🎯 Strategic Approach: Why Convertible Term Life Matters

Term life insurance isn’t just temporary protection—it’s a strategic bridge to permanent coverage for wealth builders. Unlike digital platforms that focus on lowest-cost policies, we analyze conversion potential, long-term flexibility, and integration with advanced financial strategies.

📊 2025 Market Leadership: Top Convertible Features

| Market Share (Term Life): | 19% ($3.0 billion new premiums) |

| Average Cost ($1M, 20-year): | $47/month (male), $38/month (female) |

| Conversion Age Limits: | Up to age 70 (best companies) |

| No-Exam Conversion Limits: | Up to $5M (select carriers) |

Table of Contents

- Strategic Approach: Beyond Basic Term Life Insurance

- 2025 Market Trends: Convertible Term Life Leadership

- Why Convertible Term Life Insurance Matters for Wealth Builders

- Top 10 Best Convertible Term Life Insurance Companies

- Conversion Strategy Analysis: Real Client Examples

- Strategic Features: What Sophisticated Investors Need

- Selection Criteria: Beyond Price Comparison

- Integration with Advanced Wealth Building

Convertible Term Insurance: Beyond Basic Term Life

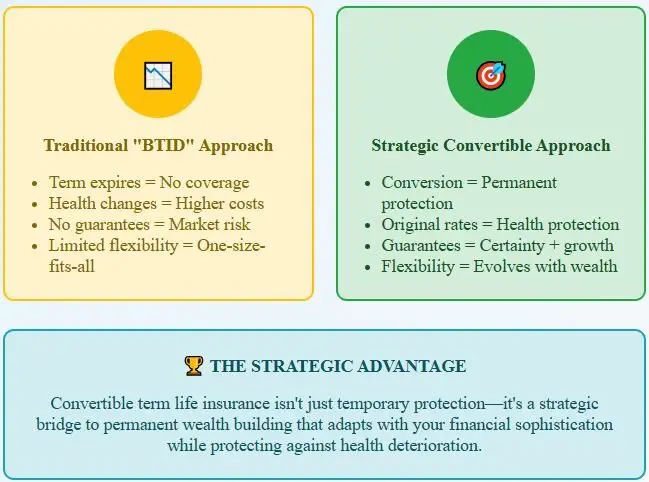

When most financial platforms recommend term life insurance, they focus on finding the cheapest policy to “buy term and invest the difference,” the advice popularized by financial personalities like Dave Ramsey and Suze Orman. But what if there’s a more sophisticated approach?

At Insurance & Estates, we don’t accept the false contrast of term life vs whole life insurance. Instead, we view convertible term life insurance as a strategic tool that bridges immediate protection with long-term wealth-building potential. For business owners, high-net-worth individuals, and sophisticated investors, the key isn’t finding the cheapest term life policy, but finding the best convertible term life insurance that can evolve with your financial strategy.

🎯 Why Most Digital Platforms Miss the Mark

Cookie-Cutter Approach: Digital-first platforms excel at processing simple applications quickly, but they often overlook conversion flexibility, business applications, and integration with advanced financial strategies.

Our Strategic Focus:

- Conversion Potential: Ability to transition to permanent coverage without new underwriting

- Business Integration: How policies fit into business succession and estate planning

- Wealth Building Synergy: Coordination with infinite banking strategies

- Long-term Flexibility: Options that adapt as financial sophistication increases

2025 Market Trends: Convertible Term Life Insurance Leadership

📊 2025 Term Life Insurance Market Analysis

| Market Metric | 2025 Performance | Strategic Significance |

|---|---|---|

| Market Share | 19% ($3.0 billion) | Steady growth in affordable protection demand |

| Growth Projection | 1-5% annually | Driven by digital platforms and competitive pricing |

| Average Premium ($1M, 35, 20yr) | $47M / $38F monthly | Affordable entry point for wealth building |

| No-Exam Coverage Limits | Up to $5M (select carriers) | Streamlined underwriting for busy professionals |

Key 2025 Trends in Convertible Term Life Insurance

1. Enhanced Conversion Features

Leading insurers like Banner Life and Pacific Life are expanding conversion age limits (up to 70) and offering conversion credits that reduce first-year permanent policy premiums. This trend reflects growing recognition that sophisticated investors need flexibility as their financial strategies evolve.

