In the realm of personal finance, few decisions loom as large as how to handle mortgage debt. For many homeowners, the allure of paying off their mortgage early is strong. After all, who wouldn’t want to own their home outright and be free from monthly payments? However, in the complex world of modern finance, what seems intuitive isn’t always the most financially advantageous path.

This article will explore an alternative strategy: using the money you might put towards early mortgage payments to instead fund a high cash value whole life insurance policy. We’ll examine the pros and cons of each approach, with a particular focus on security, risk management, and long-term financial growth.

The Saver’s Dilemma in Our Current Financial System

Before we delve into the specifics of mortgage payoff strategies, it’s crucial to understand a fundamental challenge faced by savers in our current economic environment. Our financial system, with its tendency towards inflation and low interest rates, often punishes those who prioritize saving. Traditional savings accounts and many conservative investments struggle to keep pace with inflation, resulting in a loss of purchasing power over time.

This reality leaves many financially prudent individuals in a quandary. They desire the security and peace of mind that comes with saving, but they also need their money to work for them and grow over time. It’s in this context that we need to evaluate the decision of paying off a mortgage early.

The Appeal of Paying Off Your Mortgage Early

Advantages:

1. Emotional Relief: There’s an undeniable psychological benefit to being debt-free. Eliminating a mortgage can lift a significant mental burden.

2. Increased Budgeting Flexibility: Without a mortgage payment, you have more discretionary income each month.

3. Interest Savings: Every dollar applied to principal is not accruing future interest, potentially saving hundreds of thousands over the life of the loan.

4. Simplified Finances: Owning your home outright can make it easier to sell or refinance in the future.

5. Reduced Foreclosure Risk: With no mortgage, you eliminate the risk of losing your home due to missed payments.

The Hidden Costs of Early Mortgage Payoff

While these advantages are significant, there are several drawbacks to consider:

1. Opportunity Cost: Every dollar used to pay down your mortgage is a dollar not invested elsewhere, potentially missing out on higher returns.

2. Loss of Tax Deductions: Mortgage interest is tax-deductible for those who itemize, though recent tax law changes have made this less impactful for many homeowners.

3. Reduced Liquidity: Home equity is not easily accessible. Tapping into it usually requires selling the home or taking out a new loan.

4. Suboptimal Use of Funds: If your mortgage interest rate is low (as many have been in recent years), you might earn a better return by investing elsewhere.

5. No Additional Protection: Paying off your mortgage doesn’t provide any additional insurance or death benefit protection for your family.

6. Increased Vulnerability: With more of your wealth tied up in your home, you’re more exposed to real estate market fluctuations and potential disasters.

For example, if the real estate market drops, your home’s market value could drop significantly. Also, if your home is destroyed in a fire you may have a tough time recovering enough payout from home owners insurance policy to cover it.

Equity Doesn’t Equal ROI: A Critical Consideration

Before we explore the alternative strategy using whole life insurance, it’s crucial to understand a fundamental concept about home equity: Equity doesn’t equal Return on Investment (ROI).

Many homeowners rush to pay off their mortgages, believing that increasing their home equity will somehow boost their overall returns. However, this is a common misconception. The appreciation of your home – which is your actual return on investment – is not affected by how much equity you have.

Consider this example:

Imagine two identical homes in the same neighborhood, both valued at $300,000:

- Home A has a $200,000 mortgage (33% equity)

- Home B is owned free and clear (100% equity)

If property values in the area increase by 5% over the year, both homes will appreciate to $315,000, regardless of the equity position. The owner of Home A gains $15,000 in appreciation with only $100,000 tied up in the house, while the owner of Home B gains the same $15,000 but with $300,000 tied up in the house.

This illustrates a crucial point: Your home’s return on investment is based on its total value, not your equity. Paying down your mortgage faster doesn’t increase your home’s rate of appreciation.

By understanding this concept, we can see that aggressively paying down a mortgage might not be the most efficient use of your money. It doesn’t increase your returns, and it ties up your wealth in an illiquid asset.

The Whole Life Insurance Alternative

Instead of paying extra on your mortgage, consider directing those funds into whole life insurance. And not just any whole life policy but a high cash value whole life insurance policy. These are strategically designed policies that focus on cash value growth versus the death benefit and provide much better returns than traditional policies.

Advantages of Whole Life Insurance:

1. Guaranteed Returns: Properly designed whole life policies are offer guaranteed cash value growth, with potential for higher returns through dividends.

2. Tax Advantages: Cash value grows tax-deferred, and loans against the policy can be taken tax-free.

3. Liquidity: Cash value can be accessed tax-free through policy loans or withdrawals up to your basis (amount you paid in).

4. Death Benefit: A properly designed whole life policy has a growing death benefit that provides additional financial protection for your family.

5. Asset Protection: In many states, life insurance cash values are protected from creditors. Get sued and have a judgment against you? Based on your jurisdiction, your entire cash value may be protected.

6. Infinite Banking Concept: Use your policy as your own “bank” to finance purchases and investments, recapturing interest you’d otherwise pay to traditional banks.

Case Study 15 Year versus 30 Year Mortgage

To better illustrate how this strategy works in practice, let’s look at a detailed case study. In the following video, we break down the numbers comparing a 15-year mortgage payoff strategy with a 30-year mortgage combined with a whole life insurance policy:

You can view the illustration from the video below

As demonstrated in this video case study, the strategy of combining a 30-year mortgage with a whole life insurance policy can potentially lead to significant wealth accumulation over time. Let’s explore this concept further with the Asset Multiplier Approach.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

The Asset Multiplier Approach

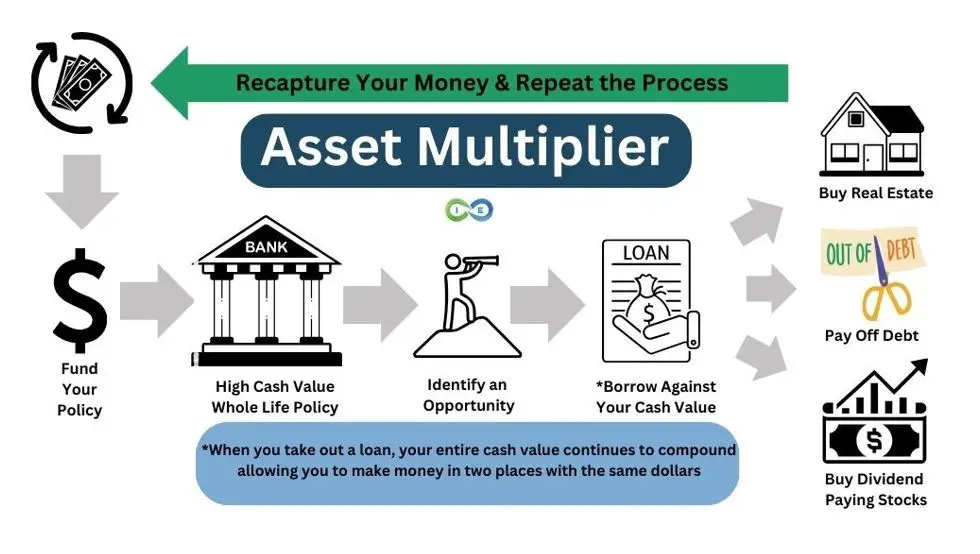

One powerful strategy is called the Assert Multiplier Blueprint. You use your whole life policy’s cash value as an opportunity fund to acquire more assets. Here’s how it works:

1. Fund your policy over time, building up cash value, your “opportunity fund.”

2. Take a loan against your cash value to purchase income-producing assets (e.g., rental properties, businesses).

3. Use the income from these assets to repay the policy loan and continue funding the policy.

4. Repeat the process, potentially accelerating your wealth growth.

This approach allows you to leverage your policy’s cash value to acquire assets that can generate returns higher than the policy loan interest rate, all while maintaining your growing death benefit protection.

Unlike a paid-off house, a whole life policy can act as an “opportunity fund” to help you acquire income-producing assets. Here’s a simplified example:

1. Instead of putting an extra $20,000/year towards your mortgage, you fund a whole life policy.

2. After several years, you’ve built up substantial cash value.

3. You can then borrow against this cash value to invest in a rental property. The rental income can be used to repay the policy loan and continue funding the policy.

4. Meanwhile, your policy’s cash value and death benefit continue to grow.

5. Your home also continues to appreciate.

This strategy allows you to:

a) Maintain mortgage interest tax deductions (if applicable)

b) Keep your money liquid and accessible

c) Potentially earn returns from multiple assets (policy, investments, home appreciation)

d) Provide growing death benefit protection for your family

By using whole life insurance this way, you’re not just eliminating debt – you’re actively building wealth while protecting your family’s financial future.

Potential Drawbacks of a Whole Life Insurance Strategy

While high cash value whole life insurance offers numerous benefits as a financial tool, it’s crucial to understand the potential drawbacks and risks associated with this strategy:

1. Higher Premiums: Whole life insurance premiums are significantly higher than term life insurance premiums for the same death benefit amount. This higher cost can strain your budget, especially in the early years of the policy. However, these policies due offer superb premium flexibility which provides a lot of financial cushion if money gets tight.

2. Complexity: Whole life policies are more complex than term life policies or simple savings accounts. Understanding the nuances of cash value growth, dividends, and policy loans requires financial literacy and often professional guidance, which is why our team provides lifetime coaching to our clients.

3. Policy Loans: While the ability to take loans against your policy’s cash value is a key benefit of whole life insurance, failing to manage these loans properly can lead to significant issues.

Life Stages and Strategy Effectiveness

This strategy is particularly powerful for younger individuals with a longer time horizon. Here’s why:

Compound Growth: The earlier you start, the more time your cash value has to grow in a true uninterrupted compound interest environment.

Lower Insurance Costs: Younger policyholders typically pay lower whole life insurance premiums for the same coverage.

Longer Investment Horizon: With 30+ years ahead, you have more time to implement the asset multiplier strategy and recover from any market downturns.

Changing Financial Needs: As you age, your life insurance needs may decrease, but your policy’s cash value can transition to serve other financial purposes, such as using it for tax-free retirement income. And your growing death benefit is a permission slip to use other assets and still leave an inheritance.

Whole Life Insurance Example

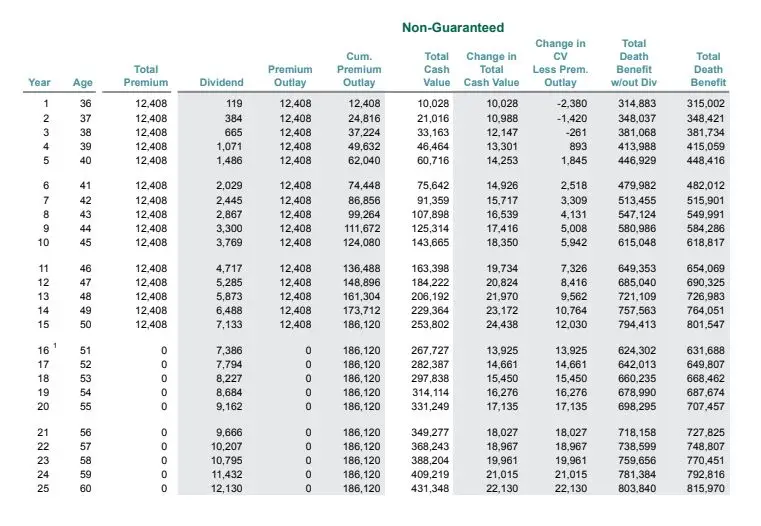

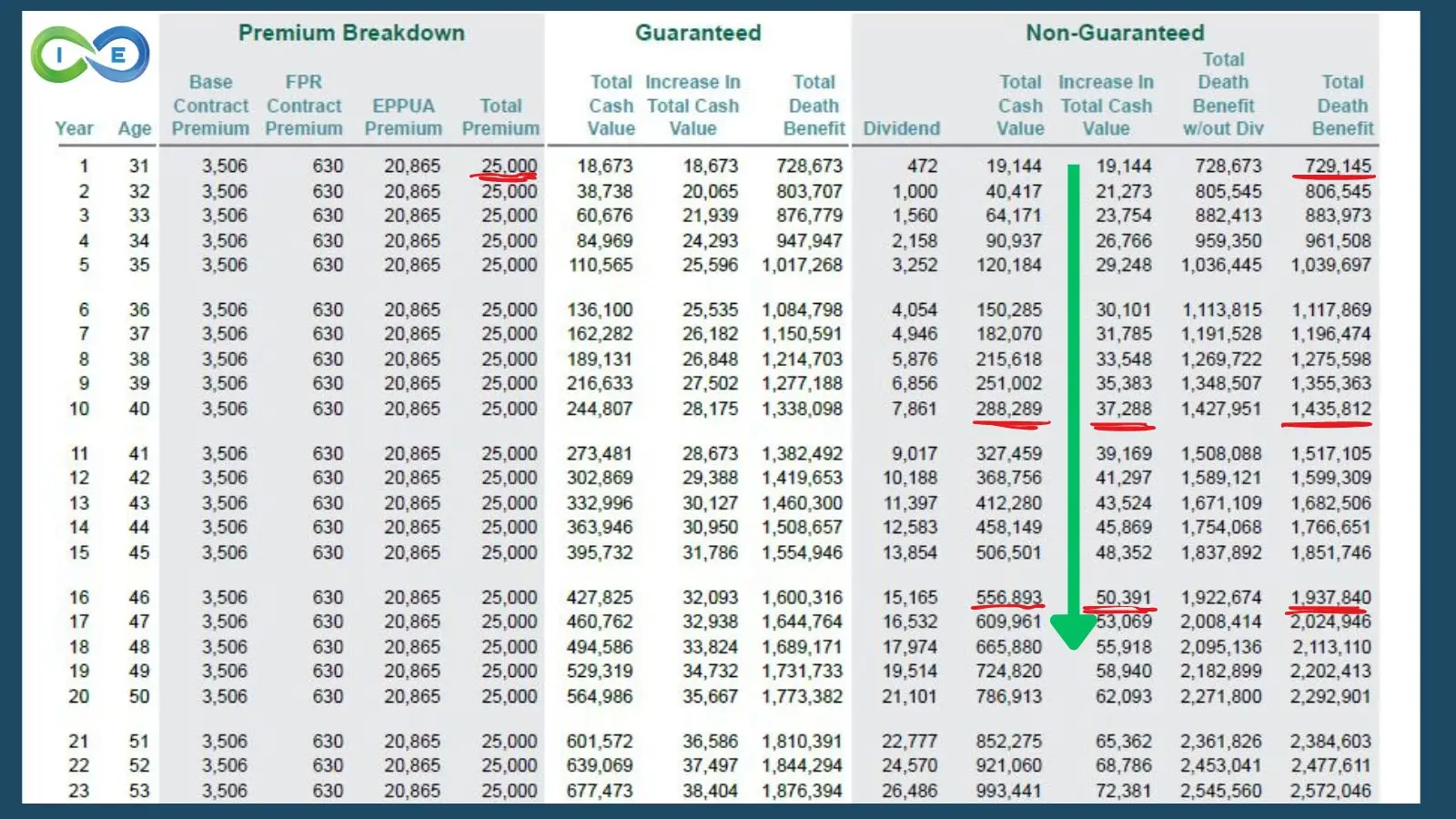

In this example we have Chris. He is 30 years old and is funding a whole life insurance policy with $25,000 a year versus paying off his mortgage early. As you can see from the illustration below, the first year Chris makes a premium payment he already has a $729,145 death benefit, which would most likely pay off his mortgage and then some. As the years go by, Chris’s cash value grows rapidly.

In year 10, his cash value is $288,289. And by year 16 it has ballooned to over $556,000. This is ready cash in his opportunity fund that he can borrow against to buy other assets, instead of having his money locked into his home equity doing nothing for him.

Also, notice his death benefit continues to grow each year. So he gets the best of both worlds. He gets the appreciation of his home, growing around 3-5% a year and the growing death benefit and cash value in his whole life insurance policy.

Current Economic Considerations

As of 2024, interest rates have risen significantly from their historic lows. This affects the mortgage vs. whole life decision in several ways:

Higher Mortgage Rates: Make the idea of paying off high-interest debt more attractive so many savers fail to consider alternatives.

Increased Whole Life Returns: Many policies are now offering guaranteed cash value growth with potential for higher total returns through dividends.

Volatile Market Conditions: Whole life is a volatility buffer shielding you form the volatility of the stock market and protecting you from sequence of returns risk. The value of guaranteed returns and death benefit protection offered by whole life insurance cannot be understated.

The Macroeconomic Perspective: Inflation and the Saver’s Dilemma

Before we dive into our conclusion, it’s crucial to consider a broader economic factor that significantly impacts this decision: inflation.

Our current financial system tends to encourage inflation, which can be particularly detrimental to savers. Here’s why this matters in the context of our mortgage payoff vs. whole life insurance discussion:

- Inflation Erodes Savings: As the value of money decreases over time due to inflation, traditional savings accounts often struggle to keep pace, resulting in a loss of purchasing power.

- Fixed Debts Become Cheaper: On the flip side, inflation can benefit those with fixed-rate debts like mortgages. As your income potentially increases with inflation over time, your mortgage payment remains the same, effectively becoming “cheaper” in real terms.

- Paying Off Mortgage as an Inflation Hedge: In this light, paying off your mortgage early can be seen as a savvy move for the inflation-conscious saver. By eliminating this debt, you’re essentially locking in a “return” equal to your mortgage interest rate, which is guaranteed and independent of inflation.

- Whole Life Insurance and Inflation: While whole life insurance policies offer guaranteed returns, it’s important to consider whether these returns will keep pace with inflation over the long term. However, the growing death benefit does provide a form of inflation protection for your beneficiaries.

Conclusion: Your Personal Financial Strategy

While we’ve explored the pros and cons of paying off your mortgage early versus investing in a high cash value whole life insurance policy, the best decision for you depends on your unique financial situation, goals, and risk tolerance. There’s no one-size-fits-all solution in personal finance.

The most effective way to determine the right strategy for your circumstances is to run your own numbers with the guidance of an experienced professional. We invite you to schedule an appointment for a free strategy session with a member of our team. During this session, we can:

- Analyze your current financial situation

- Discuss your long-term financial goals

- Compare personalized projections for both strategies

- Answer any questions you may have about whole life insurance or mortgage strategies

- Help you develop a tailored plan that aligns with your objectives

Don’t leave your financial future to guesswork. Take the first step towards a comprehensive financial strategy today. Schedule your free strategy session with one of our Pro Client Guides now, and let’s work together to create a plan that maximizes your financial potential and provides the security and growth you’re looking for.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept