Life insurance payouts increased in 2020 to a record high. Reportedly, death benefits reached levels not seen since the 1918 flu pandemic. Whether this is a reflection of COVID-19 or other factors (such as the aging baby boomer population in general) is a matter of some debate. In any event, that statistic represents a 15% increase from 2019. Total life insurance death benefit payouts were reportedly up to $90 billion, the highest ever on record to date.

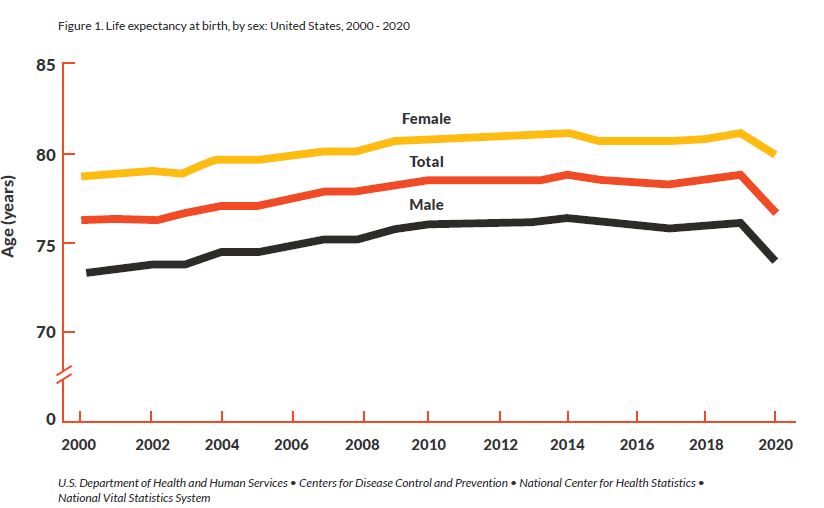

One thing is certain, over the past couple of years, the COVID-19 response drastically changed the way that we all live and work. By some metrics, the events of past 2 years have reduced the average life expectancy in the U.S. by nearly two years. Some of these statistics, as they relate to COVID-19, are impacted by how data is compiled and intrepreted and many argue that regulatory measures have exacerbated these statistics. While some contend that COVID-19 has become the third leading cause of death behind cancer, heart disease, and diabetes, questions continue to arise as to the distinction between deaths caused by COVID-19 as opposed to deaths with COVID-19.

With all of the above in mind, these dramatically increasing mortality rates have necessitated some new rules for mutual life insurance companies, some specifically related to the Covid-19 era.

To put this all in context from a life insurer standpoint, the CDC recently reported that 75% of Covid deaths had 4 comorbidities. As is usually the case, the healthier you are, you will more likely fare better against COVID-19 or any coronavirus, as well as a host of other things life throws your way.

Given the number of Coronavirus cases that have resulted in additional hospitalizations and/or deaths, one of the hardest hit industries in this global health pandemic era may arguably be insurance – and in particular, life insurers. However, to suggest that life insurance carriers are struggling may be an overstatement.

The life insurance industry typically estimates its risk, premium rates, and ultimately its profitability, based on long-term mortality and health-related data. So, given the increase in mortality rates, the impact of the coronavirus era has created some changes that could impact the way people purchase life insurance coverage going forward.

More than ever, if you plan to buy life insurance in the near future, the type of insurer that you choose can make a big difference.

Increased Claims Lead to Higher Risk for Insurers – But Not All Insurers are Faring the Same Way

According to LIMRA (the Life Insurance Marketing and Research Association), during just the initial “shock” period of the COVID-19 pandemic in 2020, the insured population in the United States suffered 12% more deaths than average.

For many insurers, though, this did not cause financial-related panic, as most carriers have money set aside in their reserves. In addition, a significant number of the early COVID-related deaths were among the older population – many of which are not covered by life insurance.

But as COVID-19 surpassed the one-year mark, things began to change – including a rise in the death rate of younger individuals. Again, what has caused this increase in mortality among the younger population deserves careful consideration. While some contend it is solely due to Omicron and other Coronavirus variants, others point to drug abuse, suicide, depression, domestic violence and other societal ills contributing to these numbers.

Similarly, among the older population, one reason for an increase in mortality is due to untreated health issues among the older population and those who already had a pre-existing condition.

For the foregoing reasons, the global life insurance industry was hit with reported claims of $5.5 billion in just the first nine months of 2021 – even though insurers were counting on lower death benefit payouts due to the rollout of COVID vaccines. This figure far outweighs the $3.5 billion for the entire year of 2020.

Claims rose primarily in the United States, due in part to more lethal COVID variants, as well as a rise in fatalities, as discussed above, among younger groups. For instance, Aegon – which conducts more than 65% of its life insurance business in the U.S., stated that claims in the Americas just during the third quarter of 2021 were more than three times higher than the same time period the year prior.

Tallying Insurers’ Losses and Preparing for More Risk Ahead

With the number of COVID-19 related deaths in the U.S. at approximately 835,000 (between the time period of January 2020 and January 12, 2022), no one knows what the future holds.

According to some experts, the initial Coronavirus that was identified in China in December 2019 could last as long as five years – and that could lead to a significant increase in risk for life insurers.

Further, additional deaths could plateu, continue or decrease as the COVID virus becomes more of an endemic – similar to the flu – noting of course the the flu also can cause numerous deaths each year, even to those who have been received a flu vaccine.

Even so, the way an insurance company is structured could have a direct impact on how – or even if – it is struggling financially, in this case, due to the Coronavirus pandemic.

Stock vs Mutual Co

For instance, there are stock insurance companies and mutual insurance companies. The major difference between the two is in their ownership structure.

A stock insurance company is owned by its shareholders, and it can be either publicly or privately traded.

Conversely, mutual insurance companies are owned by their policyholders.

Although both types of insurers work under the premise of providing coverage to their policyholders, the main goal of a stock insurance carrier is to maximize profits for its shareholders, whereas the primary mission of a mutual insurer is to continuously maintain enough capital to meet their policyholders’ needs.

Therefore, the policyholders of a stock insurance carrier do not have any control over the management of the insurer – unless they are also an investor in the company’s stock.

But the policyholders of a mutual insurance company are also considered to be its owners, and can in turn vote on its board of directors and have at least somewhat of a say in how the company is managed.

Another key difference between the two types of insurance companies lies in the carriers’ earnings, and what is ultimately done with them. In this case, a stock insurer may distribute its surplus profits (if there are any) to the shareholders in the company – who may not necessarily also be customers (i.e., policyholders).

Mutual insurers, however, may distribute their profits to policyholders by way of dividends. They may also retain the earnings in exchange for future premium discounts on coverage – which again can benefit the actual customers of the carrier.

Even given the challenges that were – and have continued to be – faced by insurers due to COVID-19, it is estimated that the insurance industry as a whole returned nearly $13 billion in premiums throughout the year 2020.

Of this, mutual insurance companies returned approximately $6.1 billion, primarily via policyholder dividends, and stock insurers returned roughly $6.8 billion, mainly through premium credits.

Based on data from The Mutual Factor 2021 report, for the year 2020, mutual insurers were estimated to have actually grown their surplus by 8.3%, whereas stock companies’ surplus grew by only 6.7%. The growth in surplus was primarily attributed to the following:

- An increase in unrealized capital gains

- Insurer income from the soaring stock market and declining interest rates

Further, mutuals’ five-year compounded average growth rate of 6.6% outperformed stock companies’ five-year surplus growth rate of 6.4%.

By the second quarter of 2021, though, the policyholder dividend ratio for mutual insurers was normalized to pre-pandemic levels of approximately 1%. However, the dividend ratios of stock insurance carriers remained flat through this same time frame, due in part to these companies’ returning money to their insureds via premium credits.

As it pertains to financial stability, both stock and mutual insurance carriers are typically rated by one or more insurer ratings agencies, including S&P, A.M. Best, Moody’s, and/or Fitch.

While all of the agencies structure their ratings in a slightly different manner, the scores or grades generally indicate the solvency of an insurance carrier, as well as its financial strength, and its ability to pay its policyholders’ claims.

While these ratings are considered to be opinion (versus fact), they are still oftentimes reviewed by both policyholders and financial professionals alike in determining the overall reliability of the insurance carrier to be there if or when a claim is filed.

The financial strength and stability of mutual insurers fared quite well as the COVID-19 pandemic made its way into its second year in the United States. For example, in the first half of 2021, there were 26 insurance companies that had their ratings upgraded by A.M. Best.

Of these carriers, 73% were mutual insurers as compared to just 27% being stock insurance companies. This same time period saw only 33% of the 15 total insurers with ratings downgrades attributed to mutual carriers.

On the insurance professional side, the 2021 Mutual Factor report showed that mutual insurance carriers are perceived as delivering better than other companies on six key criteria that agents use when selecting carriers for their clients.

Among these criteria are fair claims settlement practices and excellent communication. These more favorable perceptions by insurance professionals translates into more positive business for mutual insurers.

Post COVID Life Insurance Premiums and Underwriting Requirements

Oftentimes, being reminded of one’s mortality tends to prompt thoughts of how (or even whether) survivors will fare in the event of a worst case scenario. In this case, life insurance inquiries have increased since the pandemic began.

In fact, in just the first half of 2021, the total number of life insurance policies sold in the U.S. increased by 8% as compared with the first six months of 2020. Based on data from LIMRA’s Second Quarter U.S. Individual Life Insurance Sales Survey, this is the highest life insurance policy sales growth in nearly four decades.

But, being interested in purchasing – and even applying for – life insurance may become a challenge going forward. Some experts believe that surviving COVID-19 could make obtaining life insurance coverage more difficult – which would not be very welcome news for the millions of individuals who have been afflicted by the Coronavirus and have overcome it…a number that continues to grow by the day, both in the United States and around the globe. The other side to this concern is the protection afforded by natural immunity, as future findings may impact life insurance eligibility in a positive way, and many studies suggesting such findings are now at the forefront and under review.

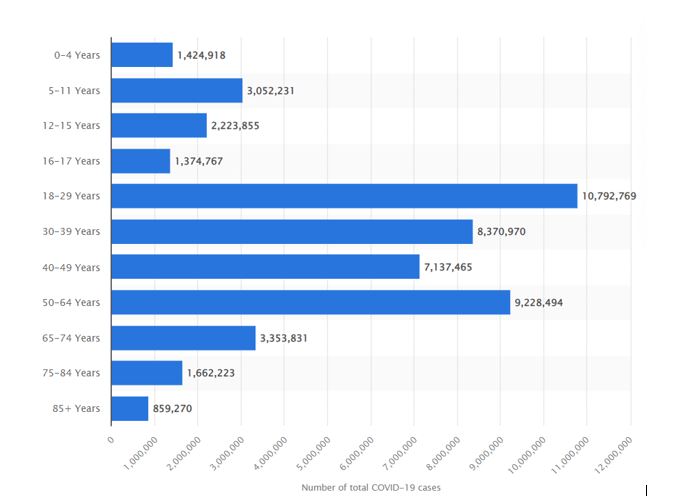

As of mid-January 2022, the total number of reported COVID-19 cases in the U.S. is just under 50 million, with the three hardest-hit age groups being 18 – 29, 50 – 64, and 30 – 39 – all prime age ranges for having various life insurance coverage needs.

Total Number of COVID-19 Cases in the United States by Age Group

(As of January 13, 2022)

Source: Statista https://www.statista.com/statistics/1254271/us-total-number-of-covid-cases-by-age-group/

COVID-related deaths and long-term illness could certainly force insurance carriers to set aside more in their reserves in order to make good on their claims payouts in the future – and this, in turn, could result in the need to charge higher premiums for coverage.

Considerations When Purchasing Life Insurance Going Forward

Presently, having contracted COVID-19 does not jeopardize and individual’s chances of obtaining life insurance coverage (provided that there are no other serious health issues with the applicant).

However, according to some actuaries, rising death benefit claims have started to eat into the excess capital that life insurance carriers set aside in order to ensure their solvency. With that in mind, these funds will have to be recouped somehow – and one of those solutions is higher premiums charged to policyholders.

In addition, a drop in average life expectancy – also brought about by the COVID-19 pandemic – puts more risk on the table for insurance carriers. Therefore, this can also factor into life insurance underwriting, as well as the premiums that are charged for coverage.

So, what can consumers anticipate if applying for life insurance in the future?

First, the life insurance screening process could become more complicated for applicants, as insurance carriers try to fully assess one’s true health condition, either positively or negatively – particularly if they have been afflicted by COVID in the past.

Here, for instance, more applicants may be required to undergo full medical exams as versus being evaluated via only a review of medical records and the answers to health-related questions on the application for coverage, especially because no one really knows for sure what the long-term effects of contracting – and surviving – COVID are yet. A similar question; however, could emerge concerning the long term impacts of vaccinations and booster shots.

With that in mind, insurers could also require more in-depth information from applicants across the board, both impacting those who have survived the Coronavirus and those who’ve been vaccinated.

Insurers are concerned about organ health, and long term health issues like pneumonia and other respiratory problems that could ultimately lead to an earlier death of a potential insured.

Even so, if an individual has otherwise been healthy, their chances of obtaining life insurance coverage may not be impacted.

In any case, it may be in anyone’s best interest to purchase life insurance sooner rather than later, before more screenings and/or regulations are put in place by insurers.

Otherwise, there is the risk of paying higher (possibly much higher) premiums for the same amount of coverage, as well as the possibility of being denied for protection as insurance carriers become more strict in their underwriting requirements.

Taking Steps for Finding the Right Life Insurance Coverage for Your Needs

While the COVID-19 pandemic may not necessarily equate to a more pressing need for life insurance, this type of coverage is certainly recommended for anyone whose passing could result in financial hardship on others, such as a surviving spouse, dependent children, and/or business partners.

If you do fall into this category, though, life insurance may become more difficult – and more expensive – to obtain as the risk of paying claims increases for insurers, and in turn, premiums are raised.

Depending on the insurance carrier, it is also possible that life insurance policy options could be adjusted, resulting in limited choices based on an applicant’s age and/or the terms and conditions of the coverage.

The type and amount of life insurance coverage that is needed (if any) will depend on factors that are unique to each individual, though. These criteria will typically include current and future financial obligations, as well as income replacement that may be required by survivors.

Once a type and amount of life insurance coverage has been narrowed down, other criteria must also be examined – such as the age and health of the proposed insured – in order to decide which insurance carrier may provide the individual with the proper coverage at a fair premium price.

When deciding on a life insurance policy to purchase, it is recommended that you work with a professional who is well-versed in how this type of coverage works, and who can assist you with “customizing” a plan to fit your – and your loved ones’ – specific short- and long-term objectives.

If you would like additional information, or if you would like to set up a time to talk with an insurance specialist who can answer any questions that you may have, feel free to contact Insurance and Estates by phone at (877) 787-7558 or via email by going to info@insuranceandestates.com. We look forward to hearing from you.