Setting the Record Straight: Dave Ramsey’s Misunderstanding of Whole Life Insurance

To begin, I’d like to point out something interesting about Dave Ramsey and Whole Life Insurance. If you are familiar with Dave, you know he thinks very poorly of whole life and has nothing positive to say about it. But here is what is interesting. Whole life aligns with his financial advice amazingly well. I created a chart that shows how whole life actually complements Dave Ramsey’s financial advice.

As you can see from the above chart, Dave Ramsey’s take on whole life insurance is completely skewed and misses critical aspects of how these policies actually work. Let’s examine the facts using real examples to show why his blanket statements about whole life insurance are incorrect.

The Truth About Tax Benefits

Dave Ramsey states that whole life insurance doesn’t grow tax-free. While technically correct that growth is tax-deferred, he fails to acknowledge that all gains and growth can be accessed 100% tax-free through policy loans. This isn’t about borrowing your own money, as Dave incorrectly claims. When you take a policy loan, you’re borrowing from the insurance company’s general account, with your cash value serving as collateral.

Importantly, even after taking a loan, you continue earning interest and dividends on your full cash value amount. For example, with $300,000 in cash value, if you take a $200,000 loan, you still earn returns on the entire $300,000. So your entire cash value is growing in true compound interest fashion, even if you borrow against it.

Real Numbers vs. Dave’s Claims

Dave Ramsey tells people whole life insurance has zero growth in the first three years and averages only 1.2% returns. He’s completely wrong. Let me show you real numbers from a Penn Mutual illustration.

Whole Life with Paid-Up-Additions

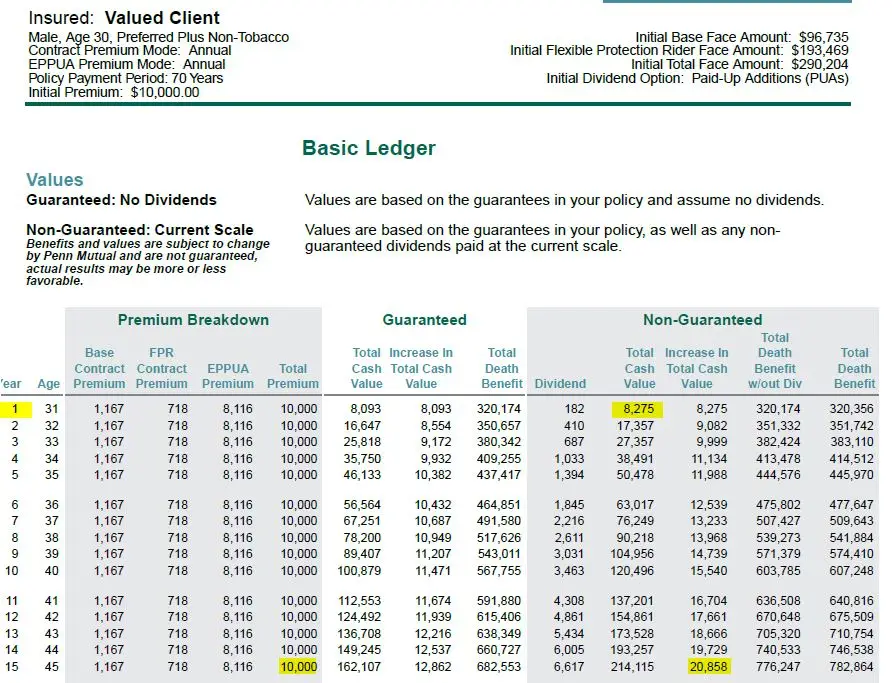

For a 30-year-old preferred plus non-tobacco client, we design the policy with $96,735 base whole life coverage and add a $193,469 term insurance rider. Total premium is $10,000 per year. But here’s where proper structure makes all the difference – $1,884 goes to the base policy and term rider, while $8,116 goes directly to paid-up additions. This maximizes early cash value and long-term growth.

Policy Years 1-15

First year cash value? $8,275 on $10,000 premium. That’s 82.75% efficiency right from the start. Not zero like Dave claims. By year 15, on your $10,000 annual premium, you’re seeing over $20,000 in annual cash value growth. This means the policy is now growing by more than double your annual premium payment.

