If you follow sports, play sports professionally, or just for fun, you are likely familiar with the exorbitant salaries and bonuses that many top athletes receive…in some cases generating 7- or 8-figures per year. But, while such significant paychecks can provide mansions and fleets of high-dollar sports cars for these icons, it’s a different story for many pro athletes when they leave the field, court, or ice for the last time.

More often than not, short careers, along with the potential for injury, and oftentimes high spending habits, can put future financial security at risk for many current and former professional athletes. So, it is critical to have a good solid game plan in place – and it’s never “too early” to create one.

What Happens to Pro Athletes After They Retire?

A career in professional sports – along with the fame and fortune that frequently go along with it – is a dream come true for many young athletes. But even for the few who actually make it into the “big leagues,” ongoing financial success and security is never guaranteed.

The 2023 list of the world’s 50 highest-paid athletes reads a lot like the Forbes 400 List – except that in many cases, these athletes generate far more money than top CEOs and founders of major corporations.

These highly paid pro athletes hail from a wide variety of sports, including golf, boxing, football, tennis, and even auto racing, with total 12-month earnings (generated from both on and off the field) that range from $45.2 million up to $136 million. Just the top ten alone have brought in more than $1.1 billion over the past year.

For many of these superstars, though, the dream lifestyle will eventually come to an end. And without a plan in place for generating incoming cash flow, day to day life could be very different in the future.

The World’s Highest Paid Athletes – 2023

| Rank | Name | Sport | Total 12-Month Earnings | On the Field Earnings | Off the Field Earnings |

|---|---|---|---|---|---|

| 1 | Cristiano Ronaldo | Soccer | $136 M | $46 M | $90 M |

| 2 | Lionel Messi | Soccer | $130 M | $65 M | $65 M |

| 3 | Kylian Mbappe' | Soccer | $120 M | $100 M | $20 M |

| 4 | LeBron James | Basketball | $119.5 M | $44.5 M | $75 M |

| 5 | Canelo Alvarez | Boxing | $110 M | $100 M | $10 M |

| 6 | Dustin Johnson | Golf | $107 M | $102 M | $5 M |

| 7 | Phil Mickelson | Golf | $106 M | $104 M | $2 M |

| 8 | Stephen Curry | Basketball | $100.4 M | $48.4 M | $52 M |

| 9 | Roger Federer | Tennis | $95.1 M | $0.1 M | $95 M |

| 10 | Kevin Durant | Basketball | $89.1 M | $44.1 M | $45 M |

Source: Forbes

In some instances, when a professional athlete opts to hang up their cleats, gloves, or skates, they are offered a “new” but related opportunity as a coach, commentator, or other similar role. Others may continue to generate a sizeable paycheck from various endorsements.

For instance, basketball great Michael Jordan earns a significant portion of his wealth by giving endorsements for numerous products and companies. Over a span of four decades, Jordan has generated nearly $2 billion (pre-tax) off the court from brands like Nike, Coca-Cola, Chevrolet, Wheaties, Hanes, Gatorade, and McDonalds, just to name a few.

Failing to Plan

But retired athletes like Jordan are few and far between. More often than not, pros who once lived the “good life,” filled with fancy accommodations and celebrity treatment, end up struggling financially – especially if they have no plans in place for how they will generate income going forward.

There is a long list of professional sports figures who have squandered countless amounts of money, invested poorly, and/or filed for bankruptcy, despite generating millions of dollars (or more) during their careers.

In fact, according to Fox Business, a stark 78% of professional athletes go broke after just three years in retirement, and 60% of NBA players file bankruptcy within five years of retiring. There are several reasons for this. For instance, many of these individuals have an overwhelming feeling to help family members and others who had supported their careers along the way.

Another key financial risk to professional athletes’ wealth is divorce. When basketball legend, Michael Jordan, and this wife Juanita Vanoy finalized their split back in 2006, the settlement was a staggering $168 million.

