Common Objections and FAQs to Whole Life Insurance and the Infinite Banking Concept

The following are objections and misunderstandings relating to high cash value whole life insurance designed for the infinite banking strategy. If you have any additional questions relating to this topic please leave us your feedback in the comment section below and we will do our best to reply in a timely manner.

Watch Barry Brooksby debunk the most common life insurance myths that could be costing you money.

Table of Contents

- Whole Life Insurance is Too Expensive

- Whole Life Returns are Very Low

- Whole Life Agents Make Huge Commissions

- The Life Insurance Company Keeps Your Cash Value

- The only people who promote whole life insurance are people who sell it

- Buy term and invest the difference (BTID) is a better choice

- A Whole Life Insurance Dividend is Just a Return of Premium

- It can take a long time to build up cash value to actually utilize.

- When you set it up, you’re either committed to the premium for the rest of your life, or you let it lapse.

- What if I can’t make my payments down the road?

- Are whole life premiums flexible?

- If you change your mind you will be hit with surrender charges in the early years.

- When I pay back my policy loan I am paying myself back with interest

- Direct recognition means the life insurance company does not pay me a dividend or interest on borrowed funds.

- How soon before I can take out a policy loan?

- How do I pay a policy loan back and do I determine how it is paid back?

- How much do I need to start Infinite Banking?

- I’ll self insure

“Whole life insurance is too expensive

The first question to ask anyone who says that whole life insurance is too expensive is what does “too expensive” mean? Another question to ask is, too expensive compared to what?

If you look at term life insurance it’s actually the most expensive form of insurance out there because every 10, 20, or 30 years if you renew the policy, the cost of insurance will be much higher than before because you’re older. When most term insurance policies annually renew the company will charge you many times more than your previous premiums. And the policy renews annually, so the premiums go up each year.

However, in a properly structured high cash value whole life insurance policy the cost for the whole life coverage is minimized and the cash value is maximized. In these types of properly structured policies the insurance costs are nominal compared to what you actually get in cash value growth and death benefit coverage.

And if you are comparing costs of whole life insurance as an asset class, whole life insurance offers several benefits that no other asset class offers. There are many benefits of whole life insurance that you can read about by following the link. To name a few here would be contractual guarantees, tax-favored status, leveraged death benefit, and creditor protection in most states.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

“Whole life returns are very low, 1 -2%”

In a traditional old style whole life policy the returns are lower than a properly structured dividend paying whole life insurance policy that is focused on maximizing cash value growth. Generally these traditional whole life policies are purchased for the permanent death benefit coverage and the returns are not the driving force of why someone would purchase one of these types of policies.

However, in a properly structured high cash value whole life policy we see returns generally around 5% and in some cases higher than 5%. This 5% return is a tax-free, net return. When you look at the returns of other investments or market based accounts, after taxes, fees, and volatility those investments are lucky to return 2%. In other words, a properly structured high cash value whole life policy that nets a 5% tax-free return will outperform, in most cases, 401K’s, IRA’s, and market based investments.

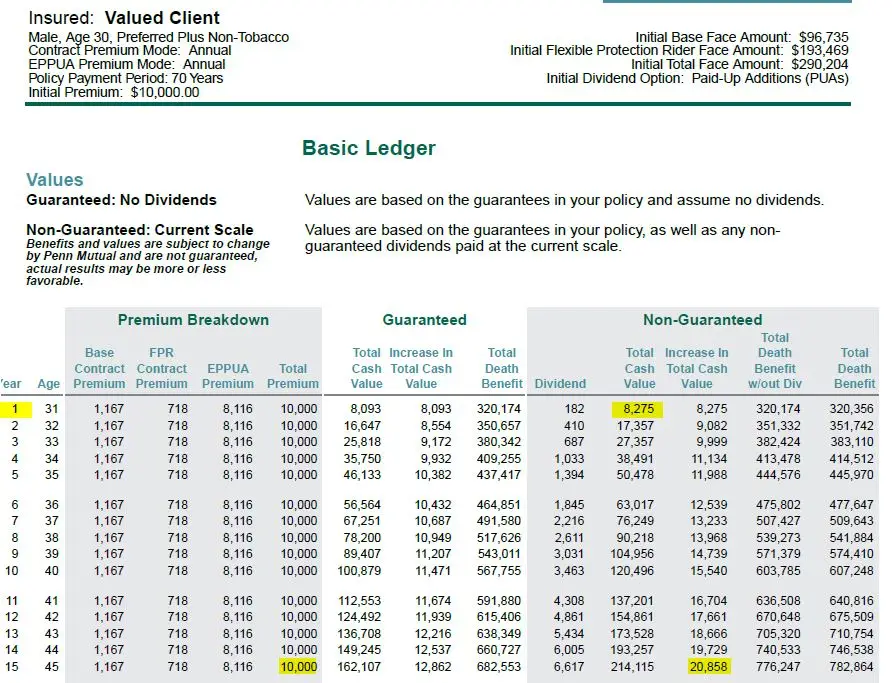

Policy Example

Let’s look at a real example to demonstrate the difference. Here’s an illustration from Penn Mutual for a 30-year-old preferred plus non-tobacco client. The policy is structured with a $96,735 base whole life coverage and a $193,469 term rider, with a total annual premium of $10,000. But here’s where proper structure makes all the difference – only $1,885 ($1,167 base + $718 term) goes to the base policy and term rider, while $8,116 goes directly to paid-up additions.

Looking at the non-guaranteed column, you can see:

- First year cash value of $8,275 on $10,000 premium (82.75% efficiency)

- By year 5, cash value grows to $50,478

- By year 10, cash value reaches $120,496

- At year 15, cash value hits $214,115, with cash value growing at over $20,000 a year

“Whole life agents make huge commissions”

In a traditional old style whole life policy, yes the commissions can be huge. For example, if a person puts $25,000 per year into a traditional whole life policy the commission on that policy can be as high as $25,000. These old-style policies generally don’t have any cash value growth in the 1st and/or 2nd year and can take a long time to see any significant cash value growth.

Alternatively, in a properly structured high cash value whole life insurance policy the commissions are dramatically reduced by 70 to 90%. Because rather than your premium going to pay a large commission, your premium goes to cash value.

This is primarily due to the policy’s design. Traditional whole life is designed so that the entire premium goes towards the base of the policy, which provides a fixed death benefit.

To reiterate, these properly structured policies are low commission policies because most of your premium goes to your cash value, not to pay a huge commission to an agent. That is mainly because high cash value whole life insurance uses paid-up additions that allow a smaller part of the premium to go towards the base, with a larger percentage of the premium payment to go towards paid-up additions. See our webinar on paid-up additions for more.

“The life insurance company keeps your cash value”

There’s a myth out there about whole life insurance that the insurance company keeps your cash value. It can appear that way in an old style traditional whole life policy. If for example you purchase a $1,000,000 whole life death benefit and over time you see the cash value grow to $100,000, you would think that upon your passing your beneficiary would get $1.1 million. But no, they would only get the $1,000,000 death benefit. It’s not that the insurance company kept the $100,000 of cash value, rather they use it to pay future death benefits of other policyholders.

Now, regarding a properly structured high cash value whole life insurance policy, that same $1,000,000 death benefit would grow over time. Let’s say the cash value grows to $300,000. You’d think that your family would get $1.3 million as a death benefit. But, in most cases your family would get more, maybe $1.4M or even up to $1.7M, because in a properly structured high cash value policy the death benefit grows over time which means your beneficiary gets more upon your passing. These properly structured policies are more efficient for cash value growth along with death benefit growth.

“The only people who promote whole life insurance are people who sell it”

There are many CFPs/Financial Advisors who either recommend or sell life insurance products, with whole life insurance being one of them. In fact, many high level money managers recommend whole life as an addition to any portfolio because it is uncorrelated to the stock market and provides alternative retirement income, like a volatility buffer, when the stock market is having a negative year.

And when you look at the social proof out there of who actually owns whole life insurance, you see major banks, corporations and many wealthy people that you would know by name. The reason banks, companies and the wealthy purchase whole life insurance is because it’s guaranteed to grow cash value every year. This cash value is not subject to stock market volatility and always grows larger from one year to the next because of the guarantees.

These whole life policies also pay an annual life insurance dividend. That dividend is tax free and is often reinvested back into cash value for additional compound growth.

Wealthy individuals and business owners also like the benefits of properly structured whole life insurance because they’re able to use the growth of the cash value and all of the gains completely tax free (if structured and done correctly). This tax-free money allows them to potentially be in a lower tax bracket in the future.

Another benefit as to why these people and companies use whole life insurance is because they have access to their cash value. This is often known as “Tier 1” capital. This cash value is accessible as soon as 30 days after a policy is started wherein a person can borrow 85 to 95% of their total cash value and use the cash for whatever they want.

And when a person or company takes a policy loan, the insurance company doesn’t require a credit check, doesn’t require an application, nor does the insurance company question what the money is being used for. They don’t care because the loan is being collateralized by the death benefit of the policy.

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

“Buy term and invest the difference (BTID) is a better choice”

The myth of buy term insurance and invest the difference is prevalent. Many financial advisors and financial entertainers recommend buying term insurance. However, statistically speaking less than 2% of term insurance ever pays out a death benefit. What that means is that most people are throwing money down the drain for a death benefit that their family will never get. We’re not saying don’t ever buy term insurance, there is a place for it. However, we recommend whole life insurance with a term rider so that you have permanent death benefit coverage.

Think about it, are you more likely to pass away before the age of 65 or after the age of 65? You know the answer, after age 65. Why then not have a permanent whole life policy that pays a guaranteed death benefit whether you pass away at 75 or 105?

Also, not everyone invests the difference with the premium savings they recoup on their term insurance policy. And for those that do invest the difference, they generally put that money in an IRA or mutual funds and are now subject to stock market volatility and sequence of returns risk, 401k and IRA fees, tax deferral for unknown future tax rates, and may end up locking up their money for a longer period of time than they would like. In other words, limited access to cash.

We believe that having a permanent whole life insurance death benefit in your portfolio allows you more peace of mind and control. Whole life provides a guaranteed death benefit and access to cash value that you and your family can enjoy generationally and that allows you to perpetuate generational wealth, tax-free in most cases.

“A whole life insurance dividend is just a return of premium”

The IRS does categorize a dividend on a participating life insurance policy from a mutual insurance company as a return of premium. Frankly, we are glad that they do because it allows the dividend to be tax free. We like the IRS definition because we want tax-free money.

However, only stating that a dividend is a return of premium is a partial truth. There are some financial entertainers out there that lead you to believe you’re overpaying for whole life insurance and you’re just getting your money back when you receive a dividend. But that’s only half of the story.

Mutual insurance companies invest premium dollars. They make money on their investments. They earn a rate of return on those investments. They make profits on those investments. Those profits come back to mutual policyholders in the form of a dividend. Mutual policy holders participate in the profits of the company. That’s a powerful benefit as a mutual policyholder.

The whole life insurance dividend, defined as a return of premium, is tax free and is reinvested back into policy cash value which means you now earn compound interest every year on that dividend. To only say a dividend is a return of premium is a naive comment and doesn’t tell the entire truth.

“It can take a long time to build up cash value to actually utilize.”

In a traditional old style whole life policy this could be true. You might not see the cash value equal to the amount of premium you’ve put into the policy for 15 to 25 years. And there’s typically no cash value available in the 1st year and maybe even the 2nd year.

However, in a properly structured high cash value whole life policy designed for the Infinite Banking Concept, the cash value can equalize as soon as the 3rd or 4th year. You can begin taking policy loans in the very first year, sometimes as soon as 30 days after the policy has been started.

With a high cash value whole life insurance policy that’s been properly structured using a PUA rider (Paid Up Additions), the majority of your premium goes to cash value, not death benefit, and that cash value will be shown in the very first year. This allows you to be your own bank, buy assets, pay off debt, and create wealth in many other ways.

“When you set it up, you’re either committed to the premium for the rest of your life, or you let it lapse.”

This could be true of a typical old style whole life policy depending on how the policy was structured, the persons age, health rating, death benefit and premium amount. But even in this type of whole life policy there are potential options to either lower the premium payment or stop the premium payment all together. If someone chooses to stop funding their whole life policy too early, it could lapse.

Generally, once the dividends are sufficient to pay for the base premium, a person could stop paying the premiums. This might affect the death benefit amount.

If a person chose to stop funding, there are two options to consider that wouldn’t cause the policy to lapse as long as other criteria has been met. These are called 1) premium offset or 2) reduced paid up.

“What if I can’t make my payments down the road?”

This is one of the most common concerns people have when considering whole life insurance, and it’s a valid question. Life is unpredictable, and financial situations can change. The good news is that properly structured high cash value whole life policies designed for infinite banking have multiple built-in safety nets that traditional whole life policies simply don’t offer.

Let’s walk through your options if you ever face financial difficulties:

Option 1: Reduce to Base Premium Only

Remember, these policies are structured with a small base premium and a large paid-up additions (PUA) rider. If money gets tight, you can simply stop paying the PUA portion and continue with just the base premium. This dramatically reduces your annual payment while keeping your policy active and growing.

Option 2: Use Your Cash Value to Pay Premiums

Here’s where the magic of cash value really shines. If you can’t even afford the base premium, you can use your accumulated cash value to cover your premium payments. Your policy essentially pays for itself from the money you’ve already built up inside it.

Option 3: Let Dividends Cover Your Premiums

Over time, your dividend payments grow substantial enough to cover your entire premium payment. This is called “premium offset,” and once you reach this point, you never have to make another premium payment out of pocket again. Your policy becomes completely self-sustaining.

Option 4: Convert to Reduced Paid-Up

If you want to eliminate all future premium obligations, you can convert your policy to “reduced paid-up.” This transforms your existing cash value into a smaller, fully paid whole life policy. No more premiums required, ever. You’ll have permanent death benefit coverage and continued cash value growth, just at a smaller amount.

Option 5: Surrender Without Penalties

Unlike most insurance products that hit you with surrender charges for early cancellation, these properly structured policies have zero surrender charges. If you absolutely need to cancel your policy, you’ll receive every dollar of your cash value. No penalties, no fees, no surprises.

The Real Advantage

What makes these policies so powerful is that they’re designed with flexibility from day one. Traditional whole life policies lock you into rigid premium payments with few options if life throws you a curveball. But infinite banking policies are built specifically to adapt to your changing financial circumstances.

Many of our clients start by maximizing their PUA contributions when their income is strong, then scale back during slower periods, and ramp back up when finances improve. The policy grows with you and your life situation.

The bottom line? You’re never truly “stuck” with payments you can’t afford. These policies offer more flexibility and safety nets than virtually any other financial product available. Rather than being a financial burden during tough times, your whole life policy can actually become a financial resource to help you through difficult periods.

Are whole life insurance premiums flexible?

With a properly structured high cash value whole life policy, we naturally build in premium flexibility. In other words, you can keep the maximum premium going as long as you would like, or you can reduce to the minimum premium, or any amount in between the minimum and the maximum.

The flexible premium option in a properly structured whole life policy will give you more peace of mind. And the options of a premium offset and reduced paid up are also available in this design.

Premium flexibility is due to your paid up additions rider which allows you to pour additional cash into your policy above and beyond your premium payment. In any given year, you can opt out of paying your paid up additions. That way, if your finances are tight for a given year you do not have to make the larger payment.

In addition, over time your dividend payment grows so that it is large enough to cover your premium payment. This allows you to use your dividend payment to cover your premium.

If you change your mind you will be hit with surrender charges in the early years.

No Surrender Charges

If needed, a person can cancel or surrender a whole life policy anytime (we don’t recommend doing this), and get all of their cash value in the policy back. There are no surrender charges in these properly designed high cash value whole life policies. So, if a policy is canceled in the 10th year and there’s $200,000 of cash value, the insurance company would mail you a check for $200,000.

“When I pay back my policy loan I am paying myself back with interest”

There is misleading information in books and the Internet that when you take a whole life insurance policy loan you earn the interest charged for the loan and it goes back into your policy cash value.

That is not true!

The interest you pay on the loan goes back to the insurance company. They give you a loan from their general account and charge you interest for that loan.

However, they do not physically remove the money from your cash value. They put a lien against your cash value. Therefore, you are still earning interest and dividends on your total cash value even though you have a loan.

Understand it correctly, you still make money on your total cash value but the interest charged for the loan does in fact go back to the insurance company.

Direct recognition means the life insurance company does not pay me a dividend or interest on borrowed funds.

Whether a company uses direct or non-direct recognition is less important than overall cash value growth and finding the right company for your needs. However, it’s helpful to understand the key differences:

Direct Recognition Companies:

- Continue paying dividends on your entire cash value, even when you have loans

- Apply an adjusted dividend rate specifically to borrowed funds

- Only policyholders with loans are affected by these adjusted rates

- The impact is targeted rather than spread across all policyholders

Non-Direct Recognition Companies:

- Pay the same dividend rate regardless of whether you have loans

- Everyone’s dividend is affected by all outstanding loans in the company

- All policyholders receive a lower net dividend to account for loans

- The impact is distributed across the entire policyholder base

Direct recognition doesn’t mean you lose dividends on borrowed funds. It simply means the company acknowledges loans by applying different rates to those portions. Some agents heavily promote non-direct companies without explaining the complete picture, often because they’re limited to selling only those products or don’t fully understand the nuances themselves.

The most important factor when choosing a whole life policy isn’t the recognition method, but rather the company’s overall strength and the policy’s design for maximizing cash value growth.

How soon can I take out a policy loan?

With a properly designed policy focused on high early cash value growth you can take out a life insurance policy loan within one month of starting your policy.

As a rule of thumb, you can expect your policy to have amassed roughly 75% of the year one premium in cash value after 12 months.

Generally, the guaranteed cash value equals total premium payments contributed to your policy by year 9 or 10. However, depending on your policy performance, the non guaranteed cash value may equal your premium payments made by year 4 or 5.

Currently, the non guaranteed internal rate of return (IRR) is around 4.5-5.5% on whole life policies designed for high cash value growth.

How do I pay a policy loan back and do I determine how it is paid back?

One huge advantage of life insurance loans is that you determine your payback schedule and payment amount.

With most insurance companies, you can pay a policy loan back with a monthly EFT bank draft, or call in and give them a payment over the phone.

And the best part is you determine either how much you want to pay per month, or calculate the payment amount based on the interest rate and the number of years to pay back the loan.

The most important part to grasp is that all the loan repayment options are flexible and are determined by you.

Also, later in life many people use their policy loan provision to supplement their retirement income.

As a result, they do not pay back their loan. Rather, the annual cash value growth and dividend payment of their whole life insurance is used as tax free retirement income.

How Much Do I Need to Start Infinite Banking?

You can start building your whole life insurance policy’s cash value with contributions as low as $250 per month, which is $3,000 a year. The key is in how you structure the high cash value whole life insurance policy.

By directing most of your contributions towards Paid-Up Additions beyond the basic premium, you’re not just paying for insurance; you’re building a financial asset that grows over time.

Each PUA you purchase immediately adds to your policy’s cash value and increases the death benefit. PUAs are small, separate whole life policies without future premium obligations—they’re “paid up” from the start. The cash value of your PUAs earns interest and dividends, just like the base policy.

“I’ll self-insure” or “My insurance needs decline over time”

Some advisors claim that as wealth grows and responsibilities decrease, you can “self-insure” instead of keeping life insurance. Here’s the reality:

Self-insuring forces your assets to do double duty – providing retirement income AND death benefit protection. This creates risk, especially if markets decline when your family needs funds most.

Consider that you’re more likely to die after age 65, which is exactly when term insurance typically expires. In fact, less than 2% of term policies ever pay out, meaning 98% of policyholders receive nothing after decades of premiums.

With properly structured whole life insurance, your death benefit grows over time alongside accessible cash value. This allows your investments to focus solely on generating retirement income while your insurance provides a guaranteed legacy that:

- Remains immune to market fluctuations

- Grows regardless of health changes

- Passes tax-free to heirs

- Offers living benefits through cash value

- Creates estate planning certainty

Plus, life insurance makes an excellent retirement income resource as it’s non-correlated to market performance, protecting your stock investments from sequence of returns risk – the devastating impact of market downturns early in retirement.

_________________________________________________________________________

Have we missed any objections or misconceptions? Please leave your feedback in the comment section below and we will do our best to provide a response to you as soon as we are able.

__________________________________________________________________________

THE ULTIMATE FREE DOWNLOAD

The Self Banking Blueprint

A Modern Approach To The Infinite Banking Concept

2 comments

Bobby Mucheson

Steve Gibbs, how can this help me and I am 68 years old. and why David Ramsey talk bad about whole life insurance?

Insurance&Estates

Hi Bobby,

Dave Ramsey probably has a vested interest in not liking life insurance other than term life due to his businesses. We have an article here on Dave and Whole Life: https://www.insuranceandestates.com/whole-life-insurance-dave-ramsey/

And it’s never too late to explore financial strategies that could benefit both you and your loved ones. At 68, you bring wisdom and perspective that younger people simply don’t have yet. While many focus on whole life insurance for younger individuals, there are several meaningful ways you could benefit:

First, a properly structured whole life policy could still serve you personally by providing a guaranteed death benefit for legacy planning and potential living benefits through cash value. Unlike term insurance that typically expires when you need it most, whole life provides permanent coverage that’s particularly valuable in your later years.

However, one of the most beautiful aspects of whole life insurance is its ability to create a multi-generational impact. You might consider establishing policies for your grandchildren, where your contributions could give them an incredible financial head start. These policies would benefit from extremely low premiums and maximum time for cash value growth.

Beyond the financial advantages, this approach gives you a wonderful opportunity to mentor your grandchildren about important financial principles. Imagine sharing your wisdom while teaching them about concepts like compound interest, tax advantages, and financial self-reliance through actual policies they’ll benefit from for decades to come.

Whether you decide to get a smaller policy for yourself, establish policies for grandchildren, or both, your thoughtful consideration of these strategies at 68 shows it’s never too late to create a lasting financial legacy.