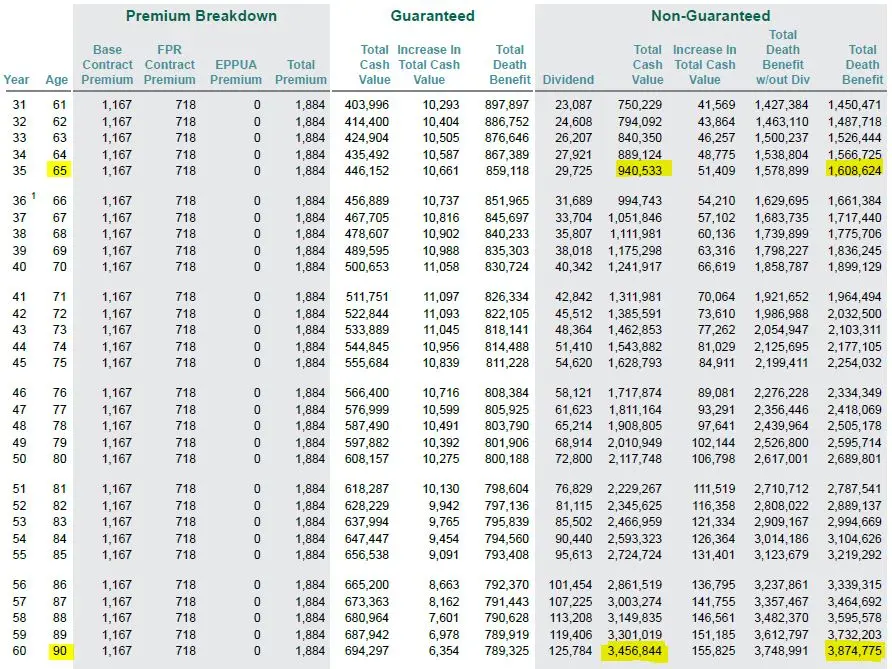

Policy Illustration Years 31-60

Look at the growth from there: By age 65, cash value hits $940,533 with a $1.6 million death benefit. At age 90, that’s $3.45 million in cash value and $3.87 million death benefit.

Does the Company Keep Your Cash Value?

Dave’s biggest misconception? He says insurance companies keep your cash value when you die. The illustration proves him wrong. The death benefit isn’t static at $290,204 – it grows substantially. Year 10 shows $607,248. Age 65 shows $1.6 million. The death benefit includes both the initial coverage AND accumulated cash value.

The internal rate of return page tells the real story about performance. Even guaranteed values turn positive after year 5. Current dividend scale shows returns over 5% in later years – all tax-free, all without market risk. These numbers explain why banks, corporations and wealthy individuals use these policies. They understand what Dave doesn’t – properly structured whole life provides guaranteed growth, tax advantages and benefits no other financial tool can match.?

What About Traditional Whole Life?

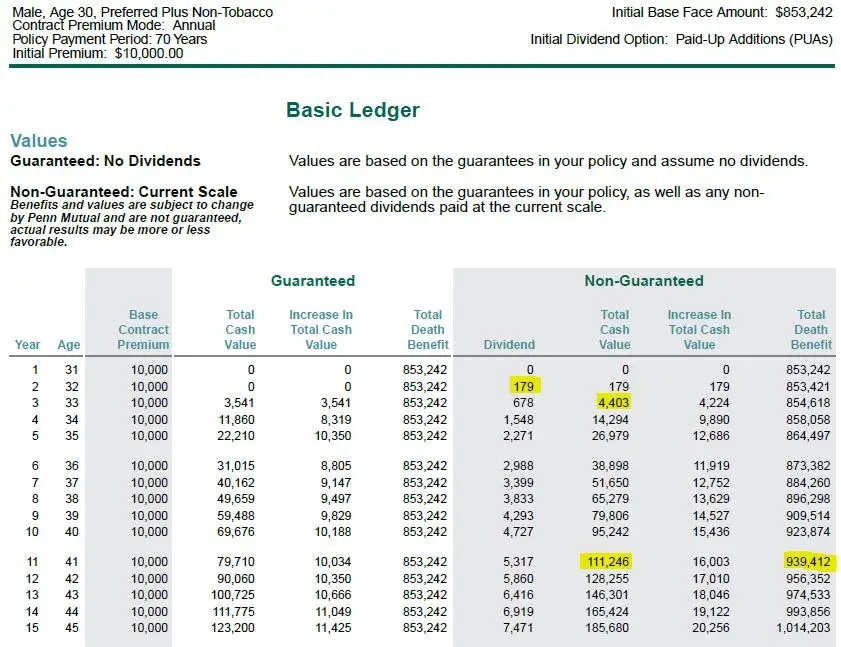

And here is something interesting. Even traditional, non-optimized whole life insurance performs better than Dave claims. Looking at a traditional whole life policy for a 30-year-old, here’s what actually happens:

First year, there’s no cash value. Year two shows $179 from the dividend. By year three, there’s $4,225 in cash value. Not exactly exciting early numbers, which is why we structure policies differently today. But watch what happens over time.

Policy Years 1-15

By year 11, with $110,000 in premiums paid, the cash value is $111,000. The death benefit grows from $853,000 initially to $939,000.

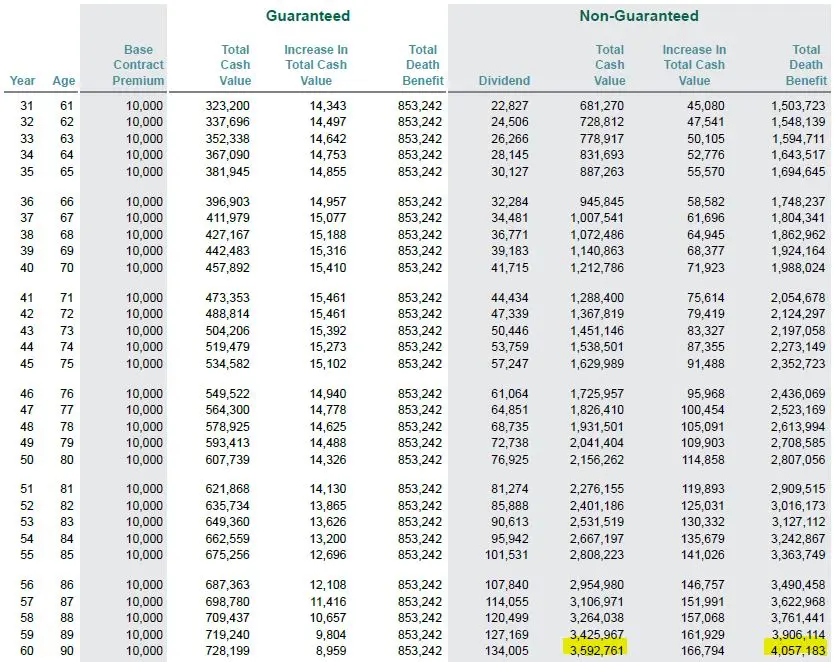

Policy Years 31-60

Let’s take this out to age 90. That $600,000 in total premiums grows to $3.59 million in cash value with a $4 million death benefit.

Run the actual math and you get a 4.92% rate of return. Not the 1.2% Dave claims. And this is with old-style traditional whole life, not even the properly structured policies we design today. The numbers prove Dave’s 1.2% claim completely wrong even using the most basic, non-optimized policy design.

This is why we focus on properly structured policies with early cash value – but I wanted you to see that even traditional whole life delivers better returns than what Dave tells people. The math doesn’t lie.

Understanding Premium Efficiency

Let’s compare the two policies above, a traditional whole life to a properly structured policy. Both start with a $10,000 annual premium, but there’s a crucial difference in how long you pay.

In traditional whole life, you’re paying that full $10,000 premium for the entire policy payment period. Over 60 years, that adds up to $600,000 in total premiums. That money does grow, reaching $3.59 million in cash value, but you’re putting in premium dollars the entire time.

Now look at our properly structured policy. We split the $10,000 premium with $1,884 going to base and term coverage, and $8,116 going to paid-up additions. Here’s the key difference, those PUA premiums stop after 30 years. After that, you’re only paying the $1,884 base premium. That drastically reduces your total premium outlay.

Let’s do the math: Years 1-30: $10,000 annually ($300,000 total) Years 31-60: $1,884 annually ($56,520 total) Total premium outlay: $356,520

So the properly structured policy not only provides better early cash value and performance, it does it with nearly $250,000 less in total premiums compared to traditional whole life. This is another reason why proper policy structure matters – you get better results while putting in less money over time.