More recently, MLB great Albert Pujols was ordered to hand over 50% of his retirement accounts and a one-time lump sum of $4.3 million to his ex-wife, along with 50% of the couple’s bank accounts and business ventures that they started during their marriage, 50% of two homes, and five high-dollar vehicles. So, parting ways with a spouse can often be a costly endeavor for professional sports figures.

A lot of retired athletes also continue to spend like they did when they were generating millions of dollars per year – even after the influx of cash flow has dried up. This can quickly lead to debt that spirals out of control, and possibly even to bankruptcy. It is estimated that Major League Baseball players file for bankruptcy four times more often than the average U.S. citizen.

Still another financial challenge for pro athletes is the short time span of their playing careers. According to a study by the RBC Sports Professionals group, the average playing career is just five years for Major League Baseball and National Basketball Association players alike.

Likewise, the average playing time is just six years in the National Hockey League and seven for National Football League players. This equates to many pro athletes “retiring” before they have even hit the age of 30.

So, whereas most “average” people have careers that span several decades, the majority of professional athletes only have a few short years to generate their massive incomes – and once that time is over, it can be difficult for them to survive on their savings for very long…if they have even saved anything at all.

With that in mind, it is critical that professional athletes start to save and invest as early as possible – as long as they do so in the proper channels. They should also not rush into any type of investment without first conducting ample due diligence, either on their own or ideally through a trusted advisor.

Unfortunately, some professional athletes – both past and present – may lack financial knowledge and in turn make poor investment decisions. Many retired athletes are also oftentimes approached for “investment opportunities” – such as buying into restaurants and other similar ventures – many of which do not end up panning out very well, resulting in financial loss.

Common Investments – Both Good and Bad – Made by Retired Pro Athletes

One of the most common misconceptions about professional athletes is that they are financially secure for life. Given the salaries that many of these pros receive, it is easy to understand why people would think that.

But, due in large part to the shortened careers of most athletes, this is not necessarily the case – which is why these individuals must look at other avenues for generating financial security going forward. In addition to – or in lieu of – getting a job, investing can provide retired athletes with an alternative.

Many professional athletes make various investments, hoping to generate income, increase wealth, or both. Some of the more common investments that are made by former pro sports stars include:

- Real estate

- Stocks and bonds

- Car Dealerships

- Tech & Service companies

- Wind turbines

- Horse farms

- Restaurants

Some athletes invest in start-up companies, with hopes that the business will turn out to be the next Amazon or Google. Sometimes these investments pan out…but not always.

A number of retired athletes have successfully made their mark in the business world, though. For example, basketball Hall of Famer Magic Johnson has built a thriving business empire, at one time even being a part owner of the Los Angeles Lakers.

Baseball great Nolan Ryan became a majority owner and chairman of a bank in his hometown of Alvin, Texas. He also became part owner of two minor league baseball teams, along with being a minority investor in a group that purchased the Texas Rangers.

Similarly, NBA star John Havlicek invested early on in an “up and coming fast food chain.” After Wendy’s became a big success, Havlicek cashed out of his investment with enough money to comfortably retire.

Many current and former professional athletes are very generous, too, choosing to donate funds to needy causes. For instance, Lebron James has given tens of millions of dollars to improve public school systems and create other opportunities for children – particularly those who are living near his hometown in Akron, Ohio.

Likewise, soccer great Christiano Ronaldo regularly contributes to emerging challenges, including making a $5 million contribution to victims of the Nepal earthquake, as well as other contributions to help orphans, AIDS victims, cancer patients, and others who are suffering around the world.

Going from Scoreboard to Time Clock – Preparing for Life After Sports

No matter how talented and healthy an athlete may be, it is extremely rare for anyone’s pro sports career to last longer than ten years. Because of that, some athletes who do not have the financial wherewithal to invest can find themselves having to make a “career transition.”

Some of these transitions are planned, while others are unexpected, due to injury or being cut from a team. In any case, athletes who plan ahead for this time period in their lives tend to have higher emotional, cognitive, and behavioral readiness compared to those who don’t.

Unlike Magic Johnson and Michael Jordan, not all former pro athletes find success in the business arena. Some end up having to work in “regular” jobs and become real estate agents, sales representatives, or warehouse workers.

In fact, it is estimated that roughly 27% of professional sports players took on sales roles after leaving the pros between 2015 and 2022, making sales the top post-retirement position for former athletes. One reason for this is because sales require a competitive mindset – something that many sports stars are already very familiar with.

10 Most Common Career Paths Former Athletes Enter

| Rank | Position | % of Transitions |

|---|---|---|

| 1 | Sales professional | 27% |

| 2 | Sports coach / instructor | 23% |

| 3 | Owner / founder | 10% |

| 4 | Financial analyst | 5% |

| 5 | Teacher | 5% |

| 6 | Business development professional | 4% |

| 7 | Financial advisor | 4% |

| 8 | Marketing specialist | 4% |

| 9 | Real estate agent | 3% |

| 10 | Recruiter | 3% |

Beyond sales and coaching, many former athletes become entrepreneurs, with approximately 10% taking on founder and business owner roles between the years of 2015 and 2022. A sizeable number of these individuals started companies that were related to their athletic background, such as sports and wellness.

Some retired athletes have even dedicated themselves to helping out their peers. For instance, former WNBA player Alana Beard founded Transition Plan, a company that prepares female pro athletes to enter into the corporate world.

For some, the transition from being a professional sports star can be a tough one – especially since it can mean losing a massive salary, as well as grappling with a loss of status and identity.

Case in point, despite earning $63 million in salary, NBA star Kenny Anderson was already flat broke on the day he left his professional basketball career. So, after he filed for bankruptcy, he became a K-12 schoolteacher.

Taking a completely different path, some pro athletes, like the famed Detroit Tiger’s outfielder Hank Greenberg, join the military. Just one day after hitting two homeruns against the Yankees, Greenberg reported to a U.S. Army induction center and became a buck private.

Other former athletes, however, go from being winners on the field to starting successful business endeavors. For instance, former Denver Broncos quarterback and Hall of Famer, John Elway, used his football earnings to launch a chain of automotive dealerships and steakhouses.

In a “perfect” world, though, some former athletes could literally “hit the jackpot.”

Harbaugh’s “Jackpot”

Take, for instance, Jim Harbaugh, the former NFL quarterback and current football coach at the University of Michigan (his alma mater). Not only is Harbaugh being paid a healthy 7-figure salary to coach the team, but the university is also helping him start a cash value life insurance policy as a part of his total benefit package.

In this particular case, the U of M loaned Harbaugh $4 million to initiate a cash value life (permanent) insurance policy, along with additional $2 million loans in each of the following five years to keep the plan and the coverage in force.

So, what happens if Harbaugh were to pass away while the policy was still in force?

The death benefit proceeds – which are estimated to be approximately $75 million – would have been more than enough for Michigan University to recoup the $14 million that the school “loaned” him to pay the premium.

In addition, his heirs would also receive at least 150% of the amount that was paid in policy premiums. So, for instance, if the University of Michigan paid $10 million, and then Harbaugh passes away, his loved ones would receive a minimum payout of $15 million in income tax free death benefit proceeds.

Harbaugh can also borrow from the policy’s cash value himself and access funds tax free – an added benefit to his overall pay plan. (This is opposed to taking taxable withdrawals from the cash value).

He can use the money that he borrows for anything he needs or wants without having to repay it. That’s because, even though the unpaid loan balance will incur interest charges, a portion of the death benefit can instead be used as repayment upon his passing, and the remainder paid out to the policy’s beneficiary(ies).

Using this type of “executive compensation” plan with permanent cash value life insurance, both Harbaugh and the University of Michigan essentially “win.” Here, even though the University could have retained control over the cash value for a certain amount of time, Harbaugh has immediate access to these funds.

