Why Tax Deferred Accounts Aren’t All They Are Cracked Up To Be

Helen thought she’d done everything right. After 30 years of maximizing her 401(k) contributions, she’d built an impressive $2.1 million nest egg. Then came the reality check: nearly half of her ‘retirement savings’ belonged to the IRS. As her financial advisor explained the impact of Required Minimum Distributions and rising tax rates, Helen realized she’d spent three decades building wealth for someone else.

Her story isn’t unique. Millions of Americans are walking into the same tax trap, following outdated advice that could cost them hundreds of thousands in retirement. But here’s what your financial advisor isn’t telling you: the game has changed, and the old rules of ‘tax-deferred growth’ no longer make sense in today’s world.

With national debt exceeding $35.8 trillion – that’s $95,000 for every man, woman, and child in America – future tax rates aren’t just a concern, they’re a mathematical certainty. The question isn’t if taxes will rise, but when. And your retirement savings are sitting in the crosshairs.

But what if there was a way to build wealth that the IRS can’t touch? A strategy that banks have used for generations to create tax-free growth and unlimited access to capital? It’s time to stop deferring taxes and start eliminating them altogether.

Quick check: Do you know what percentage of your retirement savings actually belongs to you?

🚨 Tax-Deferred Warning Signs

- Your retirement accounts have grown beyond $500,000

- You’re worried about future tax rates

- You want control over distributions

- You’re concerned about legacy planning

The 401(k) Match Trap: When “Free Money” Isn’t Really Free

“But what about my employer match? That’s free money!”

This is usually the first objection when discussing the problems with tax-deferred accounts. And for decades, financial advisors have preached that getting your full 401(k) match should be your first priority. After all, an immediate 50-100% return seems hard to beat.

But let’s think this through.

Yes, you get an immediate match on your contribution. But now BOTH your contribution AND the match are:

- Trapped in a tax-deferred account

- Subject to future tax rates you can’t control

- Forced out through RMDs

- Inaccessible without penalties before 59.5

- Building a bigger tax liability with every dollar of growth

Consider this: If you put in $6,000 and get a $6,000 match, that $12,000 could grow to $100,000 over 30 years. Sounds great until you realize the IRS might want $40,000+ of it. Your “free” money just cost you decades of tax-free growth potential and control over your own money.

What if instead you:

- Maximally funded a properly designed HCVWL policy

- Had full access to your money without restrictions

- Could borrow against it to fund Roth IRAs

- Got tax-free growth on your full balance

- Had a death benefit that far exceeded any match

- Maintained complete control over tax treatment

- Could access capital without government permission

This isn’t about giving up free money – it’s about understanding the true long-term cost of that “free” money and making strategic decisions about control, access, and tax certainty versus uncertain future tax rates.

When you factor in the loss of control, future tax uncertainty, and opportunity cost of having money trapped in tax-deferred accounts, even a 100% match starts looking less attractive compared to the power of tax-free growth and banking strategies.

The question isn’t just “Am I getting free money?” but rather “What’s the true cost of this free money over the next 30 years?”

The Numbers Don’t Lie: A Strategic Comparison

Let’s cut through the complexity and look at real returns across different savings vehicles:

- High Yield Savings Account (4.60% → 2.85% after tax)

- Treasury Money Market Fund (4.60% → 3.10% after tax)

- Municipal Money Market Fund (2.61% tax-free)

- High Cash Value Whole Life (5.15% tax-free + death benefit)

On $100,000 over 30 years:

- HYSA grows to $231,442

- Treasury MMF reaches $250,725

- Muni MMF builds to $216,679

- HCVWL compounds to $453,616

The difference is striking: High Cash Value Whole Life not only offers the highest return but keeps every penny working for you through tax-free growth and access. No RMDs, no tax drag, just pure compound growth plus a death benefit. Remember Helen’s story? This is the solution she wished she’d known about 30 years ago.

The Shift in Retirement Planning

For decades, financial advisors and CPAs have preached a consistent message: maximize your contributions to tax-deferred retirement accounts. Their reasoning seemed sound – defer taxes now while you’re working and pay them later in retirement when you’re in a lower tax bracket. This advice shaped how millions of Americans approach retirement planning.

However, the financial landscape has shifted dramatically. With national debt exceeding $35.8 trillion and growing daily, the fundamental assumption that future tax rates will be lower is increasingly questionable. This isn’t about politics or economic predictions – it’s about mathematics. The government has trillions of dollars in tax-deferred retirement accounts that have never been taxed, representing a tempting future revenue source.

The traditional retirement strategy essentially makes a bet on future tax rates. But it’s a bet where you don’t know the odds, and the house can change the rules after you’ve placed your wager. When you defer taxes, you’re not avoiding them – you’re postponing them and giving up control over how much you’ll ultimately pay.

This realization is driving a fundamental shift in retirement planning philosophy. Instead of asking “How can I pay less tax now?”, savvy investors are asking “How can I pay less tax forever?” This shift in thinking opens the door to strategies that prioritize tax-free growth over tax deferral.

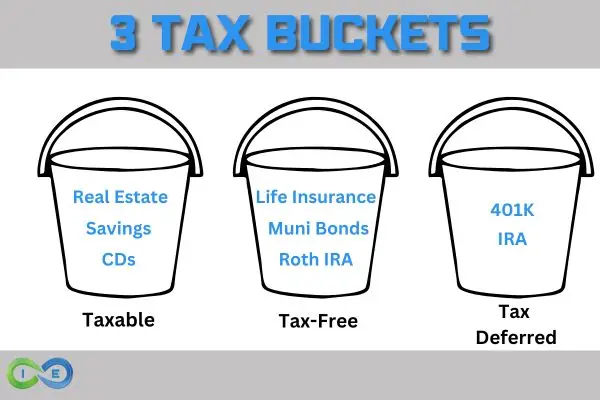

Tax-free wealth building isn’t new, but its importance has never been more relevant. By focusing on accounts and strategies that offer tax-free growth and distribution, investors can create certainty in an uncertain tax environment. These strategies include properly structured Roth accounts and specifically designed life insurance policies that allow tax-free access to money through policy loans.

Think about your current retirement strategy: Are you building wealth, or just creating a future tax liability?

Reimagine Wealth Building

It is time to reimagine wealth building through the Freedom-Oriented Wealth Foundation of volume, velocity, and value.

Volume: The Power of Self-Banking Through Life Insurance

Banks have mastered the art of building wealth by taking deposits, growing them through guaranteed returns, and lending while the original deposit continues growing. Now, forward-thinking individuals are adopting this same strategy using specially designed whole life insurance policies.

A properly structured banking policy prioritizes:

- Early cash value growth

- Flexible access to capital

- Tax-advantaged growth

- Guaranteed returns

- Uninterrupted compound interest

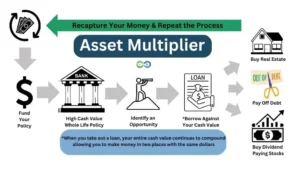

The Multiplier Effect

This strategy’s power lies in its ability to create multiple layers of tax-free growth. When you borrow against your policy:

- Your cash value continues growing uninterrupted

- Policy loans can fund other tax-free vehicles like Roth IRAs

- The same dollar grows tax-free in multiple places

- Access remains completely flexible

- No Required Minimum Distributions

- No reportable income to the IRS

The synergy with Roth accounts amplifies these benefits. While Roth IRAs have contribution limits, policy loans let you systematically fund them, creating an expanding pool of tax-free wealth. You’re using one tax-advantaged vehicle to feed another.

3X Threat

This strategy sidesteps the triple threat facing traditional retirement accounts:

- Rising future tax rates

- Forced distributions

- Limited wealth transfer options

While this approach requires patience and proper structuring, it creates something more valuable than just another retirement account – a sustainable, flexible financial foundation that gives you complete control over your money’s growth and access.

💡 Strategy Snapshot

Tax-Free Banking System + Roth Accounts =

✓ No required distributions

✓ Tax-free access to capital

✓ Guaranteed growth

✓ Legacy protection

The Banking System Advantage

Traditional banks profit twice: earning minimal interest on your deposits while charging higher rates for loans. You face qualifying requirements, market interest rates, and rigid repayment schedules.

Your self banking system reverses this dynamic. When you borrow against your policy, you’re lending to yourself. The interest you pay builds your own system’s value while your original money continues growing. No qualifications needed, no taxable events created, and no disruption to your investments’ growth.

Need capital? Instead of selling investments at a loss or creating new obligations to lenders, your self banking system provides immediate access to money while maintaining tax efficiency and continuous growth.

And consider how valuable this strategy is when markets are volatile. Since your policy provides guaranteed growth independent of market performance, you maintain reliable access to capital regardless of market conditions. This reliability can be crucial for both personal financial needs and investment opportunities.

Money Velocity: Keeping Your Money in Motion

Traditional retirement accounts are like vaults – money goes in, sits stagnant for decades, then emerges fully taxable. Your banking strategy creates dynamic money movement instead.

When you borrow against your policy, you unlock two powerful benefits:

- Your original capital continues growing uninterrupted

- Borrowed funds can be deployed for new opportunities This creates multiple layers of returns from the same initial capital.

Unlike traditional bank loans where payments only reduce debt, policy loan repayments enhance your system’s value while maintaining tax advantages. Your money stays in constant motion, working in multiple places simultaneously:

- Funding other tax-free vehicles

- Seizing investment opportunities

- Growing within your policy

- Building long-term value through loan repayments

This active approach protects against inflation and missed opportunities while maintaining continuous tax-efficient growth. And this is just the beginning.

Value Creation: Building Your Legacy

True value creation goes beyond mere accumulation – it’s about freedom, flexibility, and legacy. While traditional retirement accounts trap your money behind penalties and tax barriers, your self banking system opens doors to opportunity.

The Value Creation Advantage:

- Access capital without triggering taxes

- Make decisions based on opportunity, not tax implications

- Move quickly on business and investment opportunities

- No bank approvals needed

- Maintain continuous tax-efficient growth

Legacy Planning Made Simple

Traditional retirement accounts burden your heirs with:

- Inherited tax obligations

- Forced distributions

- Inflexible liquidation schedules

Your banking system, paired with Roth accounts, creates a clean wealth transfer:

- Tax-free benefits to heirs

- Flexible distribution timing

- Control over wealth transfer

- No forced liquidations

This combination of opportunity and legacy planning creates lasting value – not just in dollars, but in family security and generational impact.

What would change in your retirement planning if you knew taxes would double in the next 20 years?

Blueprint: Building Your Tax-Free Fortress

Moving into implementation, it’s important to understand that building this strategy requires careful planning and professional guidance. This isn’t about making a single financial move – it’s about creating an integrated system that builds tax-free wealth over time.

Your foundation isn’t a typical life insurance policy – it’s a specialized financial instrument designed for banking. The structure determines everything: cash value growth, access to capital, and tax efficiency The design requires specific considerations for cash value accumulation, policy loan provisions, and long-term sustainability. Working with professionals who understand both the insurance and banking aspects is crucial.

The next layer involves coordinating your banking system with Roth accounts and other tax-free strategies. Timing matters here. Understanding contribution limits, policy loan provisions, and how to maintain policy performance while accessing capital requires strategic planning.

Think of this like building a machine rather than making a single investment. Each component needs to work in harmony with the others. The self banking system provides the foundation and capital access, while Roth accounts add another layer of tax-free growth potential. When structured properly, these elements complement each other rather than competing for resources.

Starting with a properly designed whole life policy allows you to build a stable foundation that grows tax-deferred and provides tax-free access to capital through loans. This isn’t just about the policy itself – it’s about creating a financial base that can fuel other tax-free growth opportunities.

Many people ask about “ideal” amounts to start with or how quickly to build their banking system. The reality is that this strategy should align with your personal financial situation and goals. Some start with smaller policies and build over time, while others may have the capacity to implement more aggressive funding strategies immediately.

What’s crucial is understanding that this is a long-term strategy that becomes more powerful over time. As your banking system grows, your capacity for policy loans increases. This creates expanding opportunities to fund Roth accounts, invest in business or real estate, or seize other opportunities while maintaining tax efficiency.

Your banking system becomes more valuable over time through several mechanisms:

- Guaranteed cash value growth

- Potential dividend payments

- Death benefit increases

- Growing capacity for policy loans

- Tax-free access to capital

The real power emerges as your Roth accounts grow alongside your self banking system. This creates multiple pools of tax-free money that can work together to provide flexibility and security in retirement. Think of this as building your own personal financial ecosystem rather than just another account or investment. The goal is to create sustainable, tax-efficient wealth that you control.

💡 Quick Tip: For every $100,000 in tax-deferred accounts, consider how a 40% tax rate would impact your retirement lifestyle. That’s $40,000 you won’t have available to spend.

Real World

Building on these concepts, let’s look at how this strategy adapts to real-world situations. Traditional retirement planning often assumes a linear path – work, save, retire. But life rarely follows such a predictable course. This is where the flexibility of your banking system proves invaluable.

Consider business opportunities that arise unexpectedly. With traditional retirement accounts, your money is essentially locked away, subject to penalties and taxes if accessed early. Your banking system, however, allows you to seize opportunities without disrupting your long-term growth or creating tax events.

Market volatility provides another practical example. When markets decline, those heavily invested in traditional retirement accounts often face difficult choices. Do they sell at a loss? Continue taking withdrawals from depleted accounts? Your banking system provides an alternative. Since your policy’s growth is guaranteed and not market-dependent, you can access capital through loans while giving your other investments time to recover.

Think about major life events – children’s education, business expansion, real estate purchases, or even unexpected challenges. Having access to capital without creating tax consequences or disrupting your wealth-building strategy provides peace of mind and practical solutions.

The future tax environment is something we can’t control, but we can position ourselves strategically. While those relying solely on tax-deferred accounts are essentially betting on future tax rates, your strategy of building tax-free wealth through banking and Roth accounts puts you in a more controlled position.

CASE STUDY: A Tale of Two Retirees

Traditional Path: Robert, Age 65

– 401(k) Balance: $1.2M

– Required Distributions: $49,200/year

– Taxes Due: ~$14,760 (30%)

– Net Income: $34,440/year

Total Tax Impact: Up to $360,000 over retirement

Banking Strategy: Sarah, Age 65

– Policy Value: $1.0M

– Optional Distributions: Flexible

– Taxes Due: $0

– Net Income: Up to $50,000/year

💰 The Tax-Free Difference

On $1M in retirement savings:

– Tax-Deferred: Pay up to $370,000 in taxes

– Tax-Free Banking: Keep all $1M

Total Tax Impact: $0

Now that you’ve seen how this strategy works in practice, let’s address the common misconceptions that hold people back…

Myth-Busting: What Wall Street Doesn’t Want You to Know

Let’s address some common concerns and misconceptions about this strategy. Many people, when first learning about using whole life insurance as a banking system, are skeptical. They’ve often heard that “buy term and invest the difference” is the only sensible approach to life insurance. This view, however, misses the larger strategic purpose of using life insurance as a tax-free wealth building tool.

Another common concern is about policy loan interest. “Why would I want to pay interest to access my own money?” This thinking comes from viewing policy loans through a traditional lending lens. Instead, understand that policy loans are a mechanism for accessing capital while keeping your money working uninterrupted in the policy. The interest you pay supports the system you control, unlike bank interest that simply builds wealth for the bank.

Some worry about “tying up” money in life insurance. This reflects a misunderstanding of how a properly designed banking policy works. Your money isn’t tied up – it’s working in multiple ways simultaneously. The death benefit provides family protection, the cash value grows tax-deferred, and policy loans provide flexible access to capital.

The strategy’s power becomes particularly clear when compared to traditional retirement accounts in today’s environment. While 401(k)s and traditional IRAs offer tax deductions now, they create uncertainty about future tax implications. Your banking system, paired with Roth accounts, provides more tax certainty and control.

📊 Key Considerations

– Most retirement accounts are significantly underfunded

– Many retirees face higher tax rates than expected

– Required Minimum Distributions can push you into higher tax brackets

– Tax obligations are often overlooked in retirement planning

Tax Treatment By Account Type

One other area to consider is how each type of account passes to your heirs. Understanding these differences is crucial – they affect not just your tax bill today, but your flexibility in retirement and your family’s inheritance.

| Feature | Tax-Deferred | Taxable | Tax-Free |

|---|---|---|---|

| Current Tax Treatment | Tax deduction now | No deduction | No deduction |

| Growth | Tax-deferred | Taxed annually | Tax-free |

| Withdrawals | Fully taxable | Capital gains only | Tax-free |

| RMDs | Required at 73 | None | None |

| Early Withdrawal | 10% penalty | No penalty | Roth-10% penalty on earnings |

| Inheritance | Fully taxable to heirs | Step-up in basis | Tax-free to heirs |

| Best For | High current tax bracket | Flexible access needed | High growth expected |

Tax-Deferred (IRAs, 401(k)s)

- Heirs inherit your tax burden

- Required distributions create forced taxable income

- Can trigger higher tax brackets

- No step-up benefit

Taxable Accounts

- Step-up in basis eliminates capital gains tax

- Immediate sale option with minimal tax

- No forced distributions

- Maximum flexibility

Roth & Life Insurance

- Tax-free distributions

- No required distributions for spouses

- 10-year rule for non-spouse beneficiaries

- Ideal for high-growth assets

Strategic Considerations

- Highly appreciated assets benefit from step-up in taxable accounts

- Tax-deferred accounts face potential double taxation (estate + income)

- Life insurance provides tax-free transfer without distribution rules

- Match account types to heir tax situations

Your First 90 Days: From Tax-Trapped to Tax-Free

Let’s look at the practical steps to implement this strategy. While every situation is unique, the fundamentals remain consistent: proper policy design, professional guidance, and sustainable funding.

Success starts with finding the right professionals. Not all insurance agents or financial advisors understand banking strategy. You need someone who specializes in designing policies for banking purposes – the wrong design decisions can severely limit your strategy’s effectiveness.

Start where you are. Don’t wait for perfect conditions or try to maximize funding immediately. Begin with what’s sustainable for your budget and scale up as your system proves itself. If you’re already invested in tax-deferred accounts, build your banking system alongside them while gradually shifting toward tax-free growth strategies.

Process >Product

This isn’t a product – it’s a process that requires a mindset shift. Traditional retirement planning focuses on accumulation and hopes for the best. A self banking strategy focuses on control: you decide when to access your money, how much tax you’ll pay, and how to transfer wealth to the next generation.

The power lies in flexibility. Unlike traditional retirement accounts that lock away your money and force distributions, your banking system provides:

- Tax-free access to capital when opportunities arise

- Stability during market volatility

- Freedom to seize opportunities without penalties

- Guaranteed growth independent of market conditions

You’re not just building another retirement account – you’re creating your own financial ecosystem that mirrors how banks build wealth: through guaranteed returns, dividends, and profitable lending, all while maintaining control of your capital.

✓ Your First Steps

1. Calculate your current tax exposure

2. Review your account statements

3. List your financial flexibility needs

4. Research qualified self banking strategy professionals

5. Schedule a strategy consultation

Conclusion

The choice is yours: continue building wealth for the IRS, or take control of your financial future today. While others gamble on future tax rates, you can create certainty in an uncertain world. Your tax-free banking system isn’t just another account – it’s your pathway to true financial independence. The time to act is now, before tax rates rise and opportunities diminish. Take your first step toward tax-free wealth by scheduling a strategy consultation today.