2. Digital Innovation with Strategic Depth

While many platforms focus purely on speed and price, companies like Guardian Life and MassMutual combine digital efficiency with comprehensive underwriting that accommodates complex financial situations—essential for business owners and high-net-worth individuals.

3. Business-Focused Applications

Term life insurance companies are increasingly recognizing business applications, offering higher coverage limits (up to $50M with Banner Life and Protective Life) and simplified underwriting for business owners who need substantial coverage for key person protection and business succession planning.

💡 Market Insight: Why Conversion Matters More Than Ever

According to LIMRA research, only 2% of term life policies ever pay a death benefit—not because they’re bad products, but because most people outlive their terms. The solution isn’t to avoid term life insurance; it’s to choose convertible term life insurance that can transition to permanent coverage when your financial strategy demands it.

Why Convertible Term Life Insurance Matters for Wealth Builders

Business owners and sophisticated investors face a unique challenge: balancing immediate protection needs with long-term wealth building strategies. Traditional term life insurance expires when you need it most, while permanent coverage may be unaffordable during growth phases.

The solution: Convertible term life insurance bridges this gap, providing affordable protection today with guaranteed access to permanent coverage tomorrow, regardless of health changes. This creates an insurance arbitrage opportunity that becomes more valuable over time.

🛡️ The Ultimate Health Protection: Original Rate Class Guarantee

Critical Advantage: Convertible term life insurance allows you to convert to permanent coverage at your original health classification regardless of health changes that occur during the term period.

What This Means: If you’re approved as “Super Preferred” at age 35 but develop diabetes, high blood pressure, or other health conditions by age 50, you can still convert to permanent coverage at your original Super Preferred rates—not your current health status.

Strategic Value: This health arbitrage can save tens of thousands in permanent life insurance premiums and may be the difference between getting coverage or being declined entirely.

Real Client Example: Health Protection in Action

📊 Real Client Case Study: Health Protection Through Original Rate Class Conversion

Client Profile: 57-year-old female professional

Initial Coverage: 10-year convertible term life insurance policy

Conversion Decision (8 years into term): Converted $1 million of term coverage to whole life insurance

Conversion Results:

- Immediate Cash Value Credit: $1,400 credited upon conversion

- Conversion Flexibility: Could convert anywhere from $50,000 to $1,000,000

- Health Protection: Converted at original health classification despite 8 years of potential health changes

- Strategic Timing: Converted near end of 10-year term period for maximum value

Key Strategic Benefits:

- Original Rate Class Protection: Maintained excellent health rating from initial application

- Flexible Conversion Amount: Could choose optimal coverage amount based on current needs

- Immediate Cash Value: $1,400 head start on wealth accumulation

- Permanent Coverage Secured: Guaranteed coverage for life with cash value growth potential

Strategic Outcome: This real-world example demonstrates how convertible term life insurance provides valuable flexibility and health protection. The client secured permanent coverage at favorable rates while gaining immediate cash value, all without new medical underwriting requirements.

Important Note: This case study reflects an actual client outcome. Individual results may vary based on carrier, health classification, timing, and specific policy terms.

Business Owner Wealth Evolution Strategy

📈 Typical Client Journey: From Protection to Wealth Building

Initial Need (Age 35): Business owner needs $5M coverage for key person protection and family income replacement. Chooses convertible term life insurance at $180/month.

Business Growth (Age 45): Company value increased, tax situation complex. Converts $2M to whole life for tax-advantaged cash accumulation while maintaining $3M term coverage.

Wealth Optimization (Age 55): Converts remaining term coverage to complete infinite banking strategy, creating tax-free retirement income and legacy planning foundation.

Strategic Outcome: Total premium outlay over 20 years: $43,200. Policy values at age 55: $2.8M in death benefits plus $320,000 in accessible cash value. Without conversion options, this integration would have been impossible.

🎯 Strategic Benefits of Convertible Term Life Insurance

Immediate Benefits

- Cost-Effective Protection: Substantial coverage at affordable premiums during high-need periods

- Business Applications: Key person coverage, buy-sell agreements, and executive benefits

- Estate Liquidity: Immediate death benefit for estate planning and business succession

- Income Replacement: Protection during peak earning and family dependency years

Long-term Strategic Value

- Conversion Flexibility: Transition to permanent coverage without new medical underwriting

- Health Protection: Convert at original rate class regardless of health deterioration

- Wealth Building Integration: Bridge to infinite banking strategies

- Tax Optimization: Access to tax-advantaged permanent life insurance structures

- Legacy Planning: Foundation for multi-generational wealth transfer strategies

Integration with Advanced Financial Strategies

Convertible term life insurance serves as a cornerstone for sophisticated financial planning that goes beyond simple “protection vs. investment” thinking:

- Business Succession Planning: Term coverage protects business value while conversion options create permanent funding for estate taxes

- Tax Strategy Evolution: As tax situations become more complex, conversion to permanent coverage provides additional tax-advantaged vehicles

- Generational Wealth Building: Term policies can evolve into legacy planning tools without new underwriting requirements

- Economic Hedge: Conversion rights provide access to guaranteed returns regardless of market conditions

🤔 Beyond Financial Celebrity Advice

While financial personalities promote “buy term and invest the difference” as universal wisdom, sophisticated investors understand that optimal strategies evolve with wealth accumulation, tax complexity, and business growth. Convertible term life insurance provides the flexibility to adapt your insurance strategy without losing insurability—something permanent investment accounts can’t offer.

Top 10 Best Convertible Term Life Insurance Companies for 2025

Our 2025 analysis of the best convertible term life insurance companies prioritizes conversion flexibility, financial strength, and features that matter to sophisticated investors. Unlike rankings focused purely on price, we evaluate companies based on their ability to support long-term wealth-building strategies through superior conversion options and business applications.

🎯 Our Evaluation Criteria for Best Convertible Term Life Insurance

- Conversion Age Limits: How long conversion options remain available

- Conversion Credits/Benefits: Financial incentives that reduce permanent policy costs

- Permanent Product Portfolio: Quality and variety of available whole life and universal life options

- No-Exam Conversion Limits: Amount convertible without new medical underwriting

- Business Applications: High coverage limits and sophisticated underwriting

- Financial Strength: AM Best, S&P, Moody’s, and Fitch ratings for long-term stability

2. Protective Life – Best Value Convertible Term Life Insurance

Financial Strength Ratings

- AM Best: A+ (Superior)

- S&P: AA-

- Moody’s: A1

- Fitch: A+

Product Highlight: Classic Choice Term delivers outstanding value with competitive premiums and comprehensive conversion options. Terms available from 10-40 years with coverage up to $50M.

Strategic Value Proposition

- Exceptional Affordability: Highly competitive rates for convertible coverage

- Income Provider Option: Unique feature allowing structured death benefit payouts

- No-Exam Underwriting: Up to $1M for ages 18-45 without medical exam

- Business-Friendly Limits: Up to $50M for substantial business applications

- Conversion Flexibility: Multiple permanent product options available

Best For: Cost-conscious business owners and professionals who want premium convertible term life insurance features without paying premium prices. Excellent for those seeking substantial coverage with future conversion potential.

Detailed analysis available in our Protective Life insurance review.

3. Pacific Life – Best Conversion Benefits and Credits

Financial Strength Ratings

- AM Best: A+ (Superior)

- S&P: AA-

- Moody’s: Aa3

- Fitch: AA-

Product Highlight: Pacific Term stands out for generous conversion credits and cash credits that significantly reduce the cost of transitioning to permanent coverage—a crucial feature for long-term wealth building strategies.