In addition, both parties are subject to the life insurance contract, which can keep Harbaugh’s job secure until it ends. Otherwise, Michigan University would have to buy him out of it should the school decide to let him go.

Overall, should Harbaugh pass away, the significant amount of death benefit would certainly cover the premiums that were paid by the University – as well as the payout to his beneficiaries – with an additional substantial sum left over.

One of the other enticing factors for the University is that Harbaugh’s cash value life insurance policy isn’t tied to the same regulations as 401(k) retirement plans. For example, the latter doesn’t have to be offered to all of the other employees (whereas 401k retirement plans typically must be, within certain parameters). Today, other colleges and universities have jumped on the cash value life insurance bandwagon to “sweeten the pot” when recruiting coaches and other top employees.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

“Properly” Designed

But not all permanent life insurance policies are equal. We recommend a properly

structured policy to maximize cash value growth. We also recommend colleges and universities get second opinions from a trained insurance professional that understands properly structured policies and the types of insurance policies being considered.

To learn more about a properly designed high cash value whole life insurance policy, watch this webinar:

Why Cash Value Life Insurance Should Be Considered in Retirement Plans

Even if you aren’t a former athlete, coach, or commentator, properly structured cash value life insurance could add significant value to your retirement plan. Cash value, or permanent, life insurance offers death benefit protection, along with cash value build up within the policy. This cash value is liquid.

Unlike term life insurance – which is typically only in force for a pre-set amount of time – permanent coverage can usually remain in place for the insured’s lifetime, provided that the premium is paid. This provides for estate and legacy planning which can enable policy holders to leave more to heirs, potentially tax-free.

While many people purchase life insurance for the death benefit it can provide – which is received by the beneficiary(ies) free of income taxes – this is really just the beginning when it comes to using permanent coverage in your retirement and/or estate planning strategies.

Just some of the other features of permanent life insurance include:

- Guaranteed growth, not subject to stock market volatility

- Tax deferred growth of the cash value

- Tax free access to funds via policy loans

- Penalty free withdrawals for certain healthcare or long-term care needs

- Protection from creditors and bankruptcy (in most states)

- Privacy (i.e., no need to report it to the IRS it or include on FAFSA student loan forms)

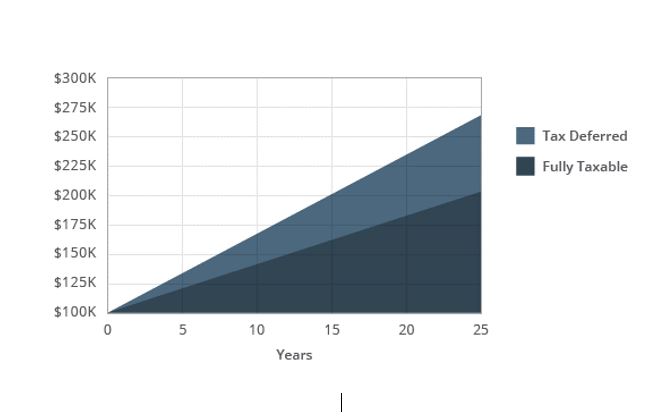

The tax deferred nature of the cash value growth means that there are no taxes due on the gain unless or until it is withdrawn above your basis in the policy (i.e. above the amount you have paid in premiums.) Therefore, these funds can grow and compound exponentially over time, especially compared to fully taxable accounts, with all other factors being equal.

Fully Taxable vs. Tax Deferred Growth

The policy holder can access funds tax free by taking a policy loan (versus a cash value withdrawal). Although many people don’t relish the idea of borrowing, doing so with cash value life insurance works differently than traditional loans from banks or other lenders.

In this case, there is no credit check and no “underwriting” associated with the life insurance loan. And, this type of “borrowing” doesn’t impact your credit score. Plus, interest will continue to accrue on the full amount of the cash value component – including the amount that is borrowed. In other words, you still earn interest and dividends on total cash value even though you have a policy loan.

