When it comes to protecting your family’s future, having proper estate planning isn’t just about creating a will, it’s about ensuring your wishes are carried out both during your lifetime and after. As a family wealth expert with over 20 years of experience, I’ve seen how proper planning can make an enormous difference in families’ lives. Let’s explore why estate planning matters and how to approach it effectively.

The Three Fundamental Questions

Before diving into complex legal documents, every family should answer these critical questions:

- Who will make medical decisions if you’re incapacitated?

- Who will manage your financial affairs if you’re unable?

- How will your assets be distributed when you pass away?

Understanding Your Options

There are three primary paths for estate planning: Will, Living Trust, Probate

- Last Will and Testament, a/k/a Will – A will is a legal document that describes how you would like your property and other assets to be distributed after your death. While important, a will alone typically requires probate court involvement.

- Revocable Trust, a/k/a Living Trust – A living trust is a powerful tool that allows asset management during life and transfers assets after death while avoiding probate. It provides flexibility and privacy that a will alone cannot offer.

- The Government Plan (Probate) – Without proper planning, your estate will go through probate, the legal process required to transfer property after someone passes away when there’s no trust in place.

THE ULTIMATE FREE DOWNLOAD

The Estate Planners Tactical Guide

Essential Legal Protection for Achievers

Why Avoid Probate?

If at all possible, it is best to avoid probate entirely. Many people don’t realize the challenges that probate creates:

- Privacy Loss: Your estate becomes public record

- Inconvenience: Trustees may have to appear in court multiple times

- Time Delays: Everything must be accounted for and proven to a judge’s satisfaction

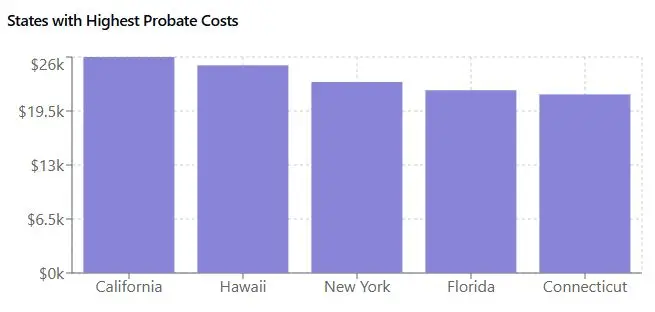

- Significant Costs: Statistically, probate costs run 3-10% of the estate value (Example: A $500,000 estate could incur $15,000-50,000 in probate costs)

Why A Will Alone Isn’t Enough

Many families believe having a will provides complete protection for their estate. What they don’t realize is that a will almost always guarantees the need for probate court involvement. This is because a will, while important, is simply a set of instructions that must be validated and executed through the probate process.

Think of it this way: a will is like leaving a letter with your wishes, but someone still needs to get permission to carry them out. That “someone” is the probate court. Even with a perfectly written will, your estate must go through probate if it has the minimum amount of assets required by probate law. This means your family still faces all the challenges of the probate process , the public exposure, the delays, and the significant costs.

A Better Way Forward: The Revocable Trust

Through my years helping families protect their legacies, I’ve found that a properly designed and funded revocable trust offers the most comprehensive protection. Think of it as creating a private roadmap for your family that bypasses the public highways of probate court.

Key Benefits of a Revocable Trust:

- Maintain privacy of your family’s affairs

- Manage assets effectively during your lifetime

- Transfer assets smoothly after death

- Avoid probate costs and delays

- Update and adjust as circumstances change

Learn More About Our Trust Program

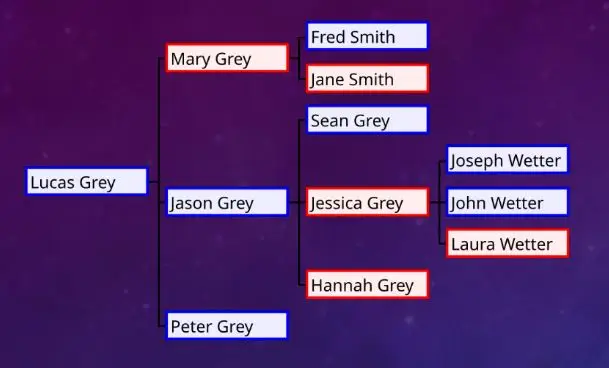

Family Tree Asset Positioning: Understanding Your Family’s Structure

Let’s walk through a practical scenario:

Imagine it’s 9 PM, and you find yourself in a hospital, unconscious. The doctors need to make critical decisions about your care. Who would you trust to make these decisions? Now you understand the importance of picking the right person for this role.

Looking at your family tree, would it be:

- Your spouse?

- One of your children?

- Perhaps a sibling?

But what if your first choice was also incapacitated? This is why we need to think deeper about succession planning. Your family tree helps identify not just your primary decision-makers, but also your best backup choices.

Understanding Key Roles

The structure of your estate plan involves several important positions: Trustor, Trustee, Successor Trustee, and Healthcare Decision Maker

Trustor (Also Known As Grantor or Settlor):

- This is you and your spouse if married

- Only Trustors can set and change trust rules

- You’ll always be the Trustor, regardless of health

Trustee:

- The manager of your trust

- Cannot change the rules, only follow them

- May change over time due to various circumstances

Successor Trustees:

- Your backup managers

- Usually come from your family tree

- Must be trusted to follow your wishes exactly

Healthcare Decision Makers:

Think carefully about who would best represent your medical wishes. Consider factors like:

- Proximity to where you live

- Ability to make difficult decisions under pressure

- Understanding of your healthcare preferences

- Emotional stability during crisis situations

Preparing for Life’s Changes

Understanding that you will always be the Trustor but won’t always be the Trustee is imperative. Several situations might require a transition of Trustee responsibilities:

- You may pass away

- Two doctors might determine you can no longer make decisions

- A judge could rule you’re no longer able to serve as Trustee

- You might choose to resign as Trustee

This is why selecting Successor Trustees who will honor your wishes precisely as expressed in your Revocable Living Trust is vital. These people typically come from your family tree, but choosing them requires careful consideration.

THE ULTIMATE FREE DOWNLOAD

The Estate Planners Tactical Guide

Essential Legal Protection for Achievers

Taking Action: Implementation Steps

If you decide to establish your Revocable Trust, our comprehensive review process includes:

- Analysis of real estate holdings

- Evaluation of long-term care plans

- Review of income plans

- Assessment of health conditions

- Examination of assets and current beneficiary arrangements

This thorough approach helps “get your house in order” and ensures nothing is overlooked in your estate plan.

Creating a Comprehensive Protection Plan

Every family needs more than just a single document for complete protection. Think of an estate plan like building a house – you need a strong foundation, solid walls, and a secure roof. Each component serves a specific purpose in protecting what matters most.

A comprehensive estate plan includes several essential documents:

- Revocable Living Trust

- Certificate of Trust

- Pour-over Wills

- Healthcare Powers of Attorney

- Financial Powers of Attorney

- Living Will

- Healthcare Directives

At the foundation lies your Revocable Living Trust, the cornerstone of your estate plan. This powerful tool gives you control during your lifetime while ensuring smooth transitions when needed. Supporting this foundation, your Certificate of Trust provides a simplified way to work with banks and other institutions without revealing your private planning details. Your Pour-over Will acts as a safety net, ensuring any assets not already in your trust will be automatically transferred there, providing complete protection for all your assets.

Meanwhile, Powers of Attorney for both healthcare and financial matters ensure someone you trust can step in to help during times of need. These crucial documents prevent the need for court intervention and allow your chosen representatives to act quickly when time is of the essence. Your Living Will and Healthcare Directives provide clear guidance about your medical care preferences, giving both your family and healthcare providers the direction they need during critical moments. Together, these documents create a comprehensive shield of protection, ensuring your wishes are honored and your family has clear direction when they need it most.

Modern Estate Planning for Modern Families

Gone are the days of estate plans gathering dust in filing cabinets. Today’s families need immediate access to their important documents, which is why we’ve integrated modern technology into every plan we create.

Through our secure online portal, you’ll have:

- 24/7 access to your documents from anywhere

- The ability to share information securely with family members

- Tools to manage and update your asset information

- Everything needed to fund your trust properly

We also provide unlimited funding letters and notary services for original documents, ensuring nothing stands in the way of implementing your plan fully. Think of this as your personal estate planning dashboard, putting protection and peace of mind at your fingertips.

Learn More About Our Trust Program

Making Your Plan a Reality

Taking action to protect your family doesn’t have to be complicated or time-consuming. We’ve streamlined the process to make it accessible and efficient for every family. Here’s what you can expect:

Timeline and Implementation

Your estate plan can be ready in as little as one week, depending on complexity. The process begins with scheduling an appointment at a time that works for you. During our initial meeting, we’ll:

- Review your family structure

- Discuss your specific concerns

- Map out your protection strategy

- Begin document preparation

The Investment in Your Family’s Future

A complete estate planning package, including all essential documents and lifetime access for updates, is $1,995. This investment includes:

Core Protection:

- All necessary legal documents

- Customization for your family

- Professional guidance throughout the process

- Lifetime access to update your information with no additional legal fees

Added Benefits:

- Complementary binder and Financial Inventory Tabs ($100 value)

- First year of document maintenance included

- Minimal annual maintenance fee of $29.95 after the first year

Follow-Up Support

After completing your initial documents, we recommend scheduling a second appointment to discuss:

- Proper funding changes if needed

- Asset alignment strategies

- Implementation questions

- Family communication plans

Future Planning Considerations

During the funding stage, we’ll explore additional protection strategies tailored to your family’s needs. This might include:

- Analysis of current assets

- Review of beneficiary designations

- Long-term care considerations

- Income protection strategies

Taking the First Step

Most people know they need proper estate planning, but common obstacles often stand in their way:

- Believing it will cost too much

- Never finding the time to get it done

- Not knowing who to talk to

- Lacking guidance through the process

But the number one reason people don’t have appropriate estate plans? They simply never got around to it. Today, you have the opportunity to change that for your family.

Schedule Your Protection Appointment

Starting your estate plan is easier than you might think:

- Choose a time that works for your schedule

- Get your plan completed in as little as one week

- Receive a complimentary binder and Financial Inventory Tabs when you schedule today

- Begin the process of protecting what matters most

During our initial meeting, we’ll discuss any ideas we have for your situation, but first, we’ll need to understand your family’s unique circumstances. This allows us to develop strategies specifically tailored to your needs. Just click the red box below to take the first step.

Want to Learn More Before Getting Started?

Discover why our process is different from traditional estate planning and how it provides better protection for your family.

Remember, estate planning isn’t just for the ultra-wealthy – it’s for every family that wants to protect what they’ve built. Click the button below and take the first step toward securing your family’s future today.