Conversion Excellence

- Cash Conversion Credits: Substantial credits reduce permanent policy first-year costs

- Premium Permanent Products: Access to high-quality whole life and universal life policies

- High Customer Satisfaction: Consistently strong ratings for service and claims

- Flexible Underwriting: No-exam options with competitive health requirements

- Long-term Stability: Strong financial ratings ensure conversion options remain viable

Best For: Sophisticated investors who prioritize conversion benefits and want access to premium permanent life insurance products. Ideal for those planning definite conversion as part of long-term wealth strategies.

Comprehensive details in our Pacific Life insurance review.

4. Guardian Life – Best for Complex Health and Business Situations

Financial Strength Ratings

- AM Best: A++ (Superior)

- S&P: AA+

- Moody’s: Aa2

- Fitch: AA+

Product Highlight: Level Term offers exceptional underwriting flexibility for applicants with health conditions or complex business situations, making it the go-to choice when other carriers decline coverage.

Specialized Underwriting Excellence

- Health Condition Expertise: Specialized underwriting for diabetes, HIV, and other conditions

- Business Owner Focus: Sophisticated underwriting for complex business situations

- Digital Innovation: Advanced online tools combined with human expertise

- Low Complaint Ratios: Superior customer service and claims handling

- Mutual Company Benefits: Policyholder-owned structure aligned with long-term interests

Best For: Business owners with complex health histories or unique underwriting situations. Excellent choice when specialized expertise is needed for approval and competitive rates.

In-depth analysis in our Guardian Life insurance review.

5. MassMutual – Best Integration with Premium Permanent Products

Financial Strength Ratings

- AM Best: A++ (Superior)

- S&P: AA+

- Moody’s: Aa3

- Fitch: AA+

Product Highlight: Vantage Term and Direct Term provide excellent conversion access to MassMutual’s industry-leading dividend-paying whole life insurance products.

Premium Product Integration

- Top-Tier Whole Life Access: Convert to industry-leading dividend-paying whole life policies

- Infinite Banking Ready: Ideal foundation for advanced wealth-building strategies

- LifeBridge Program: Free coverage options for qualifying low-income families

- Comprehensive Riders: Accelerated death benefit and waiver of premium included

- Age 90 Renewability: Extended coverage options for long-term planning

Best For: Sophisticated investors planning eventual conversion to premium whole life insurance for infinite banking or advanced estate planning strategies. Excellent for those who want access to top-tier permanent products.

Complete analysis in our MassMutual insurance review.

6. Penn Mutual – Best Conversion Credit Value

Financial Strength Ratings

- AM Best: A+ (Superior)

- S&P: A+

- Moody’s: Aa3

- Fitch: N/A

Product Highlight: Guaranteed Convertible Term offers unique conversion credits equal to the annual term premium—providing substantial value for those planning conversion to permanent coverage.

Exceptional Conversion Value

- Annual Premium Credit: Conversion credit equals full year’s term premium

- ACE Underwriting: Accelerated underwriting up to $5M for ages 20-65

- Mutual Company Structure: Policyholder ownership aligns with long-term interests

- Flexible Terms: 10, 15, 20, or 30-year options

- Business Applications: Strong support for business owner needs

Best For: Individuals planning definite conversion who want maximum financial benefit from the conversion process. Ideal for those seeking predictable conversion economics.

Detailed review available: Penn Mutual insurance analysis.

7. Prudential – Best for Senior and Executive Applications

Financial Strength Ratings

- AM Best: A+ (Superior)

- S&P: AA-

- Moody’s: Aa3

- Fitch: AA-

Product Highlight: Term Elite and Term Essential excel for older applicants and executives, with PruFast Track no-exam underwriting and flexible underwriting for senior business owners.

Executive and Senior Focus

- Senior-Friendly Underwriting: Specialized approach for older applicants

- PruFast Track: No-exam coverage up to $1M for ages 18-60

- Executive Benefits: High coverage limits for business leaders

- Conversion Flexibility: Multiple permanent product options

- Global Presence: Strong international capabilities for multinational businesses

Best For: Senior executives and older business owners who need substantial coverage with conversion flexibility. Excellent for international business applications.

Comprehensive coverage in our Prudential insurance review.

8. Lincoln Financial – Best Digital Experience with Strategic Depth

Financial Strength Ratings

- AM Best: A (Excellent)

- S&P: A-

- Moody’s: A2

- Fitch: A+

Product Highlight: LifeElements and TermAccel combine digital efficiency with sophisticated underwriting, offering streamlined applications without sacrificing conversion quality.

Digital Innovation Leadership

- LincXpress Technology: No-exam underwriting up to $1M for ages 18-60

- Streamlined Process: Digital efficiency without compromising conversion quality

- Strong Conversion Options: Access to competitive permanent products

- Business Focus: Sophisticated underwriting for business owners

- Competitive Rates: Strong pricing across age ranges

Best For: Tech-savvy professionals who want digital efficiency without sacrificing strategic conversion options. Good for those who value streamlined processes.

Full analysis: Lincoln Financial insurance review.

9. John Hancock – Best Wellness and Health Incentive Programs

Financial Strength Ratings

- AM Best: A+ (Superior)

- S&P: AA-

- Moody’s: A1

- Fitch: AA-

Product Highlight: Vitality Term rewards healthy behaviors with premium discounts and additional benefits, while maintaining strong conversion options to permanent coverage.

Wellness Integration Benefits

- Vitality Program: Premium savings for exercise, health screenings, and wellness activities

- Aspire Program: Specialized underwriting for diabetes management

- Express Track: No-exam underwriting for ages 18-60

- Health Rewards: Ongoing discounts and benefits for healthy lifestyle choices

- Conversion Flexibility: Access to John Hancock’s permanent product portfolio

Best For: Health-conscious individuals who want to be rewarded for healthy lifestyle choices while maintaining conversion options for long-term planning.

Complete details: John Hancock insurance review.

10. Principal Financial – Best Balanced Approach

Financial Strength Ratings

- AM Best: A+ (Superior)

- S&P: A+

- Moody’s: A1

- Fitch: AA-

Product Highlight: Term Life offers a well-balanced approach with accelerated underwriting, competitive rates, and solid conversion options—making it an excellent choice for straightforward applications.

Reliable Excellence

- Accelerated Underwriting: Up to $2.5M for ages 18-60 without medical exam

- Competitive Pricing: Strong rates across multiple age groups

- Conversion Options: Access to Principal’s permanent product line

- Financial Stability: Strong ratings ensure long-term conversion viability

- Business Focus: Good support for business owner applications

Best For: Applicants seeking a reliable, well-rated carrier with competitive rates and solid conversion options without specialized needs.

Detailed analysis: Principal Financial insurance review.

🏆 Quick Comparison: Best Convertible Term Life Insurance Companies

| Company | Best For | Key Advantage | Max Coverage |

|---|---|---|---|

| Banner Life | Overall Excellence | 40-year terms, age 70 conversion | $50M |

| Protective Life | Value Seekers | Competitive rates + features | $50M |

| Pacific Life | Conversion Benefits | Generous conversion credits | Varies |

| Guardian Life | Complex Situations | Specialized underwriting | Varies |

| MassMutual | Infinite Banking | Premium whole life access | Varies |

Conversion Strategy Analysis: Real Client Examples

Understanding the financial impact of conversion options helps sophisticated investors make informed decisions about convertible term life insurance. Here are typical scenarios showing how conversion strategies create value:

📊 Case Study: Business Owner Wealth Transition

Initial Situation: 40-year-old business owner needs $3M coverage for business protection and family security.

Strategy: Banner Life OPTerm 30-year convertible policy at $285/month

| Age | Action | Financial Impact |

|---|---|---|

| 40-50 | Pay term premiums | $34,200 total outlay |

| 50 | Convert $1M to whole life | $12,500/year + conversion credit |

| 60 | Convert remaining $2M | $85,000 cash value accumulated |

| 65 | Full conversion complete | $240,000 accessible cash value |

Strategic Outcome: Without conversion rights, new permanent coverage at age 50+ would have required new medical underwriting and significantly higher premiums. Conversion flexibility enabled smooth transition to permanent coverage for estate planning and tax-advantaged wealth building.

Premiums shown are illustrative examples based on typical market rates. Actual rates depend on health, state, and underwriting class. Cash value projections are illustrative and not guaranteed.

📊 Case Study: Executive Estate Planning Integration

Client Profile: 45-year-old corporate executive, increasing estate tax exposure, needs liquidity for estate planning.

Initial Coverage: $5M Pacific Life convertible term at $520/month

Evolution Strategy:

- Phase 1 (Ages 45-55): Maintain full term coverage during peak earning years

- Phase 2 (Age 55): Convert $2M to whole life using Pacific Life’s conversion credits

- Phase 3 (Age 60): Convert remaining $3M as estate values increase

Financial Impact: Conversion credits reduced first-year permanent premiums by $8,500. Total premium savings over purchasing new coverage: $47,000. Estate liquidity created: $5M immediate, $850,000 cash value by age 65.

Key Benefit: Conversion flexibility allowed strategic timing based on estate planning needs rather than insurance company underwriting requirements.

Premiums shown are illustrative examples based on typical market rates. Actual rates depend on health, state, and underwriting class. Cash value projections are illustrative and not guaranteed.

Strategic Features: What Sophisticated Investors Need in Convertible Term Life

Understanding Term Life Insurance Conversion Mechanics

Convertible term life insurance provides the contractual right to exchange your term policy for permanent coverage without new medical underwriting. This feature becomes increasingly valuable as you age and your health potentially changes.

🎯 Critical Conversion Features for Wealth Builders

1. Conversion Age Limits

What to Look For: Conversion rights extending to age 65-70

Why It Matters: Provides flexibility during peak wealth accumulation years when permanent coverage becomes more attractive for tax planning

2. Conversion Credits and Benefits

What to Look For: Credits that reduce first-year permanent policy premiums

Examples: Pacific Life’s cash credits, Penn Mutual’s annual premium credits

3. No-Exam Conversion Limits

What to Look For: High limits for conversion without medical re-underwriting

Strategic Value: Protects against health changes that could make new coverage impossible

4. Permanent Product Quality

What to Look For: Access to high-quality whole life and universal life products

Key Consideration: MassMutual’s dividend-paying whole life, Guardian’s mutual company benefits

Living Benefits and Advanced Riders

Modern convertible term life insurance policies include living benefits riders that provide access to death benefits during lifetime for qualifying conditions:

- Chronic Illness Benefits: Access to death benefits for long-term care needs

- Critical Illness Coverage: Partial benefit payments for heart attack, stroke, cancer

- Terminal Illness Acceleration: Full death benefit access when life expectancy is limited

- Disability Waiver of Premium: Continued coverage if unable to work

Business Applications and High Coverage Limits

For business owners and executives, convertible term life insurance serves multiple strategic purposes beyond family protection:

🏢 Business Owner Considerations

- Key Person Protection: Coverage up to $50M for essential business leaders

- Buy-Sell Agreements: Funding for business succession planning

- Executive Benefits: Competitive compensation and retention tools

- Estate Liquidity: Conversion to permanent coverage for estate tax planning

- Creditor Protection: Life insurance death benefits generally protected from business creditors

Selection Criteria: Beyond Price Comparison

While cost remains important, sophisticated investors should evaluate convertible term life insurance based on strategic value rather than premium price alone. Here’s our framework for selection:

🎯 Strategic Selection Framework

1. Financial Strength and Stability

Prioritize carriers with A+ or better AM Best ratings and strong secondary ratings from S&P, Moody’s, and Fitch. Conversion rights are only valuable if the company remains financially stable long-term.

2. Conversion Flexibility and Benefits

Evaluate age limits, conversion credits, and the quality of permanent products available for conversion. Look for carriers offering attractive incentives for conversion.

3. Underwriting Philosophy and Approach

Consider carriers known for fair underwriting and accommodating complex situations. Guardian Life excels for health conditions, while Banner Life offers high no-exam limits.

4. Business Owner and High-Net-Worth Focus

Choose carriers with experience serving sophisticated clients, high coverage limits, and business-friendly underwriting approaches.

5. Long-term Strategic Alignment

Select carriers whose permanent product portfolio aligns with your long-term wealth-building strategies, whether that’s infinite banking, estate planning, or tax optimization.

Working with Digital Platforms vs. Strategic Advisors

While digital platforms excel at price comparison and simple applications, convertible term life insurance selection often requires more sophisticated analysis:

- Conversion Strategy Planning: Understanding when and how to convert for maximum strategic benefit

- Business Application Expertise: Proper structuring for business owner needs and high coverage amounts

- Integration with Estate Planning: Coordination with existing estate planning and tax strategies

- Health Optimization: Maximizing underwriting outcomes for complex health or financial situations

💡 When Professional Guidance Adds Value

Digital platforms work well for straightforward applications with clear needs. However, business owners, high-net-worth individuals, and those with complex health situations often benefit from working with experienced advisors who understand both insurance products and advanced financial strategies.

Integration with Advanced Wealth Building Strategies

Convertible term life insurance becomes most powerful when integrated with sophisticated wealth-building approaches. Here’s how it fits into advanced financial strategies:

Infinite Banking Concept Foundation

Many clients begin their infinite banking journey with convertible term life insurance, transitioning to permanent coverage as their financial sophistication and cash flow increase:

- Phase 1: Convertible term provides immediate protection during wealth accumulation phase

- Phase 2: Partial conversion creates initial cash value accumulation vehicle

- Phase 3: Full conversion establishes comprehensive infinite banking system

Estate Planning and Tax Optimization

Convertible term life insurance provides strategic flexibility for estate planning as asset values grow and tax situations evolve:

🏛️ Estate Planning Integration Strategies

Generation-Skipping Trust Funding

Convert term coverage to permanent life insurance within irrevocable trusts, creating multi-generational wealth transfer vehicles without current income tax impact.

Estate Tax Liquidity Planning

Begin with term coverage for current liquidity needs, convert to permanent coverage as estate values increase and tax planning becomes more critical.

Charitable Planning Integration

Use conversion flexibility to optimize charitable remainder trust strategies and split-interest gift arrangements.

Business Succession Coordination

Term coverage protects business value initially, conversion provides permanent funding for buy-sell agreements and estate tax obligations.

Coordination with Retirement and Investment Planning

Sophisticated investors integrate convertible term life insurance with broader retirement and investment strategies:

- Tax Diversification: Conversion provides access to tax-free growth and income options

- Sequence of Returns Protection: Guaranteed values protect against market timing risks

- Alternative Asset Class: Life insurance provides returns uncorrelated with market performance

- Legacy Optimization: Leveraged wealth transfer through tax-free death benefits

Business Owner Strategic Applications

Business owners can leverage convertible term life insurance across multiple business and personal planning objectives:

🏢 Business Owner Strategy Matrix

| Business Stage | Term Life Application | Conversion Strategy |

|---|---|---|

| Startup/Growth | Key person protection, loan guarantees | Maintain flexibility for business changes |

| Mature/Profitable | Executive benefits, retention tools | Begin conversion for tax advantages |

| Succession Planning | Buy-sell funding, estate liquidity | Full conversion for permanent funding |

| Exit/Retirement | Personal estate planning focus | Optimize for wealth transfer and income |

Conclusion: Strategic Approach to Convertible Term Life Insurance

The best convertible term life insurance companies for 2025 offer more than competitive premiums—they provide strategic flexibility for sophisticated wealth-building approaches. Unlike the oversimplified “buy term and invest the difference” advice promoted by financial celebrities, successful business owners and high-net-worth individuals understand that optimal insurance strategies evolve with wealth accumulation and financial complexity.

