Mastering the Velocity of Money With Properly Designed High Cash Value Whole Life Insurance

Let’s explore mastering the velocity of money through properly designed high cash value whole life insurance. This approach challenges the conventional wisdom of saving leftovers and instead proposes a system where nearly all of your money can work for you continuously. Let’s inspect how this strategy can transform your financial future by leveraging the power of volume and velocity.

The Traditional Approach vs. The Overfunded Whole Life Strategy

⚠️Traditional Approach: Income → Taxes → Bills → Lifestyle → Save what’s left (often around 10% or less)

Traditional financial advice follows a familiar pattern:

1. Earn income

2. Pay taxes

3. Cover bills and living expenses

4. Save or invest what’s left (often 10% or less)

This approach leaves most of your money idle or working for others, not you. It’s like trying to fill a swimming pool with a garden hose while most of your water supply is diverted elsewhere.

♾️IBC/Overfunded Whole Life Approach: Income → Fund Policy → Use Policy to pay Taxes, Bills, Lifestyle

In contrast, the overfunded whole life insurance strategy works like this:

1. Earn income

2. Fund your specially designed life insurance policy

3. Use policy loans to pay taxes, bills, and living expenses

This shift might seem subtle, but its impact is profound. Instead of saving what’s left after expenses, you’re putting almost all your money to work from the start.

Understanding Volume in Finance

Volume refers to the total amount of money flowing through your financial system. With traditional savings, you’re working with a small fraction of your income. With overfunded whole life insurance, you’re potentially utilizing your entire income. This difference in volume is crucial to understanding the potential power of the overfunded whole life insurance strategy.

In a traditional savings approach, you typically save what’s left after paying taxes, bills, and living expenses—often around 10-15% of your income. This means that only a small portion of your money is actively working towards your long-term financial goals.

Moreover, this larger volume provides greater flexibility and opportunity. It allows you to leverage a larger pool of capital for investments, business opportunities, or major purchases, all while maintaining the growth and protection benefits of the life insurance policy. This approach essentially turns your personal finances into a more dynamic system, where a larger portion of your money is actively engaged in building wealth rather than sitting idle or being spent without the potential for return.

The Concept of Money Velocity

A body in motion, stays in motion

Four our purposes, velocity is the speed at which money moves through your financial system. In traditional banking, your money often sits idle. In an overfunded whole life insurance strategy, your money is constantly in motion (velocity), working for you even as you use it for daily expenses.

This continuous movement allows your money to:

- Grow through guaranteed interest and potential dividends

- Be accessible for investments or emergencies

- Fund your lifestyle

- Build a legacy for your heirs

All simultaneously, without stopping its growth.

To maximize velocity, consider these practical strategies:

- Convert monthly bills to annual payments for immediate cost savings

- For bills you cannot pay annually, pay at the last day of the month to maximize interest earned in your policy

- Use rewards credit cards (1-3% cashback) for bill payments, then pay them off monthly with policy loans to avoid credit card interest

- Direct freed-up cash flow back into your policy through paid-up additions rather than a high-yield savings account, as this maintains the policy’s tax advantages and typically offers better long-term returns

Time: The Critical Third Dimension

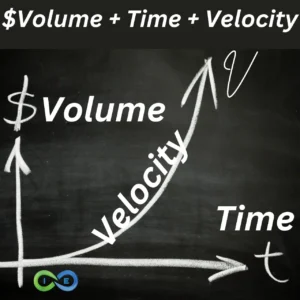

While we’ve focused on the velocity and volume of money, there’s a crucial third dimension that ties everything together: time. In financial strategies, time is not just a passive backdrop but an active participant in wealth creation. Time amplifies the effects of both velocity and volume.

The longer your money is in motion (velocity) and the more of it you have working for you (volume), the greater the potential for wealth accumulation. This is the essence of compound growth – as your money grows, it creates more money, which then grows itself, creating a snowball effect over time.

Understanding and leveraging the value of time is key to maximizing the benefits of money velocity and volume. It’s not just about how fast your money moves or how much you have – it’s about sustaining that movement and volume over the long haul. This is where the power of a well-designed whole life insurance policy truly shines, offering a unique combination of growth, stability, and flexibility that appreciates with time.

How Properly Designed Overfunded Whole Life Insurance Works

A properly designed overfunded whole life insurance policy is structured to maximize cash value growth while providing a death benefit. Key features include:

- High cash value accumulation from the start

- Guaranteed growth of cash value

- Potential for dividend payments

- Ability to borrow against the cash value

- Tax-deferred growth

- Tax-free access to cash value through loans

The “overfunded” aspect means you’re paying more than the basic premium, directing extra funds into the policy’s cash value through paid up additions which supercharge your cash value growth.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

Maximizing Volume and Velocity Simultaneously

The power of this strategy lies in its ability to maximize both volume and velocity:

Volume: By channeling most of your income into the policy, you’re working with a much larger sum of money than traditional savings methods.

Velocity: Through policy loans, your money continues to grow in the policy while simultaneously funding your lifestyle and investments.

This dual maximization creates a powerful compounding effect that’s difficult to achieve with other financial tools.

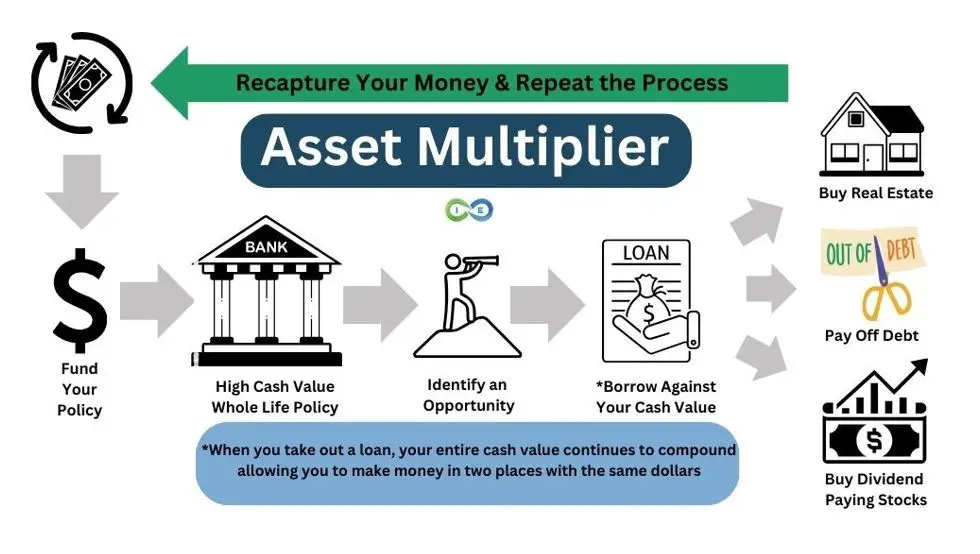

The Asset Multiplier Blueprint: Accelerating Wealth Growth

While mastering the velocity of money is crucial, combining it with the Asset Multiplier Blueprint strategy can supercharge your wealth-building efforts. The Asset Multiplier Blueprint uses high cash value whole life insurance as a foundational asset to acquire other assets, creating a cycle of wealth growth. This approach allows you to:

- Leverage your policy’s cash value to invest in other assets

- Benefit from tax-advantaged growth and tax-free policy loans

- Continue growing your policy’s cash value even as you use it for investments

- Create a self-perpetuating cycle of wealth accumulation

Scenario: Maximizing Policy Funding with Full Income

[This is a scenario for demonstration purposes only, see our disclaimer below. To see how your OWN numbers would look, please reach out to one of our Pro Client Guides. ]

Meet Sarah, a 35-year-old entrepreneur earning $150,000 annually. She’s financially savvy and looking for an optimal way to build wealth while managing her living expenses and tax obligations. Here’s how Sarah implements a strategy to funnel her entire income into a high cash value whole life insurance policy:

Sarah’s Financial Situation:

- Annual Income: $150,000

- Living Expenses: $60,000

- Taxes (28% of income): $42,000

- Debt: None

- Current Savings: $50,000 emergency fund

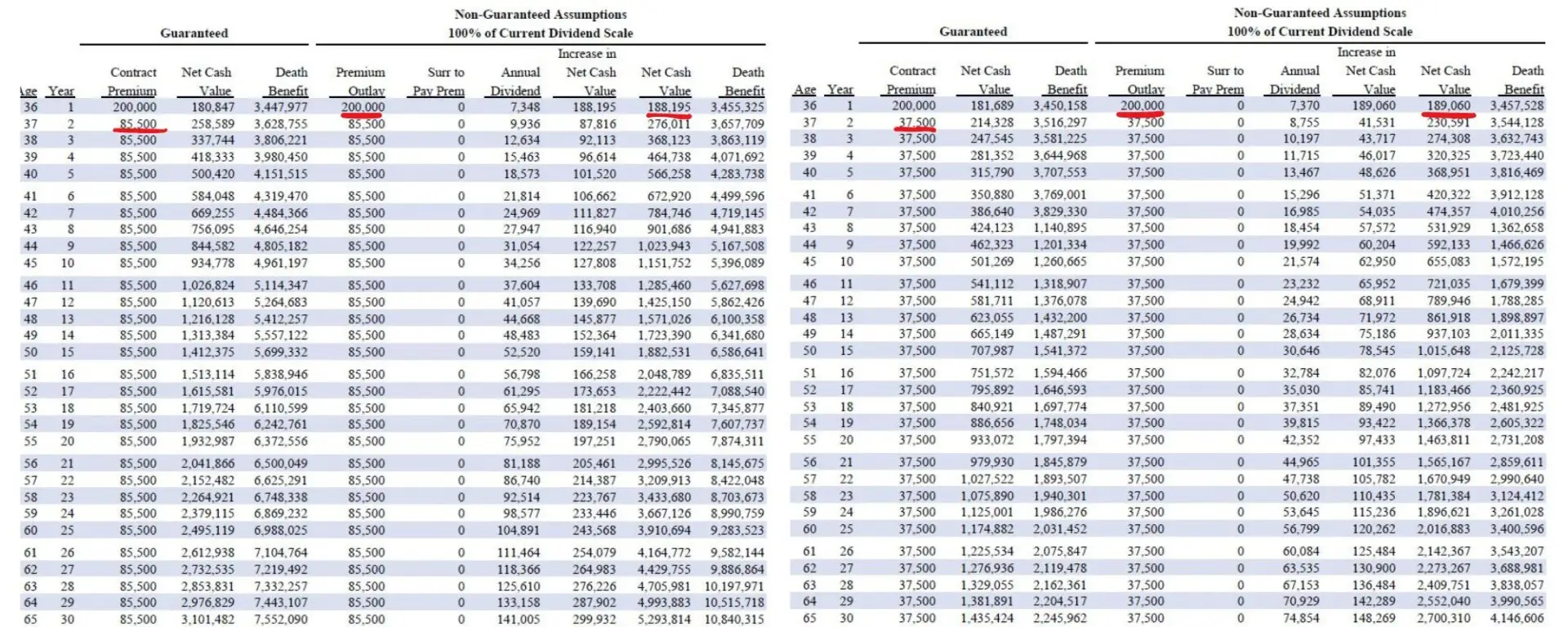

We have created two different scenarios for Sarah. In both scenarios she will be putting her entire income and lump sum into the policy. The difference is in year 2 and onward, she has the option to pay up to $85,500 into the policy and in the other option she can pay a maximum of $37,500 into the policy.

The Strategy:

- Sarah sets up a high cash value whole life insurance policy designed to accept her entire annual income of $150,000, plus an initial lump sum of $50,000.

- She funds the policy with her full pre-tax income.

- She has $189,000 total cash value in year one.

- To cover living expenses and taxes, Sarah uses policy loans:

- $60,000 for living expenses, taken out quarterly based on need.

- And $42,000 for tax payments as needed.

- She is an honest banker and pays back $8,755 a month on her policy loan.

- A year passes and she has paid back the loan, her policy has continued to grow on her full cash value, and she is positioned to make another premium payment, rinse and repeat the process again.

Practical Implementation:

Sarah maximizes both volume and velocity by:

– Converting eligible monthly expenses to annual payments

– Using rewards credit cards for payments

– Taking policy loans strategically

– Managing loans below 80% of cash value

– Redirecting freed cash flow back into the policy

Benefits:

Maximized Cash Value Growth: her entire cash value is growing in the policy, even though Sarah is using a loan of $102,000 for expenses and taxes.

Financial Flexibility: Sarah can take additional loans for unexpected expenses or investment opportunities.

Asset Protection: In many states, the cash value of whole life insurance policies may be partially or fully protected from creditors. The level of protection varies by state law.

Estate Planning: Sarah creates a significant tax-free death benefit for her beneficiaries.

Considerations:

- Sarah needs to manage her policy loans carefully, ensuring she has a plan to pay back the loans or manage the interest.

- She must be comfortable with the concept of borrowing against her policy’s cash value.

- The strategy requires discipline to maintain over the long term.

- Sarah should work with a financial professional to ensure the policy is designed to handle these large contributions without becoming a Modified Endowment Contract (MEC).

The overfunded whole life strategy allows Sarah to maximize both the volume and velocity of her money. Her entire income is constantly growing within the policy while simultaneously being used to cover her living expenses and tax obligations.

Revolutionary Money Approach

You are now shifting from a conventional money approach to a revolutionary money approach where you harness the full power of your money. And you can tailor your financial eco system it to your unique financial goals and investment preferences.

- If you want to invest in stocks, go for it – you can use policy loans to capitalize on market opportunities.

- If real estate is your thing, that works even better – use your policy as a down payment fund or for property improvements.

- If you prefer private lending, make it happen – your policy can serve as a source of capital for loans.

- Or if you just want a safe and secure way to grow your money outside of traditional banking, this strategy provides that too.

The beauty of using a high cash value whole life insurance policy as your financial foundation is that it doesn’t limit your options – it expands them. It gives you a stable base from which to pursue various wealth-building strategies while providing protection and tax advantages. Whatever your financial aspirations, this approach can be adapted to support and enhance your journey to financial freedom.

Addressing Common Misconceptions and Concerns

“Isn’t whole life insurance expensive?”

While premiums are higher than term insurance, it’s crucial to view this as a wealth-building tool, not just an expense. The growth, tax benefits, and financial flexibility can far outweigh the costs over time.

“Don’t whole life agents make huge commissions?”

In traditional whole life policies, commissions can indeed be substantial. However, properly structured high cash value policies dramatically reduce commissions by 70-90%. Most of your premium goes directly to cash value, not agent commissions. This is achieved through policy design, particularly the use of paid-up additions. Always work with an agent who prioritizes your financial growth over their commission.

“What about the loan interest?”

Yes, you pay interest on policy loans. However, the growth on your entire cash value can offset or exceed this cost.

“Isn’t this too good to be true?”

This strategy isn’t a get-rich-quick scheme. It requires discipline, proper policy design, study, coaching, and a long-term perspective. But for those who implement it correctly, it can be a powerful financial tool.

Steps to Implement This Strategy

- Educate yourself thoroughly on the concept

- Consult with a financial professional specializing in this strategy

- Analyze your current financial situation and future goals

- Design a policy that aligns with your needs and maximizes cash value growth

– Plan for optimal loan utilization (Max 80% range)

– Structure for maximum paid-up additions - Implement the strategy consistently over time

– Begin with converting monthly bills to annual payments

– Utilize rewards credit cards strategically

– Redirect freed-up cash flow to high-yield savings

– Gradually increase the number of expenses run through your policy - Regularly review and adjust as needed

An Infinite Banking strategy using overfunded whole life insurance requires discipline, proper policy design, study, coaching, and a long-term perspective but is highly rewarding for those who commit to it.

Potential Drawbacks

Policy Loan Risks and Lapse Prevention

While policy loans are a key feature of the Infinite Banking strategy using whole life insurance, they come with risks that require careful management.

Policy Loan Management:

1. Risk Prevention

– Keep loans at or below 80% of cash value

– Monitor loan interest and growth rates

– Have a clear repayment strategy

2. Lapse Prevention

If the policy lapses, any gain in the policy becomes immediately taxable as ordinary income. Further, if you have outstanding policy loans when the policy lapses, the amount of the loan is treated as a distribution and may be taxable.

Long-Term Commitment and Flexibility

The Infinite Banking strategy using whole life insurance is not a short-term financial fix, but rather a long-term commitment that requires discipline and careful planning. Further, taking advantage of coaching form an agent experienced with infinite banking is recommended.

Rethinking Opportunity Cost and Returns in the Infinite Banking Strategy

When properly implemented, the Infinite Banking strategy using whole life insurance isn’t just about the returns within the policy itself. Instead, it’s about creating a financial ecosystem that allows for broader wealth-building opportunities through its dual growth potential and leveraging policy loans to acquire more assets.

Conclusion

Mastering the velocity of money through properly designed overfunded whole life insurance represents a paradigm shift in personal finance. By focusing on volume—channeling your entire income through a growth-oriented vehicle—and velocity—keeping your money constantly in motion—you can potentially achieve far greater financial efficiency than traditional saving methods allow. This strategy isn’t just about growing wealth; it’s about taking control and making your money work harder and smarter for you, not just once, but continuously throughout your life.

While this approach may not be suitable for everyone, for those willing to embrace a new financial paradigm, it offers a compelling alternative to conventional wisdom. As with any significant financial decision, it’s crucial to thoroughly research and consult with qualified professionals before implementing this strategy.

Remember, the key to financial success often lies not just in how much you earn, but in how efficiently you can put your money to work. By mastering the velocity of money, combined with volume and time, you’re taking a significant step towards optimizing your financial future.

Next Steps

Ready to transform your financial future? Schedule a free consultation with one of our Infinite Banking experts today. Check out our Pro Client Guides and connect with one of them to discuss an Infinite Banking Strategy for you, using your own numbers.

Your Pro Client Guide is also your infinite banking coach, helping you navigate your financial future. This is a complimentary, no-strings- attached consultation where you can see how powerful this strategy is for yourself. What are you waiting for? Book you appointment today!

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept