Discover How Volume, Velocity, and Value Creation Can Transform Your Financial Future Beyond the Limitations of Conventional Wisdom

In 2003, professional boxer and heavyweight champion Mike Tyson filed for bankruptcy with $30 million in debt, despite accumulating over $300 million during his career. This striking example raises a crucial question: What’s the point of acquiring money if we can’t effectively manage it? But perhaps we’re asking the wrong question. The real issue isn’t just about management – it’s about understanding money’s true nature and creating a system that maximizes its potential.

Traditional financial advice focuses on saving a small percentage of your income and hoping for good market returns. But this approach leaves most of your money idle or, worse, working for someone else. Today, we’ll explore a revolutionary framework that combines three powerful concepts: volume, velocity, and value creation. This approach, centered around properly structured high cash value whole life insurance, offers a path to true financial freedom that goes far beyond conventional wisdom.

Comparing Whole Life Banking Strategy vs Traditional Banking

| Traditional Bank Savings Account | High Cash Value Whole Life Insurance Policy | |

|---|---|---|

| Earnings Rate | The national average yield for savings accounts is 0.58 percent APY as of Dec. 18, 2023 (*Bankrate, December 13, 2023). But actual earnings are less after tax and not guaranteed. | Guaranteed (average) 3% interest. Plus an additional 2%-4% dividends. Tax-free, so net earnings of 5%-7%, which may increase as interest rates increase. |

| Withdrawals and Earnings | Amount available for withdrawals is lower because gains in the account are taxable. | Full amount of cash value is available for withdrawals. |

| Loans | Does not offer loans. Loan would have to be obtained through a bank or other lender. | Loans are available via the cash value, with no approval needed. Plus, the amount borrowed still continues to generate interest and dividends. |

| Loan Repayment | Amount and due date of repayments is determined by the bank or lender. If payments are late or missed, it negatively impacts your credit score. | No required loan payments. Policyholder determines when and how much is paid - or even IF payments are made. |

| Added Benefits Upon Death | Paid on Death (POD) to a beneficiary. | Death benefit is paid to beneficiary income tax free. |

| Living Benefits | None | ~Chronic Illness Rider - With a chronic illness diagnosis or need for long-term care, funds may be accessed from the death benefit. ~Accelerated Death Benefit - Death benefit funds may also be accessed in the event of a terminal illness diagnosis. ~Protection from 3rd party creditors - In most states, whole life insurance is protected from creditors, lawsuits, and bankruptcy. |

| Costs | Potential savings and checking fees. | Premium is required for death benefit. However, premium payments are leveraged for a larger death benefit payout - which is received income tax free by the beneficiary(ies). |

| Creditor Protection | Minimal. | Creditor protection based on individual state laws. |

Understanding Money’s True Nature

Modern financial theory recognizes money not just as a medium of exchange but as an expression of value. When you make a purchase, receive payment for work, or invest in an asset, you’re engaging in a value exchange. This understanding is crucial because it shifts our perspective from seeing money as something to accumulate to viewing it as a tool for creating and capturing value.

The Production-Consumption Dynamic

Consider these startling statistics:

- 78% of American workers live paycheck to paycheck

- High earners making six figures often have no significant savings

- Credit card debt has reached historic highs

The paycheck-to-paycheck cycle persists because most people’s consumption habits constantly match or exceed their production capacity. Traditional financial advice focuses on restricting consumption (“live within your means”) rather than optimizing an individual’s entire financial eco-system.

The Three Pillars of Financial Freedom

I. Volume: Beyond the 10% Rule

Financial advisors have long preached saving 10-15% of your income, usually in tax-deferred retirement accounts. But this conventional wisdom has a fundamental flaw: it leaves 85-90% of your money working for someone else. The power of volume in financial strategy comes from putting more of your money to work simultaneously.