That’s because the policy holder is actually borrowing from the insurance company and simply using the cash value as collateral. So, as an example, if your permanent life insurance policy has a cash value of $480,000 and you borrow $50,000 from it, interest will continue to accrue on $480,000.

In addition to that, if the loan is not repaid when the insured on the policy dies, the unpaid balance will be paid off using proceeds from the death benefit, and the remaining funds are then paid out to the named beneficiary(ies).

Dividend paying whole life, a type of permanent life insurance, offers several guarantees, such as a(n):

- Guaranteed level premium (flexible premium options are available)

- Guaranteed death benefit (that remains in force for life)

- Guaranteed accumulation of the cash value

There are some types of permanent life insurance that are structured to enhance the growth of the cash value. These include dividend-paying, or participating, whole life insurance policies from mutual insurance companies.

Dividends are considered a return of premium, and therefore, they are not taxed to the recipient. Policy holders generally can opt to receive dividends via direct payment, an addition to the policy’s cash value, or by way of additional death benefit coverage.

Adding tax free dividends to the policy’s cash component is recommended because it can also offer significant tax advantages for the growth of the cash value. These dividends compound overtime growing cash value more rapidly. While the payment of dividends isn’t guaranteed, there are some mutual life insurance carriers that have paid a dividend to their policy holders consistently for more than 100 years.

Mutual insurance companies are often preferred over stock companies because with the former, policy holders are considered owners or “members” in the insurer, and they therefore can participate in the insurance company’s investment gains.

The purpose of maximizing growth of the cash value component in a whole life insurance policy for building wealth is to allow the policy holder to do the following:

- Take loans against the cash value in order to purchase real estate or other assets and/or pay off higher interest debt

- Create a “safe” financial component of your overall financial plan that can act as the foundation of wealth building

- Obtain true compound interest growth in a tax deferred environment

Depending on the specific policy, permanent life insurance may also offer added benefits, too, such as the ability to access funds penalty-free in the event that you (or the insured) are diagnosed with a critical, chronic, and/or terminal illness, as well as if you require certain long-term care services.

And, given the nature of tax free access to policy loans, not only can these funds supplement your retirement income, but they also will not be counted as “provisional” income for determining whether your Social Security benefits are taxable. This, in turn, can provide more net spendable income. The policy allows you to be your own bank now and use the cash value as a stream of tax-free retirement income if done correctly.

Key Financial Factors for Professional Athletes to Consider

When constructing a financial plan for the future, a life insurance retirement plan can play a key role. But, because everyone’s objectives, time frames, and risk tolerances can differ, there isn’t just one single plan that will work well for all investors and retirees across the board.

Plus, in addition to simply generating cash flow, there are other factors that retired sports professionals – and non-athletes, too – should also keep in mind in order to maximize what they generate from their investments and attain more current and future financial security.

These items include:

- Taxes

- Inflation

- Volatility

- Longevity

- Healthcare and/or long-term care needs

Taxes play a part in all stages of life – and they can also often be levied on one’s estate upon death, as well. So, it is essential to consider your entire tax situation as you create your plan.

Key tax-related components can include your:

- Filing status (i.e., single, married filing jointly, married filing separately, head of household)

- Income sources (taxable versus non-taxable, and/or tax free)

- Tax credits and deductions

Another key consideration is inflation. Over time, prices of goods and services tend to rise. Therefore, future income must also increase. Otherwise, purchasing power will wane, and it may become necessary to make difficult decisions about what to spend to spend money on, such as food or medicine…but not both.

Market volatility and the “sequence of returns”, meaning some years the market is up and other years it’s down and the time it takes to recover from losses. Volatility can wreak havoc on a market based investment portfolio. There are no guarantees in the market. Planning appropriately for these outcomes is crucial.

In addition, as people get older, the likelihood of healthcare and/or long-term care needs increase – and this can be particularly so for athletes who put their bodies to the test in their younger days.

For example, players of some sports – such as football and hockey – can suffer both minor and major injuries…and in some cases, these can lead to life-long ailments. This, in turn, can make it more likely that these individuals will require assistance in their older years, which can make them a higher risk for health and long-term care insurance protection. With that in mind, including strategies for paying costly healthcare and long-term care services is a must.

Why Now is the Time to Build Your Financial Foundation

While a “Hail Mary” pass might help win a football game as the final seconds tick away on the scoreboard, the same is not true when it comes to planning for a successful retirement. The right financial plan can require creating a viable strategy and then putting the best tools in place to get it done.

Although pro athletes may receive large paychecks, these paydays typically only last for a few short years at best. So, it is vital for sports professionals to save and invest wisely and to prepare for retirement just like everyone else.

At Insurance and Estates, we have helped thousands of people (including professional athletes) grow, manage, and protect their wealth, assets, and income in all types of market and economic environments – and often with guarantees that they didn’t realize were available.

Whether you’re just getting started or you’re quickly approaching retirement, it is never too early to start planning. That’s where we can help. So, we invite you to look at your own numbers. Set up a time to discuss your short- and long-term financial, retirement, and legacy objectives with a member of our Pro Team at Insurance and Estates by calling (877) 787-7558. We look forward to meeting you and helping you move closer to your dreams and financial goals.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Sources

2023 The World’s Highest-Paid Athletes. Forbes. May 16, 2023. https://www.forbes.com/lists/athletes/?sh=6f8bfeb95b7e

Michael Jordan Net Worth 2023. Sportskeeda. https://www.sportskeeda.com/basketball/michael-jordan-net-worth-and-income

Why do professional athletes go broke? By Shaye Galletta. Fox Business. February 2, 2022. https://www.foxbusiness.com/personal-finance/why-do-professional-athletes-go-broke

Five Reasons Professional Athletes Go Broke. March 25, 2013. Wyatt Investment Research. https://www.wyattresearch.com/markets/five-reasons-professional-athletes-go-broke/

Do Michael Jordan and Juanita Vanoy Boast the Largest Divorce Settlement in History with $168 Million. By Harnaaz Kaur. July 28, 2023. Sportsmanor. https://sportsmanor.com/nba-do-michael-jordan-and-juanita-vanoy-boast-the-largest-divorce-settlement-in-history-with-168-million/

Personal finances of professional American athletes. Wikipedia. https://en.wikipedia.org/wiki/Personal_finances_of_professional_American_athletes

Professional athletes need a retirement game plan. RBC Wealth Management. https://www.rbcwealthmanagement.com/en-us/insights/professional-athletes-need-a-retirement-game-plan

Army Inducts Highest-Paid Baseball Player. LIFE Magazine. https://books.google.com/books?id=6U4EAAAAMBAJ&pg=PA45#v=onepage&q&f=false

The next play: How pro athletes find their post-retirement careers. By Joseph Milord. September 8, 2022. LinkedIn News. https://www.linkedin.com/pulse/next-play-how-pro-athletes-find-post-retirement-careers-joseph-milord/

Divorce Settlement: Ex-LA Dodgers Star Albert Pujols To Pay Ex-Wife 5-Figures in Child Support Per Month, Will Keep His Dominican Republic Home & McLaren. By Ryan Naumann. August 18, 2023. RADAR. https://radaronline.com/p/albert-pujols-dodgers-mlb-divorce-ex-wife-deidre-brain-tumor-divorce-settlement-details-child-support-custody/

Estimated value of Jim Harbaugh’s life insurance policy? $75 million. Pro Football Talk. August 19, 2016. https://www.nbcsports.com/nfl/profootballtalk/rumor-mill/news/estimated-value-of-jim-harbaughs-life-insurance-policy-75-million

Jim Harbaugh’s Coaching Contract Shows the Value of Life Insurance. By Rachel Marshall. June 14, 2021. The Money Advantage. https://themoneyadvantage.com/jim-harbaugh-life-insurance/

What Do Athletes Do With All Their Money? May 27, 2022. AWM. https://awmcap.com/blog/what-do-athletes-do-with-all-their-money