When evaluating the top life insurance companies in 2025, Nationwide continues to stand out as a financially strong, customer-focused insurer with an impressive array of products. As a Fortune 100 company with over 95 years of experience, Nationwide balances the stability of a modern mutual company with innovative solutions for protection, growth, and retirement income. This comprehensive review examines Nationwide’s diverse product lineup, financial strength, and specialized offerings like their industry-leading long-term care solutions to help you determine if they’re the right fit for your insurance and financial planning needs.

Table of Contents

About Nationwide Insurance

Company Highlights

- Founded in 1926, with over 95 years of experience

- Fortune 100 company operating as a modern mutual

- Fourth consecutive year of record sales in 2024

- Nearly $21 billion in member claims and benefits paid in 2024

- Diverse product portfolio spanning life insurance, annuities, and specialized solutions

- Headquartered in Columbus, Ohio with nationwide presence

Nationwide is one of the largest insurance and financial services companies in the world. With a history spanning over 95 years, the company has built a reputation for stability, comprehensive coverage options, and customer-focused solutions.

Operating as a modern mutual company, Nationwide balances long-term stability with innovation. The company’s various products are underwritten by Nationwide Mutual Insurance Company and Affiliated Companies, though not all affiliated companies are mutual insurance companies, and not all Nationwide members are insured by a mutual company.

As a diversified provider, Nationwide offers an extensive range of financial and insurance products, including property and casualty insurance, life insurance, retirement savings solutions, asset management services, and strategic investments. This breadth of offerings allows the company to serve individual consumers, business owners, and corporate clients with specialized needs.

Ready to compare Nationwide with other top insurers?

Get personalized life insurance quotes from multiple A-rated companies.

Nationwide Ratings & Financial Strength

Nationwide maintains exceptional financial strength ratings, reflecting its stability, risk management practices, and ability to meet policyholder obligations:

| Rating Agency | Current Rating | Rating Category | Outlook |

|---|---|---|---|

| A.M. Best | A+ | Superior | Stable |

| Standard & Poor’s | A+ | Strong | Stable |

| Moody’s | A1 | Good | Stable |

| Comdex Ranking | 89 | Out of 100 | N/A |

| BBB | A+ | Highest Rating | N/A |

A.M. Best’s A+ (Superior) rating for Nationwide Life Insurance Company and its subsidiaries reflects the company’s “strongest” balance sheet, strong operating performance, and robust risk management practices. This top-tier rating indicates excellent ability to meet ongoing insurance obligations and financial commitments to policyholders.

Beyond financial ratings, Nationwide has demonstrated consistent performance, with 2024 marking its fourth consecutive year of record sales. The company attributes this success to its diverse product portfolio, strong distribution relationships, and commitment to protection-focused solutions.

THE ULTIMATE FREE DOWNLOAD

The Estate Planners Tactical Guide

Essential Legal Protection for Achievers

2025 Product Updates

Latest Developments at Nationwide

Nationwide continues to demonstrate strong growth and product innovation in 2025, building on its record performance in recent years. The company has expanded its product offerings while maintaining focus on customer-centric solutions and financial stability.

Performance & Growth

Nationwide has reported impressive financial performance and market growth:

- Record Sales Performance: 2024 marked Nationwide’s fourth consecutive year of record sales, highlighting the company’s momentum in the insurance and financial services market.

- Member Claims and Benefits: Nearly $21 billion in claims and benefits were paid to members in 2024, demonstrating the company’s commitment to fulfilling its financial obligations.

- Annuity Market Leadership: Nationwide has experienced three consecutive years of record annuity sales, with 2024 figures up 12% year-over-year. While 2025 sales are expected to normalize, they remain well above pre-pandemic levels.

- Community Investment: The company continues to invest in community impact and charitable giving programs, reinforcing its values-based approach to business.

Recent Innovations

Nationwide has introduced several product innovations and enhancements:

- Defined Protection℠ Annuity (DPA): Launched as Nationwide’s first Registered Index-Linked Annuity (RILA), this product features a floor structure to limit losses, three defined protection levels, and enhanced growth opportunities for investors seeking both protection and upside potential in volatile markets.

- Enhanced Digital Tools: New online capabilities for policy management, claims processing, and customer support have improved accessibility and streamlined the customer experience.

- Platinum Edge® Fixed Annuity: Updates to this flagship fixed annuity include a market value adjustment (MVA) feature for higher yield potential, addressing the needs of conservative investors seeking guaranteed income with growth potential.

- Life Insurance Enhancements: Simplified underwriting processes, expanded no-exam options, and improved living benefits have strengthened Nationwide’s competitive position in the life insurance market.

Nationwide Insurance Products

Nationwide offers a comprehensive range of life insurance products designed to meet various protection needs and financial objectives:

Term Life Insurance

Key Features of Nationwide Term Life Insurance:

- Life Essentials: No-exam term life insurance with coverage up to $1.5 million, available in 10 or 20-year terms. This product can be purchased online but is not convertible to permanent insurance.

- Guaranteed Level Term: Available in 10, 15, 20, or 30-year terms with higher coverage amounts. Requires a medical exam but is convertible to permanent insurance and offers optional accelerated death benefit riders.

- Level Premiums: Both options feature fixed premiums throughout the initial term period.

- Renewal Options: Policies can be renewed (with premium increases) after the initial term expires.

- Additional Benefits: Options for living benefits, coverage for children, and other customizable features.

Nationwide’s term life insurance provides affordable, temporary death benefit protection for specific periods, making it suitable for income replacement, mortgage protection, family protection during working years, and other time-limited insurance needs. The availability of both no-exam and fully underwritten options allows for flexibility based on individual health status and coverage requirements.

Whole Life Insurance

Key Features of Nationwide Whole Life Insurance:

- Permanent coverage with fixed premiums and guaranteed death benefit

- Guaranteed cash value growth component

- Living benefits through chronic, critical, and terminal illness riders

- Minimum coverage: $10,000 (Nontobacco Standard), $100,000 (Nontobacco Preferred), $250,000 (Nontobacco Preferred Plus)

- Note: Nationwide’s whole life policies do not pay dividends to policyholders

Nationwide’s whole life insurance provides lifelong coverage with the stability of fixed premiums, guaranteed death benefits, and cash value accumulation. These policies are designed for individuals seeking permanent protection with guaranteed values and simplicity. While Nationwide whole life policies do not pay dividends, they offer reliability through contractual guarantees and living benefit options.

Universal Life Insurance

Key Features of Nationwide Universal Life Insurance:

- Flexible premiums and adjustable death benefit options

- No-Lapse Guarantee option to ensure the policy remains in force even if cash value decreases

- Living access benefits for chronic, critical, or terminal illness

- Death benefit starting at $100,000

- Issue age up to 85, providing coverage options for older applicants

- Cash value growth based on a declared interest rate

Universal life insurance from Nationwide combines permanent protection with premium flexibility and adjustable features. With options for guaranteed coverage and living benefits, these policies provide versatility for changing financial situations. The No-Lapse Guarantee feature offers peace of mind by ensuring coverage continues even during periods of minimal premium payments or reduced cash value.

Indexed Universal Life Insurance

Key Features of Nationwide Indexed Universal Life Insurance:

- Permanent coverage with cash value growth linked to market index performance (e.g., S&P 500)

- Downside protection with guaranteed minimum interest rates

- Upside potential through index crediting strategies

- Flexible premiums and death benefit options

- Living benefit options and customizable features

- Tax-advantaged cash value accumulation and access

Indexed Universal Life (IUL) insurance from Nationwide provides permanent protection with the potential for higher cash value growth linked to market index performance. These policies feature downside protection through minimum interest guarantees while allowing participation in market gains without direct market risk. IUL is particularly suitable for individuals seeking growth potential beyond traditional fixed-interest policies while maintaining insurance protection.

Variable Universal Life Insurance

Key Features of Nationwide Variable Universal Life Insurance:

- Investment-focused permanent policy with access to a range of subaccount options

- Professional guidance for cash value investments through financial advisors

- Maximum growth potential among life insurance options (with corresponding investment risk)

- Flexible premiums and adjustable death benefits

- Tax-advantaged investment growth and access options

- Advisory VUL plan providing professional management of investment allocations

Variable Universal Life (VUL) insurance from Nationwide offers the highest growth potential among the company’s permanent life insurance options, allowing policyholders to allocate cash value among various investment subaccounts. These policies are designed for individuals comfortable with investment risk who seek maximum growth potential within a life insurance framework. The Advisory VUL option provides professional investment management for those preferring guided allocation decisions.

Need help finding the right Nationwide policy?

Speak with our insurance specialists about your specific needs and goals.

Long-Term Care Solutions

Nationwide is a standout provider in the long-term care insurance market, offering innovative asset-based solutions that combine life insurance with long-term care benefits:

YourLife CareMatters

Key Features of Nationwide YourLife CareMatters:

- Combination universal life insurance with long-term care rider

- Available for ages 40-75

- Flexible payment options: single premium, 5-pay, or 10-pay

- Cash indemnity benefit that doesn’t require receipts for reimbursement

- Guaranteed minimum death benefit (20%) even if all LTC benefits are used

- Optional inflation protection: 3% simple or 5% compound interest

- Customizable benefit periods from 2-7 years

- Flexibility to use benefits for various care options, including home modifications and family caregivers

Nationwide YourLife CareMatters is a fully-customizable asset-based long-term care solution that combines the benefits of universal life insurance with comprehensive long-term care coverage. This innovative product addresses the growing concern of long-term care costs while providing multiple benefits: cash value growth, a death benefit for beneficiaries, return of premium options, and long-term care protection through a cash indemnity model.

Long-Term Care Benefits

To qualify for long-term care benefits under Nationwide’s YourLife CareMatters, one of two scenarios must occur:

- The insured is unable to perform 2 of 6 activities of daily living (ADLs), or

- The insured requires care due to a cognitive impairment such as Alzheimer’s disease, Parkinson’s disease, or Dementia.

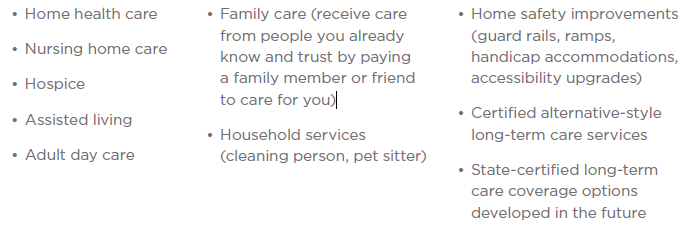

Once eligible, the cash indemnity benefit provides remarkable flexibility, allowing policyholders to:

- Receive monthly benefits without submitting receipts for reimbursement

- Use funds however they choose, including for uncovered services or family caregivers

- Make home modifications to support aging in place

- Pay for housekeeping or other services that maintain normal living

- Take less than the maximum benefit amount to extend the benefit period

- “Bank” unused benefit amounts for future needs

The Long-Term Care Cost Challenge:

Long-term care expenses continue to rise, creating a significant financial risk for many Americans. Current costs include:

- Nursing Home Care: Approximately $100,000+ per year

- Assisted Living: Around $50,000+ per year

- In-Home Care: Approximately $4,000+ per month

These costs are expected to continue rising due to inflation, making proactive long-term care planning increasingly important.

Annuity Products

Nationwide is a leading provider of annuities, with record growth in this segment and innovative product offerings designed for retirement income and asset protection:

Fixed Annuities

Key Features of Nationwide Fixed Annuities:

- Guaranteed interest rates for specified periods

- Principal protection and predictable growth

- Tax-deferred accumulation

- Flexible payout options, including lifetime income

- Death benefits for beneficiaries

- Nationwide Platinum Edge®: Flagship fixed annuity with market value adjustment (MVA) feature for higher yield potential

Nationwide’s fixed annuities provide guaranteed growth and income options for conservative investors seeking stability and predictable returns. These products offer principal protection, tax-deferred growth, and various income options, making them suitable for retirees and pre-retirees looking to secure guaranteed income streams while minimizing investment risk.

Indexed Annuities

Nationwide offers indexed annuities that provide:

- Interest crediting linked to market index performance

- Downside protection with minimum guaranteed values

- Higher growth potential than traditional fixed annuities

- Tax-deferred accumulation

- Various income options, including lifetime income guarantees

- Death benefit protection for beneficiaries

Registered Index-Linked Annuities (RILA)

Nationwide Defined Protection℠ Annuity (DPA):

- Nationwide’s first RILA product, launched in 2023

- Features a floor structure to limit losses in down markets

- Three defined protection levels for customizable risk management

- Enhanced growth opportunities compared to traditional fixed annuities

- Designed for investors seeking both protection and upside potential in volatile markets

- Tax-deferred growth advantages

- Flexible surrender periods and liquidity provisions

The Defined Protection℠ Annuity represents Nationwide’s entry into the growing RILA market, offering a middle ground between the complete protection of fixed annuities and the higher growth potential (with corresponding risk) of variable annuities. This innovative product has contributed to Nationwide’s record annuity sales, addressing the needs of retirement investors seeking balanced solutions in fluctuating market environments.

Policy Riders & Options

Nationwide offers various riders and policy options to enhance coverage and customize policies to individual needs:

| Rider/Option | Description | Available On |

|---|---|---|

| Long-Term Care Rider | Provides access to death benefit for qualified long-term care expenses | Select permanent policies |

| Accelerated Death Benefit | Allows early access to death benefit for terminal illness | Most policies |

| Accidental Death Benefit | Provides additional death benefit if death results from an accident | Most policies |

| Children’s Term Insurance | Provides term coverage for children of the insured | Most policies |

| Extended No-Lapse Guarantee | Ensures policy remains in force regardless of cash value performance | Universal life policies |

| Overloan Lapse Protection | Prevents policy lapse due to excessive loans against cash value | Certain permanent policies |

| Waiver of Premium | Waives premium payments if the insured becomes disabled | Most policies |

| Inflation Protection (LTC) | Increases long-term care benefits to help offset inflation (3% simple or 5% compound) | CareMatters policies |

These riders and options allow for significant customization of Nationwide policies to address specific concerns and objectives. From protecting against disability to enhancing long-term care benefits, these additions can transform a standard policy into a comprehensive financial solution tailored to individual needs.

Customer Service & Support

Nationwide provides multiple channels for customer support and service:

| Contact Method | Details | Availability |

|---|---|---|

| Life Insurance & Annuity Sales | 1-877-245-0761 | Business hours (M-F) |

| Customer Service | 1-800-848-6331 | Business hours (M-F) |

| Website | nationwide.com | 24/7 access |

| Online Account Management | Policy details, payments, changes | 24/7 access |

| Mobile App | Account access and service options | 24/7 access |

Nationwide is known for its good customer service and transparency regarding product details. The company has invested in digital tools and support options to enhance the customer experience, though the level of service may vary depending on the complexity of requests and specific departments involved.

Term vs. Permanent Insurance: Making the Right Choice

Term life insurance from Nationwide offers affordable, temporary protection ideal for specific time-bound needs like mortgage protection or family income replacement during your working years. With options for no medical exam coverage up to $1.5 million, term insurance provides cost-effective protection for defined periods.

Permanent insurance (whole, universal, indexed universal, variable universal) provides lifelong coverage with the additional benefit of cash value accumulation, making it suitable for legacy planning, estate planning, business continuation, and as a financial asset that can be accessed during your lifetime through loans or withdrawals.

The right choice depends on your specific financial goals, budget, timeframe for coverage needs, and whether cash value accumulation is important to your overall financial strategy. Many clients benefit from a strategic combination of both coverage types.

Nationwide Life Insurance Review Conclusion

Nationwide stands as a financially strong, customer-focused insurance provider with a diverse portfolio of products designed to address various protection, accumulation, and income needs. With exceptional financial ratings, including an A+ (Superior) from A.M. Best, the company demonstrates the stability and claims-paying ability that consumers seek in a long-term financial partner.

The company’s comprehensive life insurance lineup includes competitive term options (including no-exam coverage up to $1.5 million), whole life for guaranteed permanent protection, and various universal life options offering flexibility and growth potential. Nationwide’s standout offering remains its YourLife CareMatters product, an innovative asset-based long-term care solution that provides cash indemnity benefits with exceptional flexibility for policyholders.

In the annuity space, Nationwide continues to demonstrate market leadership with record sales and product innovation, including the introduction of its first Registered Index-Linked Annuity (RILA). These retirement income solutions complement the company’s protection-focused products, creating a comprehensive ecosystem for financial planning.

Long term care is expensive and the costs and services will likely continue to increase into the future. Currently, you can expect to pay around $100,000 a year for a nursing home and $50,000 a year for assisted living. In-home care currently costs around $4,000 a month, with these numbers growing annually due to inflation.

Nationwide’s focus on product diversity, customer service, and financial strength position it as a top choice for consumers seeking protection, growth, and retirement income solutions. While no company is perfect for every situation, Nationwide’s broad product portfolio and solid reputation make it worthy of consideration for many insurance and retirement planning needs.

Is Nationwide the best company for meeting your specific insurance and retirement planning needs?

The answer depends on your individual financial situation, goals, and preferences. Nationwide offers competitive products across multiple categories, with particular strengths in long-term care solutions, flexible permanent life insurance, and retirement income products. Their focus on products that combine protection with accumulation potential makes them especially suitable for comprehensive financial planning.

So what can you do? The first step would be to get informed. We can help you with the life insurance and long-term care planning side. If you are interested in a Nationwide policy or any of the other companies we represent, please reach out to us for personalized guidance.

Ready to See if Nationwide Insurance is Right for You?

Let us help you determine if Nationwide or another top insurance company better fits your specific financial goals.

Get a personalized quote and compare options from multiple A-rated insurance providers.

REQUEST YOUR FREE CONSULTATION

No obligation • Customized to your needs • Compare multiple top companies

4 comments

Scott

Nationwide stopped paying a dividend on a whole life policy, where they had been paying for years?! Don’t count on these folks paying a dividend long term…it’s like they sucker punch you for a while…they are high cost provider!

Insurance&Estates

Scott,

Sorry to hear that. Obviously, that is not a good business practice. In the end, a company’s reputation is all they have.

Sincerely,

I&E

Enrique Pardi

I want information about LIFE TERM INSURANCE – please write me

Insurance&Estates

Enrique,

Thank you for stopping by. Term life insurance is a rather broad topic. Is there specific information you are interested in? You can always give us a call if you have specific questions. Also, please see our article comparing and contrasting the differences between term life vs whole life.

Sincerely,

I&E