Term Insurance Reality Check

Dave promotes “buy term and invest the difference,” but here’s what he doesn’t tell you: less than 2% of term insurance policies ever pay a death benefit.

While term appears cheaper initially, it becomes the most expensive form of insurance over time because:

- You must renew every 10, 20, or 30 years with premiums that increase dramatically with age

- The premium increases are often so severe that most people can’t afford to maintain coverage in their later years, precisely when they need it most

- For example, a policy that costs $30/month in your 30s might jump to hundreds or even thousands per month in your 60s and 70s

- Coverage typically ends at age 65, leaving no protection

- There’s nothing to show for decades of premium payments for 98% of policyholders

- Even if you want to maintain coverage in your later years, the astronomical premiums often make it financially impossible

This creates a dangerous situation where many people lose their life insurance protection just as they’re entering retirement, leaving their families vulnerable exactly when financial protection becomes most critical.

Why Banks and the Wealthy Choose Whole Life

If I could ask Dave two questions, they would be:

Why do banks and major corporations hold billions in permanent cash value insurance?

Why do wealthy individuals and business owners consistently use these policies?

It is because Banks (BOLI) and Corporations (COLI) understand the unique benefits:

- Guaranteed growth without market volatility

- Tax-free access to gains through policy loans

- Tier-one capital accessibility

- Permanent death benefit protection

- Asset protection advantages

These benefits are real. When you see the biggest banks and financial institutions in America putting billions of dollars into permanent life insurance, they’re doing it for a reason. They have teams of financial analysts looking at every possible way to grow and protect their money. And they choose whole life insurance (Tier One Capital) consistently.

So when Dave Ramsey tells you whole life insurance is a terrible product, ask yourself: why are the smartest financial minds in the country using it? They understand something Dave doesn’t want to acknowledge, that properly structured whole life insurance is a powerful financial tool that can help build and protect wealth.

The Truth About Risk

Dave completely misses the mark when he tries to frame whole life insurance as some kind of risky investment. He’s trying to compare it to market-based investments like mutual funds and stocks where you can lose money. But that’s absolutely wrong. To be clear, properly structured whole life insurance is one of the most guaranteed financial products you’ll ever find.

Consider that every single year, your cash value is going to grow. That’s guaranteed. You’re going to earn a guaranteed interest rate. That’s locked in. And on top of that, you’re getting dividend payments from insurance companies that have been paying dividends consistently for over 120 years. Through world wars, the Great Depression, market crashes, every economic downturn you can think of these companies have honored their commitments.

Now compare that to what Dave recommends investing in mutual funds and stocks. How’d that work out in 2008? How about 2020? If you’re invested in the market, you’re dealing with real risk. Your account can go down 20%, 30%, even 50% in a bad year. But with properly structured whole life insurance? Your cash value keeps growing, guaranteed. No losses, no market stress, no wondering if you can retire because the market crashed at the wrong time.

When Dave calls this a “risk game,” he’s showing that he fundamentally doesn’t understand how these policies work. There’s nothing risky about guaranteed growth and a guaranteed death benefit. The only risk here is following Dave’s advice and missing out on one of the most powerful and secure financial tools available.

Company Selection and Experience

Based on 17 years of analyzing these policies, we exclusively recommend top mutual insurance companies with proven track records. These are companies that have demonstrated reliability through multiple economic cycles and consistently honored their commitments to policyholders. In addition, most have been in existence for over 100 years and have consistently paid a dividend each and every year.

Final Thoughts

Dave Ramsey’s blanket statements about whole life insurance are harmful and misleading. These policies, when properly structured, offer guaranteed growth, tax advantages, and lasting protection that term insurance cannot match. The math is clear: $600,000 in premiums growing to $3.59 million in cash value with a $4 million death benefit demonstrates the power of properly structured whole life insurance.

Unlike the mutual funds Dave recommends with their market volatility and potential losses, whole life insurance has been providing guaranteed growth and protection for nearly 200 years. The key is working with professionals who understand how to properly structure these policies for maximum benefit.

See What’s Possible With Your Numbers

While these examples demonstrate the potential of properly structured whole life insurance, every person’s financial situation is unique. If you’re curious about how these concepts might apply to your specific circumstances, we invite you to schedule a conversation with one of our Pro Client Guides.