Update October 31, 2018: VOYA will no longer be offering individual life insurance policies heading into 2019. You can read more here.

To put it simply, we at Insurance and Estates think very highly of VOYA Financial. There is something about Voya that makes you sit back and take notice of the way the management desires to create something unique.

In the following Voya insurance review we will explore the company’s history, ratings, its elite services and various products, including its life insurance policies, and the additional benefits therein.

VOYA Life Insurance Company

Anyone on a legitimate search for the top cash value life insurance companies would benefit from getting acquainted with the best life insurance companies available before deciding on the right company that will be the right fit for you.

We at I&E create various life insurance reviews of our favorite whole life insurance and indexed universal life insurance companies in the industry.

We do this to arm you with the know-how and expertise you need to make the correct decision on the company that will be the right fit for your specific needs, goals and objectives.

About Voya

Formerly known as ING Reliastar, AKA ING Life Insurance and Annuity Company , Voya has made a name for itself as a leader in retirement planning. In 2017 alone it has earned the following accolades:

- Included in the 2017 Fortune 500 list (#266)

- Named a 2017 World’s Most Ethical Companies® by Ethisphere Institute

To date, Voya has helped over 13.6 million customers. Voya derives its abstract name from the word ‘voyage’, reflecting momentum and optimism. (1)

On April 7, 2014, ING U.S., Inc. (AKA ING Reliastar) officially became Voya Financial Inc., completing the re-branding of its image into a company focused on making a secure financial future possible.

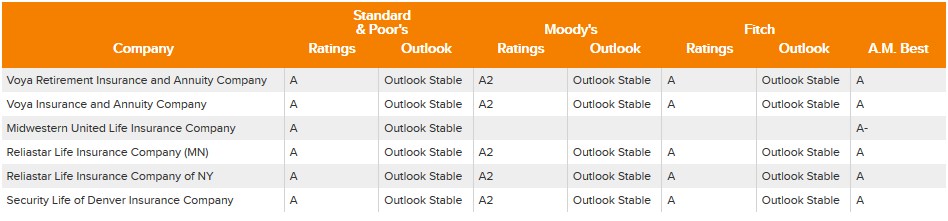

Voya Financial Ratings

Voya is a top rated life insurance company. The company currently has the following ratings from, A.M. Best Company, Standard and Poor’s, Moody’s and Fitch:

Voya’s Financial Ratings:

- A.M. Best rating: A (3rd highest of 15)

- Standard & Poor’s rating: A (6th highest of 20)

- Moody’s rating: A2 (6th highest of 21)

- Fitch rating: A (6th highest of 21)

- Comdex ranking: 77 (out of 100)

Products Offered by Voya

Voya has a great product line. The company’s products and services feature:

Insurance including

- Term life insurance

- Universal life insurance

- Indexed universal life insurance

- Variable universal life insurance

Retirement including

- employer-sponsored savings plans

- holistic retirement and income guidance

Investment Management including

- Equities

- Fixed Income

- Multi-Asset Strategies and Solutions

Annuities including

- Immediate Annuities

- Fixed Annuities

- Fixed Indexed Annuities

Employee Benefits including

- Life Insurance

- Disability Insurance

- Voluntary Life Insurance

Life Insurance Policies offered by

Voya offers some of the best permanent life insurance. The company has a large offering of permanent cash value life insurance coverage including universal life, indexed universal life and variable universal life.

We believe there are benefits to all types of policies, and that there is no one size fits all product. But in our opinion there is a clear advantage of permanent life vs term life.

Benefits of Term Life Insurance

- Lower Initial Cost

- Income Protection

- Mortgage Protection

- Conversion Option

Benefits of Permanent Life Insurance

- Buy Sell Agreements

- Key Man Insurance

- Estate Planning

- Infinite Banking

- Premium Financing

- Executive Bonus (Section 162) Plans

- Non-Qualified Deferred Compensation Plans

- Split Dollar Life Insurance

Voya Life Insurance Policies [Plans and Features]

Voya offers several permanent life insurance products, including

- Universal Life

- Variable Universal Life

- Indexed Universal Life

Voya also offers no exam life insurance via the company’s Orange Pass program. Currently, two IUL policies are offered, Indexed Universal Life-Accumulator and Indexed Universal Life-Protector.

Indexed Universal Life vs Variable Universal Life

Both IUL and VUL policies offer coverage, pay a death benefit and accumulate cash value.

Both IUL and VUL policies provide flexibility. You can adjust your premium payments and your death benefit protection to accommodate lifestyle changes.

The primary difference between IUL vs VUL is how your cash value is utilized within the policy.

With IUL policies, the cash value is applied to the policy’s fixed account, where it will earn interest based on what the company’s declared rate. From there, you can transfer all or a portion of your cash to different indexed accounts. The indexed accounts follow, in part, the performance of major equity indexes, such as the S&P 500. You are not directly investing in the stock market.

With VUL policies, the cash value is also applied to the policy’s fixed account, which you then transfer to variable investment options, much like mutual funds. The VUL variable accounts are directly investing in the stock market.

With IUL policies, your cash value is protected due to a floor and a cap. The floor is a guaranteed rate, usually around 0-2% determined by the specific account your money is in. The cap is the maximum return your IUL can deliver, typically around 12-14%.

With VUL policies, there is no minimum floor and no maximum cap. Your cash value account will increase (or decrease) in step with the variable accounts you invest in.

Voya Indexed Universal Life Global Choice

Voya’s indexed universal life policy is available for ages 18-90 for face amounts starting at $50,000. IUL standard rates available up to 90 years old. Available with GPT or CVAT tests.

Account options include

- S&P 500 1 Year Point to Point Indexed Strategy

- 2 Year Global Indexed Strategy (S&P 500, Euro Stox 50, Hang Seng Index)

- 5 Year Global Indexed Strategy (S&P 500, Euro Stox 50, Hang Seng Index)

- Or choose a blend of strategies

Guaranteed Floor

- Fixed Strategy (2% guaranteed floor)

- Indexed Account (0% guaranteed floor)

2 Death benefit options:

- Option A: level death benefit

- Option B: increasing death benefit

Policy loan options

- Traditional loans

- Select loans

Current Cap and Participation Rate

- S&P 500 Indexed Strategy: 13.5% with 100% participation rate.

- Global Indexed Strategy (2 year): No cap with 65% participation rate.

- Global Indexed Strategy (5 year): No cap with 90% participation rate.

Surrender Charge: the first 9 policy years and for 9 years from a face amount increase

Voya Chronic Illness Rider

Chronic Illness Riders allow you to access a portion of your death benefit in advance if you are diagnosed with a qualifying chronic illness, such as malignant cancer, Alzheimer’s, heart disease, diabetes, COPD, etc. There are generally two ways you can qualify to receive cash indemnity from your death benefit with the chronic illness rider.

The first way is to be unable to perform 2 of 6 activities of daily living for at least 90 days. The second way is to develop a severe cognitive impairment that puts you at risk to your health and safety.

If you qualify for your cash indemnity benefit from your chronic illness rider, you can access the lesser of 2% of your death benefit monthly or 24% annually or up to the IRS per diem limit, currently $360 daily ($131,400 annually) for 2017, with maximum lifetime benefit of $2,000,000.

The policy pays a cash indemnity, rather than reimbursement which requires proof of expenses. Instead, you can use the cash indemnity benefit for whatever you choose.

Additional Benefits of Cash Value Life Insurance

Tax free life insurance policy loans

You have the right to take life insurance loans from the carrier by using your cash value as collateral. You loan will be charged either a fixed or variable interest rate. All unpaid interest due will be applied to your principle. You do not have to repay your loan, but failure to repay can lead to adverse consequences.

Tax deferred cash value growth

Cash value in your policy grows tax deferred per IRC 7702. Tax free growth is a huge advantage, creating true compound interest since your principle and interest are always growing.

Tax free death benefit

Your policy’s death benefit is paid to your beneficiary income tax free. But be aware that larger estates may be subject to the federal estate tax or to your state’s inheritance tax, if applicable.

Voya Life Insurance Policy Riders

- Accelerated Benefit Rider – Allows you access to a portion of your death benefit if you are diagnosed with a qualifying condition

- Adjustable Term Insurance Rider – add term coverage to your policy to increase your death benefit

- Additional Insured Rider – allows you to add more coverage for your spouse or life insurance for kids

- Cash Value Flex Rider – (AKA Supplemental Insurance Rider) potentially generates more cash value in the policy’s early years

- Chronic Illness Rider – if you become chronically ill you can gain access to your death benefit to help pay expenses

- Early Cash Value Rider – the surrender value is not less than 95% of the premiums paid on the policy in years 1-6 of your policy – allows for greater early year cash value accumulation

- Overloan Lapse Protection Rider – helps prevent lapsing the policy due to excessive policy loans

- Premium Deposit Fund Rider – an interest bearing account that helps pay your premium when it’s due

Voya Review Conclusion

Voya is a great company that offers some of the best permanent coverage in the marketplace. But the question remains…

Is VOYA Financial the right company for you?

Maybe.

But without speaking to you and discovering your goals, needs and objectives we cannot say which company will best suit your needs.

Do you have questions or would you like to see an illustration of Voya or any of the other top cash value life insurance companies we represent?

Give us a call today for a free life insurance consultation with an advanced markets professional.

4 comments

Christina

Voya financial has done an awful job at giving us a straight answer on a deferred compensation issue. They seem to have given the very large sum of money to the wrong person instead of the designated beneficiary on file. Now we’re getting the run around and “well look into it and call you back” to no avail. Awful situation. Now we’ll get the law involved ….

SJG

Hello Christina,

Sorry to hear about your situation with Voya and thanks for sharing. Sometimes people get us confused with their insurance company because we write articles about various companies. I just want you to be aware that we aren’t the company and if you want to connect with them directly, you’ll need to make sure you’re on their website and connecting with their office.

Best to you in your efforts.

Steve Gibbs for I&E

Steven Gibbs is a licensed insurance agent, and the following agent

license numbers of Steven Gibbs are provided as required by state law:

Resident License; AZ agent #17508301,

Non-resident Licenses: TX agent #2273189, CA agent #0K10610,

LA agent #769583, MA agent #2049963, MN agent #40563357,

UT agent #655544.

Michael F

I’ve found Voya Financial (supplemental illness/injury insurance through employer) to be very unresponsive and purposely delaying finishing a claim I filed last month when I was diagnosed with an aggressive cancer.

I’m shocked how they’ve completely ignored me and have yet to respond to ANY emailed question I have sent via their website.

What I had initially thought would be a godsend upon receiving this terrible news had turned into another stressor on top of everything else I’m having to go through.

I would suggest look elsewhere for insurance to help at a time of need.

I’m curious how Voya Financial was awarded ‘Ethical company’??

Insurance&Estates

Hello Michael, sorry to hear about your situation and experience. We only review based upon what we have at the time so will certainly include your experience as a reference for our readers. Best to you.

I&E