

Right, only 2 cons which were dismissed immediately. Sales pitch, never discusses fees or liquidation of assets. Been to a presentation before, get ALL the facts. They will reply, ” We will get back to you.”

Insurance&Estates

Hello Robert, thanks for your comment, although I’m not sure exactly what you’re getting at. Are these cons you’ve experienced concerning the LIRP strategy in general or your perception of something that should’ve been included in the article? Not sure where the reference to “sales pitch” or “they” is directed so simply trying to clarify.

Best, Steve Gibbs for I&E.

Jonathan

enjoyed the articles. I read the IUL and the LIRD. I had a company i sat with mention a IUL.

Your articles were very informative.

Insurance&Estates

Jonathan,

Thank you for the feedback. We appreciate you taking the time to let us know our articles were informative.

Best regards,

I&E

Judy Hajek

I am interested in a LIRP. My husband and I are 55 and 52 respectively. We have 1 mil between our IRA’s and 401K’s, Most of the amounts are in taxable accounts. I’m trying to reduce our taxes in retirement and have read a little about the LIRP. I’d like to know if it makes sense for us at this time in our lives. We both plan to retire at age 60.

Insurance&Estates

Hi Judy,

Thank you for reaching out. Please keep an eye out for our reply via the contact information you supplied.

Sincerely,

I&E

Razi Salman

Is there a way for me to avoid interest received with LIRP?

Thanks,

Razi

Financial Services Mania

A cornerstone of financial planning is the recognition that everyone’s economic and life situation is unique. Personalized service is essential when matching clients with the right financial products and services, and you’ll get nothing less from us.

We will do best Retirement planning with whole life insurance is a powerful strategy that is … “traditional” components of a life insurance retirement plan( LIRP)

Independent, objective portfolio analysis

Asset allocation review

Long-term care cost-benefit analysis

Estate tax reduction and financial legacy review

Insurance&Estates

Yes, everyone’s life and economic situation is unique. There certainly is no “one-size-fits-all” product. Thank you for your insightful comment.

Gisselle

Interested in opening an LIRP

Steven Pfeiffer

I have a significant portfolio, my wife and I are 60 and would be interested in what you might have to offer.

Insurance&Estates

Hello Steven, great to hear of interest and thanks for reading. Will have one of our experienced Pro-Client Guides, Jason or Denise, reach out to you soon.

Best,

Steve Gibbs

TJ Gill

I have some questions and would like to talk to your advisors. Please send me some contact info (Phone # etc.) Thanks

Insurance&Estates

Hello TJ, thank you for your interest. You can e-mail us at info@insuranceandestates.com with any specific questions or contact information or call us at 877-787-7558. Let us know if you’d like to have one of our Pro-Client Guides reach out to you?

Best,

Steve Gibbs

Cindi

I have money in my IRA that a LIRP firm wants me to take $18,000 out of and put in a LIRP. I am 64. Does this make sense? And how long do I have to keep it in before I can take out?

Insurance&Estates

Hi Cindi,

Thanks for stopping by. We would be happy to work with you but we cannot give out specific information to your unique circumstances through the comment section of our website. Please give us a call if you would like a complimentary strategy session.

Sincerely,

I&E

Greg

I am just learning about LIRP’s, and recently heard about a hybrid model where the interest earned ceiling was higher but had a 1 – 2 percent potential loss floor. Would you explain these further for me?

Insurance&Estates

Greg,

We sent an email answering your posted question. Please check your inbox.

Thank you,

I&E

Mark

My wife and I invested in a lirp three years ago. We have been hit with financial hardship and when I asked our financial planner about liquidating the lirp or rolling it over into a traditional annuity they told us that the investment could not be liquidated for what we had invested. In fact he told us that none of the one hundred thousand dollars would be refundable back to us which sounds completely insane Does this sound right?

Insurance&Estates

Mark,

Thank you for reaching out to us. We will be in contact with you shortly.

Sincerely,

I&E

Amulya

I wish you would post the reply here publicly, so that others with same questions can find out the answers.

Kurt Kaufman

I would like more info about creating a Life Insurance Retirement Plan.

Insurance&Estates

Kurt,

Thank you for stopping by and for leaving the request. We will reach out to you shortly with some additional information on LIRPs.

Sincerely,

I&E

Mike

Great article. My wife and I started a LIRP last year to supplement about 500k in 401k savings. With 25 years until retirement we set our LIRP up under 10k annual payments to provide a $5000 monthly income at age 65. Thank you for the great read.

Insurance&Estates

Mike,

Happy Memorial Day! Thanks for stopping by. Glad you enjoyed the article.

Sincerely,

I&E

gary

Can you wrap in supplemental medical, dental, etc insurance, disability, rehab, etc. into a LIRP?

Jack Maverick

Very good question from Gary – I hadn’t thought of that. 🙂

Insurance&Estates

Gary,

Thank you for the inquiry. We will reach out to you shortly via the contact info you provided.

Sincerely,

I&E

Rk

Interested is in lirp with minimal death benefit and premium. Mainly interested for health riders and tax free access.

Thanks