Through properly structured dividend paying whole life insurance, you can channel a significantly larger portion of your income into a financial vehicle that offers:

- Guaranteed growth

- Tax advantages

- Creditor protection

- Access to capital through policy loans

- Continuous compound growth even while utilizing the money

II. Velocity: Making Every Dollar Work Harder

Velocity refers to how quickly and efficiently money moves through your financial system. Traditional banking keeps your money stagnant – sitting in checking accounts earning nothing or locked away in retirement accounts you can’t access without penalties.

Traditional Approach:

- Money sits in checking account (earning 0%)

- Bills paid monthly (money leaves system)

- Savings earn minimal interest

- Investment gains taxed annually

Whole Life Banking System Approach:

- Entire income flowing through policy

- Policy continues growing even while money is in use

- Policy loans provide tax-free access

- Multiple layers of growth simultaneously

III. Value Creation: Production vs Consumption

Economic research consistently supports the idea that sustainable wealth is derived from creating value in the marketplace, rather than from merely saving or conserving resources. Many people, however, focus exclusively on limiting their spending or saving money rather than using it as a tool to generate more value. This is where the true power of a self-banking system comes into play.

The essence of becoming a producer instead of merely a consumer lies in shifting focus towards production through value creation. Money, in its simplest form, is an expression of value. When you create value for others—whether through a product, a service, or innovation—money follows naturally. The key is to identify how you can contribute to the marketplace in meaningful ways, offering something that enhances the lives of others, and thereby reaping financial rewards. In this sense, wealth becomes a byproduct of value creation, not the end goal.

Value Creation:

- Focuses on producing goods/services that fulfill needs or solve problems for others.

- Money as a tool: Viewed as a way to generate more value, not just something to accumulate.

- Generates wealth through innovation: Offering something new or improving existing products or services.

- Active engagement in the marketplace: Building businesses, creating investments, and leveraging opportunities.

- Long-term mindset: Focus on sustained growth and reinvestment of profits.

- Multiplies financial potential: Creates opportunities for income streams, appreciation, and wealth transfer.

- Financial independence: You control the creation and flow of value, leading to more freedom and flexibility.

- Leverages assets: Uses tools like whole life insurance to multiply money through growth and reinvestment.

Consumption:

- Spending money on goods/services for personal use without generating future value.

- Money as an end goal: Viewed as something to be saved or spent without considering its potential to create more wealth.

- Passive approach to finances: Limited focus on how money can grow beyond basic saving or spending habits.

- Short-term focus: Prioritizes immediate satisfaction rather than investing in future growth.

- Wealth depletion: Continuous spending leads to diminishing resources with no system to replenish them.

- Reliance on external systems: Dependent on external income sources or market conditions rather than creating value internally.

- Accumulating debt: Often involves financing consumption through credit, leading to financial strain.

- Limited financial growth: Money is spent and gone, with no residual or compounding value.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

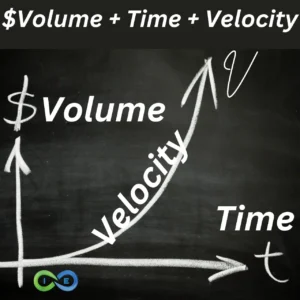

TIME

While much emphasis is placed on value creation, velocity, and the amount of money in motion, there’s a pivotal element that needs to be accounted for: time. Time is not merely a passive factor in financial strategies; it’s an active force that magnifies the impact of both velocity and volume in wealth-building efforts.

The longer your money remains in circulation (velocity) and the more capital you have working for you (volume), the more exponential the potential for wealth creation. This embodies the concept of compound growth – where money, as it grows, generates more money, creating an accelerating cycle of accumulation over time.

Mastering the value of time is crucial to maximizing the impact of both money’s velocity and volume. It’s not just about how quickly your money moves or how much of it is at work – it’s about maintaining that momentum and volume over an extended period. This is where a strategically designed whole life insurance policy excels, offering a powerful blend of growth, stability, and long-term flexibility that appreciates with time.

The Integrated Strategy: Combining Volume, Velocity, and Value

Think of traditional banking like a leaky bucket – money flows in and constantly leaks out through taxes, fees, lost opportunity costs, and inefficient use. Our integrated strategy using properly designed whole life insurance transforms this leaky bucket into a dynamic financial ecosystem.