🎯 Key Takeaways for 2025

Top Carrier Recommendations:

- Banner Life: Best overall conversion flexibility with 40-year terms and age 70 conversion

- Protective Life: Outstanding value with competitive rates and high coverage limits

- Pacific Life: Superior conversion benefits and credits

- MassMutual: Premium permanent product access for infinite banking strategies

- Guardian Life: Specialized underwriting for complex situations

Strategic Considerations:

- Conversion age limits and credit benefits often matter more than initial premium differences

- Financial strength ratings ensure long-term conversion option viability

- Business applications require carriers with high limits and sophisticated underwriting

- Integration with advanced wealth strategies requires careful carrier selection

Beyond Price Comparison: The Value of Strategic Guidance

While digital platforms excel at price comparison, convertible term life insurance selection for sophisticated investors requires deeper analysis. The best approach considers:

- Long-term Strategic Alignment: How policies integrate with evolving financial goals

- Conversion Optimization: Timing and methods for maximum strategic benefit

- Business Integration: Coordination with business planning and succession strategies

- Tax and Estate Planning: Alignment with comprehensive wealth planning approaches

Looking Forward: The Evolution of Wealth Building

As financial markets become more volatile and tax policies continue evolving, the guaranteed, tax-advantaged features of permanent life insurance become increasingly valuable. Convertible term life insurance provides the bridge between immediate protection needs and long-term wealth optimization strategies.

The most successful clients don’t view life insurance as an either/or decision between term and permanent coverage. Instead, they use convertible term life insurance as a strategic tool that adapts to changing circumstances while preserving insurability and providing flexibility for wealth-building evolution.

Ready to Optimize Your Convertible Term Life Insurance Strategy?

Discover how the best convertible term life insurance companies can support your long-term wealth-building goals. Our experienced advisors help you navigate carrier selection, conversion planning, and strategic integration.

In Your Complimentary Strategy Session, You’ll Discover:

- ✓ Which convertible term life insurance carriers best fit your situation

- ✓ Optimal conversion timing and strategy planning

- ✓ Integration with infinite banking and estate planning approaches

- ✓ Business owner applications and high coverage strategies

- ✓ Comparison of conversion benefits and long-term value

No obligation. Expert guidance from licensed professionals who understand advanced wealth strategies.

Frequently Asked Questions About Convertible Term Life Insurance

Q: What is the best convertible term life insurance company in 2025?

A: The best convertible term life insurance company depends on your specific needs. Banner Life excels for overall flexibility with 40-year terms and age 70 conversion. Protective Life offers outstanding value, while Pacific Life provides superior conversion benefits. MassMutual is ideal for infinite banking strategies.

Q: How does convertible term life insurance work for wealth building?

A: Convertible term life insurance provides affordable protection initially, then allows conversion to permanent coverage without new medical underwriting. This creates a bridge to tax-advantaged wealth building through whole life or universal life insurance cash values.

Q: What are conversion credits and why do they matter?

A: Conversion credits are financial incentives that reduce first-year permanent policy premiums when converting from term coverage. Pacific Life and Penn Mutual offer substantial credits that can save thousands of dollars during conversion.

Q: How much convertible term life insurance coverage can I get without a medical exam?

A: No-exam limits vary by carrier and age. Banner Life’s Lab Lift program offers up to $4M, while Protective Life provides up to $1M for ages 18-45. Penn Mutual’s ACE underwriting supports up to $5M for ages 20-65.

Q: Is convertible term life insurance better than buying whole life insurance directly?

A: It depends on your situation. Convertible term life insurance provides immediate affordability and flexibility to convert later. Direct whole life purchase offers immediate cash value growth. Many sophisticated investors use both strategies simultaneously for optimal protection and wealth building.

Q: How does convertible term life insurance fit into infinite banking strategies?

A: Convertible term life insurance serves as an excellent entry point for infinite banking. Clients begin with affordable term coverage, then convert portions to whole life insurance as cash flow allows, gradually building a comprehensive infinite banking system.

Q: What business applications work best with convertible term life insurance?

A: Convertible term life insurance excels for key person protection, buy-sell agreements, and executive benefits. High coverage limits (up to $50M with Banner Life and Protective Life) accommodate substantial business valuation protection with future conversion flexibility.

Q: When should I convert my term life insurance to permanent coverage?

A: Conversion timing depends on your financial situation and goals. Common triggers include increased cash flow, tax planning needs, estate planning requirements, health changes, or reaching conversion age limits. Strategic planning helps optimize timing for maximum benefit.