The Banking Foundation

At the core of this strategy lies a properly structured high cash value whole life insurance policy. Unlike traditional whole life policies, these are infinite banking policies specifically designed to:

- Maximize early cash value

- Provide flexible premium structures

- Minimize commission through paid-up additions

- Create optimal policy loan opportunities

- Generate tax-advantaged growth

The key design elements of these policies are what differentiates high cash value whole life from traditional whole life policies. Specialized riders are used to maximize early cash value growth. There is an emphasis on paid-up additions and a de-emphasized focus on the death benefit. Term insurance is often blended into the policy to allow overfunding of the policy and avoid the policy becoming a modified endowment contract, or MEC.

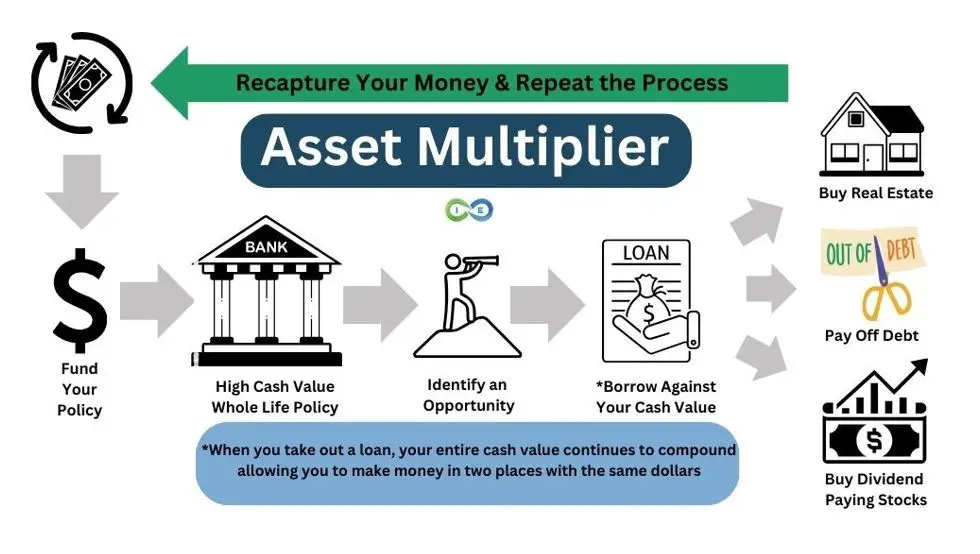

The Asset Multiplier Blueprint

Once your banking foundation is established, the Asset Multiplier Blueprint strategy accelerates wealth building through multiple layers of growth and value creation. Start with a properly structured policy that generates guaranteed cash value increase and potential dividend payments, all accumulating tax-deferred within your policy.

Through strategic policy loans, you gain access to capital without interrupting the policy’s uninterrupted compound growth trajectory. This creates your first layer of multiplication – your money continues growing within the policy while simultaneously being deployed for investments or business opportunities. Each dollar now works in multiple ways at once.

Value capture represents the next phase of multiplication. As your investment properties generate rental income, your business creates profits, or your other ventures produce returns, this new capital can be directed back into your self banking system. Your original policy continues growing uninterrupted, your investments generate their own returns, and you maintain access to capital for future opportunities – all simultaneously.

This continuous cycle of growth, reinvestment, and value capture creates what we call the Asset Multiplier Blueprint. Unlike traditional investing where you must liquidate one asset to purchase another, this system allows your money to keep working in multiple places simultaneously. Think of it as having your money work three jobs at once instead of just one.

Practical Applications

The true power of this strategy emerges when we examine real-world implementations. Let’s explore how this system works across different scenarios:

Real Estate Integration

A real estate investor uses their self banking system to:

- Fund down payments while maintaining policy growth

- Cover renovation costs through strategic policy loans

- Create tax advantages through proper structuring

- Build multiple streams of value simultaneously

Business Expansion

An entrepreneur leverages their personal banking system to:

- Fund inventory purchases

- Cover seasonal cash flow fluctuations

- Invest in business expansion

- Create their own financing system

Personal Banking Transformation

A family implements a family banking system to:

- Convert monthly bills to annual payments for immediate savings

- Create tax-advantaged college funding

- Build multi-generational wealth

- Maximize everyday financial efficiency

Implementation Framework

Getting Started

Success with this strategy begins with a strong educational foundation. Take time to understand the core concepts of infinite banking, such as policy design, cash flow management, and strategic loan utilization. Understanding how money moves through your system and how to optimize each dollar’s potential creates the foundation for effective implementation.

Partner With A Pro

Setting up your policy requires careful attention to detail and expert guidance. Partner with experienced professionals who understand the nuances of policy design for wealth creation. Your policy structure must align with your goals while maintaining optimal funding ratios and flexibility. This isn’t about buying a standard insurance policy – it’s about creating a sophisticated financial tool that serves as your wealth-building foundation.

Integration

The final phase focuses on integrating this system into your financial life. Convert your existing expenses to maximize efficiency within your banking system. Map out clear investment strategies that leverage your policy’s unique advantages. Create systematic approaches to capture value from your various financial activities, ensuring each dollar works as hard as possible within your wealth-building ecosystem.

Success

Success requires patience and dedication to understanding these components fully. Many people rush to implementation without grasping the fundamental principles, leading to suboptimal results. Take the time to build your knowledge, work with professionals who can guide and coach you, and systematically integrate these strategies into your financial life.

Risk Management and Optimization

While this strategy offers powerful benefits, proper management is crucial:

Policy Loan Management

- Keep loans below 80% of cash value

- Maintain clear repayment strategies

- Monitor loan interest against policy growth

- Structure loans for maximum tax efficiency

Investment Integration

- Balance opportunities against policy stability

- Create clear criteria for loan utilization

- Maintain proper cash flow management

- Build systematic reinvestment approaches

Legacy Building

The personal banking system we’ve outlined extends far beyond personal wealth creation, laying the groundwork for lasting multi-generational impact. Through strategic policy structuring, your wealth transfers to the next generation free from tax burdens, preserving the full value of your financial legacy.

Family banking takes this legacy planning to new heights. Your system becomes a foundation for teaching financial literacy and responsible wealth management to your children and grandchildren. They learn not just about money, but about creating and preserving value across generations. This hands-on education proves far more valuable than simply inheriting wealth.

Advanced wealth preservation techniques ensure your financial legacy remains protected from market volatility, creditors, and unnecessary taxation. Your banking system creates a fortress around your family’s wealth, allowing it to grow and flourish for generations while maintaining the flexibility to adapt to changing circumstances and opportunities.

Next Steps

Start by examining your current financial structure with fresh eyes. Look beyond traditional metrics like savings rates and investment returns to understand how money truly flows through your personal economy. Search for opportunities to increase both volume and velocity within your existing financial activities. A professional consultation can help identify optimal policy designs that align with your specific situation and goals.

Moving forward, focus on long-term strategy implementation. Create a systematic approach to funding that maximizes the efficiency of every dollar. Establish clear criteria for when and how to utilize policy loans, ensuring each decision aligns with your wealth-building objectives. Develop an integrated investment strategy that leverages your banking system’s unique advantages while maintaining consistent growth.

Remember that this system requires regular monitoring and adjustment. Markets change, opportunities arise, and your financial needs evolve. Build in regular review periods to assess performance, adjust strategies, and ensure your system continues operating at peak efficiency. Success comes from consistent application of these principles combined with thoughtful adaptation to changing circumstances.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Conclusion

Traditional financial advice focusing on saving 10% and hoping for good market returns leaves most of your money’s potential untapped. By understanding and implementing these advanced financial principles through properly structured whole life insurance, you can create a powerful system that maximizes every dollar’s potential through volume, velocity, and value creation.

Ready to transform your financial future? Schedule a free consultation with one of our Pro Client Guides today to discuss how this strategy can work with your specific situation and goals.

Sources:

Escaping the Rat Race: What School Failed to Teach You About Money, by James Jani